Novo Resources to Trade on the OTCQB Market

VANCOUVER, British Columbia, Jan. 02, 2025 (GLOBE NEWSWIRE) — Novo Resources Corp. (TSX: NVO) (ASX: NVO) (OTCQB: NSRPF) announces that it has transitioned its trading platform from the OTCQX to the OTCQB market in the United States.

Effective immediately, Novo Resources will now trade on the OTCQB under the ticker symbol NSRPF. This transition reflects the company’s evolving strategic priorities while continuing to provide an opportunity for increased engagement with the U.S. investment community while maintaining access to a highly respected U.S. trading platform.

“We are pleased to make this transition to the OTCQB, which is better suited to our current growth stage and offers a more efficient, cost-effective platform for both our shareholders and potential investors,” said Mr. Michael Spreadborough, Executive Co-Chairman of Novo Resources. “Our commitment to advancing gold exploration in Western Australia remains steadfast, and this change will help enhance our market presence in the U.S. and beyond, ultimately supporting our goal of creating long-term value for stakeholders.”

The OTCQB is a premium tier of the OTC Markets Group, offering increased visibility, higher compliance standards, and greater trading efficiency. Despite the change, Novo Resources remains committed to transparency, regular communication with investors, and providing operational updates.

Novo Resources continues to trade on the TSX under the symbol NVO and on the ASX under the symbol NVO.

Authorised for release by the Board of Directors.

CONTACT

| Investors: Mike Spreadborough +61 8 6400 6100 info@novoresources.com | North American Queries: Leo Karabelas +1 416 543 3120 leo@novoresources.com | Media: Cameron Gilenko +61 466 984 953 cameron.gilenko@sodali.com |

ABOUT NOVO

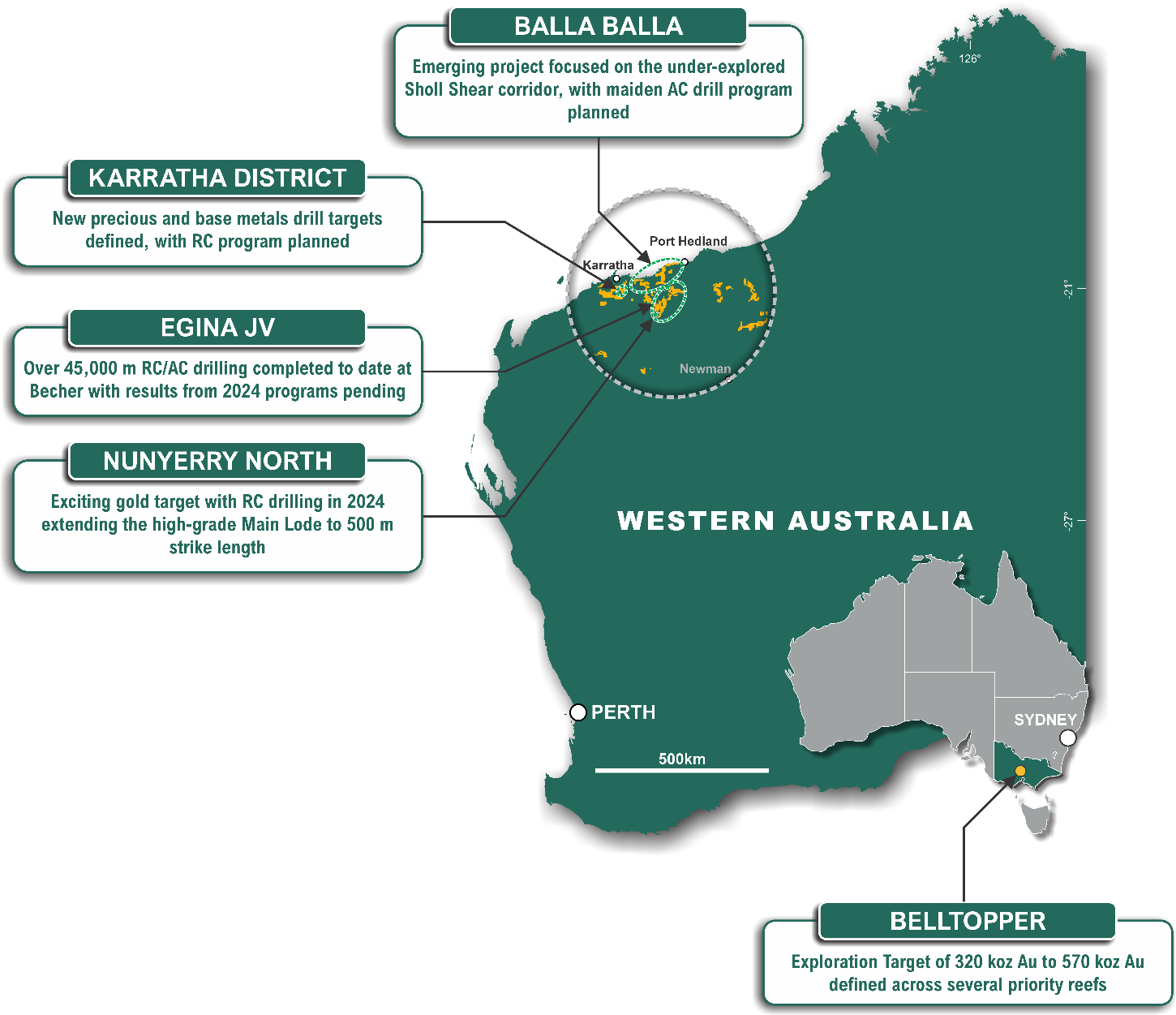

Novo is an Australian based gold explorer listed on the ASX and the TSX focused on discovering standalone gold projects with > 1 Moz development potential. Novo is an innovative gold explorer with a significant land package covering approximately 5,500 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper project in the Bendigo Tectonic Zone of Victoria, Australia.

Novo’s key project area is the Egina Gold Camp, where De Grey Mining is farming-in to form a JV at the Becher Project and surrounding tenements through exploration expenditure of A$25 million within 4 years for a 50% interest. The Becher Project has similar geological characteristics as De Grey’s 12.7 Moz Hemi Project1. Novo is also advancing gold exploration at Nunyerry North, part of the Croydon JV (Novo 70%: Creasy Group 30%), where 2023 exploration drilling identified significant gold mineralisation. Novo continues to undertake early-stage exploration across its Pilbara tenement portfolio.

Novo has a significant investment portfolio and a disciplined program in place to identify value accretive opportunities that will build further value for shareholders.

Please refer to Novo’s website for further information including the latest Corporate Presentation.

An Exploration Target as defined in the JORC Code (2012) is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. Accordingly, these figures are not Mineral Resource or Ore Reserve estimates as defined in the JORC Code (2012). The potential quantities and grades referred to above are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. These figures are based on the interpreted continuity of mineralisation and projection into unexplored ground often around historical workings. The Exploration Target has been prepared in accordance with the JORC Code (2012). As detailed in the Company’s ASX announcement released on 25 September 2024 (available to view at www.asx.com.au). The Tonnage range for the exploration target is 1.5Mt to 2.1Mt and the Grade range is 6.6g/t Au to 8.4g/t Au. The Company confirms that it is not aware of any new information that material affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the original market announcement continue to apply and have not materially changed.

1. Refer to De Grey ASX Announcement, Hemi Gold Project Resource Update, dated 21 November 2023. No assurance can be given that a similar (or any) commercially viable mineral deposit will be determined at Novo’s Becher Project.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7b3e33ad-d947-48fb-b70c-856c6e1e7f17

![]()