Xali Gold Closes Acquisition of Pico Machay Gold Project

VANCOUVER, British Columbia, Dec. 24, 2025 (GLOBE NEWSWIRE) — Xali Gold Corp. (TSXV:XGC) (“Xali Gold” or the “Company”) is very pleased to announce the closing on December 24th, 2025, of the acquisition of the Pico Machay Gold Project (“Pico Machay” or the “Project”), an advanced exploration stage project in Peru with a near-term production goal, as announced in the Company’s October 24th, 2025 news release. Xali Gold acquired the company Minera Calipuy S.A.C. (“Calipuy”), which wholly owns Pico Machay, from Pan American Silver Corp. (“Pan American”) and its subsidiary, Aquiline Resources Inc. (“Aquiline”).

“With the acquisition of Pico Machay now closed, our full attention turns to advancing the asset and unlocking its value,” said Joanne Freeze, President and CEO of Xali Gold. “Pico Machay offers both immediate value and substantial upside, particularly given that the historical resource was calculated using a long-term gold price of just US$700 per ounce. In the current gold price environment, we see a compelling opportunity to aggressively move the Project forward. Over the coming months, our priority will be to update the historical resource estimate as well as review and optimize previous engineering studies, including the low-cost, low-strip ratio open-pit heap-leach concept outlined by prior owners, with the objective of rapidly advancing the Project into near-term production.”

As per the terms of the agreement with Pan American and Aquiline, Xali Gold has paid the initial cash payment of US$500,000 to close the acquisition and acquire the shares of Calipuy. Details on the remaining cash payments (all dollar values are United States dollars) are:

| Time Period | Cash Payments |

| December 24th, 2026 (1st Year Anniversary) | $1.5M |

| December 24th, 2027 (2nd Year Anniversary) | $1.5M |

| December 24th, 2028 (3rd Year Anniversary) | $4.0M |

| December 24th, 2029 (4th Year Anniversary) | $3.0M |

| Earlier of December 24th, 2030 or commencement of commercial production | $4.5M |

| Upon completion of a technical report prepared in accordance with NI 43-101 disclosing aggregate mineral reserves or mineral resources classified as any of proven mineral reserves, probable mineral reserves, measured mineral resources, or indicated mineral reserves, greater than 1.25M oz Au in the aggregate for the Project (the “Contingent Payment”) | $2.5M |

| Total | $17.0M |

The transaction with Pan American and Aquiline to acquire 100% of their collective interest in Calipuy is arm’s length and no finders’ fees were paid.

The payments of up to $17M are secured by Promissory Notes for each of the five deferred payments and the Contingent Payment, a first-priority Share Pledge Agreement over 100% of Calipuy’s shares and a first-priority Mortgage Agreement over both Pico Machay as well as the Company’s Las Brujas II property in Peru. The Promissory Notes are unconditionally and irrevocably guaranteed by Calipuy and Candente Gold Peru S.A.C., they do not bear interest prior to their respective maturity dates and are non-convertible into any securities. In the event of a failure to pay on the maturity date, the Promissory Notes immediately accrue default interest at a rate of the Federal Funds Rate plus 800 basis points.

A total of $15M (including the initial cash payment paid at closing) is to be paid over 5 years for the known historical gold resource. If more than 1.25M oz Au aggregate mineral reserves or mineral resources classified as any of proven mineral reserves, probable mineral reserves, measured mineral resources, or indicated mineral resources (as per CIM Definitions) are disclosed in a National Instrument 43-101 technical report then Xali Gold is to pay an additional $2.5M. Xali Gold has provided Pan American with a Purchaser’s Special Indemnity. This indemnity is unlimited in amount and indefinite in duration and covers all existing and future liabilities (environmental, tax, labour, etc.) of the Project.

Calipuy is the recorded, legal and beneficial holder of 100% interest in a total of 17 mining rights (the “Mining Rights”) that make up the Project. All Mining Rights are in good standing and in force. The Mining Rights would expire in 2039, if production has not commenced by that time.

There is an existing 1% Net Smelter Return (“NSR”) royalty covering the El Alcatraz 4 concession which covers the centre of the historical resource. The NSR, which covers all metals, was granted to Maverix Metals Inc. in July 2016. The royalty is perpetual, with no cap on payments and no buyback provision. In January 2023, Triple Flag Precious Metals Corp. completed the acquisition of Maverix Metals Inc. and now holds the NSR.

In addition to the Mining Rights, there exists a Comprehensive Registry of Mining Formalization (REINFO) which is administered by the Ministry of Energy and Mines of Peru (“MINEM”). REINFO was introduced in 2017 and formalizes companies and businesses that are active in small mining or artisanal mining and exempts them from criminal liability for illegal mining. REINFO permits are designed to bring informal mining operations into the formal economy.

As a result of the REINFO permits, there has been some artisanal mining activity on the Property, most of which is reported to have occurred from 2020 to 2022. There are currently six valid REINFO permits on the Property. Xali Gold is aware of some limited underground workings. There also appears be a rudimentary and abandoned leach pad present on the Project. Only a few local people appear to be active recently and with minimal support. Xali Gold plans to work with the REINFO owners to be able to extensively sample previously drilled zones from existing underground workings. This is expected to enable the Company to do some very valuable work while waiting for surface drilling permits.

Xali Gold’s local Peruvian counsel have advised that the Company will not hold any environmental liability associated with any informal mining activity by reporting it to the government of Peru as soon they take ownership of Calipuy.

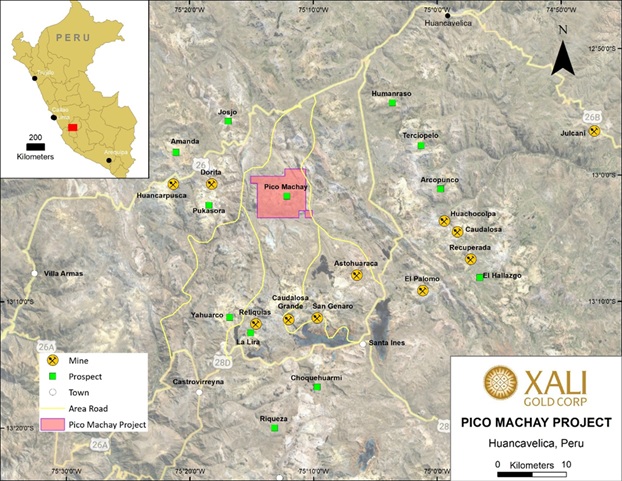

The Pico Machay Project is located in the community of Santa Ana (see Figure 1 below), with whom Silver Mountain Resources Inc. recently signed a 20-year agreement allowing them to reactivate and operate the Reliquias Mine. Xali Gold looks forward to engaging with the Santa Ana community and advancing Pico Machay under a mutually beneficial framework.

Figure 1: Huancavelica Mining Projects

About Xali Gold

Xali Gold is a gold and silver exploration company focused on advancing opportunities in the Americas. The Company is focused on completing the exploration and development of Pico Machay, an advanced exploration stage gold project in South America with a near-term production goal. Xali Gold maintains exploration potential as well as two royalty agreements with third parties who have the rights to produce gold and silver from specific areas of the El Oro gold-silver Project in Mexico, a historic district-scale system with a long history of significant gold and silver production.

Xali Gold is dedicated to being a responsible Community partner.

Joanne C. Freeze, P.Geo. is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the contents of this release.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

On behalf of the Board of Xali Gold Corp.

“Joanne Freeze” P.Geo.

President, CEO and Director

For further information please contact:

Joanne Freeze, President & CEO

Tel: + 1 (604) 512-3359

info@xaligold.com

Forward-looking Disclaimer

This press release contains forward-looking information within the meaning of Canadian securities laws (“forward-looking statements”). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements.

Forward-looking statements in this press release include, without limitation: the timing of payment of the five deferred payments and the Contingent Payment; the timing to conduct updated exploration work on the Project, including optimizing prior engineering studies and timing to prepare a current mineral resource estimate for the Company (that is not a historical resource under NI 43-101); the Company’s plans to work with REINFO owners to sample previously drilled zones; expected engagement with the Santa Ana community; timing to bring the Project into production, if at all; impacts of artisanal miners on the Project and environmental liabilities, if any; impacts and results of community engagement with indigenous populations located near the Project. These forward-looking statements are made as of the date of this press release. Although the Company believes the forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

Known risk factors and assumptions include risks associated with exploration and project development; accessing further funding and related dilution: continuing its projected growth, or being fully able to implement its business strategies; the calculation of mineral resources and additional work required to convert historical resources to current mineral resources; the nature, quality and quantity of any mineral deposits that may be located on the project; operational risks associated with mining and mineral processing; fluctuations in metal prices and assumptions including costs; title matters; government regulation; obtaining and renewing necessary consents, authorizations, licenses and permits; environmental liability and insurance; reliance on key personnel; local community opposition; currency fluctuations; labour disputes; competition; variations in market conditions, and the volatility of our common share price and volume; future sales of shares by existing shareholders; and other risk factors described in Xali Gold’s MD&A and other filings with Canadian securities regulators, which may be viewed at www.sedarplus.ca. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Xali Gold expressly disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ea92f802-f2bd-497e-964e-3f41805698e0

![]()