New Research Findings Reveal Employers Who Contribute to HSAs See Double-Digit Growth in Employee Participation

New HealthEquity research indicates employers who optimize HSA contribution strategies are more directly supporting their employees’ financial well-being

DRAPER, Utah, Sept. 26, 2024 (GLOBE NEWSWIRE) — HealthEquity, Inc. (Nasdaq: HQY) (“HealthEquity”) today released research findings on how Health Savings Account (HSA) contribution strategies influence how employees participate in their HSA benefits. The qualitative and quantitative analysis included a sample of nearly 2,000 HealthEquity clients and more than 2 million HSA members. The analysis provides insight for employers who want to create impactful HSA benefit strategies that support their employees’ financial wellbeing.

“Benefit leaders want employees to get the most out of their benefits — including HSAs — and fostering utilization is a constant challenge,” said Amanda Riley, head of enterprise client relationships at HealthEquity. “What we find is that a deliberate employer HSA contribution strategy increases participation, and by extension, more healthcare savings.”

As of June 2024, nearly $137 billion in assets were housed in over 37 million HSAs in the U.S1. HealthEquity found that companies who both seed HSA contributions—by providing an initial contribution into employees’ HSA accounts, and match employee contributions see 15 percent higher participation than companies who don’t contribute. Further, matching and seeding individually each drives 11 percent higher participation in HSA programs.

The research frames HSA contribution strategies through six key areas of impact. The areas include enrollment, employer cost savings, employee benefit equity, contribution support, employee savings retention and investing.

Some of the key findings in these areas concluded that:

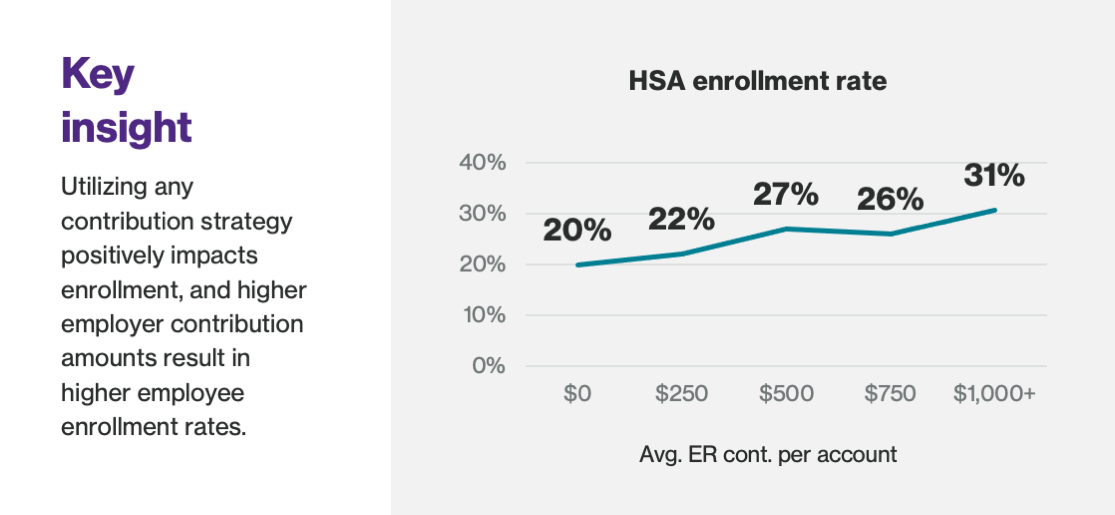

- Any employer contribution will increase HSA enrollment, and enrollment is positively correlated with the amount of money employers are willing to contribute.

- An HSA matching strategy yields the highest employee contribution rate, but similar to a 401(k)-matching incentive, puts the decision-making and financial burden on employees.

- HSA seed contribution strategies provide the most positive impact to benefits equity — meaning the upside increases evenly across all pay grades. A seed strategy also helps members’ savings retention and investing—while decreasing their financial burden.

There are also cost savings to consider. Employees who participate in HSAs save 16% on average, and employers save an average 2% for each HSA enrollee, per a separate study from the Kaiser Family Foundation2.

The HealthEquity Employer Contribution Study results, detailed insights, and industry-specific recommendations can be found online and will be discussed further on an upcoming webinar “The impact of HSA employer contribution strategy”, scheduled for November 14. The webinar will also provide additional considerations for benefit leaders and an opportunity for discussion with industry leaders.

About HealthEquity

HealthEquity and its subsidiaries administer HSAs and various other consumer-directed benefits for over 16 million accounts, working in close partnership with employers, benefits advisors, and health and retirement plan providers who share our unwavering commitment to our mission of saving and improving lives by empowering healthcare consumers. Through cutting-edge solutions, innovation, and a relentless focus on improving health outcomes, we empower individuals to take control of their healthcare journey while ultimately enhancing their overall well-being. Learn more about our “Purple service” and approach at www.healthequity.com.

Resources:

1 2024 Midyear Devenir HSA Market Statistics & Trends, 2024

2 KFF Employer Health Benefits Survey, 2023

Media Contact:

Amy Cerny

Director of Corporate Communications

acerny@healthequity.com

Check out the HealthEquity newsroom for the latest HealthEquity news, original research, fresh content, and social media highlights.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4fb9e40a-edd8-4f73-bf2f-5bda60abc823

![]()