Robex Resources Inc. Announces Increase of Inferred Resources, Construction Update and Bridge Extension

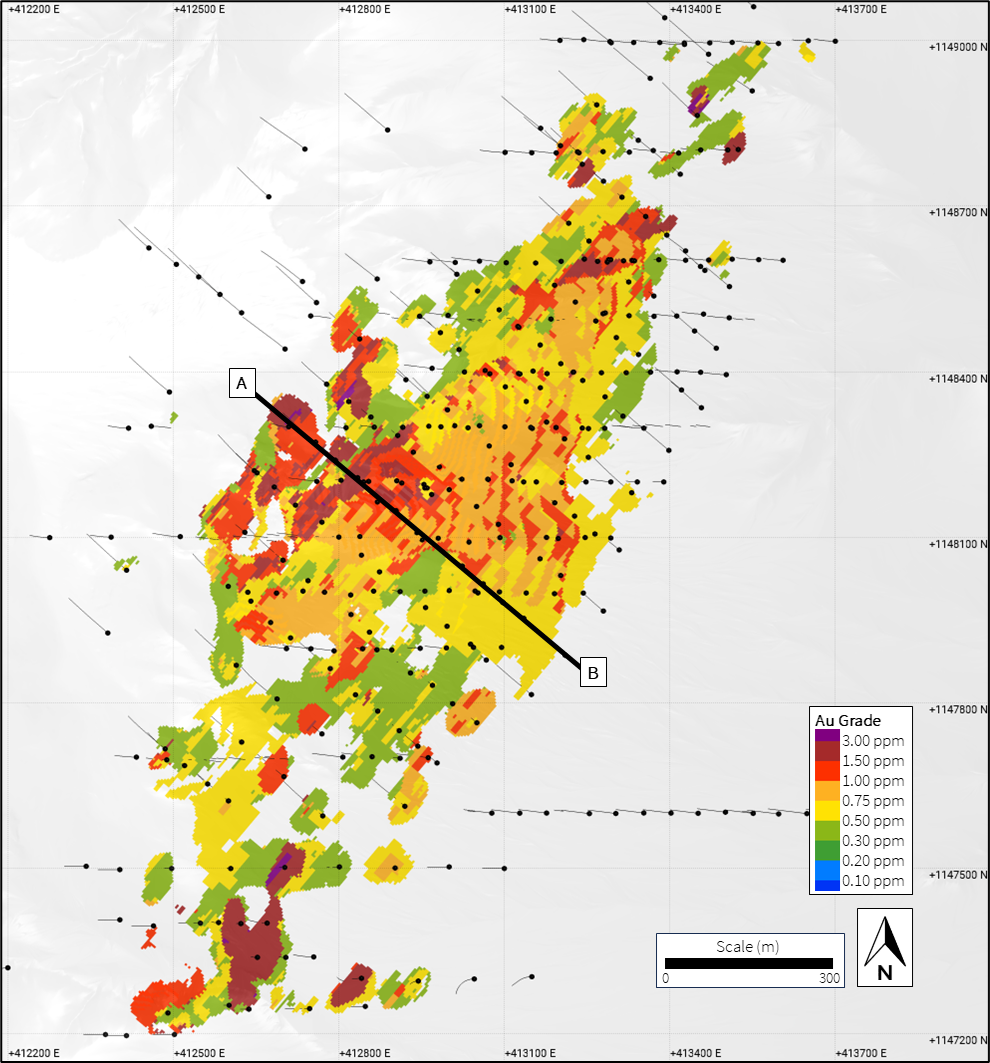

Figure 1

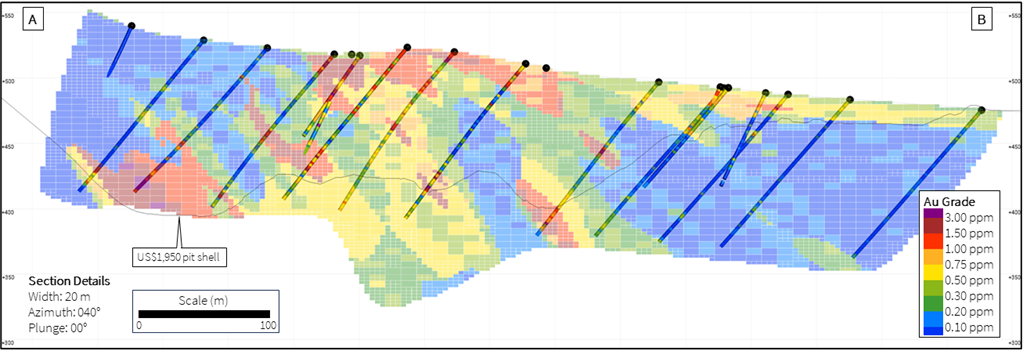

Figure 2

Figure 3

Figure 4

Figure 5

QUEBEC CITY, Dec. 22, 2023 (GLOBE NEWSWIRE) — Robex Resources Inc. (TSXV: RBX) (“Robex” or the “Company”) is pleased to announce (i) a 43-101 Mineral Resources Estimate Update for the Mansounia deposit and start of an optimized Feasibility Study (“FS”) for Q2 2024, (ii) to prioritize workstreams to bring Mansounia in the Kiniero project and review the impact on the project timeline; and (iii) extension of the existing US$ 35m Bridge Facility (the “Bridge”) with Taurus Mining Finance Fund No. 2, L.P. (“Taurus”) alongside their support for the US$ 115m Project Finance Facility (the “Project Finance”).

Highlights of the Mansounia 2023 Mineral Resources Estimate (“MRE”) update include:

- The total contained gold for Mansounia Inferred Mineral Resources on a standalone basis has increased by +169% compared to the previous 2022 Kiniero Gold Project Feasibility Study MRE on Mansounia.

- The 2023 MRE update for Mansounia increases the total contained gold of the Kiniero Gold Project Inferred Mineral Resources by +52% compared to the previous 2022 Kiniero Gold Project FS MRE.

MANSOUNIA DEPOSIT RESOURCES INCREASES CONFIRMS PROSPECTIVITY OF THE KINIERO PROJECT

Following completion of the first phase of Mineral Resource delineation drilling at the Mansounia deposit1 and recent drill spacing study, Robex reports a significant increase in its inferred resources base, as shown in the table below. The Mansounia Central deposit is approximately 3km south of the Kiniero processing plant at the Kiniero Gold Project in Guinea, West Africa.

The Mineral Resource Estimate (MRE) update, prepared by Micon International Co Limited (“Micon”), includes the Mansounia Central and Mansounia South deposits, and has been updated based on an extensive 147 RC drill hole delineation drilling programme totalling 23,310 meters, with a complete review and remodelling of the wireframe interpretations.

Table 1: Mineral Resources of the Mansounia Deposit, effective December 21, 2023.

| Pit | Classification | Tonnage (Mt) | Grade (Au g/t) | Contained Gold (koz) |

| Mansounia | Inferred | 29.22 | 0.95 | 896 |

Notes:

- The Mineral Resource Estimate has been prepared in accordance with National Instrument 43-101 (NI 43-101) Standards of Disclosure for Mineral Projects and has an effective date of December 21, 2023.

- To demonstrate Reasonable Prospects for Eventual Economic Extraction (RPEEE), open pit Mineral Resources were constrained by an optimised pit shell. All blocks above the cut-off and within the pit shell were included in the Mineral Resources. Robex created the optimised pit shell.

- Cut-off grades for Mineral Resource reporting were calculated using a gold price of US$1,950 oz and are: laterite 0.5 g/t Au; saprolite (oxide) 0.3 g/t Au; saprock (transition) 0.7 g/t Au; and fresh 0.9 g/t Au.

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. There is no certainty that all or any part of the estimated Mineral Resources will be converted into Mineral Reserves.

- Average density values used are: laterite 2.12 t/m3; saprolite (oxide) 1.66 t/m3; saprock (transition) 2.46 t/m3; and fresh 2.66 t/m3.

- Grade interpolation by ordinary kriging using a rotated block model (azimuth 40°) with a block size of 12 m (X) by 24 m (Y) by 5 m (Z). Outlier management used grade capping for extreme outliers and a restricted search neighbourhood for outliers on a domain-by-domain basis.

- All Mineral Resources were classified as Inferred. To limit extrapolation, a volume was used to constrain the interpolated blocks to approximately 10 m below the base of the drilling and 40 m lateral to the drilling.

- Totals presented in this table are reported from the Mineral Resource models, are subject to rounding, and may not sum exactly.

Table 2: Comparison of the Inferred Mineral Resources for the 2023 MRE Update and the 2022 Kiniero Gold Project FS.

| Inferred Mineral Resources | 2022 FS2 | 2023 MRE Update1 | ||||

| Pit | Tonnage (Mt) | Grade (Au g/t) | Contained Gold (koz) | Tonnage (Mt) | Grade (Au g/t) | Contained Gold (koz) |

| SGA | 9.64 | 1.54 | 479 | |||

| Jean | 1.63 | 1.68 | 88 | |||

| Sabali North & South | 0.27 | 0.98 | 9 | |||

| Sabli South | 2.93 | 1.03 | 97 | |||

| West Balan | 0.84 | 1.51 | 41 | |||

| Banfara | 0.78 | 1.46 | 37 | |||

| Mansounia3 | 12.32 | 0.84 | 333 | 29.22 | 0.95 | 896.3 |

| Total in situ | 28.42 | 1.18 | 1,082 | 45.31 | 1.13 | 1,647 |

Notes:

- Micon completed the 2023 MRE update for Mansounia in December 2023. The total in situ Inferred Mineral Resources were calculated using the 2023 MRE Update for Mansounia.

- All other pits other than Mansounia were not updated in 2023 by Micon and remain unchanged from the 2022 FS as stated in the technical report by AMC Consultants “Technical Report, Kiniero Gold Project, Guinea. Effective date 01 June 2023”.

- The 2022 FS refers to Mansounia as Mansounia Central.

Figure 1: Plan view map of Mansounia shows the completed drilling and modelled grade shell wireframes.

Figure 2: Cross-section A-B shows the (top) modelled grade shell wireframes that remain open at depth; (middle) interpolated block Au grades, to limit extrapolation a volume was used to constrain the interpolated blocks to approximately 10 m below the base of the drilling and 40 m lateral to drilling; (bottom)interpolated block Au grades constrained to Inferred Mineral Resources within the US$1,950 pit shell and above cut-off (laterite 0.5 g/t Au; saprolite 0.3 g/t Au; saprock 0.7 g/t Au; and fresh 0.9 g/t Au).

START AN OPTIMISED FEASIBILITY STUDY FOR Q2 2024

Robex has engaged Soutex and Wacom to engineer the required small design modifications, including two additional CIL tanks and a larger oxygen plant for a throughput increase to 4.1 Mtpa.

Robex is now starting working on an optimized Feasibility Study to (i) include the Mansounia resources modelling across the deposits and update the Reserves and Resources on the entire project; (ii) update the capital expenditure to accommodate a higher oxide mix at 4.1Mtpa; and (iii) add flexibility in the current design to accommodate future expansion of 6Mtpa.

CONSTRUCTION UPDATE – SLOW DOWN DUE TO FUEL SUPPLY RISK AND ENGINEERING

At this stage the impact on the project timeline is under review due to the new engineering work required and the current situation in Guinea with the fuel supply disruption which are slowing down construction activities. A revised project timeline will be communicated during H1 2024.

Current spending on the project stands at c. US$ 50m as of October 30th, 2023, and earthworks on site is progressing well (Figure 3, 4 and 5). The dewatering is also progressing well with 9 meters drop from original topography. This will give Robex access to continue delineating the resources at SGA (479Koz of inferred resources at 1.54g/t).

Figure 3: SGA pit dewatering progress with an approximated 9m drop.

Figure 4: Construction site overview with KCP (Wacom Group) construction area

Figure 5: Plant Earthworks construction

TAURUS BRIDGE EXTENSION UNTIL JUNE 21ST 2024

The current Bridge Facility provided by Taurus was drawn from time to time since closing of the facility in April 20232 and is now fully drawn at US$ 35m. Proceeds of the funds were allocated to developing the Kiniero Gold project by ordering of long lead items, start of earthworks and others work programs.

Given the resources update at Mansounia Central and ongoing technical works to carry out as part of the optimized Feasibility Study, Robex and Taurus agreed to extend the maturity of the Bridge Facility by 6 months from December 22nd 2023 to June 21st 2024. This additional time will allow Robex to optimize value of the Kiniero Gold project and will provide additional time to finalize the US$ 115m Project Finance Facility as set out in the Mandate Letter previously signed3. The extension comes alongside the following revised key terms:

- Interest rate 10% per annum (from 8% currently);

- Royalty of 0.25% capped at 1.5Moz of gold across Kiniero’s licences, including buy-back mechanism subject to specifics conditions;

- Permitted indebtedness headroom increased from US$ 4m to US$ 12m subject to certain conditions;

- Security, covenants and other conditions remain unchanged;

The Bridge still has no requirements for hedging. Closing of the extension is subject to customary conditions.

Aurelien Bonneviot, President and CEO: “We are pleased to see Mansounia delivering inferred resources increase. This is a significant advancement towards the delineation of the 4.5 km Sabali – Mansounia corridor. This resource confirms the prospectivity of our Mansounia Licence and that’s why the company have decided to include it in an optimised feasibility study. We thank Taurus for supporting Robex in extending the maturity of the bridge and reiterating their support for the Project Financing.”

Qualified Person

The information in this announcement, which relates to the updated Mineral Resource Estimate for Mansounia, has been approved by Dr Ryan Langdon, PhD, MCSM, MEarthSci, CGeol, FGS, who is a professional registered with the Geological Society of London and an independent consultant to the Company. Dr Ryan Langdon is the Senior Mineral Resource Geologist of Micon International Co Limited and has over 12 continuous years of exploration and mining experience in various mineral deposit styles. Dr Ryan Langdon has sufficient experience relevant to the style of exploration, mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as a Qualified Person under the terms of NI 43-101. Dr Ryan Langdon consents to inclusion in the announcement of the matters based on this information in the form and context in which it appears.

About Robex Resources Inc.

Robex is a multi-jurisdictional West African gold production and development company with near-term exploration potential. The Company is dedicated to safe, diverse and responsible operations in the countries in which it operates with a goal to foster sustainable growth. The Company has been operating the Nampala mine in Mali since 2017 and is advancing the Kiniero Gold Project in Guinea.

Robex is supported by two strategic shareholders and has the ambition to become a-tier gold producers in West Africa.

More Information

| ROBEX RESOURCES INC. | FINANCIAL COMMUNICATIONS RENMARK INC. |

| Aurélien Bonneviot Chief Executive Officer Stanislas Prunier +1 581 741-7421 | Robert Thaemlitz Account Manager +1 416 644-2020 or +1 212 812-7680 E-mail: rthaemlitz@renmarkfinancial.com |

Forward Looking Statement

Certain information set forth in this news release contains “forward‐looking statements” and “forward‐looking information” within the meaning of applicable Canadian securities legislation (referred to herein as forward‐looking statements). Except for statements of historical fact, certain information contained herein constitutes forward‐looking statements which includes, but is not limited to, statements with respect to: the potential development and exploitation of the Mansounia Central Deposit or the Kiniero Project and the Company’s existing mineral properties and business plan, including the completion of feasibility studies or the making of production decisions in respect thereof; the future financial or operating performance of the Company, the Mansounia Central Deposit and the Kiniero Project; results from work performed to date; the realization of mineral resource and mineral reserve estimates; the development, operational and economic results of any prefeasibility study that may be undertaken or not for the the Mansounia Central Deposit, including cash flows, revenue potential, potential for staged development, capital expenditures, development costs and timing thereof, extraction rates, life of mine projections and cost estimates; magnitude or quality of mineral deposits; anticipated advancement of the Kiniero Project including mine plan; exploration expenditures, costs and timing of the development of new deposits; exploration potential and opportunities at the Mansounia Central Deposit; costs and timing of future exploration; the completion and timing of future development studies; estimates of metallurgical recovery rates; anticipated advancement of the Mansounia Central Deposit , the Kiniero Project and future exploration prospects; requirements for additional capital; the future price of metals; government regulation of mining operations; environmental risks; the timing and possible outcome of pending regulatory matters; the realization of the expected economics of the Mansounia Central Deposit and the Kiniero Project; and future growth potential of the Mansounia Central Deposit. Forward-looking statements are often identified by the use of words such as “may”, “will”, “could”, “would”, “anticipate”, ‘believe”, expect”, “intend”, “potential”, “estimate”, “budget”, “scheduled”, “plans”, “planned”, “forecasts”, “goals” and similar expressions. Forward-looking statements are based on a number of factors and assumptions made by management and considered reasonable at the time such information is provided. Assumptions and factors include: the Company’s ability to complete its planned exploration programs; the absence of adverse conditions at the Kiniero Project or the Mansounia Central Deposit; no unforeseen operational delays; no material delays in obtaining necessary permits; the price of gold remaining at levels that render the Mansounia Central Deposit and the Kiniero Project economic; the Company’s ability to continue raising necessary capital to finance operations and reimburse short-term liabilities; and the ability to realize on the mineral resource and mineral reserve estimates. Forward‐looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward‐looking statements. These risks and uncertainties include, but are not limited to: general business, economic and competitive uncertainties; the actual results of current and future exploration activities; geopolitical risk, political risks inherent to mining in developing countries, conclusions of economic evaluations; meeting various expected cost estimates; benefits of certain technology usage; changes in project parameters and/or economic assessments as plans continue to be refined; future prices of metals; possible variations of mineral grade or recovery rates; the risk that actual costs may exceed estimated costs; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); title to properties; the impact of COVID-19 on the timing of exploration and development work and management’s ability to anticipate and manage the foregoing factors and risks. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in the forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Readers are advised to study and consider risk factors disclosed in the Company’s disclosure documents for a more complete discussion of such risk factors and their potential effects, which may be accessed through the Company’s profile on SEDAR at www.sedar.com.

There can be no assurance that forward‐looking statements will prove to be accurate, or even benefit Robex, if any, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward‐looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The forward-looking statements contained herein are presented for the purposes of assisting investors in understanding the Company’s plan, objectives and goals and may not be appropriate for other purposes. Forward-looking statements are not guarantees of future performance and the reader is cautioned not to place undue reliance on forward‐looking statements.

Please refer to the “Risk Factors” section of the Company’s annual information form for the year ended December 31, 2022, dated April 28, 2023, and to the “Risks and Uncertainties” section of each of the Company’s management’s discussion and analysis dated April 28, 2023 for the years ended December 31, 2022 and December 31, 2021, and the Company’s management’s discussion and analysis dated August 28, 2023 for the six-month periods ended June 30, 2023 and June 30, 2022, all of which are available electronically on SEDAR at www.sedar.com. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Please refer to press release dated November 20th, 2023

2 Please refer to press release dated April 20th, 2023

3 Please refer to press release dated January 24th, 2023

All figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/04c74da1-51a1-4069-a4a8-45f42be9551d

https://www.globenewswire.com/NewsRoom/AttachmentNg/72c1c77d-c52b-43bc-bb0d-4341c12ada81

https://www.globenewswire.com/NewsRoom/AttachmentNg/1601660a-af9a-4944-b122-106a7296ff40

https://www.globenewswire.com/NewsRoom/AttachmentNg/ccb1cf65-add0-4ba9-b79a-6b9b0ed834b5

https://www.globenewswire.com/NewsRoom/AttachmentNg/3ae1df1f-7264-4415-ae12-79f5f4712ea8

![]()