VERB Delivers Remarkable 2024 Financial Performance

Quadruple Digit % Gains Year-Over-Year and Triple Digit % Gains Quarter-Over-Quarter Reflected in 2024 Form 10-K

Debt-Free and $13.50 Cash Value Per Common Share*

Increased Growth Projected For Q1 2025

LAS VEGAS and LOS ALAMITOS, Calif., March 25, 2025 (GLOBE NEWSWIRE) — Verb Technology Company, Inc. (Nasdaq: VERB) (“VERB” or the “Company”), Transforming the Landscape of Social Commerce, Social Telehealth and Social Crowdfunding with MARKET.live; VANITYPrescribed; GoodGirlRx; and the GO FUND YOURSELF TV Show, today filed its Form 10-K reporting financial and operating results for the full year and the quarter ending December 31, 2024.

Summary Financial Results

For the Year Ended December 31, 2024

- Total revenue was $895 thousand, an increase of $832 thousand, or 1,321%, over the previous year. Represents the greatest amount of revenue generated since the strategic sale of the Company’s direct sales SaaS business unit in June 2023

- Cash Value per common share – $13.4 (*includes value of highly-liquid professionally managed investments)

- *Year-End Cash position $13.5 million ($8.5 million cash, plus $4.9 million in highly-liquid investments). Does not include $1.7 million cash added in Q1 2025.

- Strong Cash Position – expected to fund operations into 2028 and beyond

- Net loss from continuing operations reduced by $4.3 million, represents an improvement of 29% over prior year

- Operating loss reduced by $2.2 million, represents an improvement of 16% over prior year

- General and Administrative expenses reduced by $0.3 million, represents an improvement of 2% over prior year, indicates enhanced Company financial performance attributable to increases in revenue – not excessive cost cutting measures

- All Remaining Debt retired in Q1 2025

Three Months Ended December 31, 2024

- Total Q4 revenue – $723 thousand, an increase of $694 thousand, or 2,393%, from the prior year comparable quarter – represents an increase of $595 thousand, or 465% over Q3. Indicates enormous revenue growth in Q4 attributable to management’s recent operational and marketing changes which are further validated by projected Q1 2025 results.

Results of Operations

Fiscal Year Ended December 31, 2024 Compared to Fiscal Year Ended December 31, 2023

The following is a comparison of the results of our operations for the years ended December 31, 2024 and 2023 (in thousands):

| Years Ended December 31, | ||||||||||||

| 2024 | 2023 | Change | ||||||||||

| Revenue | $ | 895 | $ | 63 | $ | 832 | ||||||

| Costs and expenses | ||||||||||||

| Cost of revenue, exclusive of depreciation and amortization shown separately below | 224 | 19 | 205 | |||||||||

| Depreciation and amortization | 1,077 | 2,331 | (1,254 | ) | ||||||||

| General and administrative | 11,238 | 11,508 | (270 | ) | ||||||||

| Total costs and expenses | 12,539 | 13,858 | (1,319 | ) | ||||||||

| Operating loss from continuing operations | (11,644 | ) | (13,795 | ) | 2,151 | |||||||

| Other income (expense) | ||||||||||||

| Interest income | 692 | – | 692 | |||||||||

| Unrealized loss on short-term investments | (44 | ) | – | (44 | ) | |||||||

| Interest expense | (237 | ) | (1,193 | ) | 956 | |||||||

| Financing costs | (90 | ) | (1,239 | ) | 1,149 | |||||||

| Other income, net | 812 | 1,162 | (350 | ) | ||||||||

| Change in fair value of derivative liability | 1 | 221 | (220 | ) | ||||||||

| Total other income (expense), net | 1,134 | (1,049 | ) | 2,183 | ||||||||

| Net loss from continuing operations | $ | (10,510 | ) | $ | (14,844 | ) | $ | 4,334 | ||||

Revenue

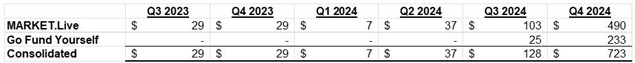

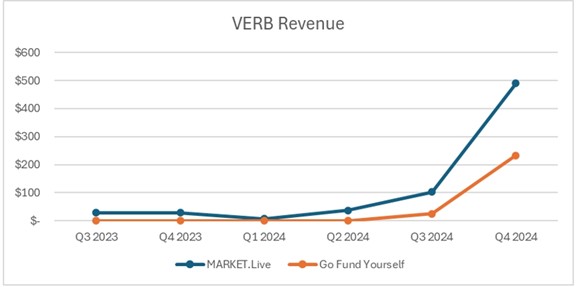

Revenue was $895 for the year ended December 31, 2024, as compared to $63 for the year ended December 31, 2023. The revenue increase of $832, representing an increase of 1,321%, is primarily attributable to revenue received from our MARKET.live business unit services packages and from our Go Fund Yourself business unit.

Revenue was $723 for the quarter ended December 31, 2024, as compared to $29 for the quarter ended December 31, 2023. The revenue increase of $694, representing an increase of 2,393%, is primarily attributable to tremendous growth from our MARKET.live business unit services packages and from our newly-formed Go Fund Yourself business unit.

Revenue was $723 for the quarter ended December 31, 2024, as compared to $128 for the quarter ended September 30, 2024. The revenue increase of $595, representing an increase of 465%, is primarily attributable to tremendous growth from our MARKET.live business unit services packages and from growth in our Go Fund Yourself business unit.

The table below sets forth our quarterly revenues from the quarter ended September 30, 2023 (first quarter following the direct sales SaaS sale) through the quarter ended December 31, 2024, which reflects the trend of revenue over the past six fiscal quarters:

Operating Expenses

Depreciation and amortization expense was $1,077 for the year ended December 31, 2024, as compared to $2,331 for the year ended December 31, 2023. The decrease of $1,254 is due to a revision in the amortization of software development costs resulting from extending the life of the asset on January 1, 2024.

General and administrative expenses including stock compensation expense were $11,238 for the year ended December 31, 2024, as compared to $11,508 for the year ended December 31, 2023. The decrease of $270 or 2%, in general and administrative expenses including stock compensation expense is primarily due to a decrease in stock compensation expense and a decrease in legal fees.

Other Income (Expense), net

Other income (expense), net, was $1,134 for the year ended December 31, 2024, which was primarily attributable to other income, net of $812 and interest income, net of $455 both offset by financing costs of $90.

Liquidity and Capital Resources

Overview

As of December 31, 2024 and 2023, we had the following balances of cash, restricted cash, and highly liquid investments.

| As of December 31, | ||||||||

| 2024 | 2023 | |||||||

| Cash | $ | 7,617 | $ | 4,353 | ||||

| Restricted Cash | 878 | – | ||||||

| Investments: Government-Backed Securities | 3,731 | – | ||||||

| Investments: Corporate Bonds | 1,182 | – | ||||||

| Total | 13,408 | 4,353 | ||||||

Subsequent to December 31, 2024, we received $1,724 of our ERC short-term receivable.

Conference Call Information

VERB CEO, Rory J. Cutaia will hold a conference call today, March 25, 2025, at 1:00 p.m. Eastern time to discuss the 2024 results and strategic plans for 2025. A telephonic replay of the conference call is available from 4:00 p.m. Eastern time today through April 8, 2025.

VERB Q4 and FY 2024 Earnings Call

Date: Tuesday, March 25, 2025

Time: 1:00 p.m. Eastern time (10:00 a.m. Pacific time)

To access by phone: Please call the conference telephone number 10-15 minutes prior to the start time. An operator will register your name and organization.

Meeting Link: CLICK HERE

Toll Free: 1-877-407-4018

Toll/International: 1-201-689-8471

Telephonic Replay: Available after 4:00 p.m. Eastern time on the same day through Tuesday, April 8, 2025 at 11:59 PM ET

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 13752553

About VERB

Verb Technology Company, Inc. (Nasdaq: VERB), is the innovative force behind interactive video-based social commerce. The Company operates three business units, each of which leverages its social commerce technology and video marketing expertise. The Company’s MARKET.live platform is a multi-vendor, livestream social shopping destination at the forefront of the convergence of e-commerce and entertainment, where brands, retailers, creators, and influencers engage their customers, clients, fans, and followers across multiple social media channels simultaneously. GO FUND YOURSELF is a revolutionary interactive social crowd funding platform and TV show for public and private companies seeking broad-based exposure across social media channels for their crowd-funded Regulation CF and Regulation A offerings. The platform combines a ground-breaking interactive TV show with MARKET.live’s back-end capabilities allowing viewers to tap, scan or click on their screen to facilitate an investment, in real time, as they watch companies presenting before the show’s panel of “Titans”. Presenting companies that sell consumer products are able to offer their products directly to viewers during the show in real time through shoppable onscreen icons. VANITYPrescribed.com and GoodGirlRx.com are telehealth portals, intended to redefine telehealth by offering a seamless, digital-first experience that empowers individuals to take control of their healthcare needs. They were designed and developed to disrupt the traditional healthcare model by providing tailored healthcare solutions at affordable, fixed prices – without hidden fees, membership costs, or inflated pharmaceutical markups. GoodGirlRx.com, a partnership with Savannah Chrisley, a well-known lifestyle personality and advocate for health and wellness, offers customers access to convenient, no-hassle telehealth services and pharmaceuticals, including the new weight-loss drugs, with fixed pricing regardless of dosage, breaking away from the industry’s traditional model of excessive pricing and pharmaceutical gatekeeping.

The Company is headquartered in Las Vegas, NV and operates full-service production and creator studios in Los Alamitos, California.

For more information, please visit: www.verb.tech

Follow VERB and MARKET.live here:

VERB on Facebook: https://www.facebook.com/VerbTechCo

VERB on Twitter: https://twitter.com/VerbTech_Co

VERB on LinkedIn: https://www.linkedin.com/company/verb-tech

VERB on YouTube: https://www.youtube.com/channel/UC0eCb_fwQlwEG3ywHDJ4_KQ

Sign up for E-mail Alerts here: https://ir.verb.tech/news-events/email-alerts

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties and include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance, or achievements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, those identified in our filings with the Securities and Exchange Commission (the “SEC”), including our annual, quarterly and current reports filed with the SEC and the risk factors included in our annual report on Form 10-K filed with the SEC today. Any forward-looking statement made by us herein is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement whether as a result of new information, future developments or otherwise.

Investor Relations Contact: investors@verb.tech

Media Contact: info@verb.tech

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/98fa0d86-9d94-4cfa-97f5-ffd4c89edad9

https://www.globenewswire.com/NewsRoom/AttachmentNg/c013f2c6-3f17-4624-bd9a-60b7c28ab5fe

![]()