West Red Lake Gold Provides Madsen Mine Operations Update

VANCOUVER, British Columbia, Aug. 06, 2025 (GLOBE NEWSWIRE) — West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) is pleased to provide an update on ramp-up activities at the Madsen Mine in Red Lake, Ontario.

“July was a good month for Madsen and our mine operations team, and we continue to track to plan on our ramp up,” said Shane Williams, President and CEO. “Mine ramp-up is about adding equipment, developing access to high-priority mining areas, and increasing operational efficiency until the mine consistently produces the targeted daily tonnage at the targeted grade. During July, all these ramp-up elements played a positive role at Madsen. The mill achieved an average of 94% recovery over the month while processing 500-800 tonnes per day. Additionally, material mined from sill access development carried gold grades well above expectation on several occasions. Collectively, this enabled Madsen to pour 3,800 ounces for the month of July.”

July Production

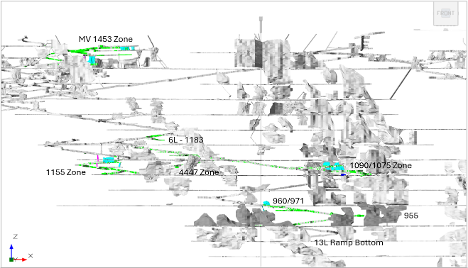

In July the Madsen mine operations team completed sill development and mining in eight (8) areas spread across McVeigh, South Austin, and Austin. Sill development was a priority in the month, to enable a focus on stope mining in August. Mill feed in July was therefore a mix of mined material and low-grade stockpiles. Mined material carried an average grade of 8.9 grams per tonne gold. Since sill mining is less efficient than stope mining in terms of producing tonnage, mined tonnage was combined with low grade stockpile to produce an average grade of around 5g/t going into the mill.

Three (3) gold pours took place over the month to produce 3,800 ounces of gold. Of that, 3,595 ounces were sold at an average price of US$3,320 per oz. to generate US$12 million ($C16.4M) in revenues.

Figure 1. Long section of the Madsen Mine showing the eight areas of active mining, sill development, and access development through the month of July 2025.

Continued Strong Stope Reconciliation

Tightening drill hole spacing from 20 metres to 7 metres (average distances) to inform an in-house resource model of high accuracy and resolution prior to final stope design is fundamental to West Red Lake Gold’s approach to mining at Madsen. The mineralized system at Madsen has been altered and deformed, resulting in gold mineralization that is high grade and pervasive but not always continuous. Tight definition drilling to inform an accurate geologic model is essential for better understanding grade continuity in the deposit.

The effectiveness of this approach was apparent in the close reconciliation between expected and actual grades and tonnes in the bulk sample (see May 7 news release). Figure 2 below shows a similar degree of reconciliation for a recently mined stope in McVeigh. Expected or modeled grade is shown in blue. Average grade mined is shown in red. Number of muck samples taken is shown in orange.

Figure 2. Muck grade versus modelled grade by sample date for a long-hole stope in the McVeigh area mined in July.

July Sill Grade Performance

Stope areas at Madsen are drill tested to 7-metre spacing. Sills, which are the access levels developed above and below stopes to create access to mine, are not always drilled to 7-metre spacing because of stope and drill bay geometry. In addition, chip sampling along sills adds data to the model before stopes are mined. As a result of these two factors, sills are expected to return higher grade variability versus the model than stopes.

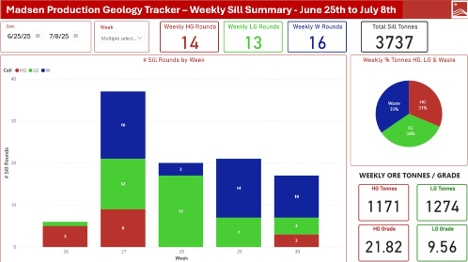

Such variability is shown in Figure 3 below, which is a summary generated weekly at site by the Production Geology team that shows the number of sill development rounds that were expected to generate high grade (red), low grade (green), and waste (blue) material and the actual grades achieved for each kind of material.

Sill development constituted a large portion of the Madsen mine production profile in weeks 26 (June 25 – July 1) and 27 (July 2-8) for two reasons: 1) the mine plan called for above-average sill development in those weeks, and 2) the sill material mined carried significantly higher gold grades than expected. Figure 3 shows the actual grade for high- and low-grade material for weeks 26 and 27 combined.

In weeks 26 and 27, the 1,274 tonnes of sill material expected to be low grade averaged 9.56 g/t Au. Low grade sill ore is defined as tonnes expected to grade between 1.5 and 3.5 g/t Au. The 1,171 tonnes of sill material expected to be high grade averaged 21.82 g/t Au (Figure 3).

Figure 3. Weekly Sill Summary for June 25-July 8 from the Madsen Mine Production Geology Grade Control Tracker. This figure is provided only as an example to demonstrate grade performance at Madsen for the month of July. The Production Geology Report is a tool used solely for internal grade control tracking purposes and should not be considered prescriptive of the Madsen Mine resource estimate or assumed as National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) compliant.

“In July we saw the short-term resource model doing its job: stope grades reconciled closely to predicted model grades, and in fact exceeded planned grades in many cases,” said Jill Christmann, Madsen Mine Chief Geologist. “We also saw the benefit of a workflow that guides mining to the right rocks in the form of strong sill grades, in some cases exceptionally strong. And the value of grade control sampling to fine tune our model ahead of stope mining was clear: the grade surprises were in the sills, where that additional layer of data is missing, while stopes reconciled to the model. Higher variability means sills will at times also surprise to the downside, but this month the sills we mined really shone.”

Mine Ramp Up

The Company is working on two projects to support further mine ramp up and operational stability for the balance of the year. These projects are expected to add capacity to move material out of the mine and enable effective storage of waste rock underground in the mine. Material movement capacity and flexibility are integral requirements for underground mining success.

Shaft Renovation

To prepare the Madsen Shaft to return to skipping material, the Company developed a 3-stage plan with stage 1 to be implemented by year end. To achieve stage 1 skipping the company purchased a new hoist rope, a 5-tonne skip, and scrolls, which are expected in the coming months. The Company is also cleaning out and preparing the loading pocket on 11 level (550 metre depth). This work is in addition to that completed in 2024 and H1 2025 when the hoist mechanism and shaft were rehabilitated such that the cage was certified to move personnel to inspect/repair the shaft.

Once phase 1 is complete with this new equipment, the shaft will be able to move approximately 300-400 tonnes of material to surface a day. These tonnes will be additive to current material moving capacity.

Figure 4. An example of shaft rehabilitation work completed in 2024.

Cemented Rock Fill (CRF) Project

Ore and waste must both be moved in a mine. The less waste that must be brought to surface the better, for a mine’s costs and efficiency.

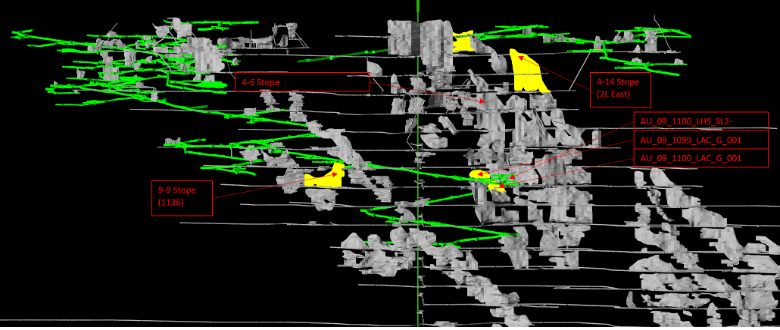

Most historic stopes at Madsen are backfilled but there are also a number of large empty stopes. These voids are ideal repositories for waste rock. To utilize such voids effectively, waste rock must be turned into Cemented Rock Fill (“CRF”).

West Red Lake Gold contracted a CRF batch plant and operator, who mobilized to site in July. In August the Company expects to start backfilling CRF into historic voids.

Historic stopes near current mining areas on the 9 level in Austin and South Austin collectively offer space to hold over 70,000 tonnes of waste rock. Additional large voids closer to surface in the upper Austin area offer potential to hold 102,000 tonnes of waste rock. Moving waste rock from where it is generated underground to these voids, rather than to surface, will free up significant haulage capacity.

Figure 5. A long section of the Madsen Mine showing historic mining. Remnant open stopes that West Red Lake Gold has identified as potentially suited for CRF waste rock storage are highlighted in yellow.

“Mine ramp ups are always balancing two competing needs: producing planned ounces in a given month and developing to ensure the ability to continue producing planned ounces in the months ahead,” said Williams. “Positive surprises, like the high-grade sills we encountered several times in July, make it easier to achieve that balance. July therefore helped set us up for success in the coming months.

“The shaft utilization and CRF projects are ways we are increasing efficiencies for the longer term at Madsen. Hoisting ore and waste rock up via a shaft and reducing the need to truck waste material out of the mine are ways to alleviate ventilation and equipment pressures, thus creating the kind of optionality that helps underground mines thrive.”

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, and by Maurice Mostert, P.Eng., Vice President of Technical Services for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

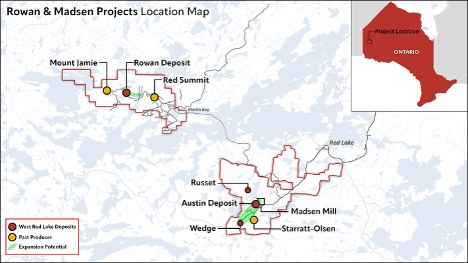

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a gold mining company that is publicly traded and focused on its flagship high-grade Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also owns the Rowan Property in Red Lake, which hosts a small, high-grade deposit that West Red Lake Gold is looking to advance towards production.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company’s website

at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release.

Forward-looking information involves numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices; and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended December 31, 2024, and the Company’s annual information form for the year ended December 31, 2024, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/aa0c632a-10e4-4cea-a635-57eeb7e9922d

https://www.globenewswire.com/NewsRoom/AttachmentNg/d18c9404-9b1c-4e17-b82d-3cb93c2fe108

https://www.globenewswire.com/NewsRoom/AttachmentNg/c003e8f7-9f1e-456e-a363-5b00d9ac07f7

https://www.globenewswire.com/NewsRoom/AttachmentNg/4ecf0a66-1eec-49a0-88cf-73195f45e575

https://www.globenewswire.com/NewsRoom/AttachmentNg/f7521a17-c879-4590-9110-498b0d583d92

https://www.globenewswire.com/NewsRoom/AttachmentNg/b4ab9bf1-6489-418a-b921-3be6187b0c03

![]()