Upexi Grows Treasury to 1.819 Million SOL Worth $331 Million with a $58 Million Unrealized Gain in Under Three Months

Upexi purchased an additional 100,000 SOL, and anticipates it may generate up to approximately $26 million in annual staking revenue based on current SOL holdings

Company releases adjusted metrics for enhanced transparency and analysis

TAMPA, Fla., July 21, 2025 (GLOBE NEWSWIRE) — Upexi, Inc. (NASDAQ: UPXI) (the “Company” or “Upexi”), a brand owner specializing in the development, manufacturing and distribution of consumer products with diversification into the cryptocurrency space, today announced the acquisition of 100,000 SOL, bringing its treasury holdings to 1,818,809 SOL worth $331 million. The recent purchase follows the successful closing of a roughly $200 million equity and convertible notes private placement last week.

Treasury and Staking Update

On July 17, Upexi purchased 100,000 SOL for $17.7 million, or $176.77 per SOL. The Company now holds 1,818,809 SOL, up 147% from the 735,692 SOL at the end of June and of which 56% were purchased in locked form for a discount. The 1.8 million SOL were acquired for $273 million and are valued at $331 million using the current price of SOL1 for an unrealized gain of approximately $58 million inclusive of both SOL appreciation and the locked SOL discount.

Upexi continues to stake substantially all its SOL, which generates an approximately 8% yield. Based on the current price of SOL and an 8% yield, Upexi anticipates it may generate up to approximately $26 million in annual staking revenue based on current SOL holdings.

“Upexi was the first public company to raise a large-scale equity private placement for an altcoin digital asset treasury,” said Allan Marshall, Chief Executive Officer of Upexi. “In just three months, we have successfully closed two additional accretive capital raises, including a highly innovative in-kind convertible note, and grew the treasury to 1.8 million SOL or $331 million. With multiple value accrual mechanisms – from intelligent capital issuance to staking and discounted locked SOL purchases – we are confident we can and will continue to create significant value for shareholders.”

Brian Rudick, Upexi Chief Strategy Officer, added, “Underpinned by the leading high performance blockchain and with digital asset legislation in the US poised to pass, Upexi is well-positioned to benefit from increasing blockchain adoption. From a rising treasury value to an expanding multiple and more accretive issuances, Upexi offers investors multiple potential ways to benefit should Solana perform well in the future. We believe this positions Upexi as an optimal vehicle for investors seeking exposure to digital assets.”

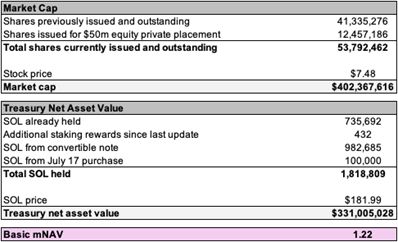

Current Metrics (and Basic mNAV)

As of July 18, Upexi had a market cap of $402 million based on the 53.8 million shares currently issued and outstanding. In addition, Upexi holds 1.8 million SOL, for a net asset value (NAV) of $331 million. The $402 million market cap is equivalent to 1.2x the value of the SOL it holds, and Upexi will heretofore refer to this metric as the “Basic mNAV.”

| Current Metrics |

Sources: Yahoo Finance, CoinGecko. Note: UPXI price as of Friday, July 18, 2025 at 4:00pm EST.

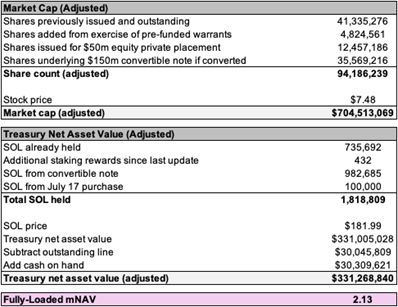

Adjusted Metrics (and Fully-Loaded mNAV)

Management believes financials adjusted for certain possible or likely items can supplement investor analysis and is thus providing the following information assuming 1) pre-funded warrants are converted into common equity shares, 2) the roughly $150 million convertible notes convert to equity, 3) the outstanding line is repaid, and 4) cash on hand is used to buy Solana.

Under the above assumptions, Upexi has an adjusted share count of 94.2 million, equating to an adjusted market cap of $705 million using Friday’s closing price, and its adjusted net asset value is $331 million. This adjusted market cap is equivalent to 2.1x the adjusted value of the SOL it holds, and Upexi will heretofore refer to this metric as the “Fully-Loaded mNAV”.

| Adjusted Metrics |

Sources: Yahoo Finance, CoinGecko. Note: UPXI price as of Friday, July 18, 2025 at 4:00pm EST. Assumes cash on hand is used to buy spot SOL.

About Upexi, Inc.

Upexi is a brand owner specializing in the development, manufacturing, and distribution of consumer products. The Company has entered the cryptocurrency industry and cash management of assets through a cryptocurrency portfolio. For more information on Upexi’s treasury strategy and future developments, visit www.upexi.com.

Follow Upexi on X – https://twitter.com/upexitreasury

Follow CEO, Allan Marshall, on X – https://x.com/marshall_a22015

Follow CSO, Brian Rudick, on X – https://x.com/thetinyant

Forward Looking Statements

This news release contains “forward-looking statements” as that term is defined in Section 27A of the United States Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements in this press release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations, or intentions regarding the future. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the inherent uncertainties associated with business strategy, potential acquisitions, revenue guidance, product development, integration, and synergies of acquiring companies and personnel. These forward-looking statements are made as of the date of this news release, and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward- looking statements. Although we believe that the beliefs, plans, expectations, and intentions contained in this press release are reasonable, there can be no assurance that such beliefs, plans, expectations or intentions will prove to be accurate. Investors should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in our annual report on Form 10-K and other periodic reports filed from time-to-time with the Securities and Exchange Commission.

Company Contact

Brian Rudick, Chief Strategy Officer

Email:brian.rudick@upexi.com

Phone: (216) 347-0473

Media Contact

Gasthalter & Co.

Upexi@gasthalter.com

Investor Relations Contact

KCSA Strategic Communications

Valter Pinto, Managing Director

Email: Upexi@KCSA.com

Phone: (212) 896-1254

1 Uses the SOL price as of 4:00pm EST on Sunday, July 20, 2025 throughout this press release.

Photos accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a8b0dbd1-98af-4feb-bacd-a1f75df4b026

https://www.globenewswire.com/NewsRoom/AttachmentNg/b1aa1908-dbe5-47ce-a634-fbc874522b6a

![]()