Tomingley Exploration Intersects Significant Gold at El Paso

PERTH, Australia, Aug. 18, 2025 (GLOBE NEWSWIRE) — As originally indicated in an investor announcement dated 14 August 2025, Alkane Resources Limited (ASX: ALK; TSX: ALK; OTCQX: ALKEF) is pleased to provide the latest exploration results for drilling in the region around the Company’s Tomingley Gold Operations in Central New South Wales:

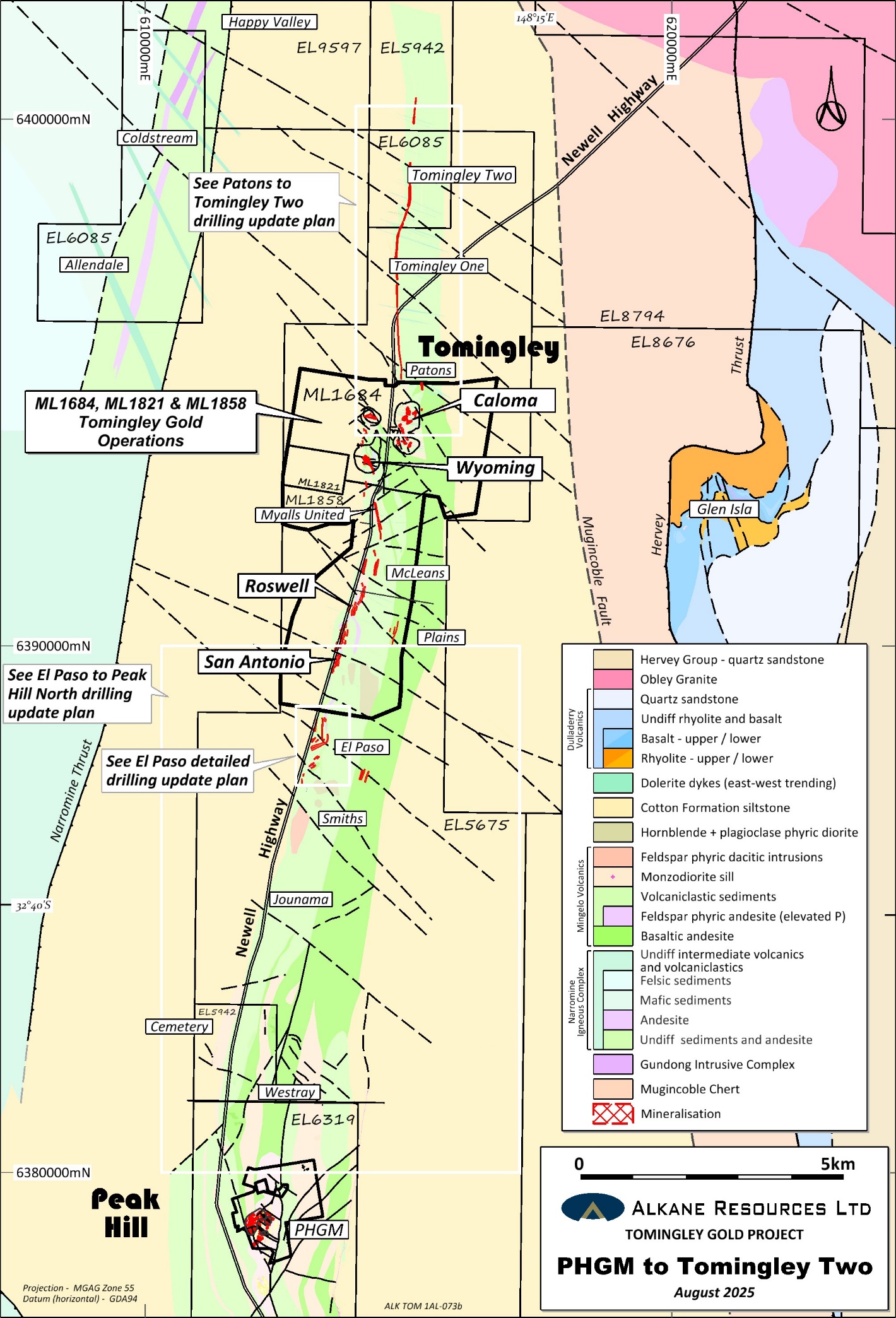

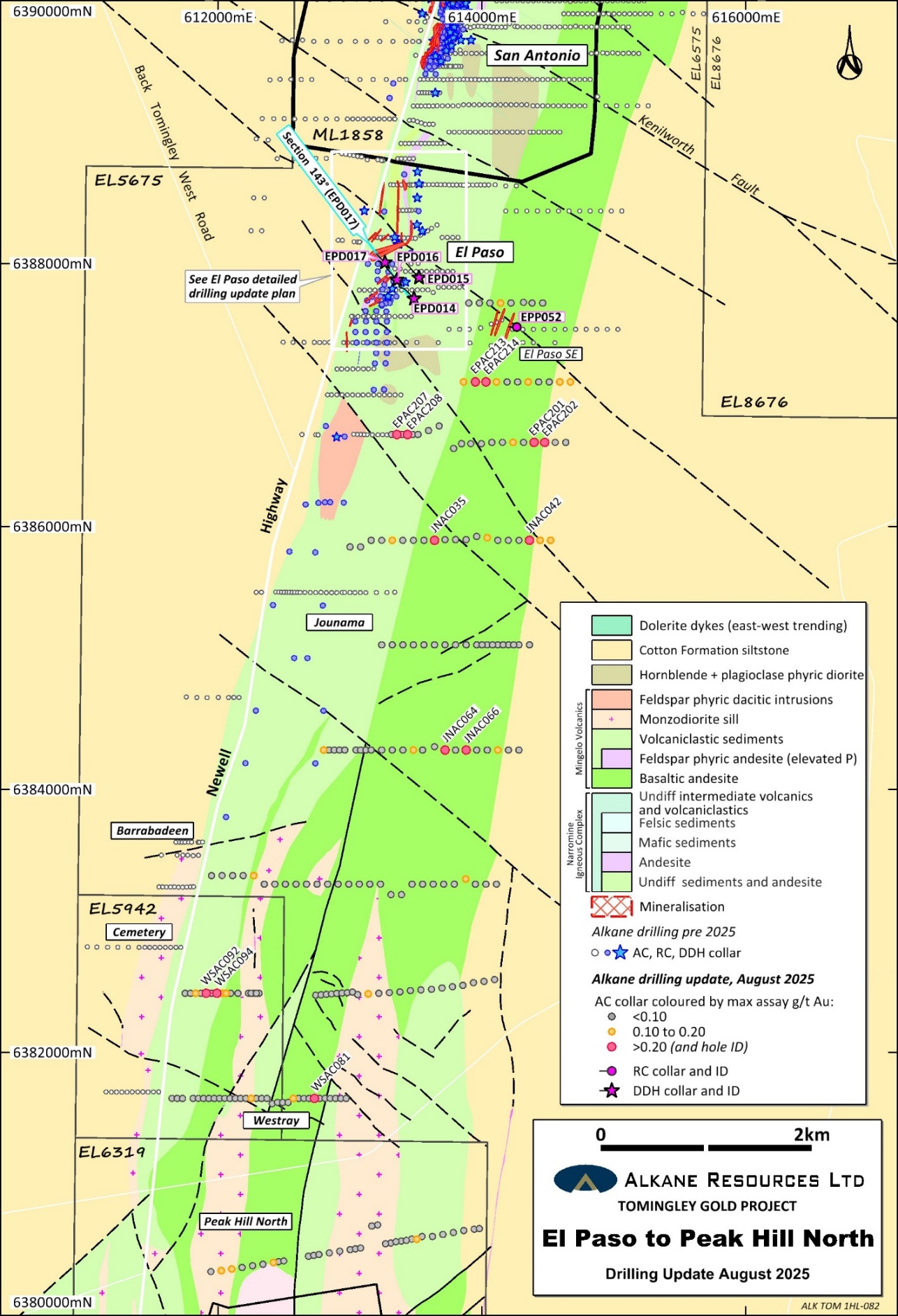

- Exploration within the Tomingley Gold Project (TGP) has focussed on defining targets that will add to the resource inventory and further extend mine life for the Tomingley Gold Operations (TGO). Exploration comprised diamond core, RC and air-core drilling at several targets within 5km of TGO.

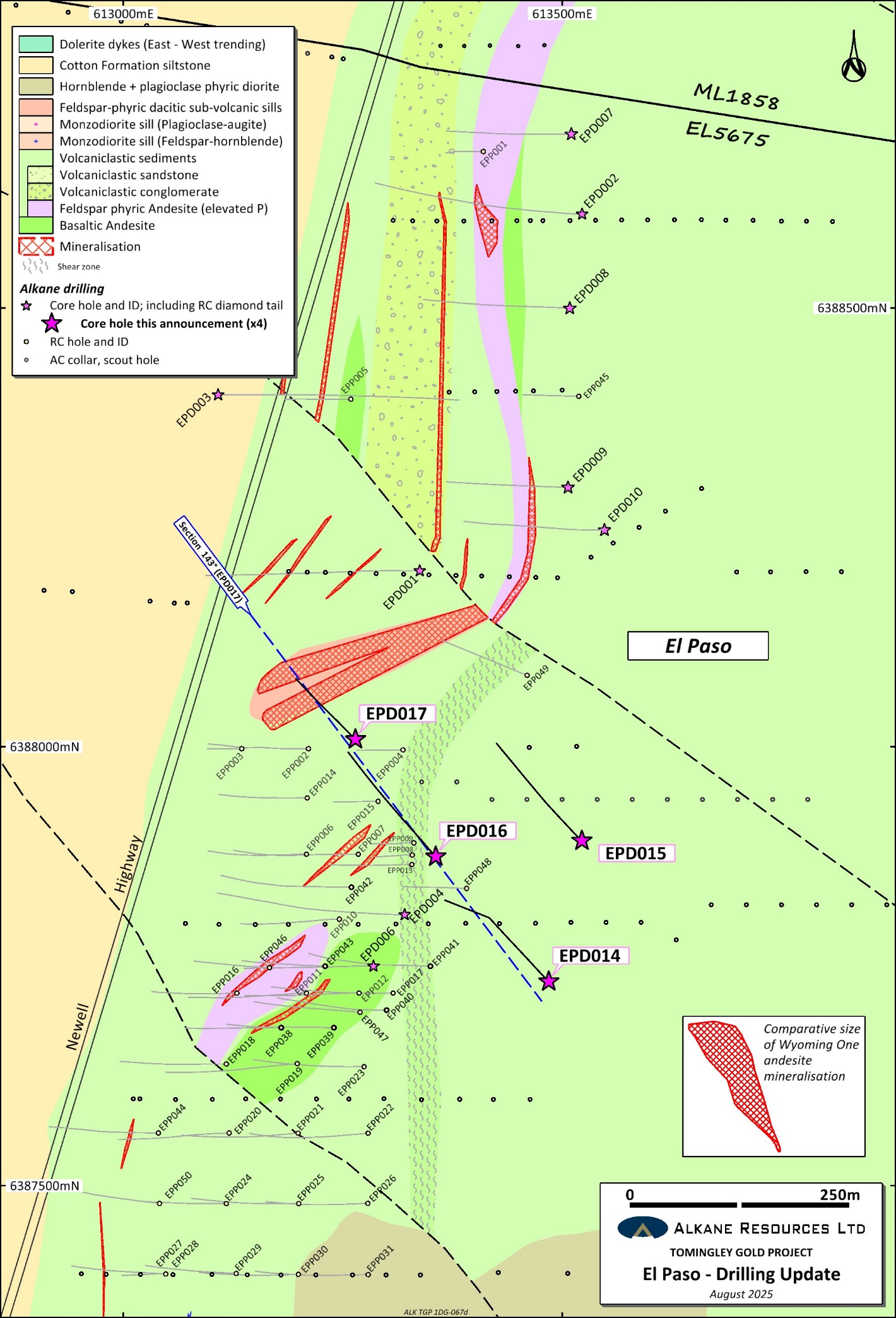

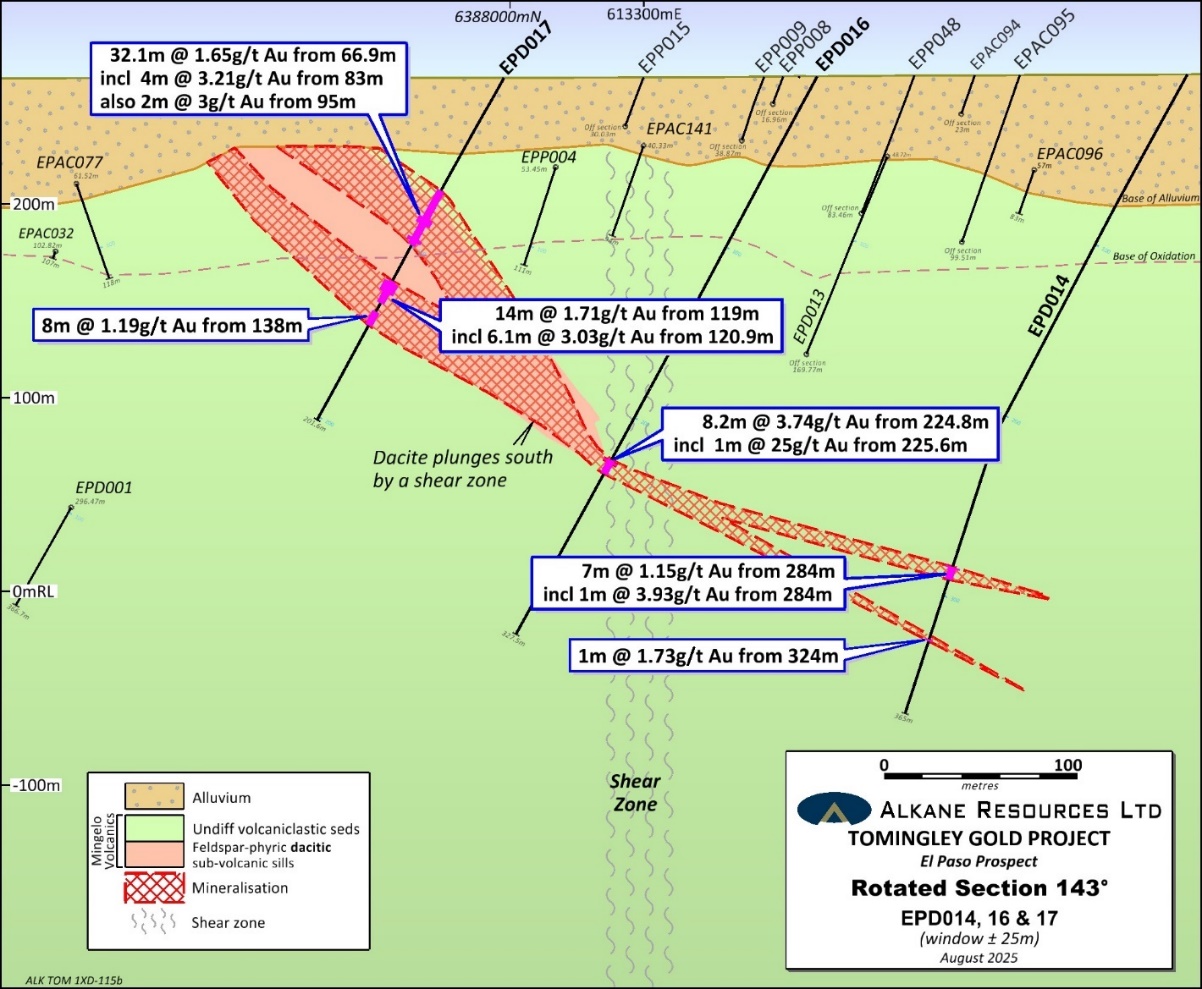

- Drilling at the El Paso prospect, 2km south of the San Antonio deposit comprised four diamond core drill holes, totalling approximately 1,200 metres, and targeted a prospective dacite unit which is geochemically identical to the dacite unit that is the host for high-grade mineralisation in the southern part of the San Antonio deposit. Significant gold intercepts, that are near to true thickness, highlight the potential of the mineralisation associated with the dacite:

| EPD016 | 8.2 metres grading 3.74 g/t Au from 224.8 metres; | |||

| Incl | 1 metres grading 25.0 g/t Au from 225.6 metres. | |||

| EPD017 | 32.1 metres grading 1.65 g/t Au from 66.9 metres; | |||

| incl | 4 metres grading 3.21 g/t Au from 83 metres; | |||

| also | 2 metres grading 3.00 g/t Au from 95 metres; | |||

| and | 14 metres grading 1.71 g/t Au from 119 metres; | |||

| incl | 6.1 metres grading 3.03 g/t Au from 120.9 metres; | |||

| and | 8 metres grading 1.19 g/t Au from 138 metres. |

- 2,000 metres of diamond core drilling is planned to begin next month to further define an exploration target for El Paso.

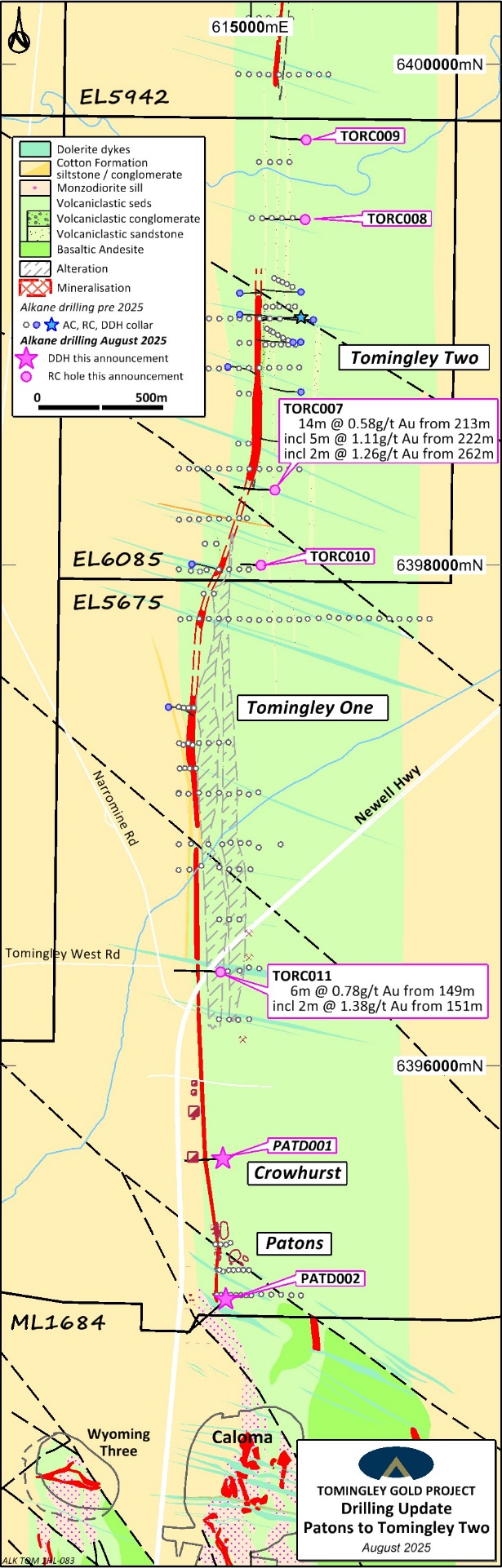

- Five RC drill holes were completed to test along the 5km long Au-As ‘Tomingley Structure’ that extends north from the historic Tomingley workings. The assay results support the prospectivity of the Tomingley Structure to host significant gold mineralisation that includes the Tomingley Two prospect:

| TORC007 | 14 metres grading 0.58 g/t Au from 213 metres; | |||

| Incl | 5 metres grading 1.11 g/t Au from 222 metres; | |||

| and | 2 metres grading 1.26 g/t Au from 262 metres. | |||

| TORC011 | 6 metres grading 0.78 g/t Au from 149 metres; | |||

| incl | 2 metres grading 1.38 g/t Au from 151 metres. |

- Two diamond core drill holes were completed to separately test beneath the historic Tomingley gold workings and to map the andesite that is host to the majority of the Caloma gold deposit north into the EL. A low gold grade, large quartz reef was intersected beneath the Tomingley workings, and the Caloma andesite was intersected 600m north of the Caloma open cut.

- 17,000 metres of air-core drilling has identified new areas of gold mineralisation between El Paso and Peak Hill within the Mingelo Volcanic belt. Significant gold results were received in several new areas including El Paso SE, Jounama and Westray prospects including:

| EPAC201 | 12 metres grading 0.35 g/t Au from 75 metres; | |||

| incl | 3 metres grading 0.93 g/t Au from 84 metres. | |||

| EPAC214 | 9 metres grading 0.29 g/t Au from 72 metres. | |||

| JNAC035 | 3 metres grading 0.39 g/t Au from 63 metres. | |||

| WSAC092 | 3 metres grading 0.55 g/t Au from 54 metres. | |||

| WSAC094 | 3 metres grading 0.59 g/t Au from 24 metres. |

- Planned regional exploration around Tomingley for the next 12 months comprises a high-resolution drone magnetic survey over the area surrounding and including Peak Hill to aid delineate fertile structures and map new prospective volcanic terrain beneath cover. Other target generation work includes mapping, soil sampling and air-core drilling at various prospects including Glen Isla, Gundong and Trewilga. RC and diamond core drilling for a total of 6,000m is planned to test targets at El Paso, El Paso SE, Tomingley Two, Glen Isla and Westray.

- In parallel with routine grade control drilling at the planned San Antonio open pit and Roswell underground at TGO, a significant underground drilling program is testing McLeans, Roswell North and the Roswell Western Monzodiorite. Results are anticipated in October.

Alkane Managing Director & CEO, Nic Earner, said: “We continue to explore at Tomingley within our approved mining areas and regionally, seeking to add further mine life, scale, and grade to Tomingley. It is pleasing to see the extent of mineralisation in the broader Tomingley region, and we look forward to continuing to add to our resource base.”

Tomingley Gold Project

Alkane Resources Ltd 100%

The Tomingley Gold Project (TGP) covers an area of approximately 440 km2 stretching 60 km north-south along the Newell Highway from Tomingley in the north, through Peak Hill and almost to Parkes in the south. The TGP contains Alkane’s currently operating TGO, an open pit and underground operation with a 1 Mtpa processing facility.

Over the past several years Alkane has conducted an extensive regional exploration program that led to the definition of Mineral Resources at the Roswell and San Antonio deposits (ASX Announcement 2 May 2022 and ASX Announcement 16 February 2021), separate from the established resources and reserves at TGO. Alkane has completed a 2.7 km long drive from the Wyoming One open cut to Roswell. Roswell and San Antonio now form part of TGO, with processing of ore mined from underground at Roswell beginning in April 2024. The focus for the exploration team has turned to other targets within the TGP, both near-mine and further out from TGO.

Exploration over the previous 12 months for TGP comprised high-resolution drone magnetics, air-core drilling testing the Mingelo Volcanic belt between El Paso prospect and Peak Hill, and deeper RC/DD drilling testing El Paso, Tomingley Structure, and the historic Tomingley workings that are all located within 7 km of the Tomingley processing facility.

As part of the recent exploration drilling, assay results were received from 233 air-core (AC) drill holes for a total of 16,693 metres; 6 reverse circulation (RC) drill holes for a total of 1,442 metres; and 6 diamond core (DD) drill holes for a total of 1,883 metres.

The exploration undertaken:

- Targeted a highly prospective dacite volcanic host unit at the El Paso prospect with 4 DD holes;

- To test gold mineralisation intersected by previous AC drilling SE of El Paso prospect with 1 RC hole;

- Tested 2 km x 7 km segment of the Mingelo Volcanic belt (TGO host rock) between El Paso and Peak Hill for Au-As anomalism with 233 AC drill holes;

- Completed 2 DD holes north of the Caloma open cut to map near-mine stratigraphy and to test beneath the historic Tomingley workings;

- Further test the Au-As ‘Tomingley Structure’ around the Tomingley Two prospect and north of the historic Tomingley Workings with 5 RC holes; and

- Surveyed a section of Mingelo Volcanic Belt north of Peak Hill with a high-resolution drone magnetic survey to aid delineation of major structures, and volcanic units for drill targeting.

El Paso

The El Paso prospect is ~2 km south of the San Antonio deposit (406,000 oz Au * details in appended table). Mineralisation associated with attenuated volcanic units was discovered at this prospect in 2017. Several programs of drilling intersected multiple zones of mineralisation, however the complexity of the geology, the widespread alteration and difficult drilling conditions has so far impeded the effective delineation of substantial gold resources.

Four mud rotary collared DD holes were recently completed to further test significant gold mineralisation associated with a dacite volcanic unit intersected in the previous round of drilling by EPD013 – 12 m @ 1.50 g/t Au from 297 m (ASX announcement 7 October 2024). Significant gold mineralisation includes intercepts that are approximately true thickness (estimated at 90%):

| EPD014 | 7 metres grading 1.15 g/t Au from 284 metres; | |||

| incl | 1 metre grading 3.93 g/t Au from 284 metres; | |||

| and | 1 metre grading 1.73 g/t Au from 324 metres. | |||

| EPD016 | 8.2 metres grading 3.74 g/t Au from 224.8 metres; | |||

| incl | 1 metres grading 25.0 g/t Au from 225.6 metres. | |||

| EPD017 | 32.1 metres grading 1.65 g/t Au from 66.9 metres; | |||

| incl | 4 metres grading 3.21 g/t Au from 83 metres; | |||

| also | 2 metres grading 3.00 g/t Au from 95 metres; | |||

| and | 14 metres grading 1.71 g/t Au from 119 metres; | |||

| incl | 6.1 metres grading 3.03 g/t Au from 120.9 metres; | |||

| and | 8 metres grading 1.19 g/t Au from 138 metres. |

The dacite has a northeast strike length of over 400m, dips to the southeast and appears truncated by a subvertical north-trending shear zone along strike and down dip to the east. The dacite is believed to continue at depth to the south (west of the shear zone).The mineralisation appears to continue down dip (across the shear zone) within the volcaniclastic sediments, as a possible conduit structure to the mineralisation hosted in the dacite. A further 2,000m of mud rotary diamond core drilling is planned to begin in September to contribute to defining an exploration target for El Paso.

One RC drill hole was planned to test an Au-As zone of mineralisation previously intersected by three AC drill holes, 1 km southeast of El Paso (ASX announcement 7 October 2024). Unfortunately, the RC drill hole failed to overcome the sandy alluvial overburden and underlying saprolitic regolith, terminating in gold mineralised bedrock at 124m, grading 0.22 g/t Au. Mud rotary diamond drilling is being prioritised to test this new prospect properly.

EPD017 – Sericite-carbonate altered dacite with sheeted quartz-albite veins and pyrite-arsenopyrite selvages from 6.1m interval grading 3.03 g/t Au from 120.9 m.

Tomingley Structure prospects

The ‘Tomingley Structure’ is an Au-As mineralised structure that extends north 5km from the historic Tomingley workings and transects the Tomingley Two prospect. The Tomingley Structure was originally delineated by reconnaissance air-core drilling north of Tomingley and identified the Tomingley One and Tomingley Two prospects (ASX announcement 8 June 2004). Mineralisation associated with the structure comprises strong quartz veining/silicification and intense sericite alteration with pyrite-arsenopyrite hosted in meta-sediments. The structure is covered by shallow alluvium immediately south of the historic Tomingley workings, deepening to approximately 30 metres at Tomingley One and to over 100 metres north of Tomingley Two.

Five RC drill holes for a total of 1,318 metres tested along the ‘Tomingley Structure’. Significant gold (+0.2 g/t Au) was intersected in three holes and in addition significant arsenic (+0.1 % As) was intersected in a fourth hole. The fifth RC hole did not reach target depth due to sandy alluvium bogging the rod string, terminating the hole at 148 metres. Significant gold mineralisation from the drilling includes:

| TORC007 | 14 metres grading 0.58 g/t Au from 213 metres; | |||

| incl | 5 metres grading 1.11 g/t Au from 222 metres; | |||

| and | 6 metres grading 0.56 g/t Au from 258 metres; | |||

| incl | 2 metres grading 1.26 g/t Au from 262 metres. | |||

| TORC011 | 6 metres grading 0.78 g/t Au from 149 metres; | |||

| incl | 2 metres grading 1.38 g/t Au from 151 metres. | |||

Work is planned at Tomingley One (e.g. TO035 – 2m @ 10.9g/t Au from 34m; ASX announcement 8 June 2004) and Tomingley Two (e.g. TORC005 – 11m @ 1.7 g/t Au from 158m including 4m @ 3.87 g/t Au from 159m; ASX announcement 16 September 2021) prospects to better characterise the structures and lithologies integral for significant gold mineralisation. Two diamond core drill holes are planned, to collect structural measurements and to define any key lithologies focussing mineralisation.

Tomingley Gold Workings and near-mine exploration

Two diamond core holes were completed from surface to test near-mine targets immediately north of the mining lease. Diamond hole (PATD002) targeted 600m north of the Caloma open cut to test for an extension to the andesite that hosts the majority of the Caloma gold resources (pre-mining Caloma resource 369,400 oz Au – ASX announcement 29 March 2012). The hole intersected a package of carbonaceous shales, fine-grained volcaniclastic sediments and the Caloma andesite with an estimated true thickness of 60 metres (similar thickness as observed at Caloma). Mineralised quartz veining was observed in the footwall sediments to the andesite with a best intercept of:

PATD002 5 metres grading 0.44g/t Au from 80.3 metres.

Whilst only minor alteration and mineralisation was observed in the andesite, PATD002 was collared to the southwest which is not optimal for targeting Caloma’s moderately west-dipping mineralisation. Further drilling in planned to target this prospective lithology with diamond drill holes collared to the east, from the west side of the Newell Highway.

The historic Tomingley gold workings were targeted for the first time in Alkane’s history, with one diamond core hole (PATD001). The workings (Crowhurst & Sons Mine – 62kg Au production 1883-1911) are an estimated 117m deep, PATD001 was targeted 30 metres below this depth. The drilling intersected a package of carbonaceous shales and volcaniclastic siltstones that was host to a 30-m-thick quartz reef with significant pyrite (and trace arsenopyrite) mineralisation. The quartz reef below the workings returned a best intercept of:

PATD001 9.5 metres grading 0.27 g/t Au from 175.5 metres.

The historic average head grade at Crowhurst is recorded as 26 g/t Au, so there are likely strong plunge controls to any high-grade ore shoots. Structural work is underway to determine an orientation for the existence of these shoots prior to further drill-testing.

Reconnaissance AC drilling

233 air-core drill holes were completed for 16,693 metres along nominal 800 m-spaced traverses to test an approximate 2 km x 7 km section of the Mingelo Volcanic Belt between El Paso prospect and Peak Hill. The section of the belt is blind, covered by alluvium ranging from only a few metres to over 50 metres. Three potential new zones of mineralisation were discovered:

Southeast of El Paso – Two holes (EPAC213 – 4) intersected Au-As mineralisation in weathered basaltic andesite, approximately 1 km southeast of El Paso, and 400 m southwest of previously AC defined Au-As mineralisation.

This apparent northeast mineralisation trend parallels the orientation observed at El Paso. Significant Au-As anomalism was also intersected (EPAC201 – 2, JNAC042) along the eastern margin for 800 m of the extensive basaltic-andesite unit.

Best Au intercepts include:

| EPAC201 | 12 metres grading 0.35 g/t Au from 75 metres; | |||

| incl | 3 metres grading 0.93 g/t Au from 84 metres. | |||

| EPAC214 | 9 metres grading 0.29 g/t Au from 72 metres. |

Westray – Two holes (WSAC092, 94) intersected significant Au-As anomalism in volcaniclastic sediments proximal to andesites.

Best Au intercepts include:

| WSAC092 | 3 metres grading 0.55 g/t Au from 54 metres. | |||

| WSAC094 | 3 metres grading 0.59 g/t Au from 24 metres. |

Two deeper RC or DD drill holes are planned to test the coincident AC and soils Au-As target at Westray and the El Paso SE prospect.

Planned exploration program

Planned exploration around the Tomingley Gold Operations (TGO) for the next 12 months comprises a high-resolution drone magnetic survey over the area surrounding and including Peak Hill to delineate fertile structures and to map new volcanic terrain beneath the cover sequence to the east of Peak Hill. Other exploration involves work at numerous prospects, including 6,000m of deeper RC/DD drilling, comprising:

El Paso, El Paso SE, Tomingley One, Tomingley Two, Caloma North (orogenic Au) – diamond drilling;

Glen Isla (epithermal Au) – mapping, induced polarisation (IP) survey and diamond drilling;

Westray (orogenic Au) – RC drilling;

Reconnaissance, McGregors (orogenic Au) – air-core drilling;

Gundong (magmatic Ni, orogenic Au) – air-core drilling;

Trewilga (orogenic Au) – soil sampling.

In parallel with routine grade control surface drilling at the planned San Antonio open cuts and underground drilling at Roswell underground, a significant underground drilling program is testing McLeans, Roswell North and the Roswell Western Monzodiorite. These results are anticipated in October.

| Table 1 – Tomingley Gold Project Significant Gold Results – August 2025 (>0.2g/t Au) | |||||||||||

| Hole ID | Easting (MGA) | Northing (MGA) | RL (m) | Dip | Azimuth (Grid) | Total Depth | Interval From (m) | Interval To (m) | Intercept (m) | Au (g/t) | Prospect |

| EPD014 | 613485 | 6387733 | 267 | -60 | 315 | 365 | 284 | 291 | 7 | 1.15 | |

| incl | 284 | 285 | 1 | 3.93 | |||||||

| and | 318 | 319 | 1 | 0.27 | |||||||

| and | 324 | 325 | 1 | 1.73 | |||||||

| EPD015 | 613522 | 6387893 | 266 | -60 | 315 | 327.7 | No significant results or dacite | ||||

| EPD016 | 613356 | 6387875 | 266 | -62 | 318 | 327.5 | 180 | 181.1 | 1.1 | 0.24 | |

| and | 224.8 | 233 | 8.2 | 3.74 | |||||||

| incl | 225.6 | 226.6 | 1 | 25.0 | El Paso | ||||||

| and | 294 | 295 | 1 | 0.71 | |||||||

| EPD017 | 613264 | 6388008 | 265 | -61 | 315 | 201.6 | 58 | 59 | 1 | 0.65 | |

| and | 66.9 | 99 | 32.1 | 1.65 | |||||||

| incl | 83 | 87 | 4 | 3.21 | |||||||

| also | 95 | 97 | 2 | 3.00 | |||||||

| and | 119 | 133 | 14 | 1.71 | |||||||

| incl | 120.9 | 127 | 6.1 | 3.03 | |||||||

| and | 138 | 146 | 8 | 1.19 | |||||||

| EPP052 | 614264 | 6387518 | 271 | -61 | 273 | 124** | 123 | 124 | 1* | 0.22 | |

| PATD001 | 614887 | 6395628 | 278 | -61 | 268 | 300.7 | 175.5 | 185 | 9.5 | 0.27 | |

| PATD002 | 614899 | 6395066 | 275 | -56 | 228 | 360.7 | 17 | 18 | 1 | 0.23 | |

| and | 65.1 | 66 | 0.9 | 0.21 | Tomingley | ||||||

| and | 73 | 74 | 1 | 0.20 | Workings | ||||||

| and | 80.3 | 85.3 | 5 | 0.44 | |||||||

| TORC011 | 614878 | 6396374 | 278 | -60 | 274 | 300 | 149 | 155 | 6 | 0.78 | |

| incl | 151 | 153 | 2 | 1.38 | |||||||

| TORC007 | 615095 | 6398299 | 283 | -61 | 272 | 304 | 213 | 227 | 14 | 0.58 | |

| incl | 222 | 227 | 5 | 1.11 | |||||||

| and | 235 | 236 | 1 | 0.33 | |||||||

| and | 240 | 243 | 3 | 0.40 | Tomingley | ||||||

| and | 258 | 264 | 6 | 0.56 | Structure | ||||||

| incl | 262 | 264 | 2 | 1.26 | |||||||

| TORC008 | 615216 | 6399379 | 283 | -61 | 270 | 310 | 126 | 129 | 3 | 0.24 | |

| TORC009 | 615220 | 6399698 | 283 | -61 | 273 | 256 | No significant results | ||||

| TORC010 | 615040 | 6397999 | 282 | -61 | 273 | 148** | Hole abandoned early | ||||

* hole finished in mineralisation. ** hole abandoned early.

True widths are approximately 90% (El Paso) and 60% (Tomingley Two and Tomingley Workings) of intercept width.

| Table 2 – Tomingley Gold Project Significant Gold Aircore Results – August 2025 (>0.2g/t Au) | |||||||||||

| Hole ID | Easting (MGA) | Northing (MGA) | RL (m) | Dip | Azimuth (Grid) | Total Depth | Interval From (m) | Interval To (m) | Intercept (m) | Au (g/t) | Prospect |

| EPAC201 | 614395 | 6386640 | 265 | -60 | 270 | 106 | 63 | 66 | 3 | 0.20 | |

| and | 75 | 87 | 12 | 0.35 | |||||||

| incl | 84 | 87 | 3 | 0.93 | |||||||

| EPAC202 | 614475 | 6386640 | 265 | -60 | 270 | 114 | 69 | 72 | 3 | 0.25 | |

| EPAC207 | 613355 | 6386700 | 265 | -60 | 270 | 80 | 57 | 60 | 3 | 0.23 | |

| EPAC208 | 613435 | 6386700 | 265 | -60 | 270 | 81 | 24 | 27 | 3 | 0.62 | |

| EPAC213 | 613950 | 6387100 | 270 | -60 | 282 | 119 | 102 | 105 | 3 | 0.64 | Regional |

| EPAC214 | 614030 | 6387100 | 270 | -60 | 270 | 106 | 72 | 81 | 9 | 0.29 | |

| JNAC035 | 613640 | 6385895 | 265 | -60 | 270 | 117 | 63 | 66 | 3 | 0.39 | |

| JNAC042 | 614360 | 6385895 | 265 | -60 | 270 | 90 | 51 | 54 | 3 | 0.24 | |

| JNAC064 | 613720 | 6384300 | 265 | -60 | 270 | 97 | 78 | 81 | 3 | 0.33 | |

| JNAC066 | 613880 | 6384300 | 265 | -60 | 270 | 75 | 48 | 51 | 3 | 0.25 | |

| WSAC081 | 612730 | 6381650 | 270 | -60 | 270 | 71 | 36 | 39 | 3 | 0.38 | |

| WSAC092 | 611910 | 6382450 | 270 | -60 | 270 | 82 | 54 | 57 | 3 | 0.55 | |

| WSAC094 | 611990 | 6382450 | 270 | -60 | 270 | 64 | 24 | 27 | 3 | 0.59 | |

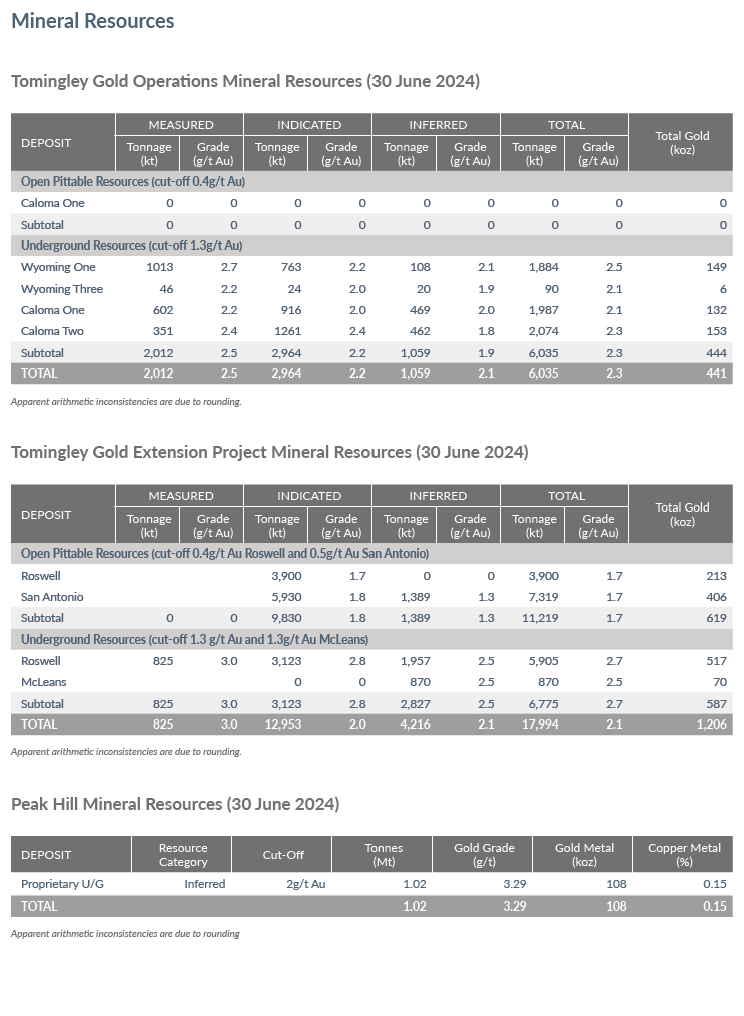

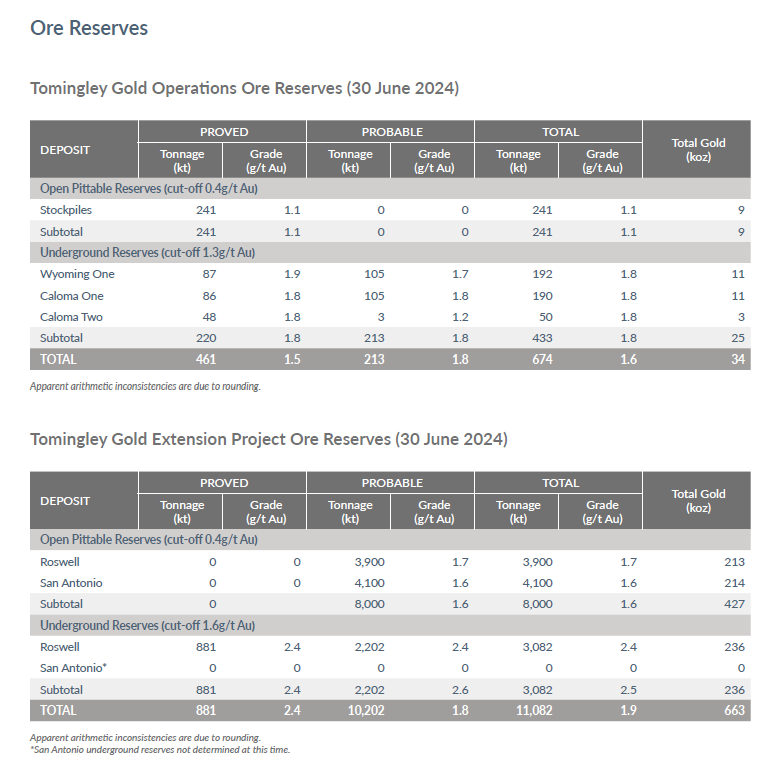

Annual revised Resources and Resources to take account of depletion and expansion from exploration and improved gold price, are being compiled for release in September 2025.

Disclaimer

Nothing in this report should be construed as either an offer to sell or a solicitation of an offer to buy or sell securities.

This report contains certain forward-looking statements and forecasts, including possible or assumed reserves and resources, production levels and rates, costs, prices, future performance or potential growth of the Company, growth or other trend projections. These statements are based on expectations as at the date of the report. Forward-looking statements inherently involve known and unknown risks, uncertainties and other factors outside of Alkane’s control and actual results, performance and achievements may differ materially from those expressed or implied from these forward-looking statements depending on a variety of factors. Alkane makes no representation, assurance or guarantee as to the accuracy or likelihood or fulfilment of any forward-looking statement or any outcomes expressed or implied in any forward-looking statement. You should not put undue reliance on forward-looking statements.

Ore Reserves and Mineral Resources Reporting Requirements

As an Australian Company with securities listed on the Australian Securities Exchange (ASX), Alkane is subject to Australian disclosure requirements and standards, including the requirements of the Corporations Act 2001 and the ASX. Investors should note that it is a requirement of the ASX Listing Rules that the reporting of ore reserves and mineral resources in Australia is in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code) and that Alkane’s ore reserve and mineral resource estimates and reporting comply with the JORC Code.

Alkane is also subject to certain Canadian disclosure requirements and standards as a result of its secondary listing on the Toronto Stock Exchange (TSX), including the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). Investors should note that it is a requirement of Canadian securities law that the reporting of mineral reserves and mineral resources in Canada and the disclosure of scientific and technical information concerning a mineral project on a property material to Alkane comply with NI 43-101.

Unless otherwise advised above or in the relevant market announcements referenced, the information in this report that relates to exploration results, mineral resources and ore reserves is based on information compiled by Mr David Meates, MAIG, (Exploration Manager NSW) who has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code and who qualifies as a “qualified person” under NI 43-101 . Mr Meates consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

Mineral resource and reserve information included in this announcement is derived from Alkane’s ASX announcement titled “Annual Mineral Resources and Reserves Statement” released to the ASX on 4 September 2024 and the technical report entitled “Tomingley and Peak Hill Gold Projects, NSW, Australia—Technical Report for NI 43-101”, with an effective date of June 6, 2025, which is available for review on SEDAR+ (www.sedarplus.ca) under Alkane’s issuer profile and on Alkane’s website at https://alkane.com.au/. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcements and that the form and context in which the Competent Person’s findings are presented have not been materially altered.

This document has been authorised for release to the market by Nic Earner, Managing Director and CEO.

ABOUT ALKANE ‐ www.alkane.com.au ‐ ASX:ALK | TSX: ALK | OTCQX: ALKEF

Alkane Resources (ASX:ALK; TSX:ALK; OTCQX:ALKEF) is an Australia-based gold and antimony producer with a portfolio of three operating mines across Australia and Sweden. The Company has a strong balance sheet and is positioned for further growth.

Alkane’s wholly owned producing assets are the Tomingley open pit and underground gold mine southwest of Dubbo in Central West New South Wales, the Costerfield gold and antimony underground mining operation northeast of Heathcote in Central Victoria, and the Björkdal underground gold mine northwest of Skellefteå in Sweden (approximately 750km north of Stockholm). Ongoing near-mine regional exploration continues to grow resources at all three operations.

Alkane also owns the very large gold-copper porphyry Boda-Kaiser Project in Central West New South Wales and has outlined an economic development pathway in a Scoping Study. The Company has ongoing exploration within the surrounding Northern Molong Porphyry Project and is confident of further enhancing eastern Australia’s reputation as a significant gold, copper and antimony production region.

The following tables are provided to ensure compliance with the JORC Code (2012) edition requirements for the reporting of exploration results.

JORC Code, 2012 Edition – Table 1 TOMINGLEY GOLD PROJECT – Regional Exploration August 2025

Section 1 Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections.)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

|

|

|

| |

|

| |

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

|

| |

|

| |

| Logging |

|

|

|

| |

|

| |

| Sub-sampling techniques and sample preparation |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

| Quality of assay data and laboratory tests |

|

|

|

| |

|

| |

| Verification of sampling and assaying |

|

|

|

| |

|

| |

|

| |

| Location of data points |

|

|

|

| |

|

| |

| Data spacing and distribution |

|

|

|

| |

|

| |

| Orientation of data in relation to geological structure |

|

|

|

| |

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

|

| |

| Exploration done by other parties |

|

Climax (in JV with Newcrest, Transit, MPI Gold) (1989-2003) – Tenement-wide heli-magnetics, MMI soils (no anomalism as deep cover was prohibitive); 70x air-core drill holes for 7,458m over magnetic targets intersecting broad zones of Au-Cu anomalism. Follow up 3x diamond core tails off air-core pre-collars for 764m with a petrology study. |

| Geology |

|

|

| Drill hole Information |

|

|

|

| |

| Data aggregation methods |

|

|

|

| |

|

| |

| Relationship between mineralisation widths and intercept lengths |

If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg ‘down hole length, true width not known’). |

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

|

|

CONTACT: NIC EARNER, MANAGING DIRECTOR & CEO, ALKANE RESOURCES LTD, TEL +61 8 9227 5677

INVESTORS & MEDIA: NATALIE CHAPMAN, CORPORATE COMMUNICATIONS MANAGER, TEL +61 418 642 556

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6c927d8e-b97c-4ff8-995a-ed26734b5735

https://www.globenewswire.com/NewsRoom/AttachmentNg/54f3a2cd-9026-41ad-93b8-7717898ad222

https://www.globenewswire.com/NewsRoom/AttachmentNg/78686766-18e5-4905-acd1-8e4875670ede

https://www.globenewswire.com/NewsRoom/AttachmentNg/2e7ba512-c1bc-4d02-8a4b-de124c3b7d0b

https://www.globenewswire.com/NewsRoom/AttachmentNg/e6e99713-98b3-4da9-9157-a7a51bc43341

https://www.globenewswire.com/NewsRoom/AttachmentNg/75bbf0d3-39f1-4e8e-ae25-7494ce48d1a1

https://www.globenewswire.com/NewsRoom/AttachmentNg/d446f7e9-cd44-4da1-8807-c1ee8d92d2cc

https://www.globenewswire.com/NewsRoom/AttachmentNg/adb82a50-c9ff-489a-af2e-6b7509b02685

![]()