NowVertical Group Reports Second Quarter 2025 Financial Results

Company Hosting Investor Webinar on Thursday August 28, 2025, at 10:00 AM EDT

TORONTO, Aug. 27, 2025 (GLOBE NEWSWIRE) — NowVertical Group Inc. (TSX-V: NOW) (“NOW” or the “Company”), a leader in AI-driven data solutions, announces financial results for its second fiscal quarter ended June 30, 2025. Unless otherwise specified, all dollar amounts are expressed in U.S. dollars. Management will host an investor webinar at 10:00 AM EDT (7:00 AM PDT) on Thursday August 28th, to discuss the Company’s financial and business results.

Selected Financial Highlights for the Three and Six Months Ended June 30, 2025:

- Revenue was $8.2 million in the three months ended June 30, 2025 (“Q2 2025”), a 13% decrease from $9.4 million for the three months ending June 30, 20241 (“Q2 2024”), while revenue for the six months ended June 30, 2025 (“H1 2025”) was $18.6 million, a 4% increase from $17.9 million over the six months ended June 30, 20241 (“H1 2024”).

- Gross Profit was $3.8 million in Q2 2025, a 24% decrease from $5.1 million in Q2 20241 and was $9.0 million in H1 2025, a 6% decrease from $9.6 million n H1 20241.

- Administrative Expenses were $3.2 million in Q2 2025, a 31% decrease from $4.6 million in Q2 20241 and were $6.8 million in H1 2025, a 26% decrease from $9.3 million in H1 20241.

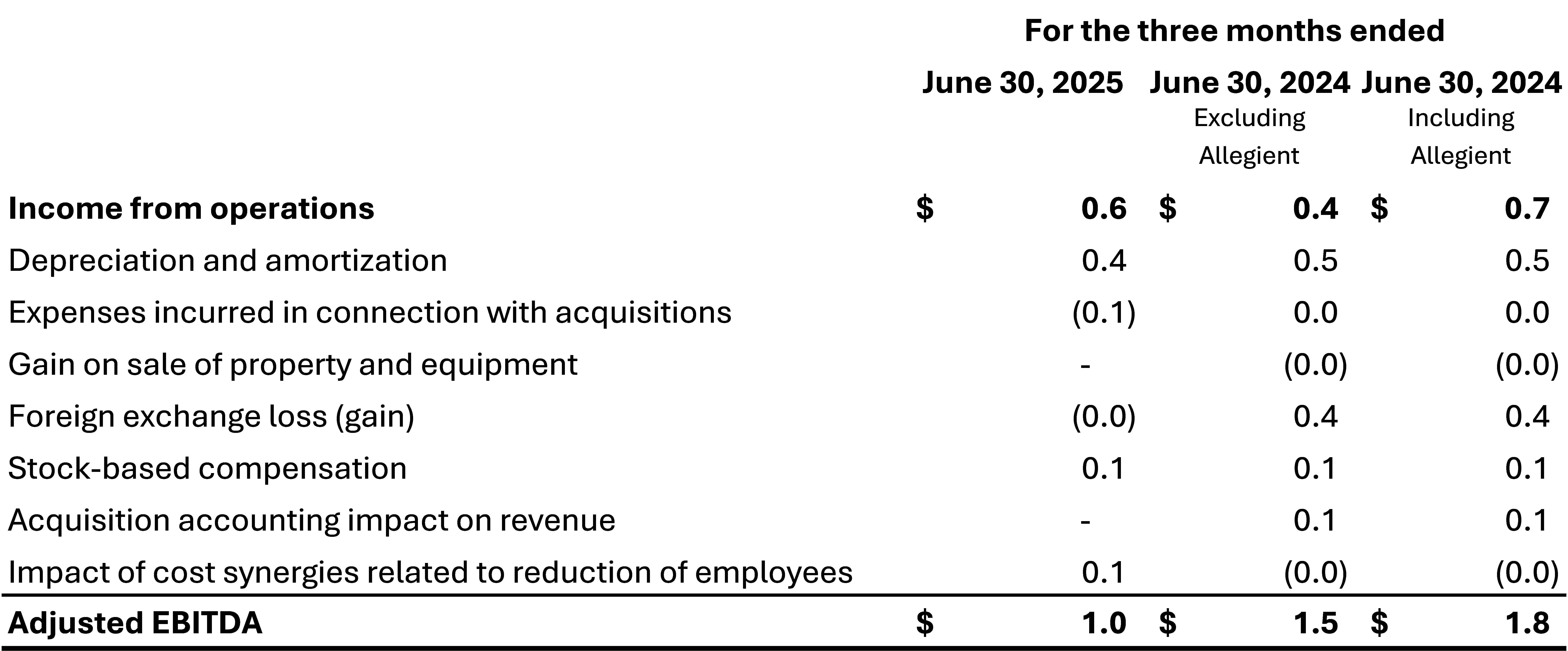

- Income from Operations was $0.6 million in Q2 2025, a 41% increase from $0.4 million in Q2 20241 and was $2.1 million in H1 2025, a 622% increase from $0.3 million in H1 20241.

- Adjusted EBITDA was $1.0 million in Q2 2025, a 29% decrease from $1.5 million in Q2 20241, while Adjusted EBITDA was $3.6 million in H1 2025, a 36% increase from $2.6 million in H1 20241. Adjusted EBITDA is a non-GAAP financial measure, see “Non-IFRS Measures” below.

“As we close the first half of 2025, NowVertical has taken another meaningful step forward delivering positive operating income and a 36% increase in adjusted EBITDA year-to-date. While Q2 2025 revenue declined 13%, largely due to the planned Chile restructuring, multi-year reseller contract adjustments, and the deferral of certain public sector deals, our strategic accounts grew 44% year-over-year and now represents over 70% of H1 2025 revenue. This shift strengthens the quality and predictability of our revenue mix and underpins our path towards sustainable growth. With continued focus on seeking high-value engagements, we remain confident in our ability to deliver a strong H2 2025 and advance toward our growth and profitability objectives.” said Sandeep Mendiratta, CEO of NOW.

Q2 2025 and Subsequent Business Highlights:

- May 30, 2025: Announced that the company secured Up to $26 Million USD in Financing with HSBC to Fuel Growth.

- June 18, 2025: Announced that the company was to Participate in Bristol Capital – Hosted Webinar to Showcase Business Overview.

- July 02, 2025: The Company announced that its integration strategy accelerated account expansion and cross-market growth.

- July 07, 2025: Announced the companies 2025 Shareholder Meeting Results and Equity Grants.

- July 25, 2025: Announced that the company was to attend Qlik AI Reality Tour, Deepening Strategic Partnerships and Showcasing AI Leadership.

Q2 2025 Financial Results Investor Webinar:

The Company invites shareholders, analysts, investors, media representatives, and other stakeholders to attend our upcoming webinar. Management will discuss Q2 2025 results, followed by a question-and-answer session.

Investor Webinar Registration:

Time: Thursday, August 28, 2025, 10:00 AM in Eastern Time (US and Canada)

Registration Link:

https://us02web.zoom.us/webinar/register/WN_Sit0k4PKSZSgCPkj4hD1-g#/registration

A recording of the webinar and supporting materials will be made available in the investor’s section of the Company’s website at https://www.nowvertical.com/news-and-media.

Additional Information:

The Company’s second quarter 2025 condensed consolidated interim financial statements, notes to financial statements, and management’s discussion and analysis for the three ended June 30, 2025, are available on the Company’s SEDAR+ profile at www.sedarplus.com.

1Comparative amounts for Q2 2024 and H1 2024 exclude Allegient Defense, Inc. (“Allegient”) which was divested on May 24, 2024.

About NowVertical Group Inc.

The Company is a data analytics and AI solutions company offering comprehensive solutions, software and services. As a global provider, we deliver cutting-edge data, technology, and artificial intelligence (AI) applications to private and public enterprises. Our solutions form the bedrock of modern enterprises, converting data investments into business solutions. NOW is growing organically and through strategic acquisitions. For further details about NOW, please visit www.nowvertical.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Andre Garber, CDO

IR@nowvertical.com

Investor Relations:

Bristol Capital Ltd.

Stefan Eftychiou

stefan@bristolir.com

+1(905)326-1888 x60

Cautionary Note Regarding Non-IFRS Measures:

This news release refers to certain non-IFRS measures. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. The Company’s definitions of non-IFRS measures used in this news release may not be the same as the definitions for such measures used by other companies in their reporting. Non-IFRS measures have limitations as analytical tools and should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS. The Company uses non IFRS financial measures including “EBITDA”, and “Adjusted EBITDA”. These non-IFRS measures are used to provide investors with supplemental measures of our operating performance and to eliminate items that have less bearing on our operational performance or operating conditions and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. The Company believes that securities analysts, investors and other interested parties frequently use non-IFRS financial measures in the evaluation of issuers. The Company’s management also uses non-IFRS financial measures to facilitate operating performance comparisons from period to period and prepare annual budgets and forecasts.

Non-IFRS Measures:

The non-IFRS financial measures referred to in this news release are defined below. The management discussion and analysis for the three months ended June 30, 2025, available at nowvertical.com and on SEDAR+ at www.sedarplus.com contains supporting calculations for Adjusted Revenue, EBITDA % and Adjusted EBITDA

“Adjusted EBITDA” adjusts net income (loss) before depreciation and amortization expenses, net interest costs, and provision for income taxes for revenue adjustments in “Adjusted Revenue” and items such as acquisition accounting adjustments, transaction expenses related to acquisitions, transactional gains or losses on assets, asset impairment charges, non-recurring expense items, non-cash stock compensation costs, and the full year impact of cost synergies related to restructuring activities, such as a reduction of employees.

The Company has reconciled Adjusted EBITDA to the most comparable financial measure as follows:

“EBITDA %” is defined as Adjusted EBITDA as a percentage of Adjusted Revenue.

“Adjusted Revenue” adjusts revenue to eliminate the effects of acquisition accounting on the Company’s revenues, which predominantly pertain to fair market value adjustments to the opening deferred revenue balances of acquired companies.

Cautionary note regarding Forward-Looking Statements

This news release may contain forward-looking statements and forward-looking information (within the meaning of applicable securities laws) which reflect the Company’s current expectations regarding future events. All statements in this news release that are not purely historical statements of fact are forward-looking statements and include statements regarding beliefs, plans, expectations, future, strategy, objectives, goals and targets. Although the Company believes that such statements are reasonable and reflect expectations of future developments and other factors which management believes to be reasonable and relevant, the Company can give no assurance that such expectations will prove to be correct. Forward-looking statements can generally be identified by the use of forward-looking words such as “may”, “should”, “will”, “could”, “intend”, “estimate”, “plan”, “anticipate”, “expect”, “believe” or “continue”, or the negative thereof or similar variations. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause future results, performance, or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements are not guarantees of future performance and undue reliance should not be placed thereon, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the Company. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

All of the forward-looking statement contained in this press release are qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial condition or results of operation. Unless otherwise noted or the context otherwise indicates, the forward -looking statements contained herein are provided as of the date hereof, and the Company does not intend, and does not assume any obligation, to update the forward-looking statements except as otherwise required by applicable law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/bc716e18-1f4f-4713-927f-0280c5e7b928

https://www.globenewswire.com/NewsRoom/AttachmentNg/cccda6ee-501a-4ffb-864a-cc6772406a37

![]()