Prenetics Announces Oversubscribed Approximately $48 Million Equity Offering with Potential for $216 Million in Total Proceeds to Fuel IM8’s Global Expansion and Bitcoin Treasury Strategy

Distinguished Investor Group Includes Kraken, American Ventures, Exodus (NYSE: EXOD), XtalPi (2228.hk), DL Holdings (1709.hk) GPTX by Jihan Wu and Leading Institutions

World No. 1 and 4-time Grand Slam champion Aryna Sabalenka expands her stake in Prenetics

Adrian Cheng, one of Asia’s most influential visionaries and an original cornerstone investor in Prenetics’ IPO increases his stake, reflecting enduring conviction in the company’s global vision

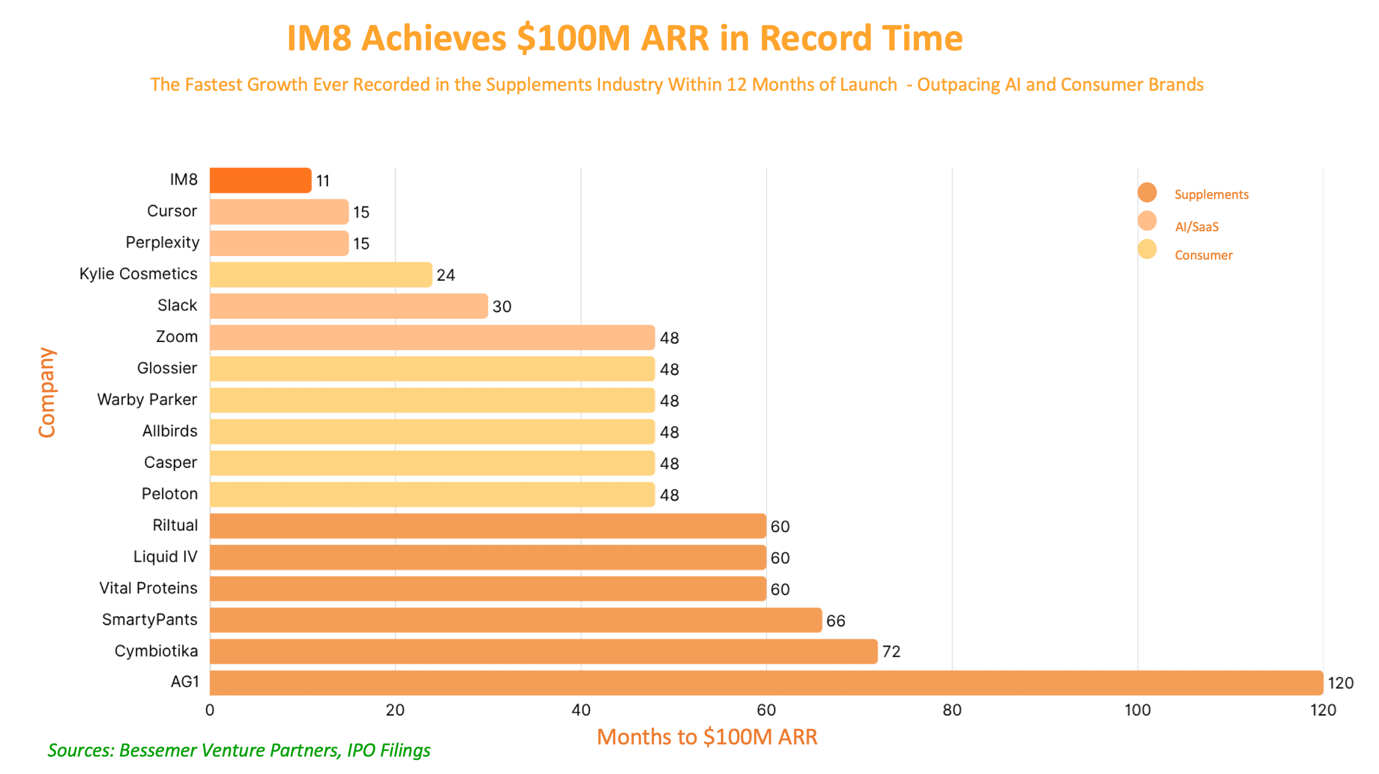

IM8 Achieves $100 Million in Annual Recurring Revenue Within 11 Months of Launch

IM8 Guidance $180 to $200 Million Revenue in 2026, Driving Company Toward Multi-Billion Dollar Valuation

Prenetics CEO Danny Yeung to Host Investor Conference Call, Today at 11:00am ET

CHARLOTTE, N.C., Oct. 27, 2025 (GLOBE NEWSWIRE) — Prenetics Global Limited (NASDAQ: PRE) (“Prenetics” or the “Company”), a leading health sciences company, today announced the successful pricing of a public offering of 2,992,596 Class A ordinary shares and/or pre-funded warrants to purchase Class A ordinary shares, together with accompanying Class A warrants and Class B warrants to purchase up to an aggregate of 5,985,192 Class A ordinary shares at a combined price per Class A ordinary share and/or pre-funded warrant and accompanying Class A warrant and Class B warrant of $16.08. The gross proceeds to the Company from the offering are expected to be approximately $48 million, before deducting placement agent fees and offering expenses. The offering was led by sole placement agent Dominari Securities LLC.

The offering includes a double warrant structure, with the Class A warrant exercisable at $24.12 per Class A ordinary share (50% premium to the $16.08 offering price) and with the Class B warrant exercisable at $32.16 per Class A ordinary share (100% premium to the $16.08 offering price). Both warrants will be exercisable immediately upon issuance and expire five years after issuance. The Company may receive up to total proceeds of approximately $216 million ($168 million in additional gross proceeds), if all of the Class A warrants and Class B warrants are exercised for cash in full.

This strategic capital raise was supported by a distinguished group of institutional and individual investors. Notable participants include:

- Kraken – One of the world’s largest cryptocurrency exchanges and digital asset platforms. Strategic Value: Crypto and Bitcoin partnership opportunities with IM8 for seamless customer experiences

- American Ventures LLC – Investment vehicle focused on growth companies including those in AI and crypto. Strategic Value: Crypto and Bitcoin investment expertise to enhance Prenetics’ treasury strategy.

- Exodus (NYSE: EXOD) – Publicly-traded multi-asset cryptocurrency wallet company serving millions of users globally with secure, self-custodial solutions. Strategic Value: Potential integration with IM8 platform for crypto-enabled health and wellness ecosystem

- GPTX by Jihan Wu – Investment vehicle of Jihan Wu, the legendary Bitcoin mining pioneer, Founder, Chairman and CEO of Nasdaq-listed Bitdeer Technologies Group (NASDAQ: BTDR), one of the world’s largest cryptocurrency mining companies. Strategic Value: Unmatched expertise in Bitcoin mining infrastructure and large-scale accumulation strategies to enhance Prenetics’ Bitcoin treasury initiative.

- XtalPi (2228.HK) – $6 billion market cap Hong Kong-listed innovator at the intersection of quantum physics, artificial intelligence, and robotics, pioneers intelligent drug and material discovery. Strategic Value: Strong capabilities and proven success in AI-driven molecular design for next-generation health supplements and cosmetic actives with potential for commercial licensing and product development partnerships with IM8.

- DL Holdings (1709.HK) – over $3.5 billion AUM-Hong Kong Stock Exchange-listed MFO, investment banking and digital assets group focusing on multi-strategy investment funds. Strategic Value: Digital asset management expertise and institutional Bitcoin strategy guidance

- Mythos Group – Multi-strategy digital asset holding company with strong presence in the Asia-Pacific region, focusing on blockchain integration and Bitcoin strategies. Strategic Value: Insights into optimizing Bitcoin treasury initiative

- AV8 Group – A global investment platform fusing celebrity, capital, and creativity to build iconic brands and ventures. Strategic Value: Expands IM8’s global reach through celebrity partnerships and cultural influence

- G70 – A premier multi-family office advising and managing the wealth of Asia’s most distinguished and influential family businesses. Strategic Value: Strengthens Prenetics’ network among Asia’s most influential family businesses.

- Aryna Sabalenka – World #1 tennis and 4-time Grand Slam Champion, global ambassador for IM8, and an existing Prenetics shareholder. Strategic Value: Her further investment deepens alignment with IM8’s mission to elevate human performance and longevity, while amplifying the brand’s global reach across sports, wellness, and consumer audiences worldwide.

- Adrian Cheng – One of Asia’s most influential visionaries, shaping the future of culture, creativity, and capital; an original cornerstone investor in Prenetics’ IPO. Strategic Value: Brings unparalleled access to global cultural networks, visionary partnerships, and long-term capital within Asia’s most dynamic innovation ecosystem.

- Johnny Han – Chairman and CEO of CST Group, a business Trailblazer driving the company’s evolution from legacy mining to a diversified investment empire. Strategic Value: Strengthens IM8 and Prenetics’ network among leading family offices and strategic partners across Asia.

- Dr. Richard Petty – a best-selling author, former member of the IFAC board and B20, company director, awarded business school professor, keynote speaker, and investor with extensive global business experience. Strategic Value: Deep experience in new market entry and development and improving competitiveness, global experience in financial innovation, DAT governance, and a transition to an AI-enabled new economy.

- Roman Khan – the co-founder and president of Peak 21, an e-commerce holding company that acquires, scales and operates direct-to-consumer brands, building a profitable portfolio generating hundreds of millions annually. Strategic value: His expertise in digital brand building and operational scaling brings strategic value to IM8’s rapid global expansion and e-commerce acceleration.

The offering is executed to close on or around October 28, 2025, subject to the satisfaction of customary closing conditions.

Danny Yeung, CEO and Co-Founder of Prenetics and IM8, commented,

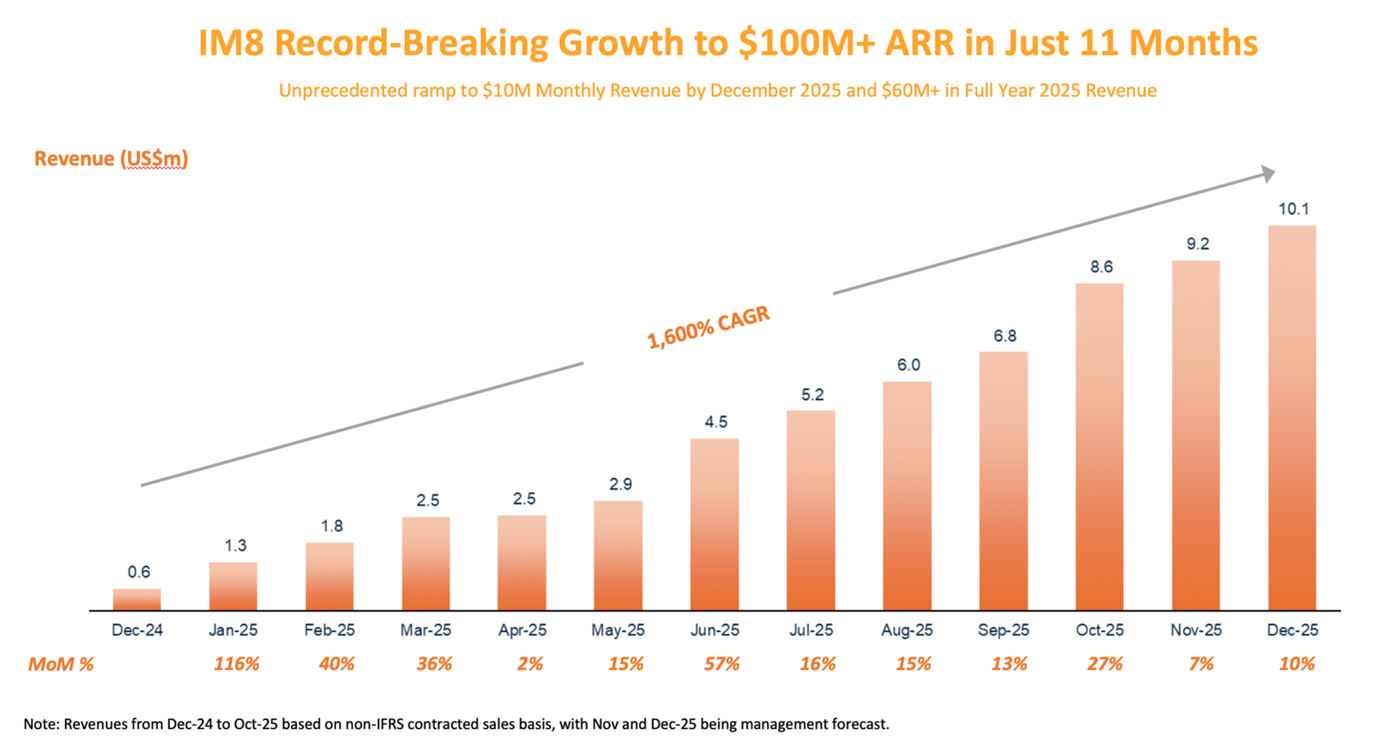

“This is a defining moment for Prenetics. In just 11 months, IM8 has achieved $100 million in annual recurring revenue — the fastest growth ever recorded in the supplements industry within 12 months of launch— positioning us on a clear path toward becoming a multi-billion-dollar global brand. It’s clear that IM8 has huge global potential, evidenced already by our extraordinary traction across multiple markets, as we pursue our share of the $704 billion global supplements market expected by 20301.

We’re particularly honored to have the backing of a distinguished group of new and existing strategic investors who share our confidence in the transformative potential of our dual-engine strategy. Their continued investment and expertise will be invaluable as we accelerate IM8’s global expansion while advancing our disciplined Bitcoin treasury initiatives, including the potential to accelerate our daily 1 BTC accumulation strategy.

To maximize shareholder value and focus our efforts, we have begun a strategic review of our other business units within Prenetics with the intention to divest them, which we believe will be accretive to shareholders. This strategic focus will allow us to dedicate all of our resources and expertise to the massive IM8 opportunity while strategically accumulating Bitcoin moving forward.

Looking ahead, our long-term ambition is bold yet realistic: to reach $1 billion in annual revenue alongside $1 billion in Bitcoin holdings within the next five years. For more insights into our strategic vision, I encourage everyone to read our comprehensive manifesto at www.Prenetics.com/manifesto.”

Kyle Wool, CEO of Dominari Securities said, “The investor response to this offering is a testament to the market’s confidence in Prenetics’ dual-engine growth strategy. We are proud to have partnered with Prenetics on this transaction.”

The Company believes its core business is building momentum, anchored by its rapidly expanding supplement brand, IM8, which has experienced significant growth — reaching $100 million in annual recurring revenue (“ARR”) in just 11 months since launch.

IM8’s remarkable growth is further evidenced by strong operational metrics: the brand has delivered over 12 million servings to more than 420,000 customer purchases across 31 countries since launch in December 2024. The recent launch of Daily Ultimate Longevity has driven significant momentum, with average order value increasing from $110 to $145, reflecting robust consumer demand for IM8’s premium product offerings.

Financial Outlook

For October 2025, IM8 is expected to generate more than $8.6 million in monthly revenue, representing an ARR run rate of approximately $103 million. Approximately 80% of all new orders came from subscriptions on IM8’s website, underscoring the brand’s strong recurring base and revenue predictability. The Company is also providing for the first time guidance for IM8 for the full year 2026, and anticipates delivering revenues between $160 million and $200 million.

Following the closing of the offering, Prenetics will hold approximately $100 million in cash and approximately 275 BTC, valued at $31 million as of Oct 27, 2025 in Bitcoin holdings — $131 million in total liquidity — further strengthening its balance sheet and financial flexibility. This foundation, combined with consistent Bitcoin accumulation by purchasing 1 BTC every single day commencing August 1, 2025 and the explosive growth of IM8, positions Prenetics for accelerated expansion and long-term value creation for shareholders.

For more information on Prenetics’ Bitcoin treasury strategy, please refer to Danny Yeung’s manifesto: https://Prenetics.com/manifesto.

For comprehensive financial information and investor materials, please visit: https://ir.prenetics.com/

For real-time access to the Company’s Bitcoin holdings, please visit https://prenetics.com/btc

Live Conference Call

The Company will host a conference call today at 11:00 am ET time. To participate in the webinar, please register here.

If you are interested in receiving a replay of the live event, please contact PRE@mzgroup.us.

Dominari Securities LLC (“Dominari”) acted as the sole placement agent for the Offering. Reed Smith LLP served as counsel to the Company. Sichenzia Ross Ference Carmel LLP served as counsel to Dominari.

The securities were offered and will be sold pursuant to a shelf registration statement on Form F-3, as amended (No. 333-288824), including base prospectus, declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on September 11, 2025. A preliminary prospectus supplement and the accompanying base prospectus relating to the public offering has been filed with the SEC and is available on the SEC’s website at http://www.sec.gov. A final prospectus supplement and accompanying prospectus describing the terms of the offering will be filed with the SEC and will be available on its website at www.sec.gov. The offering will be made only by means of the prospectus supplement and the accompanying base prospectus. Copies of the preliminary prospectus supplement, the final prospectus supplement and the accompanying prospectus relating to the offering may also be obtained, when available, from the offices of Dominari Securities LLC, Attention: Syndicate Department, 725 5th Ave 23 Floor, New York, NY 10022, by email at info@dominarisecurities.com, or by telephone at (212) 393-4500.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Prenetics

Prenetics (NASDAQ: PRE) is a leading health sciences company redefining the future of health and longevity through IM8 — its flagship consumer brand co-founded with David Beckham and championed by World No. 1 and four-time Grand Slam winner Aryna Sabalenka — now the fastest-growing supplement brand globally, reaching $100 million in annual recurring revenue within just 11 months of launch — the fastest growth ever recorded in the global history of the supplements industry, even outpacing today’s leading AI startups.

As the first consumer health company to establish a Bitcoin Treasury, Prenetics continues to pioneer at the intersection of health innovation and digital assets — purchasing 1 Bitcoin per day, now totaling 275 BTC as of October 27, 2025.

Forward-Looking Statements

This press release contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” and similar statements. Prenetics may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials, and in oral statements made by its officers, directors, or employees to third parties. Statements that are not historical facts, including statements about Prenetics’ beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s ability to meet all of the terms and conditions of the offering and complete the offering, the Company’s ability to execute its new Bitcoin treasury strategy; the volatility of Bitcoin; the Company’s ability to manage its growth and expansion; the company’s ability to compete in the highly competitive consumer health market; and other risks and uncertainties. Further information regarding these and other risks is included in Prenetics’ filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and Prenetics does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Investor Relations Contact:

investors@prenetics.com

PRE@mzgroup.us

Angela Cheung

Investor Relations / Corporate Finance

angela.hm.cheung@prenetics.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c3147489-7623-4bcb-8e65-41eba6ccfda6

https://www.globenewswire.com/NewsRoom/AttachmentNg/315e099d-fdb0-4d3f-b2ca-f3ffc2d70628

1 https://www.grandviewresearch.com/industry-analysis/nutritional-supplements-market

![]()