Parex Resources Announces Its Proposal to Acquire GeoPark and an 11.8% Ownership Position

CALGARY, Alberta, Oct. 29, 2025 (GLOBE NEWSWIRE) — Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) announces that it submitted a Proposal (the “Proposal”) to the Board of Directors of GeoPark (NYSE: GPRK) to acquire all outstanding common shares of GeoPark for US$9.00 per share in cash. Following a lack of constructive engagement with, and rejection of the Proposal by the Board of Directors of GeoPark (the “GeoPark Board”), Parex has also acquired an 11.8% ownership position in GeoPark. The Proposal represents:

- a 44% premium to GeoPark’s share price at the time of the Proposal;

- a 51% premium to GeoPark’s share price as of October 21, 2025, the trading day immediately prior to the time Parex acquired a greater than 5% ownership position in GeoPark;

- a 38% premium to GeoPark’s 90-day, volume-weighted average share price as of October 28, 2025; and

- a total value for GeoPark of approximately US$940 million, including net debt, which at strip pricing meaningfully exceeds the value of GeoPark’s Colombian proved plus probable reserves based on its 2024 year-end reserves disclosure.

Parex believes the all-cash premium Proposal delivers immediate, compelling, and certain value to GeoPark shareholders, and allows them to avoid the significant risks associated with GeoPark’s recently announced Argentine investment. Despite this, the GeoPark Board has refused to engage with Parex regarding its Proposal, and the GeoPark Board has not offered a convincing explanation for why it is refusing to explore an opportunity for their shareholders to receive cash for their shares at a significant premium.

As an indication of the seriousness of the Company’s interest in this transaction, Parex has acquired an 11.8% ownership stake in GeoPark, which allows Parex to call a special shareholder meeting of GeoPark shareholders. Parex remains ready and willing to engage with GeoPark to finalize a transaction as outlined in the Proposal.

Imad Mohsen, President and Chief Executive Officer, said, “Our Proposal would deliver immediate and compelling value to GeoPark shareholders. By rejecting the Proposal, the GeoPark Board denied its shareholders an opportunity to receive cash for their shares at a significant premium. Instead, GeoPark proceeded with an acquisition in Argentina, which entails significant spending, high debt levels, and execution risk. Given the inherently low-risk nature of our all-cash Proposal, we believe GeoPark shareholders should be made aware of the premium they are being offered and provided the opportunity to review our Proposal.”

The Proposal’s rejection by the GeoPark Board is part of a larger pattern in which GeoPark has failed to engage constructively with Parex to reach a deal in their shareholders’ best interests. The following summarizes key events leading up to this announcement:

- December 2021: Parex submits a proposal to acquire GeoPark in a cash and share transaction at a sizable premium. Parex agrees to a standstill as part of the negotiations regarding the proposal. GeoPark later rejects Parex’s proposal knowing the standstill prevented Parex from making its proposal public.

- September 4, 2025: Parex submits a Proposal to acquire GeoPark in an all-cash offer for US$9.00 per share, representing a 44% premium to GeoPark’s share price.

- September 17, 2025: After the GeoPark Board fails to respond to the Proposal and Parex became aware that GeoPark was pursuing a transaction in Argentina, Parex reiterates the strategic benefits of its Proposal to GeoPark, and requests engagement from the GeoPark Board before GeoPark agrees to a transaction outside of Colombia.

- September 25, 2025: GeoPark announces a capital-intensive, early-stage investment in Argentina.

- October 15, 2025: After six weeks of not engaging, the Chief Executive Officer of GeoPark informs the Chief Executive Officer of Parex in writing that the GeoPark Board has summarily rejected the Proposal.

- October 29, 2025: Parex acquires an 11.8% ownership interest in GeoPark, just below the threshold in GeoPark’s Shareholder Rights Plan, implemented by the GeoPark Board on June 3, 2025.

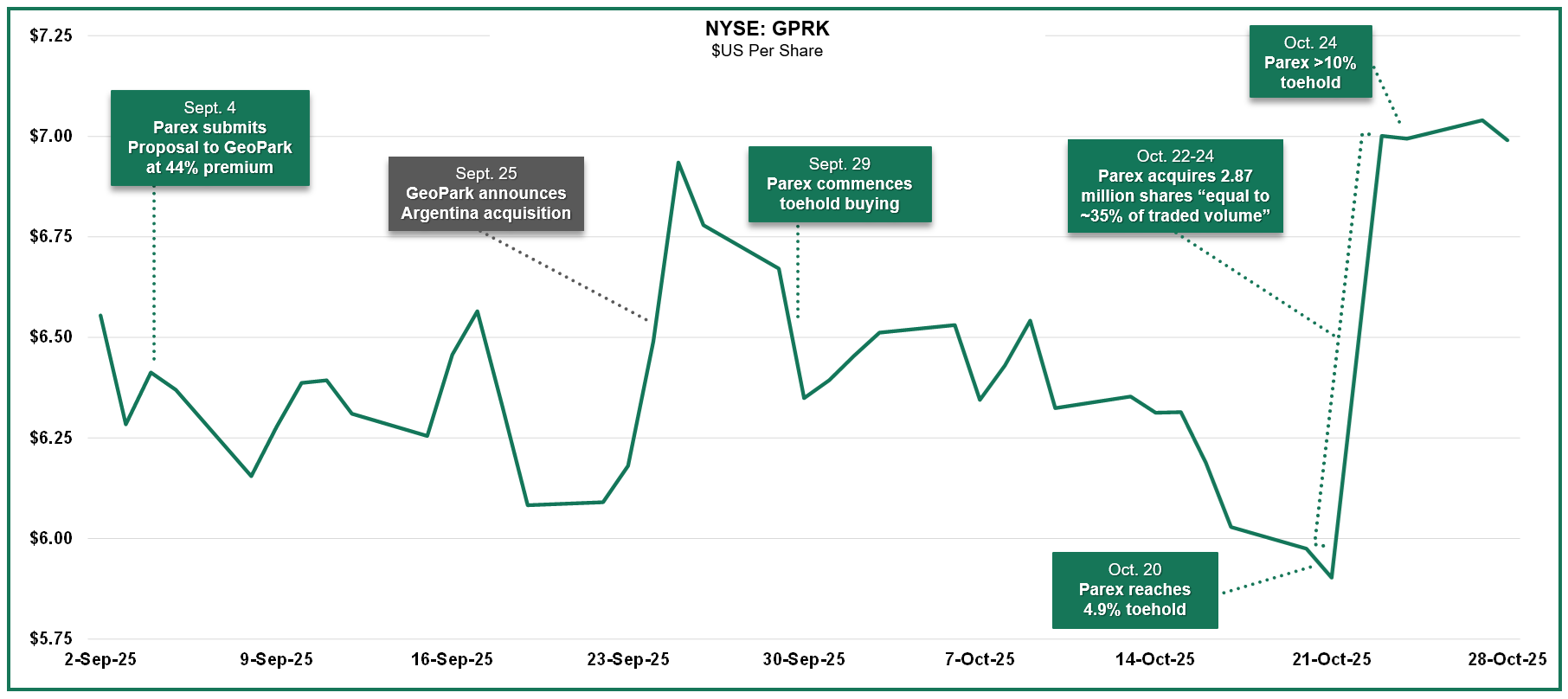

The chart below outlines GeoPark’s daily, volume-weighted share price performance from September 2, 2025, to October 28, 2025, surrounding Parex’s Proposal and leading up to this announcement.

The Company remains ready and willing to engage with GeoPark to finalize a transaction as outlined in the Proposal, and is hopeful that the GeoPark Board will reconsider its position given the compelling benefits for its shareholders.

Parex has retained Scotiabank as its financial advisor; Paul, Weiss, Rifkind, Wharton & Garrison LLP, Burnet, Duckworth & Palmer LLP, and Appleby (Bermuda) Limited LLP as its legal counsel; and Innisfree as its proxy solicitor.

For additional information about the Proposal, a presentation is available at www.parexresources.com under Investors.

Formal Proposal to the GeoPark Board on September 4, 2025

September 4, 2025

Board of Directors

GeoPark Limited

Calle 94 N° 11-30, 8th floor

Bogotá, Colombia

| Attention: | Sylvia Escovar Gómez, Chair of the Board of Directors Felipe Bayon, Chief Executive Officer |

| Re: | Firm Proposal for the Acquisition of GeoPark Limited by Parex Resources Inc. |

Dear Sylvia and Felipe:

We are pleased to submit this firm proposal (the “Proposal”) outlining the principal terms and conditions for the acquisition of GeoPark Limited (“GeoPark”) by Parex Resources Inc. (“Parex”) (the “Transaction”).

Proposed Transaction Terms

1. Price and Consideration

Parex proposes to acquire all of the currently issued and outstanding common shares of GeoPark (“Common Shares”) for US$ 9.00 per Common Share in cash (“Price”). The proposed Price represents a premium of approximately 44% to the closing price of the Common Shares on September 3, 2025.

2. Structure

Parex, or a wholly-owned subsidiary of Parex, would acquire all the Common Shares.

3. Financing

Parex is in a very strong financial and operating position. The Transaction consideration would be funded by Parex’ existing cash and other sources of financing that have been advanced by Parex.

4. Approvals and Conditions

Parex has obtained all of the necessary internal approvals to submit this Proposal.

The Transaction is subject to the negotiation and execution of a definitive agreement (the “Definitive Agreement”) as well as the receipt of all required shareholder, regulatory and other material third party approvals. The Transaction would not be subject to approval by Parex shareholders, and the Definitive Agreement will not include a financing condition.

Parex anticipates that the Definitive Agreement would contain customary closing conditions, customary representations, warranties and covenants in respect of each of GeoPark and Parex prior to closing, as well as customary deal protection provisions. We also anticipate that the directors and senior management of GeoPark would enter into voting agreements to support the Transaction.

5. Schedule

Given our familiarity with GeoPark’s main asset and people, we are highly confident in our ability to complete, negotiate and execute within approximately 30 days a mutually acceptable Definitive Agreement. Parex is ready to mobilize both its internal team and its financial and legal advisors immediately.

6. Confidentiality

This Proposal is being submitted on the basis that GeoPark shall keep its existence and contents strictly confidential.

7. Term

This Proposal is open for your consideration until 5:00 p.m. (MDT) on September 26, 2025, after which time this Proposal shall terminate.

Concluding Remarks

Parex is excited about the potential of the combined company, and we believe the Proposal offers compelling value for GeoPark shareholders.

Please feel free to contact the undersigned at [REDACTED] / email: [REDACTED] if you have any questions or need additional clarification regarding our Proposal.

We believe that time is of the essence and very much look forward to hearing from you at your earliest convenience.

PAREX RESOURCES INC

| By: | Imad Mohsen, President & CEO |

About Parex Resources Inc.

Parex is one of the largest independent oil and gas companies in Colombia, focusing on sustainable, conventional production. The Company’s corporate headquarters are in Calgary, Canada, with an operating office in Bogotá, Colombia. Parex shares trade on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike Kruchten

Senior Vice President, Capital Markets & Corporate Planning

Parex Resources Inc.

403-517-1733

investor.relations@parexresources.com

Steven Eirich

Senior Investor Relations & Communications Advisor

Parex Resources Inc.

587-293-3286

investor.relations@parexresources.com

Cautionary Statements

General

This press release is provided for informational purposes only as of the date hereof, is not complete and may not contain certain material information about Parex or GeoPark, including important disclosures and risk factors associated with an investment in Parex or GeoPark. The contents of this press release have not been approved or disapproved by any securities commission or regulatory authority in Canada, the United States or any other jurisdiction, and Parex expressly disclaims any duty on Parex to make disclosure or any filings with any securities commission or regulatory authority, beyond that imposed by applicable laws.

Non-Binding Proposal

Parex cautions Parex shareholders, GeoPark shareholders and others considering trading in Parex securities or GeoPark securities that each of the Proposal (with the proposed transaction contemplated by the Proposal being the “Proposed Transaction”), the presentation referenced in this press release and this press release itself are non-binding and do not constitute and should not be construed as an offer or intention to make an offer directly to GeoPark shareholders. There can be no assurance that any definitive offer will be made by Parex, that GeoPark will accept any offer made by Parex, that any agreement will be entered into by Parex and GeoPark or that the Proposal or any other transaction will be approved or consummated. Parex does not undertake any obligation to provide any updates with respect to the Proposal, except as required by applicable law.

No Offer or Solicitation

This press release (including the Proposal described herein and the presentation referenced herein) is not intended to and does not constitute an offer to sell or the solicitation of an offer, or an intention to offer, to subscribe for or buy or an invitation to purchase or subscribe for any securities in Canada, the United States or any other jurisdiction. This press release does not take into account the particular investment objectives or financial circumstances of any specific person who may receive it. This press release does not constitute a recommendation to participate in the Proposed Transaction or to purchase any securities. In addition, this press release is not intended to, and does not, solicit a proxy from any shareholder of GeoPark.

Advisory on Forward-Looking Statements

Statements contained herein that are not historical facts constitute “forward-looking statements” and “forward-looking information” (together, “forward-looking statements”) within the meaning of applicable securities laws that reflect management’s current expectations, internal projections, assumptions, estimates or beliefs concerning, among other things, future growth, future performance and/or growth, results of operations, production, future capital, economic conditions and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. The use of any of the words “plan”, “expect”, “prospective”, “intend”, “believe”, “should”, “anticipate”, “estimate”, “hope” or other similar words, or statements that certain events or conditions “may”, “will” or “would” occur are intended to identify forward-looking statements. These statements are only predictions and actual events or results may differ materially. Although the Company’s management believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievement since such expectations are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause Parex’s actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements contained in this press release include, but are not limited to: statements with respect to the Company’s focus, growth, plans, priorities and strategies and the benefits to be derived from such plans; the value to GeoPark shareholders resulting from the completion of the Proposed Transaction; the reduced risks for the GeoPark shareholders upon the completion of the Proposed Transaction; GeoPark’s Colombian proved and probable reserves data; the estimated total transaction value of the Proposed Transaction; the Company’s ability to call a meeting of shareholders of GeoPark; the terms of the Proposal; the details of the Proposed Transaction, including the price and consideration, source of funds, conditions and path to completion of such Proposed Transaction; the estimated timing of the Proposed Transaction; and Parex’s commitment in pursuing the Proposed Transaction and engaging with GeoPark. Further, as the Proposal and the Proposed Transaction are subject to further discussions, negotiations and actions of each party, all statements related to the Proposal and the Proposed Transaction are forward-looking statements.

Although the forward-looking statements contained in this press release are based upon assumptions which management believes to be reasonable, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. With respect to forward-looking statements contained in this press release, Parex has made assumptions regarding, among other things: current and anticipated commodity prices and royalty regimes; availability of skilled labour; timing and amount of capital expenditures; future exchange rates; the price of oil, including the anticipated Brent Oil price; the impact of increasing competition; conditions in general economic and financial markets; availability of drilling and related equipment; effects of regulation by governmental agencies; receipt of partner, regulatory and community approvals, including as they may relate to the Proposal; royalty rates; future operating costs; uninterrupted access to areas of each of Parex’s and GeoPark’s operations and infrastructure; recoverability of reserves and future production rates; the status of litigation; timing of drilling and completion of wells; on-stream timing of production from successful exploration wells; operational performance of non-operated producing fields; pipeline capacity; that Parex will have sufficient cash flow, debt or equity sources or other financial resources required to fund its capital and operating expenditures and requirements as needed; that each of Parex’s and GeoPark’s conduct and results of operations will be consistent with Parex’s expectations; the estimates of GeoPark’s reserves and net debt position are accurate in all respects; that Parex will have the ability to develop its oil and gas properties, and the oil and gas properties of GeoPark, in the manner currently contemplated; that Parex’s evaluation of its existing portfolio of development and exploration opportunities is consistent with its expectations; current or, where applicable, proposed industry conditions, laws and regulations will continue in effect or as anticipated as described herein; the expected terms and conditions of the Proposed Transaction; potential benefits to shareholders of GeoPark resulting from the Proposed Transaction; the market position of Parex after the completion of the Proposed Transaction; the governmental relationships of Parex after the completion of the Proposed Transaction; that Parex will have sufficient financial resources for the Proposed Transaction; and other matters.

These forward-looking statements are subject to numerous risks and uncertainties, including but not limited to: the impact of general economic conditions in Canada and Colombia; prolonged volatility in commodity prices; industry conditions including changes in laws and regulations including adoption of new environmental laws and regulations, and changes in how they are interpreted and enforced in Canada and Colombia; determinations by OPEC and other countries as to production levels; competition; lack of availability of qualified personnel; the results of exploration and development drilling and related activities; obtaining required approvals of regulatory authorities in Canada and Colombia, including as it relates to the Proposal; risks associated with negotiating with foreign governments as well as country risk associated with conducting international activities; volatility in market prices for oil; fluctuations in foreign exchange or interest rates; environmental risks; changes in income tax laws or changes in tax laws and incentive programs relating to the oil industry; changes to pipeline capacity; ability to access sufficient capital from internal and external sources; failure of counterparties to perform under contracts; risk that Brent Oil prices are lower than anticipated; uncertainties as to whether any definitive offer will be made by Parex or whether GeoPark will accept any offer made by Parex; whether GeoPark will enter into discussions with Parex regarding the proposed combination of Parex and GeoPark; the outcome of any such discussions, including the possibility that the terms of any such combination will be materially different from those described herein; the conditions to the completion of any combination, including the receipt of GeoPark shareholder approval and the receipt of all required regulatory approvals; risks related to the completion, timing and potential benefits of the proposed combination of Parex and GeoPark; the possibility that the combined company resulting from such a combination may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all; the integration of GeoPark’s operations with those of Parex and the possibility that such integration may be more difficult, time-consuming and costly than expected or that operating costs and business disruption may be greater than expected in connection with any business combination transaction; risk that GeoPark’s reserves estimates and net debt position are different than publicly announced; risk that GeoPark’s conduct and results of operations are not consistent with Parex’s expectations; risk that Parex’s evaluation of GeoPark’s existing portfolio of development and exploration opportunities is not consistent with its expectations; risk that Parex is unable to achieve the anticipated benefits of the Proposed Transaction; and other factors, many of which are beyond the control of the Company. Readers are cautioned that the foregoing list of factors is not exhaustive.

Parex management has included the above summary of assumptions and risks related to forward-looking information provided in this press release in order to provide shareholders with a more complete perspective on Parex’s current and future operations (including operations resulting from the completion of the Proposed Transaction) and such information may not be appropriate for other purposes. Parex’s actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what benefits Parex will derive. The impact of any one risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty as these factors are interdependent, and Parex’s future course of action would depend on the assessment of all information at that time. These forward-looking statements are made as of the date of this press release and Parex disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws. Due to the risks, uncertainties and assumptions inherent in forward-looking statements, readers should not place undue reliance on these forward-looking statements.

These cautionary statements qualify all forward-looking information contained in this press release.

Information Regarding GeoPark

This press release includes information (including forward-looking information) relating to GeoPark, including statements regarding GeoPark’s net debt value (“GeoPark Net Debt Data”) and GeoPark’s Colombian year-end 2024 proved and probable reserve value (“GeoPark Reserve Data”), statements regarding GeoPark’s recent Argentina transaction, statements regarding approval for the Proposal by GeoPark’s shareholders and certain public statements made by GeoPark. This information was derived from publicly available documents of GeoPark (as described below), as well as certain other third-party sources.

Although Parex management has no knowledge that would indicate that any information contained in the documents filed by GeoPark is untrue, incomplete or unreliable (except as otherwise set forth herein), Parex does not assume any responsibility for the accuracy, completeness or reliability of the GeoPark Net Debt Data (nor if it complies with applicable Canadian GAAP or IFRS standards), the GeoPark Reserve Data or in the information contained in such third-party sources (as described below), or for any failure by GeoPark to disclose events that may have occurred or that may affect the significance, currency or accuracy of any such information, which are unknown to Parex. Such third-party data cannot be verified or guaranteed by Parex due to limits on the availability and reliability of data inputs, the third-party nature of such data and other limitations and uncertainties inherent in using third-party data. Parex has not independently verified any of the data from third-party sources referred to in this press release or ascertained the underlying assumptions relied upon by such sources.

The GeoPark Net Debt Data was derived from GeoPark’s disclosure of its second quarter 2025 debt, as described in further detail in GeoPark’s press release dated August 5, 2025 titled “GeoPark Reports Second Quarter 2024 Results” filed on EDGAR on Form 6-K. Net debt is described therein as “current and non-current borrowings less cash and cash equivalents”. Further details of the calculations of financial debt and cash and cash equivalents used to generate this net debt measure are provided therein. Parex believes referring to GeoPark Net Debt Data is relevant as it helps the reader understand the potential transaction value, and this GeoPark Net Debt Data is the most recent publicly-available data provided by GeoPark for this purpose.

The statement regarding GeoPark Reserve Data is derived from the DeGolyer and MacNaughton Corp. estimate of the proved and probable reserves based on the Petroleum Resources Management Services methodology, as described in further detail in the press release of GeoPark dated February 25, 2025 titled “GeoPark Announces Pro Forma 2P Reserve Replacement of 480%” filed on EDGAR on Form 6-K. Parex has no knowledge as to whether such GeoPark Reserve Data was prepared in accordance with National Instrument 51-101 (“NI 51-101”) and thus cautions the reader that the data relied upon here may not be analogous to reserves data prepared in accordance with NI 51-101 and the procedures and standards contained in the Canadian Oil And Gas Evaluations Handbook (“COGEH”).

There is no certainty that the data used for GeoPark Reserve Data will be similar to reserve data prepared in accordance with NI 51-101 and the COGEH. Pursuant to NI 51-101 and the COGEH, reserves are estimated remaining quantities of crude oil, natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on analysis of drilling, geological, geophysical and engineering data, the use of established technology and specified economic conditions, which are generally accepted as being reasonable. Under NI-51-101 and the COGEH, reserves can be classified into proved, probable and possible, according to the degree of certainty associated with the estimates. Most relevant are the categories of proved and probable, where as defined under NI 51-101 and the COGEH: (i) proved reserves are those reserves that can be estimated with a high degree of certainty to be recoverable, it is likely that the actual remaining quantities recovered will exceed the estimated proved reserves; and (ii) probable reserves are those additional reserves that are less certain to be recovered than proved reserves, it is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the estimated proved plus probable reserves. Although no assurance can be given by Parex that the GeoPark Reserve Data has been prepared in accordance with NI 51-101 and the COGEH, Parex believes referring to the GeoPark Reserve Data is relevant as it helps quantify the Proposed Transaction value in relation to best information available regarding GeoPark’s reserves.

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bc7559c0-d0d3-4f2f-abec-00fcc59ba0ad

PDF available: http://ml.globenewswire.com/Resource/Download/ef736637-0041-4f18-bbad-751e4a856952

![]()