MoonFox | Bilibili: A “Forever Young” Platform with a Long-term Vision

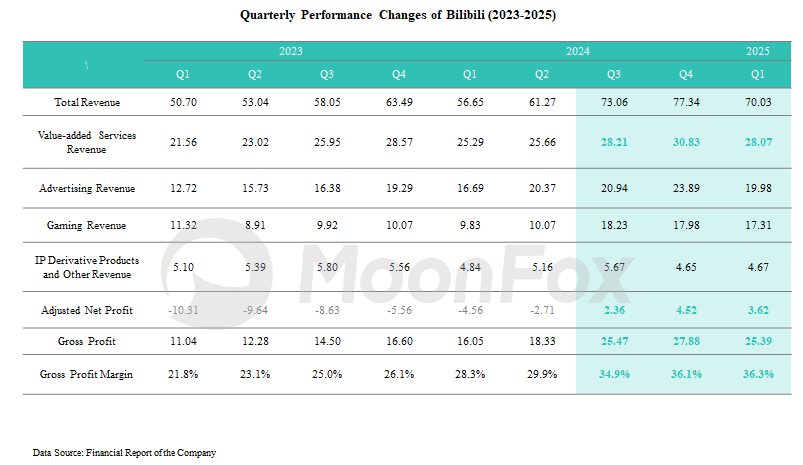

Shenzhen, June 26, 2025 (GLOBE NEWSWIRE) — Shenzhen, June 26, 2025 (GLOBE NEWSWIRE) — Since Q3 2024, Bilibili has achieved profitability for three consecutive quarters, marking an acceleration in its commercialization efforts.

Over the past few years, the explosive growth of short video has significantly disrupted traditional content production and marketing models. As a leading platform for medium-to-long video, Bilibili bore the brunt of these shifts, and its relatively slow commercialization was frequently questioned. However, it’s clear that Bilibili has consistently sought a balance between community-driven content and commercial monetization — striving to enhance its revenue capabilities while preserving its signature user experience and community atmosphere.

With the release of its Q1 2025 financial reports, Bilibili has successfully initiated a positive feedback loop between commercialization and content innovation. As the internet UV dividend reaches its ceiling, we have to re-evaluate Bilibili’s true marketing value.

I. Evolution of User Value: Still Youth-oriented, with Upgraded Consumption Vitality

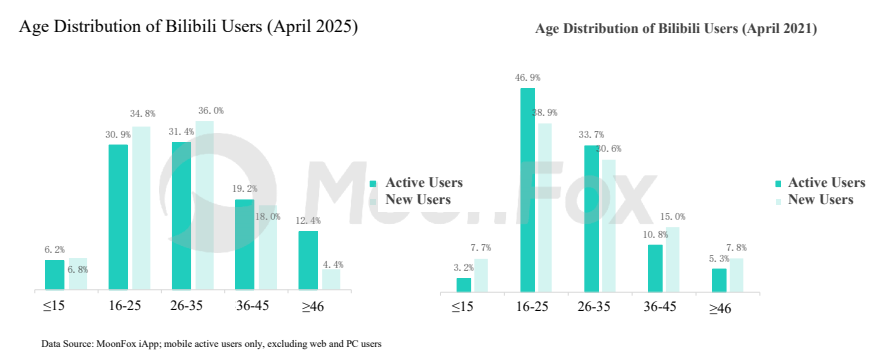

As one of China’s earliest ACG (Anime, Comics, and Games) communities, Bilibili has long attracted passionate niche enthusiasts, building a culture where users “Powered by Love”. This grassroots, interest-based social environment has continuously drawn waves of young creators. Compared to 2021 (when the average user age was 23 and users under 25 made up 50.08%), the platform’s user base has aged slightly, with an average age of 26 in 2025. However, its core user value remains clear: youthful, highly engaged, and increasingly capable of spending.

The platform’s mass-market evolution has not diluted its youth-oriented DNA. Beyond the core ACGN demographic, students and young professionals fresh out of college continue to inject new vitality into the community.

- According to MoonFox Data, as of April 2025, Bilibili’s monthly active users had an average age of 26. Among them, 62.25% were aged 16-35. Among new users added in April, 70.82% were in the 16-35 age group.

- In contrast, back in April 2021, the age structure of users was younger. According to MoonFox Data, as of April 2021, Bilibili’s monthly active users had an average age of 23. At that time, 50.08% of active users were under 25, while users over 35 made up only 16.18%, which was 15 percentage points lower than in 2025.

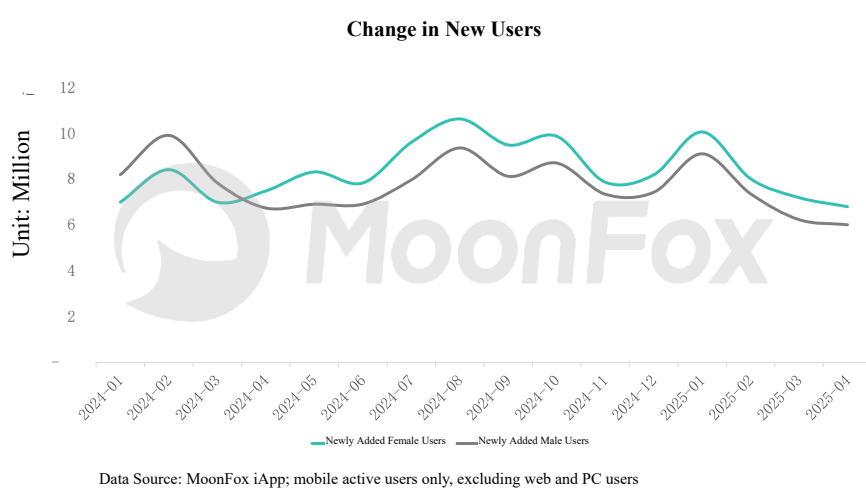

According to MoonFox Data, Bilibili is also seeing a growing presence of female users. In April 2025, women accounted for 44% of active users, increased by 1 percentage point YoY. Notably, female new users significantly outpaced male users throughout the past year. This influx has driven growth in content consumption, especially in lifestyle-related verticals, though challenges remain in sustaining long-term retention and monetization of these new cohorts.

According to the 2024 financial report, views in the maternity and parenting category content rose 76% YoY, significantly outpacing other categories. In addition, content related to home decoration, beauty & fashion, automotive, and sports & fitness also showed rapid growth.

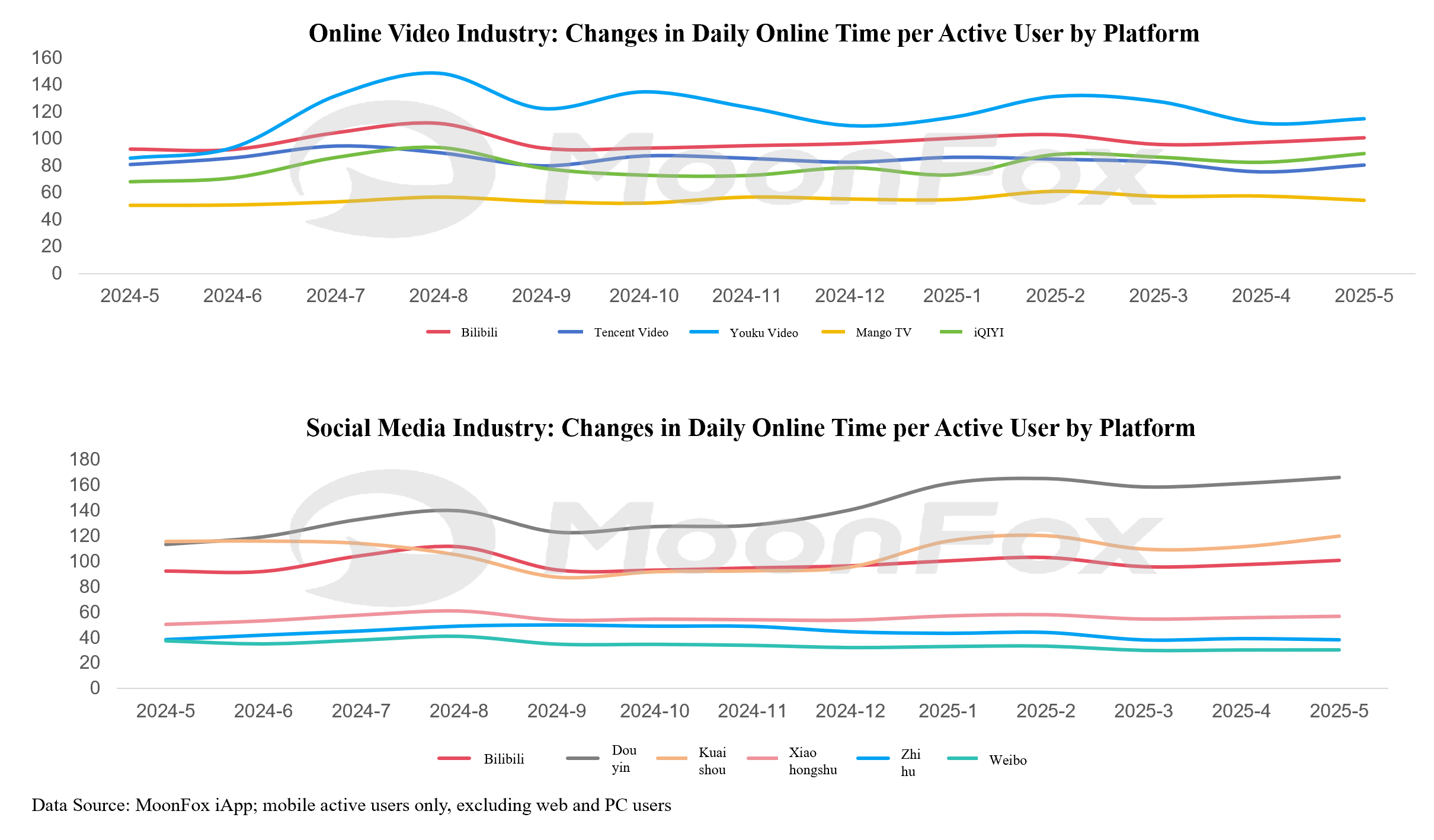

Over the past three years, both Bilibili’s monthly active users and the number of paid Premium Members have continued to rise steadily. User stickiness keeps increasing. Since Q3 2023, the platform has maintained a daily active user base of over 100 million, with average daily usage time stabilizing between 100-110 minutes.

Whether measured against long-form video platforms or mainstream social media apps, Bilibili continues to exhibit strong competitiveness in terms of user time spent. As the platform expands to reach a broader audience, its user retention and engagement have remained robust. These “high levels of stickiness” reflect Bilibili’s consistent strength in content creation and community value.

II. Evolution of Content Value: “Professional Production + Youthful Expression” as a Strategic Moat

1. Deepening OGV Strategy to Build a Robust IP Matrix

In terms of content formats and production models, leading social platforms such as Douyin, Xiaohongshu, and Bilibili all offer broad creative ecosystems. Content ranges from UGC (User-Generated Content), PUGC (Professionally User-Generated Content), PGC (Professionally Generated Content), to OGV (Occupationally Generated Video), delivered via short videos and medium-to-long videos, live streaming, images, and audio, often cross-distributed across platforms. Among these, OGV represents Bilibili’s key strategic lever for deepening content value and building platform differentiation. The continued premiumization and IP-ification of OGV not only enhances Bilibili’s brand but also creates more monetization opportunities for other content creators by expanding content categories and formats.

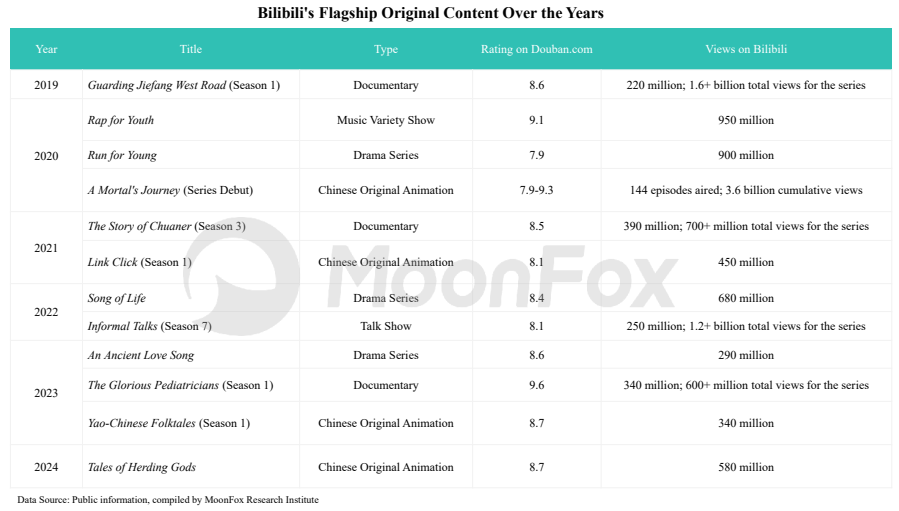

Bilibili’s OGV ecosystem now follows a clear incubation path: “Premium Content” → “Evergreen IP” → “Cross-platform Phenomenal IP”. Premium Content includes high-quality documentaries, original Chinese animation, music variety shows, and short drama series, giving rise to new breakout titles each year. “Evergreen IPs” emerge from long-tail influence and continued investment in premium content. A select few IPs break through platform boundaries, achieving phenomenal widespread social impact.

2. Unique Variety and Documentary Styles: Bilibili’s “Methodology” for Cross-demographic Breakthroughs

Bilibili’s variety and documentary programming stands out for its youth-centric storytelling and emotional resonance, achieving both critical acclaim and commercial success. A standout case is Guarding Jiefang West Road, which debuted in 2019. This documentary-variety hybrid follows real cases from a local police station on the streets of Changsha City, adopting a reality TV style to deliver legal education. In a series of hilarious and absurd real events, legal knowledge is conveyed to the audience. The series was dubbed “a hand-drawn scroll of urban life” by the Bilibili users and went viral, eventually airing on CCTV and regional television networks.

The vivid portrayal of everyday life infused with a lively local atmosphere, the integration of Changsha’s cultural and tourism elements, and the personalized expression shaped by the reality show format have not only inspired organic sharing among young audiences and prompted offline check-ins, but also created opportunities for commercial partnerships in future IP series. The exclusive title sponsorship spans a wide range of industries, including food and beverages, pharmaceuticals, insurance, and automotive. In addition, the program collaborates with professional content creators to interpret legal knowledge and analyze real-life cases, generating secondary dissemination and enabling multi-channel brand integration.

In 2023, Bilibili and Shenzhen Media Group partnered with the same production company of Guarding Jiefang West Road, TVZONE, to launch The Glorious Pediatricians, an innovative medical documentary series. The IP leveraged nearly the same commercialization playbook as Guarding Jiefang West Road, from narrative tone to brand partnerships and cross-channel distribution.

Beyond large IPs, Bilibili has also cultivated a range of niche, small-format shows that deeply explore social issues and Gen Z lifestyles, capturing mindshare within specific subcultures. These titles often go viral thanks to a content strategy combining OGV (full-length programs) + PUGC (expert content) + UGC (cross-industry uploader content). Examples include the 2024 “International Chinese Debating Competition”, the 90’s Dating Agency launched in 2021, and the upcoming 00’s Career Agency and 90’s Rental Agency in 2025.

3. Doubling Down on Original Chinese Animation to Strengthen Predictable Revenue Streams

In 2023, Bilibili’s senior leadership revealed that 67% of Bilibili’s ACG users had begun actively consuming original Chinese animation, with users watching an average of 10 series each, totaling over 700 million hours of view time and 5 billion user interactions. Bilibili’s deep understanding and sensitivity to the ACG industry forms a key moat in its original Chinese animation strategy. In turn, this strengthens user stickiness and drives monetization through membership subscriptions, advertising, derivative products, and offline events.

At the end of 2024, Bilibili announced a lineup of 43 upcoming original Chinese animations, backed by a clearer and more strategic release schedule compared to previous years. In 2025, IP sequels, female-centric IPs, and original animation have become core highlights. Among the 12 original series, several are continuations or expansions of existing hit IPs, such as Yao-Chinese Folktales 2 and Link Click: Yingdu Chapter. To Be Hero X, which launched globally in April, marks Bilibili’s first original Chinese animation released simultaneously worldwide. As of May 27, the series was still ongoing, having amassed 97.51 million views on its Mandarin dub and over 6 million views on the Japanese dub, outperforming earlier entries like To Be Hero: BABA and To Be Hero: LEAF.

In addition to originals, adaptations of popular comics and novels remain pillars of the original Chinese category. Notably, in 2025 Bilibili has moved beyond its traditional “male-oriented action drama IPs”, tapping into content that resonates with female viewers. For example, the adaptation of The Legend of Princess Chang-Ge, which premiered in February, and the upcoming animation First Frost, both reflect a shift towards more emotionally driven storytelling. This shift reflects not only the platform’s broader approach to content themes, but also a subtle response to the evolving needs driven by the growth of its female user base. However, The Legend of Princess Chang-Ge failed to meet audience expectations, receiving an average rating of 7.6, significantly lower than its fantasy-genre peers. Viewer criticism cited plot alterations and stiff 3D character modeling as major issues, indicating that female-oriented IP adaptations still pose notable creative challenges for Bilibili’s original Chinese animations.

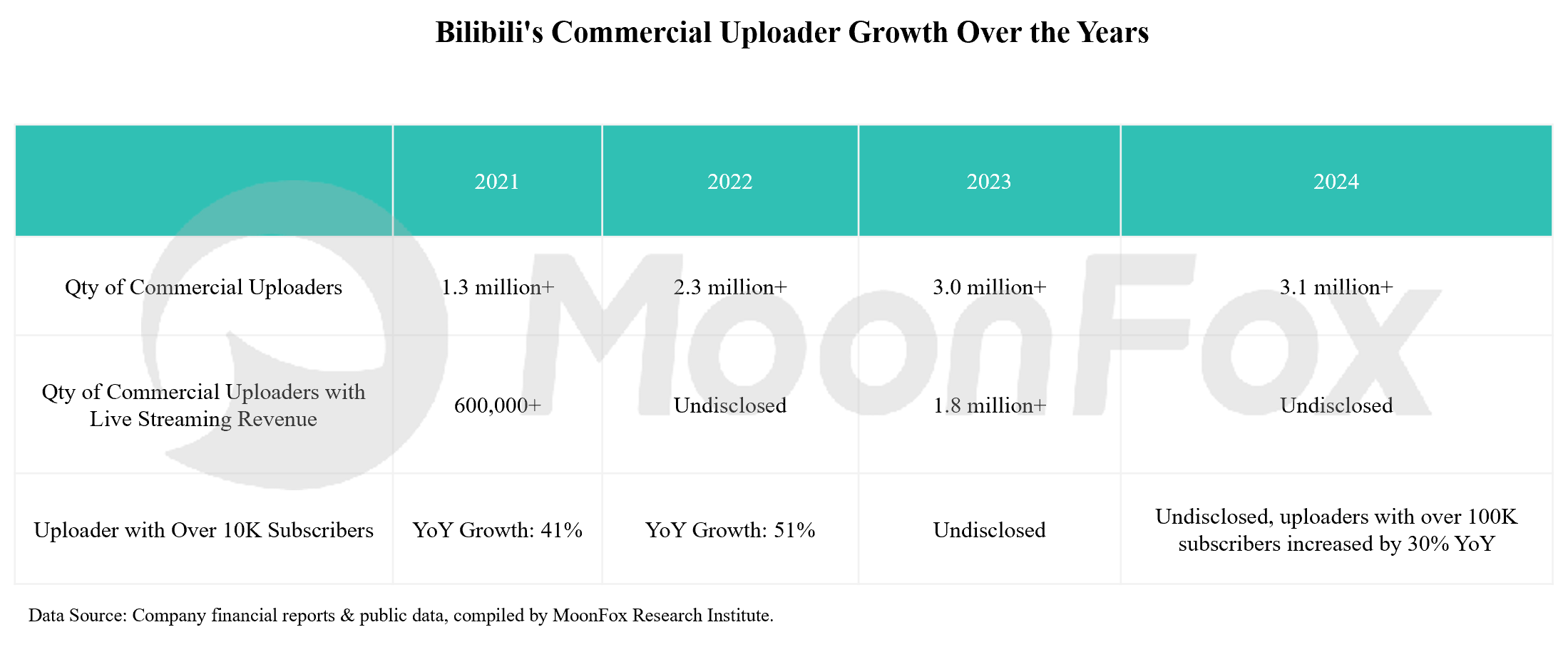

4. The Uploader Ecosystem: Connecting with Users through “Content Quality”

While Bilibili, like other platforms, employs “interest-based” content recommendations, its waterfall-style feed gives users greater control over final content selection. This increases visibility for mid- and long-tail uploaders, making content quality the core driver of user retention. This more decentralized distribution mechanism has fostered a healthy creative environment, enabling UP creators to build lasting relationships with their audience through consistent, high-quality output. According to Jiemian.com, nearly 90% of Bilibili Power Up 100 in 2024 had been publishing content for over 5 years. Over 2 million creators have been active on the Bilibili for 5+ years,

This robust creator(uploader) ecosystem fuels diversified content demand, while Bilibili’s active community feedback loop helps scale content innovation and creator growth.

As of now, Bilibili’s homepage features 36 primary content categories, and official data indicates that more than 2 million subcultural tags exist on the platform. In 2024, its daily video views averaged 4.8 billion. From the annual report data, it is evident that content in emerging sectors such as maternity & childcare, sports & wellness, travel, and AI is also growing rapidly on Bilibili.

In Q1 2025 alone, viewing time for AI-related content increased by 130%. Notable uploads include: A 10,000-Word Deep Dive: What Are AI Agents?, posted in March by @qiuzhi2046, which garnered over 440,000 views. A 2022 upload from @xiao_lin_shuo, titled How Advanced Is AI? Isn’t It Growing Too Fast?, which continues to gain traction, now surpassing 1.55 million views as of late May. These videos combine technical insights with a relaxed, humorous delivery. In addition, Q1 saw a rapid surge in paid courses on AI fundamentals, Python, and practical AI tools, reflecting strong demand. Uploaders, through youthful and accessible communication styles, help demystify complex topics. As a result, new technologies and product innovations can quickly reach and resonate with younger demographics, building early-stage trust and engagement.

III. Evolution of Marketing Value: From “UV Pool” to “Endorsement Pool”

1. “Trust Endorsement” Through Cultural Identity

By investing deeply in OGV content, Bilibili has built a rich matrix of cultural IPs, fostering a strong sense of trust and identity among users. When brands participate as title sponsors or co-creators, they are seen as part of the “Powered by Love” community. In recent years, numerous emerging consumer brands have embedded themselves into Bilibili’s ecosystem by “playing” with users, blending in naturally with youth subcultures and communities.

For example, in the automotive sector, Wuling Motors sponsored the popular interview show Wuling Auto, and collaborated with top auto uploaders to showcase product strength. Its official account, @Wuling Silver Mark, has amassed 970,000 followers. In 2024, the game Black Myth: Wukong went viral, driving fans to visit real-life filming locations. This cross-industry linkage was dubbed a “pilgrimage tour” by Bilibili users. The official account @Culture and Tourism Department of Shanxi Province launched a series of culture and tourism video campaign titled “Travel Shanxi with Wukong”, with single episodes surpassing 1.2 million views, effectively promoting local culture and landscapes in multiple aspects.

2. Long-term “Companion Marketing”

While 5G online surfing and memes thrive in Gen Z culture, Bilibili’s connection of “Youthful Expression” with young users goes beyond trend-chasing. What really sets the platform apart is its ability to deliver deep emotional value through companionship and shared growth. “Companionship and personal growth” are key themes that enable Bilibili’s content to resonate with younger audiences. The platform’s strength lies in its ability to build long-term user engagement and embed brand perception early in the consumer journey. Popular content IPs span key moments such as college entrance exams, graduation season, summer holidays, and Youth Day, offering brands concrete scenarios to expand their influence and revitalize their image.

In the consumer goods sector, Dreame, Guyu, and Laifen, among other emerging Chinese brands, have all established content matrices on Bilibili to engage young consumers. In the food &beverage industry, Uni-President Group sponsored the Bilibili Graduation Concert for three consecutive years (2022-2025), while also investing in original comedy content and foodie uploaders. These efforts gradually reshaped its brand image, increasing penetration among younger audiences.

3. “Authenticity” as a Driver of High Conversion

Bilibili’s highly participatory user base, known for their “real human” feel, raises the bar for brand marketing & endorsement, but it also creates valuable opportunities for small and mid-sized brands. Bilibili’s community atmosphere amplifies the weight of user feedback. Metrics such as the number of danmaku, video completion rate, and the “triple interaction”(likes, coins, and sharing), and favorites serve as concrete indicators of content quality. At the same time, the higher threshold for user engagement makes interactions more meaningful. Because of this high bar for interaction, Bilibili has been seen as harder for advertisers’ endorsement and slower in conversion compared to platforms like Xiaohongshu or Douyin.

However, during the 2023 “618” Shopping Festival, beauty brand PROYA achieved a live streaming ROI of 2.69, among the highest in the industry, challenging traditional perceptions. In e-commerce monetization on Bilibili platform, home & lifestyle uploader @Mr.MiDeng generated over RMB10 billion in GMV in 2023, while fashion uploader @Yingwuli achieved RMB 50 million in a single live session in 2024 and now hosts monthly live sales. A series of best-selling new product categories shows that users on Bilibili still possess strong untapped purchasing power. At the same time, when we look at the sources of these best-selling products, many “niche yet high-quality” brands have successfully generated endorsement and achieved strong conversion rates.

Whether it’s @Mr.MiDeng or @Yingwuli, their sales are driven by long-form videos or live streaming rich in industry insights and in-depth product explanations, covering everything from product colors, materials, and manufacturing processes to after-sales service and issue resolution. Compared to the brand endorsement and marketing premium brought by major labels, smaller brands with reliable quality and durable products are often more likely to gain popularity under the influence of content uploaders.

IV. Conclusion: Bilibili Is Redefining the Future of “Youth Marketing” through a Positive “Content – User – Commerce” Cycle

From a niche ACG vertical community “Powered by Love” to a profitable content platform with three consecutive profitable quarters, Bilibili has preserved its youthful DNA. Yet it has also evolved into a more inclusive space, welcoming diverse interests from female users to lifestyle enthusiasts. Its expansion into OGV content, while maintaining strong creator ecosystems, positions Bilibili as a comprehensive video platform, one that deepens premium content moats, strengthens user stickiness, and broadens commercial possibilities.

For brands, Bilibili’s value extends far beyond being a mere “UV Pool”. It serves as a cultural and emotional companion to multiple youth cohorts, and has become an irreplaceable space for both emerging and mid-tier brands looking to connect authentically with young audiences. As users cast their votes through the triple interaction, their danmaku comments also convey a strong authenticity sense toward the product. The collaboration between brands and creators feels more like an in-depth dialogue rather than a hard-sell ad driven purely by UVs.

For Bilibili, sustained profitability may only be the beginning. By leveraging content to win the hearts of young users, its business model is in turn fueling a virtuous cycle—reinvesting in the very content ecosystem that brought them there. This positive flywheel is laying a long-term foundation for the platform’s future growth.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

For Media Inquiries:

Contact: zhouxt@jiguang.cn | Website: http://www.moonfox.cn/en

Attachment

![]()