Prairie Operating Co. Completes Transformative Acquisition from Bayswater

Pro-Forma Reserve Data

Reconciliation of Non-GAAP Measure

Expands footprint in DJ Basin to ~55,000 net acres and inventory life to ~10 years

Increases average daily production by ~25,700 net BOEPD

Immediately accretive and maintains strong balance sheet

Houston, TX, March 26, 2025 (GLOBE NEWSWIRE) — Prairie Operating Co. (Nasdaq: PROP) (the “Company,” “Prairie,” “we,” “our” or “us”), today announced the successful closing of its previously announced $602.75 million acquisition of certain Denver-Julesburg Basin (DJ Basin) assets (the “Bayswater Assets”) from Bayswater Exploration and Production and its affiliated entities (collectively, “Bayswater”). This acquisition further strengthens Prairie’s position as a leading operator in the DJ Basin, enhancing its production base and long-term growth potential.

“This acquisition is a pivotal moment for Prairie, significantly expanding our operational footprint in the DJ Basin,” said Edward Kovalik, Chairman and CEO of Prairie. “By integrating these high-quality assets, we are materially enhancing our production profile, strengthening our financial position, and creating meaningful value for our shareholders. Prairie remains singularly focused on executing our strategic vision to become a premier high-growth, low-cost oil producer.”

Gary Hanna, President of Prairie, added, “the addition of the Bayswater Assets further establishes Prairie as a leading operator in the DJ Basin. These assets are a strong complement to our existing portfolio, and we remain focused on maximizing operational efficiencies, optimizing production, and delivering sustainable growth for shareholders.”

Transaction Highlights:

- Transformational Increase in Oil-Weighted Production: Adds ~25,700 net BOEPD (69% liquids).

- Expands Footprint / Inventory Life: Additional 24,000 net acres, adding to approximately 600 highly economic drilling locations and roughly 10 years of drilling inventory.

- Significantly Increases Free Cash Flow: Expected to be immediately accretive to per-share cash flow metrics.

- Maintains Strong Balance Sheet: Expected leverage ratio of ~1.0x at closing with upsized credit facility and ample liquidity.

- Meaningful Infrastructure Synergies: Leverages advantageous takeaway contracts and existing infrastructure to drive operational efficiencies and reduce development costs.

Completed at an attractive valuation, the assets contribute 77.9 million barrels of oil equivalent (MMBOE) in proved reserves with an estimated PV-10 value of $1.1 billion (a non-GAAP financial measure reconciled below), further enhancing the Company’s financial position. With this expansion, Prairie anticipates a substantial uplift in its 2025 production, revenue, and adjusted EBITDA, reinforcing its commitment to delivering long-term shareholder value.

Transaction Details and Advisors

The transaction was funded through a combination of proceeds from a new issuance of Series F convertible preferred stock to a single institutional investor, a common stock public offering, a draw on the newly expanded Company’s $1 billion credit facility, and a direct issuance of common stock to Bayswater. Following the closing, Prairie has approximately 35.4 million shares of common stock outstanding.

Citi served as exclusive financial advisor and Norton Rose Fulbright US LLP served as legal advisor to Prairie. Citibank N.A. also led the financing under the Company’s expanded credit facility, with Latham & Watkins LLP as legal advisor to Citibank N.A.

About Prairie Operating Co.

Prairie Operating Co. is a Houston-based publicly traded independent energy company engaged in the development and acquisition of oil and natural gas resources in the United States. The Company’s assets and operations are concentrated in the oil and liquids-rich regions of the Denver-Julesburg (DJ) Basin, with a primary focus on the Niobrara and Codell formations. The Company is committed to the responsible development of its oil and natural gas resources and is focused on maximizing returns through consistent growth, capital discipline, and sustainable cash flow generation. More information about the Company can be found at www.prairieopco.com.

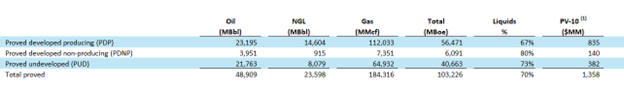

Pro-Forma Reserve Data

A summary of the estimated reserves and values of our properties (inclusive of the Bayswater Assets), as of December 31, 2024, and as determined by Cawley, Gillespie & Associates, Inc., the Company’s independent petroleum reserve evaluation firm, using SEC pricing.

Pro-Forma Reserve Data

(1) PV-10 is a non-GAAP financial measure. Please see “Reconciliation of Non-GAAP Measure” below.

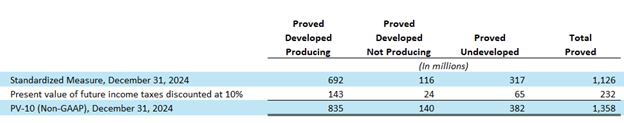

Reconciliation of Non-GAAP Measure

PV-10

This press release contains PV-10, which is a financial measure not presented in accordance with U.S. GAAP. PV-10 is derived from the Standardized Measure of Discounted Future Net Cash Flows (“Standardized Measure”), which is the most directly comparable GAAP financial measure for proved reserves. PV-10 is a computation of the Standardized Measure on a pre-tax basis. PV-10 is equal to the Standardized Measure at the applicable date, before deducting future income taxes discounted at 10%. Neither PV-10 nor standardized measure represents an estimate of the fair market value of the applicable crude oil, natural gas and NGLs properties. We believe that the presentation of PV-10 is relevant and useful to our investors as a supplemental disclosure to the Standardized Measure, or after-tax amount, because it presents the discounted future net cash flows attributable to our reserves before considering future corporate income taxes and our current tax structure. While the Standardized Measure is dependent on the unique tax situation of each company, PV-10 is based on prices and discount factors that are consistent for all companies.

The following table reconciles PV-10 to the Standard Measure, which is the most directly comparable GAAP financial measure:

Reconciliation of Non-GAAP Measure

Forward-Looking Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included herein, are forward-looking statements, including statements about our acquisition of the Bayswater Assets, including the expected benefits of such transaction, our financial performance following such acquisition, estimates of oil, natural gas and NGLs reserves, estimates of future oil, natural gas and NGLs production. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on the Company’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, the Company disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. The Company cautions you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of the Company, including the risks related to our acquisition of the Bayswater Assets, our ability to recognize the anticipated benefits of the Bayswater Assets, the possibility that we may be unable to achieve expected free cash flow accretion, production levels, drilling, operational efficiencies and other anticipated benefits of the Bayswater Assets within the expected time-frames or at all, and our ability to successfully integrate the Bayswater Assets. There may be additional risks not currently known by the Company or that the Company currently believes are immaterial that could cause actual results to differ from those contained in the forward-looking statements. Additional information concerning these and other factors that may impact the Company’s expectations can be found in the Company’s periodic filings with the Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K filed with the SEC on March 6, 2025, and any subsequently filed Quarterly Report on Form 10-Q and Current Report on Form 8-K. The Company’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

Investor Relations Contact:

Wobbe Ploegsma

info@prairieopco.com

832.274.3449

Attachments

![]()