MoonFox Data | “New Consumer Trends F4” Soar in Hong Kong Stock Market; Pop Mart’s Mark Value Hits All-Time High

Shenzhen, June 26, 2025 (GLOBE NEWSWIRE) — Fueled by the global explosion in popularity of LABUBU, Pop Mart, one of the so-called “New Consumer Trends F4” stocks on the Hong Kong Stock Exchange, has seen its share price skyrocket. As of market close on June 9, Pop Mart’s market capitalization reached HKD 336.8 billion, setting a new all-time high. With a 48.73% ownership stake, founder Wang Ning has now become the richest individual in Henan province.

According to MoonFox Data, Pop Mart’s monthly average DAU (daily active users) on mobile surged 257% since the beginning of the year, while its customer UV index at offline retail stores rose 11%. The continued rise in its share price is a direct reflection of the company’s comprehensive growth across all operational metrics. Behind this momentum lies a meticulously planned commercial strategy that has laid a solid foundation for sustained growth.

Building and Operating the Pop Mart IP Universe

A global co-creation network of artists: POP MART has built a global creative network of over 200 designers, operating under a dual-track model of “emerging talent discovery + master collaborations.” By working closely with prominent artists such as Hong Kong designer Kenny Wong (creator of the “MOLLY” IP) and Dutch illustrator Kasing Lung (creator of the “LABUBU” IP), the company transforms artistic concepts into commercial value through a full industrialized pipeline of “concept sketches → 3D modeling → mass production → retail”.

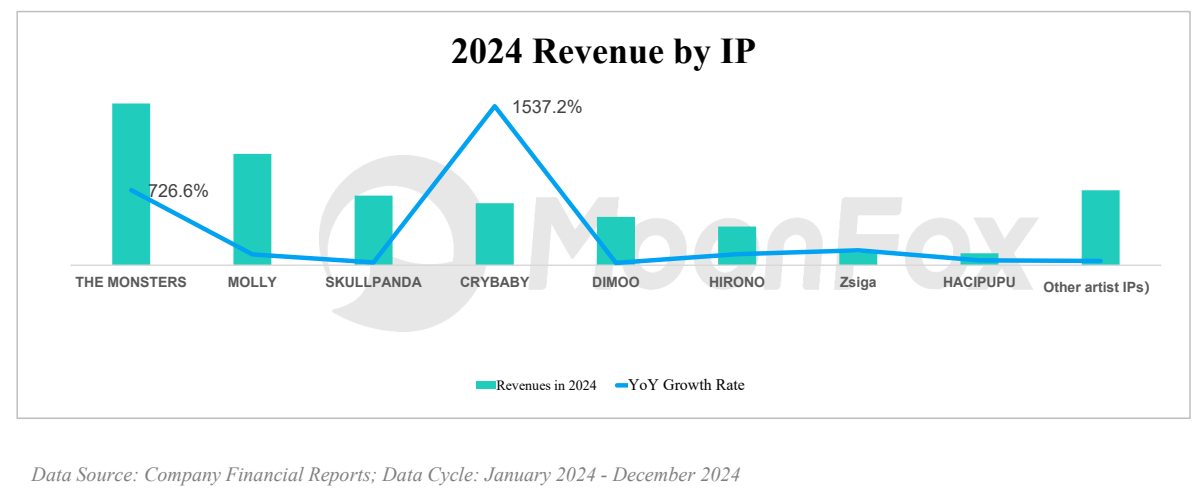

Emotionally resonant design: Take CRYBABY as an example: its core design concept revolves around “crying as therapy” and the idea that “everyone has moments when they need to cry”. It aims to encourage people to move forward with courage after releasing their emotions. By conveying the core message of emotional freedom, it provides emotional value to fans and evokes deep resonance, making it Pop Mart’s fastest-growing emerging IP in 2024, with a YoY revenue increase of over 1,537.2%.

Continued development of core IPs: Classic IPs such as MOLLY and DIMOO continue to iterate with new themes, while emerging IP THE MONSTERS (which includes LABUBU) has expanded beyond static pop toys and figurines into plush accessories and interactive companions through diverse product designs and performances featuring park character interactions. These efforts have strengthened emotional bonds with fans, driving a remarkable 726.6% YoY revenue growth in 2024.

Tiered pricing strategy across consumer scenarios:

Blind Box Economy (RMB 59-69): By lowering the threshold to trigger impulse purchases, it enhances interactive fun through “hidden edition mysticism” and “blind box strategies”, stimulating desire to buy with the unpredictability of content and the scarcity of hidden editions.

Mega Collection (RMB 1,000-10,000+): The MEGA series (e.g., 1000% SPACE MOLLY) targets high-spending collectors with an emphasis on art investment. Collaborations with institutions like the Van Gogh Museum and artists like Mika Ninagawa elevate the brand’s cultural cachet and pricing power, appealing to sophisticated buyers seeking both emotional and investment value.

Understanding core consumers and capturing emotional demand:

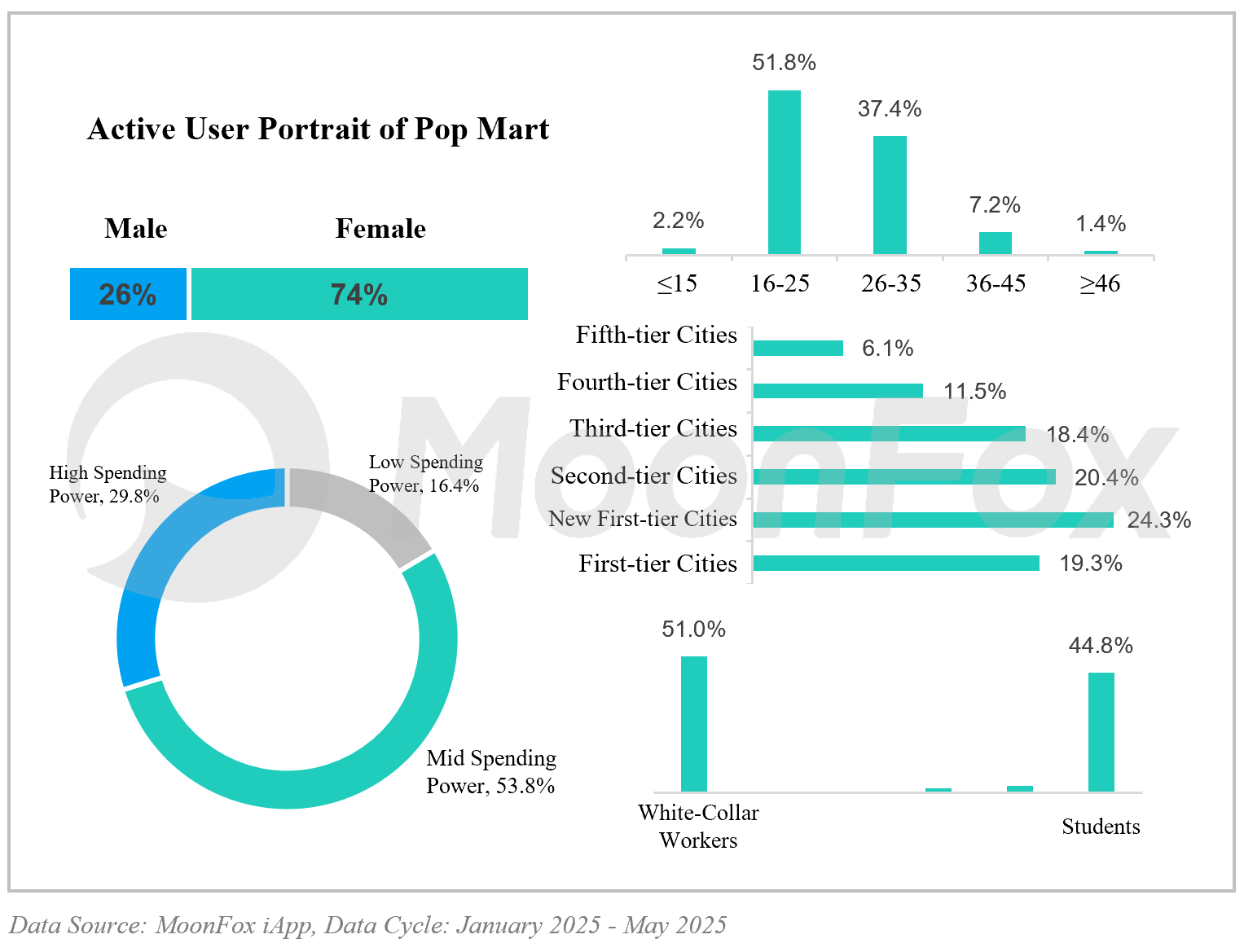

According to Pop Mart’s active user portrait, the core consumer group consists primarily of women aged 16 to 35, with Generation Z and young white-collar workers as the dominant force. These users are mainly concentrated in first- and second-tier cities with developed consumer markets. They are highly receptive to new trends, willing to pay for emotional value, possess a certain level of economic stability, and demonstrate strong purchasing intent. As both primary buyers and key nodes in social sharing, they play a central role in driving consumption and brand communication.

The rise of Pop Mart’s commercial empire lies in its deep understanding and precise grasp of the consumer psychology of its target audience. By skillfully leveraging various psychological mechanisms, Pop Mart transforms the act of purchasing pop toys into an experience rich in fun and emotional connection. The unpredictability of blind boxes offers instant gratification; IP collectibles serve as symbols of self-expression for young consumers; and the exclusivity of hidden editions fosters a sense of group identity and pride. Together, these elements cater to a wide range of emotional needs, including comfort, individuality, surprise, achievement, and social connection.

Omni-channel Reach and Precision Operations

Offline Retail Expansion and Store Functionality Upgrade

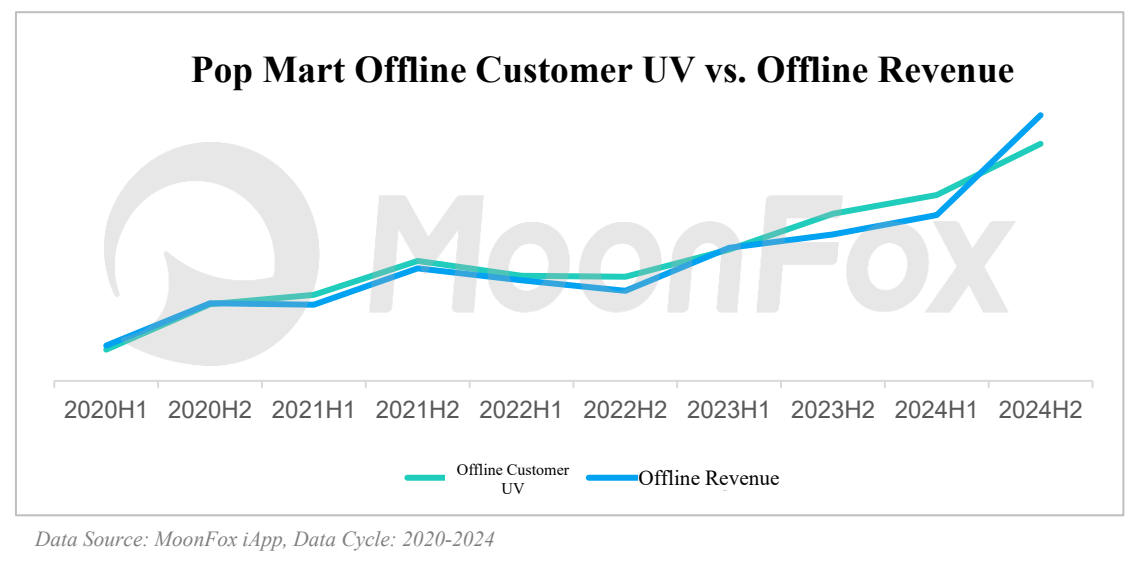

Retail Stores: By the end of 2024, Pop Mart had opened 401 stores across Mainland China, primarily located in high-traffic commercial districts. With an emphasis on immersive store design, each outlet serves not just as a point of sale but also as a powerful channel for brand storytelling and customer engagement. According to MoonFox Data, the offline customer UV index in 2024 increased by 47.7% YoY, showing a strong correlation with in-store revenue.

ROBOSHOPS: By the end of 2024, Pop Mart had deployed 2,300 ROBOSHOPS, with a net increase of 110 units during the year. These automated vending machines, with their low operating costs and flexible deployment, have accelerated enterprises’ penetration into multi-tier cities and high-frequency consumption scenarios such as commercial complexes and transportation hubs, significantly enhancing the efficiency of consumer reach.

Online Omni-channel Expansion and Development

Self-owned Platforms: Pop Mart Official Mall and Pop Mart Blind Box Machine (WeChat applet) are the company’s core proprietary online channels. The Pop Mart Blind Box Machine simulates the offline blind box experience, enhancing user engagement and purchase satisfaction, and has demonstrated strong sales growth. According to MoonFox Data, the Pop Mart Blind Box Machine’s MAU grew by 58.5% throughout 2024, with revenue increasing 52.7% YoY.

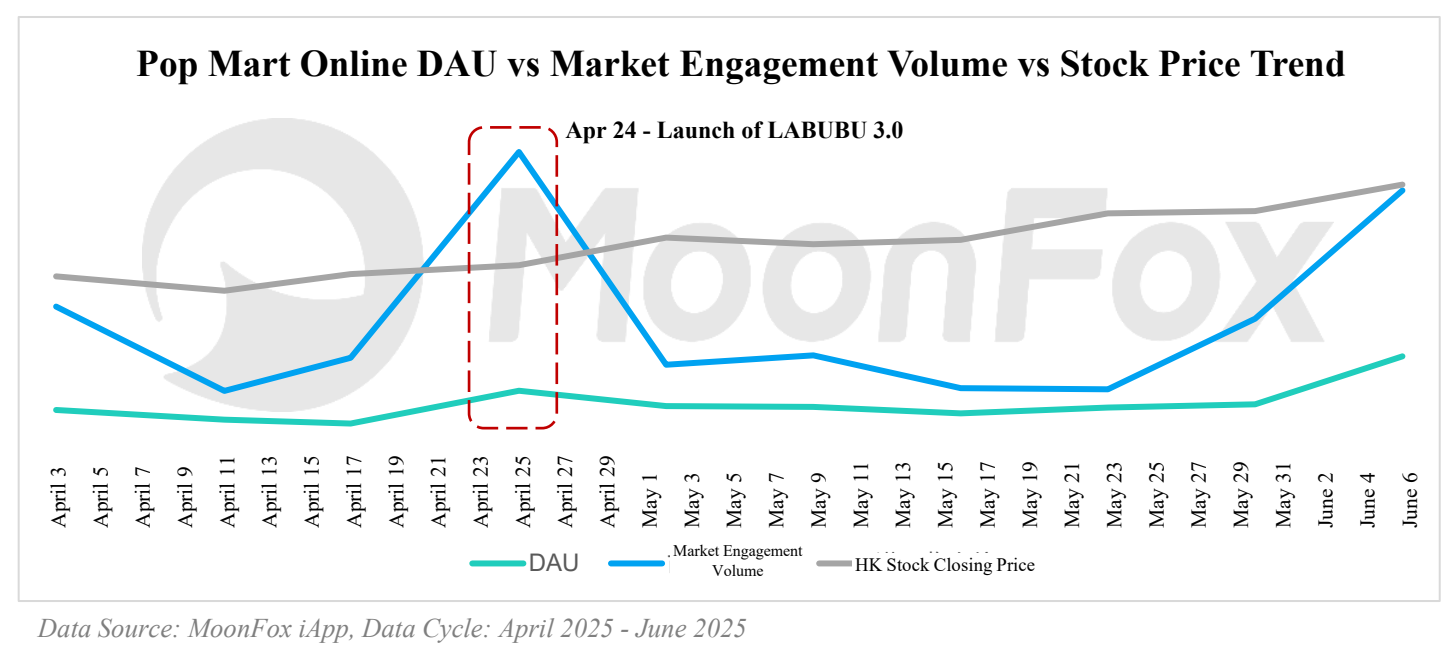

Additionally, following the online release of LABUBU 3.0 on April 24, Pop Mart saw an explosive short-term spike in market buzz and DAU, which was soon followed by a sustained upward trend in its share price, with growth momentum significantly accelerating in June.

Third-Party E-commerce Platforms: Pop Mart has established official flagship stores on mainstream e-commerce platforms such as Tmall, JD.com, and Douyin. According to its 2024 financial report, its overall revenue from online channels rose 76.9% YoY, with Douyin and Tmall seeing particularly strong growth.

Membership System Development and Value

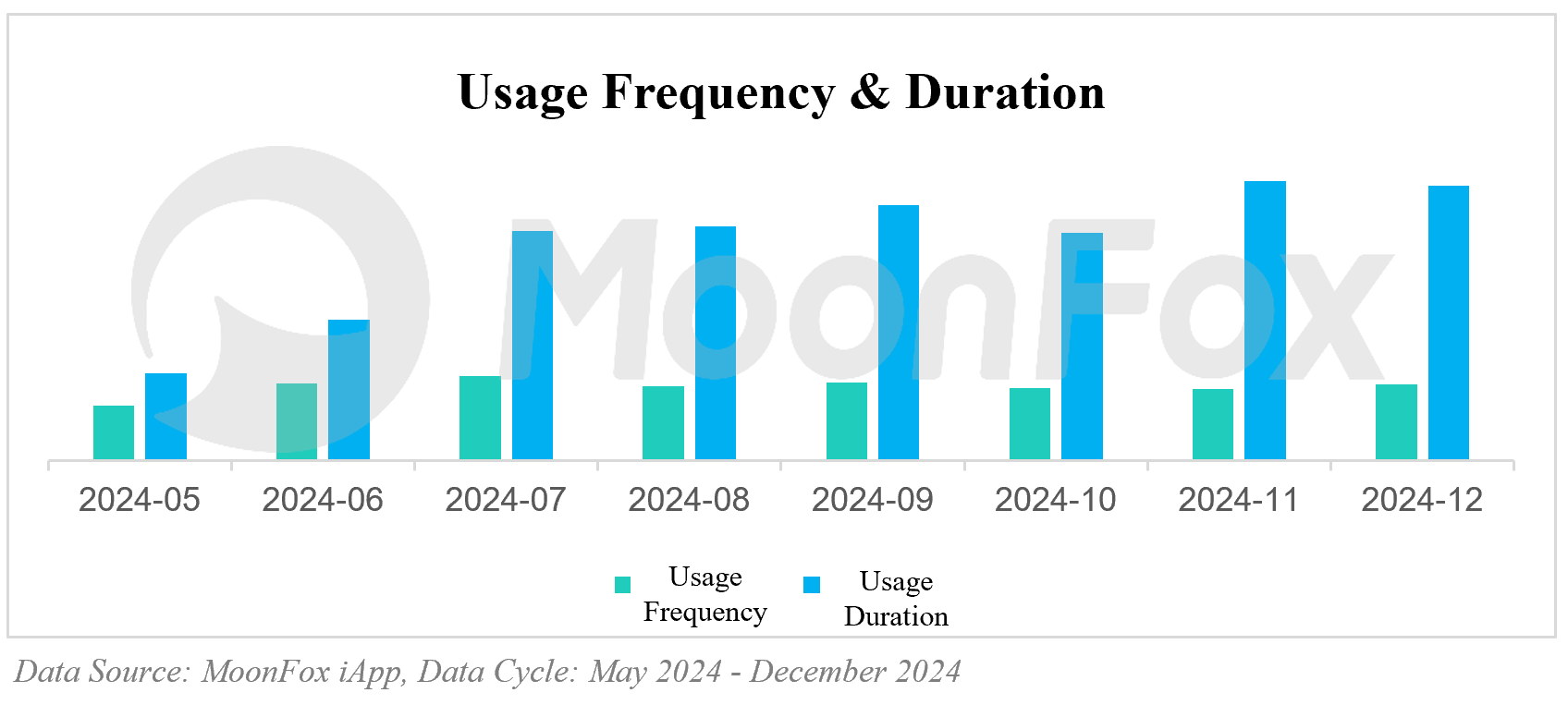

Pop Mart has built a large and highly active membership ecosystem. By implementing a tiered membership system and offering exclusive benefits such as points redemption, birthday gifts, and early access to new products, the brand has significantly boosted customer loyalty and lifetime value. According to the financial report data of 2024, the number of registered members in mainland China reached 46.083 million, with members contributing 92.7% of total sales. The repurchase rate stood at 49.4%. User behavior data from the app side also indicates growing frequency and duration of use.

Meanwhile, Pop Mart is accelerating both the diversification of its IP portfolio and its global expansion. The company is undergoing a transformative shift from a “pop toy manufacturer” to a global IP ecosystem operator. Several major international investment banks have expressed bullish views on Pop Mart. Deutsche Bank, for instance, issued a report stating that Pop Mart’s potential market size is significantly larger than previously estimated, maintaining a “Buy” rating and raising its target price from HKD 200 to HKD 303.

Looking ahead, the key challenges for Pop Mart will include sustaining the creative momentum of its IP lifecycle, addressing delayed tech integration, and restoring community trust. To maintain the emotional engagement of its 40 million users, the company must ensure that the “emotional deposit interest rate” on their emotional deposits keeps pace with “emotional inflation”. For investors, Pop Mart’s rise represents a “collective reckoning” within the investment community, an opportunity in the new consumer trends to step beyond traditional frameworks and develop a deeper understanding of consumer culture, identity, and behavioral trends behind each channel. In many ways, these qualitative insights may prove more predictive than financial report figures alone.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

For Media Inquiries:

Contact: zhouxt@jiguang.cn | Website: http://www.moonfox.cn/en

Attachment

![]()