Oxurion Avoids Bankruptcy, Announces Board and Management Changes and Enters into Binding Letter of Intent with its Main Creditor Atlas

Regulated information – Inside information

- No bankruptcy filing

- Significant reduction in Working Capital costs

- Atlas commits to fund Oxurion’s Working Capital costs (including the Preclinical GA Program) through 2024 using the existing Atlas Funding Program, under the conditions as set out below

- Intent to put in place Debt Restructuring plan

- Two new independent directors have been co-opted to the Board, and a new CEO/CFO, who will also act as an executive board member, have been appointed upon proposal of Atlas

Leuven, BELGIUM – December 28, 2023 – 9:00 PM CET – Oxurion NV (Euronext Brussels: OXUR), a biopharmaceutical company headquartered in Leuven, announced today it has avoided bankruptcy by entering into a binding letter of intent (LOI) with Atlas Special Opportunities LLC (Atlas) and an addendum to the existing subscription agreement for convertible bonds with Atlas. Pursuant to these agreements, Atlas will continue to fund Oxurion under the existing EUR 20.8 million funding program with a focus on Oxurion’s preclinical programs and monetizing its other existing assets, potentially including both THR-149 and THR-687, while at the same time Oxurion is putting in place a debt restructuring plan with Oxurion’s creditors and seeking future corporate transactions or a business combination that would be complementary to debt restructuring, all of which remains uncertain.

For the last five years, Oxurion’s preclinical program has been focused on developing innovative therapeutics to preserve the vision of elderly people suffering from Age-related Macular Degeneration (AMD) generally, and Geographic Atrophy (GA) specifically. GA is an advanced form of AMD and is the leading cause of blindness worldwide – GA is estimated to affect between 5-8 million people currently and is expected to increase at a rate of 7% annually.

The market potential for GA is estimated at between USD 3-6 billion by 2028. Given this market potential, vast amounts of time and capital that have been invested to find an effective treatment for GA. Earlier this year the FDA approved the first medicine for the treatment of GA, SYFOVRE®1 (pegcetacoplan injection) from Apellis. SYFOVRE was shown in clinical trials to reduce the rate of GA lesion growth by no more than 36% with monthly IVT injections, with no significant improvement in vision, which leaves a tremendous unmet need for an effective treatment for GA. In August of this year, a second product was approved for GA, IZERVAY™2(avacincaptad pegol intravitreal solution) from Iveric Bio, an Astellas company, with a similar profile to SYFOVE. Prior to the approval of IZERVAY, Iveric Bio, whose principal asset was IZERVAY, was acquired by Astellas for USD 5.9 billion, demonstrating the significant value assets for treating GA can potentially generate.

Both SYFOVRE and IZERVAY target a single pathway, the complement pathway. However, the causes of GA are multifactorial and Oxurion has developed a disease specific target discovery platform enabling it to study the disease from different angles in a rapid and capital efficient manner. Using the platform, Oxurion has already identified potential novel pathways involved in the pathogenesis of AMD/GA disease that have the potential to provide better treatment options for GA patients that are not focused solely on the complement pathway.

The next step for Oxurion is to seek to validate these targets in various in vitro and in vivo models that the preclinical team has developed over the past years and that are representative of the disease characteristics of AMD/GA (patient in a dish). Oxurion’s approach potentially differentiates it from other methods through its unbiased target discovery approach and its multitargeting drug format, which the Company considers to be necessary to improve efficacy compared to the standard of care for such a multi-factorial disease.

The Company expects that, if successful, its lead generation work could allow Composition of Matter patents to be filed in 2024, which would be the next value inflection point, after which the Company estimates it would take around two years and a further investment of approximately EUR 20 million in working capital before initiating a proof of concept study.

Had the Company not been capital constrained, it would have undertaken these efforts previously. Atlas has now committed to fund the Company’s running costs including the GA program at least through 2024, provided the modified liquidity and market capitalization conditions set forth below are met, and to consider means of further monetizing both the Oncurious and Oxurion assets (potentially including THR-687 and THR-149), and in parallel to seek future corporate transactions or business combinations.

To achieve these aims, the Company has agreed with the Chief Development Officer (CDO), the newly promoted Chief Scientific Officer (CSO), and the entire preclinical team to stay at the Company. The team consists of six world-class scientists with combined experience in researching retina diseases of more than 75 years, including 4 PhD’s/MDs. The team is led by Dr. Andy De Deene, CDO, who is a medical doctor with more than 15 years of retina drug development experience and led the development of Jetrea® which was approved in over 50 countries, and Philippe Barbeaux, CSO, a PhD with more than 15 years of preclinical experience in retina-related diseases. Andy and Philippe will both be members of the Executive Committee, together with the new acting CEO/CFO, Pascal Ghoson, who is a former M&A specialist at Rothschild bank and CFO of various listed companies on Euronext.

Given that the Company will change its focus to preclinical development, the size of the Company will be reduced to approximately 10 persons, and the remainder of the Company’s personnel, including the current CEO/CFO Tom Graney, will participate in a voluntary redundancy program on terms that have been agreed, which will result in a cost saving of approximately 67% of its personnel cost going forward.

Under the terms of the LOI, Atlas commits to pay EUR 500,000 to Kreos Capital VI (UK) Limited/Pontifax Medison Finance (Israel) L.P. and Pontifax Medison Finance (Cayman) L.P. (Kreos/Pontifax), and Kreos/Pontifax have agreed to remove the freeze on the Company’s bank accounts up to the same amount to pay certain costs related to December 2023. In addition, Atlas has committed to finance the additional funds required to cover the one-off expenses related to implementation of the LOI, for a total amount of EUR 355,000 (“LOI costs”). Atlas has also committed to funding the preclinical program through 2024 in monthly tranches of EUR 300,000 to be paid monthly starting in January 2024 through December 2024 (“Running costs”), provided that the conditions of the Atlas funding program, which are described below, are met (together the Running costs and the LOI costs are referred to as the “Working Capital costs”), allowing for Oxurion to stay in going concern, but not to exceed the remaining amount under the Atlas funding program, which is EUR 8.5 million. Atlas will not receive any commission fee in the context of the LOI.

The Working Capital costs will be funded through the issuance of mandatory convertible bonds after the date of the LOI under the terms of the existing Atlas funding program. Atlas has agreed to waive liquidity and market capitalization conditions of the convertible bonds to fund the LOI Costs and the convertible bonds issued to set-off the EUR 500,000 reimbursement of Kreos/Pontifax. Subsequent tranches are subject to facilitated liquidity and market capitalization conditions (market cap at EUR 500,000 and total trading value of last 22 days above EUR 200,000). Atlas currently holds 296 convertible bonds in a total amount of EUR 7.4 million.

Atlas formally commits not to convert Convertible Bonds issued after the LOI to pay the Working Capital costs and the LOI costs (the “New Convertible Bonds”) and to only convert old convertible bonds (i.e. convertible bonds issued in accordance with the Subscription Agreement and outstanding on the date of the second amendment to the funding program (the “Old Convertible Bonds”)) having a combined EUR value equivalent to the New Convertible Bonds issued after the date of the LOI until the earlier date between (i) 12 months from the date of the LOI, (ii) the announcement by the Company of a potential partnership or transaction involving a third party or any major scientific update, or (iii) when the last rolling 22 trading days total volume of shares traded on the market is valued above EUR 1 million, in which case Atlas will be entitled to convert and trade shares in excess of the amount of New Convertible Bonds, but agrees not trade more than 30% of the total daily volume traded. The Atlas funding program is described further below and in section 13 (pp. 46 – 50) of the Prospectus dated March 29, 2023 (link), the supplements dated June 13, 2023 (link) August 22, 2023 (link), Section 1. (pp. 1 – 2) of the Third Supplement dated October 2, 2023 (link) and November 15, 2023 (link) (the “Prospectus”) and the Board reports dated March 7, 2023 (link) and respectively October 2, 2023 (link).

Thomas Clay, Patrik De Haes and Tom Graney have stepped down from the Board as a condition of the LOI, and Charles Paris de Bollardière (former secretary of the Board of TotalEnergies), James Hartmann (former auditor at the U.S. Securities & Exchange Commission and Chief Compliance officer of various companies) have been co-opted as new independent directors and the new CEO/CFO, Pascal Ghoson, has been co-opted as a new executive director (the “New Board”). This press release is issued by the New Board.

The primary driver underlying the Company’s communication last month that it was preparing to file for bankruptcy and that shareholders would likely not receive any value for their shares, was the right held by Kreos/Pontifax to enforce their security interest to freeze the Company’s liquid assets, which they did. That risk has been eliminated by Atlas successfully agreeing terms with Kreos/Pontifax to acquire their outstanding debt of around EUR 2.1 million for approximately EUR 1.6 million by entering into a binding agreement to purchase the debt along with assignment of the claim and related pledge, rights, interests, and security of Kreos/Pontifax, which shall be transferred to Atlas when Kreos/Pontifax is repaid, which is expected to occur on January 1, 2024, and until then, Kreos/Pontifax has agreed not to enforce their security interest. This repayment from Atlas to Kreos/Pontifax will not be dilutive to the shareholders. A comparable second rank security package shall cover any future New Convertible Bonds’ subscriptions. Oxurion shall immediately partly reimburse the debt transferred from Kreos/Pontifax to Atlas with its own financial means and funds provided via New Convertible Bonds, and reduce the debt and the related pledge to around EUR 0.5 million by mid-January 2024.

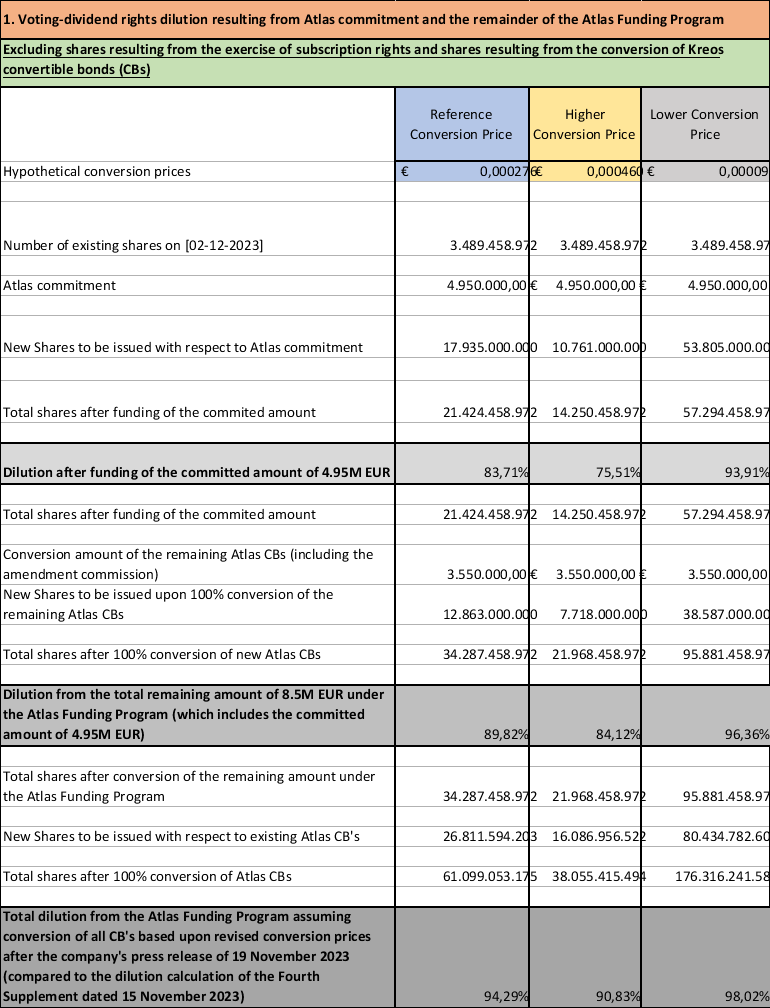

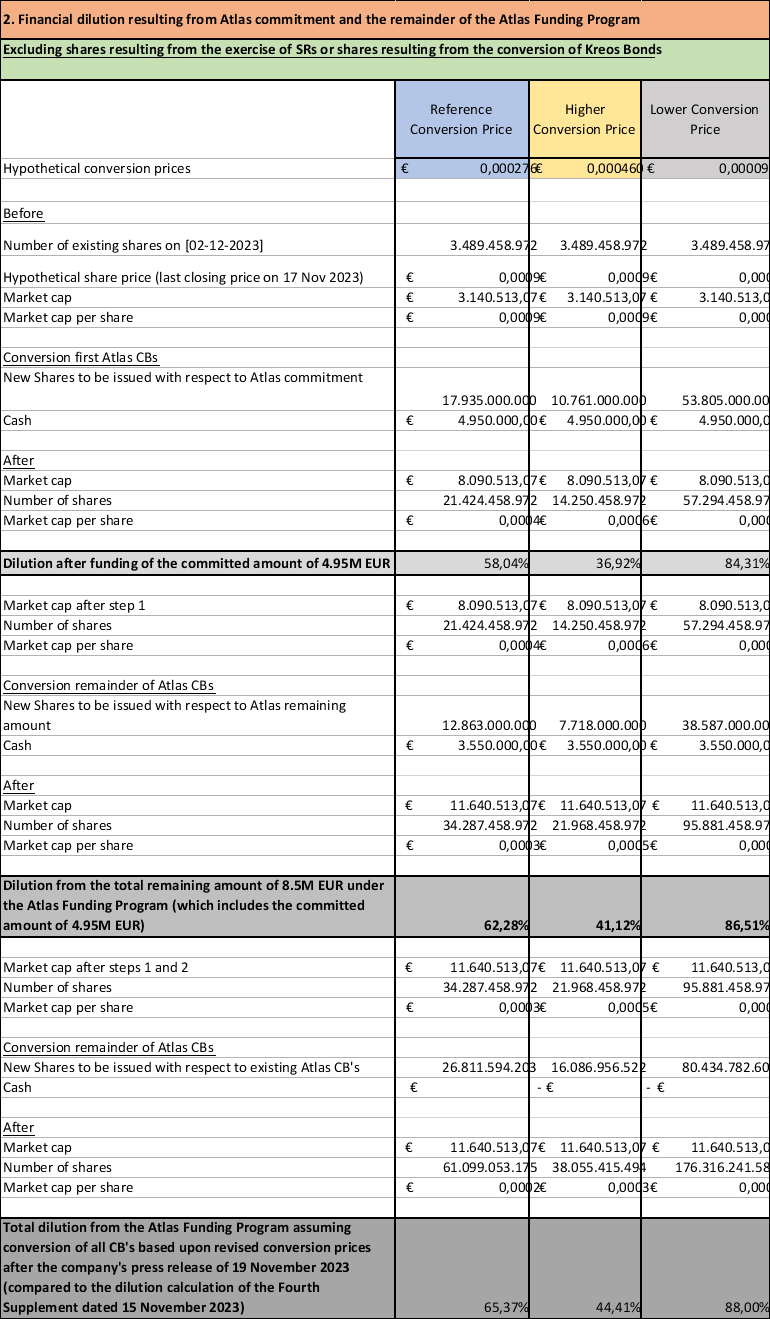

The conversion of mandatory convertible bonds under the existing funding program will significantly dilute existing shareholders, and to limit the amount of the dilution, while at the same time avoiding bankruptcy, as described above, Atlas has formally committed to limit its conversions of convertible bonds as described above. Concerning the amount of the dilution from the shares converted for the convertible bonds, while it is difficult to predict, the attached Annex to this press release attempts to project the possible dilution at a hypothetical conversion price of EUR 0.000460 to EUR 0.000092. For instance, the conversion of the Working Capital costs of EUR 4,950,000, could, at a hypothetical conversion price of EUR 0.000460 to EUR 0.000092, lead to the issuance of 10,761,000,000 to 53,805,000,000 new shares (depending on the conversion price), being a dilution of the voting rights of 75.51% to 93.91% and a financial dilution of 36.92% to 84.31% compared to the situation as of the date of this press release. Reference is made to the attached dilution table as Annex 1. In the event the total Working Capital costs would amount to the total remaining amount under the Atlas funding program, i.e. EUR 8.5 million, this could lead to the issuance of 18,479,000,000 to 92,392,000,000 new shares (depending on the conversion price), being a dilution of the voting rights of 84.12% to 96.36% and a financial dilution of 41.12% to 86.51% compared to the situation as of the date of this press release. Were Atlas to convert all EUR 7.4m in convertible bonds that they currently hold, together with the entire EUR 8.5m remaining under the Atlas Funding Program, at the hypothetical conversion prices set out above, and maintain ownership of all shares issued upon conversion, which is not its intent, this would result in Atlas holding more than 90% of Oxurion’s shares. However, given that Atlas intends to sell its shares issued upon conversion, it is highly unlikely that it would cross the threshold of 30% of the voting rights of Oxurion.

In view of the extent of the dilution, any prospect of recovery for existing shareholders as far as share value is concerned is remote.

At the same time, Oxurion is in the process of negotiating a debt restructuring plan with Oxurion’s larger creditors, which seeks their agreement to a significant reduction of their debt, combined with potential conversion to equity, payment delays and maturity extensions. The Company’s current debts amount to approximately EUR 15 million. The Company’s largest creditors are Atlas, Kreos/Pontifax and Syneos Healthcare. It is uncertain whether the Debt Restructuring will be successful, but were that to be the case, it is expected that the repayments will be financed by the Company issuing additional New Convertible Bonds to Atlas and potential debt for equity swaps (the “Debt Repayment”). While the amount of the Debt Repayment is being negotiated, the total amount of the New Convertible Bonds to be issued for the Working Capital Costs, LOI Costs, plus the Debt Repayments, shall not exceed the remaining funding available under the Atlas funding program as of the date of the LOI, which is EUR 8.5 million. Reference is made to the dilution table in Annex 1.

Based on the foregoing, the Board has determined that the bankruptcy conditions are not met and the Company therefore will not file for bankruptcy as long that continues to be the case.

About Oxurion

Oxurion (Euronext Brussels: OXUR) is engaged in developing next-generation standard of care ophthalmic therapies for the treatment of retinal disease. Oxurion is based in Leuven, Belgium. More information is available at www.oxurion.com.

Important information about forward-looking statements

Certain statements in this press release may be considered “forward-looking”. Such forward-looking statements are based on current expectations, and, accordingly, entail and are influenced by various risks and uncertainties. The Company therefore cannot provide any assurance that such forward-looking statements will materialize and does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or any other reason. Additional information concerning risks and uncertainties affecting the business and other factors that could cause actual results to differ materially from any forward-looking statement is contained in the Company’s Annual Report. This press release does not constitute an offer or invitation for the sale or purchase of securities or assets of Oxurion in any jurisdiction. No securities of Oxurion may be offered or sold within the United States without registration under the U.S. Securities Act of 1933, as amended, or in compliance with an exemption therefrom, and in accordance with any applicable U.S. state securities laws.

For further information please contact:

| Oxurion NV Pascal Ghoson Chief Executive Officer Tel: +33 6 18 49 05 04 pascal.ghoson@nessman-partners.com | US Conway Communications Mary T. Conway mtconway@conwaycommsir.com

|

Annex: Dilution Table

Dilution table

1 Registered trademark of Apellis Pharmaceuticals, Inc.

2 Trademark of Iveric Bio, an Astellas company.

Attachments

![]()