Kraken Robotics Reports Record Q3 2025 Financial Results

60% Revenue Growth, 59% Gross Margin, and 25% EBITDA Margin

ST. JOHN’S, Newfoundland and Labrador, Nov. 24, 2025 (GLOBE NEWSWIRE) — Kraken Robotics Inc. (TSX-V: PNG, OTCQB: KRKNF) (“Kraken” or the “Company”), announced it has filed its financial results for the quarter ended September 30, 2025 (“Q3 2025”). Please refer to the unaudited Condensed Consolidated Interim Financial Statements and Management’s Discussion and Analysis (“MD&A”) for quarter ended September 30, 2025, filed on www.sedarplus.ca for more information. Unless otherwise specified, all dollar amounts are denominated in Canadian dollars.

Q3 2025 Financial Highlights

- Consolidated revenue in Q3 2025 increased 60% to $31.3 million, compared to $19.6 million in the prior year. The growth was driven by record shipments of subsea batteries and synthetic aperture sonar to defense industry customers, solid organic growth in sub bottom imaging services, and the acquisition of 3D at Depth Inc. (3D at Depth) which provides subsea LiDAR services predominantly to offshore energy customers.

- Product revenue in the quarter increased 46% to $18.3 million, compared to $12.5 million in the prior year. During the quarter both our SeaPower™ subsea battery and our synthetic aperture sonar (SAS) businesses recorded a record level of shipments. As in the past, quarterly revenue can fluctuate significantly due to the timing of product orders and shipments.

- Service revenue in the quarter increased 85% to $13.0 million compared to the prior year due to growth in our sub-bottom imaging services business as well as from the acquisition of 3D at Depth and its subsea LiDAR services.

- Gross profit in the quarter increased 81% to $18.6 million, compared to $10.3 million in the prior year due to the overall growth in the business and the acquisition of 3D at Depth. Gross profit margin was 59% compared to 52% in the prior year and improved over the prior year due to revenue mix, with a higher percentage of revenue coming from higher margin products and services in the current year compared to the prior year.

- Adjusted EBITDA1 for the quarter grew 92% year-over-year to $8.0 million, compared to Adjusted EBITDA1 of $4.1 million in the comparable quarter, implying an adjusted EBITDA1 margin of 25.5% compared to 21.2% in the comparable year.

- Capital expenditures/intangible assets purchased were $6.3 million in the quarter, compared to $0.7 million in the comparable quarter. The increase is related to our new battery facility in Canada as well as growth in internal marine assets to drive service revenue growth.

- On July 7, 2025, Kraken closed a bought deal, short form prospectus offering 43.2 million common shares at $2.66 per common share for gross proceeds of $115.0 million.

- Total assets were $330.7 million on September 30, 2025, compared to $101.2 million on September 30, 2024. Cash at the end of the quarter totaled $126.6 million, compared to $14.9 million in the prior year, while working capital totaled $193.9 million, compared to $43.2 million in the prior year.

- Net income was $3.3 million compared to a net income of $1.6 million in the comparable quarter. Basic and diluted earnings per share were $0.01 as compared to $0.01 in the prior year.

- Revenue and Adjusted EBITDA guidance for 2025 remains unchanged from the guidance provided after Q2 results on August 21, 2025. In 2025, management expects revenue between $120 million and $135 million and Adjusted EBITDA between $26 million and $34 million. The guidance midpoints represent 40% revenue growth and 45% Adjusted EBITDA growth. Quarterly revenue and Adjusted EBITDA1 can fluctuate significantly due to the timing of customer orders and shipments. Capital expenditures/intangible asset guidance range is increased to $20.0 million to $21.0 million from $13.0 million to $17.0 million. The capex guidance is increasing with additional investment in our current and new subsea power manufacturing facilities as well as internal marine assets to drive service revenue growth.

________________________

1 Adjusted EBITDA is a non-IFRS financial measure, and gross margin and adjusted EBITDA margin are non-IFRS ratios, in each case with no standard meaning under IFRS, and may not be comparable to similar financial measures disclosed by other issuers. Refer to the “Non-IFRS Measures” section of this press release.

CEO Comments

Record Q3 financial results highlight continued momentum for Kraken Robotics across maritime defense and offshore energy markets. Record sales of subsea batteries and synthetic aperture sonar are from the growing adoption of uncrewed underwater vehicles (UUVs) by navies around the world, as they modernize existing fleets and add non-expensive force multipliers for naval defense and maritime security. We have completed several important customer demonstrations this year and request for proposal (RFP) activity for defense programs is accelerating. Globally, governments are modifying defense procurement to make it more agile and make greater use of commercial off the shelf (COTS) solutions. These trends are additive to the multi-year investment cycle we are seeing across our defense customer base. With additional capacity coming online in 2026 and a strengthened balance sheet we are well positioned to meet customer requirements. In offshore energy, our offshore services business offers a variety of highly specialized resources to image subsea infrastructure with high precision. With an exceptional team of scientists, engineers, and offshore operators, our dual use technologies can be deployed to customers however they want to acquire actionable intelligence – by purchasing and operating equipment, renting equipment, or having Kraken provide a service to them.

Non-IFRS Measures

The Company has included certain non-IFRS financial measures and non-IFRS ratios in this press release, including adjusted EBITDA, adjusted EBITDA margin, gross profit, gross profit margin, and working capital. Management believes that non-IFRS financial measures and non-IFRS ratios, when supplementing measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-IFRS financial measures and non-IFRS ratios do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. This data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Adjusted EBITDA and Adjusted EBITDA Margin

The Company believes that, in addition to conventional measures prepared in accordance with IFRS, adjusted EBITDA is useful to securities analysts, investors and other interested parties in evaluating operating performance by presenting the results of the Company on a basis which excludes the impact of certain non-operational items which enables the primary readers of the press release to evaluate the results of the Company such that it was operating without certain non-cash and non-recurring items. Adjusted EBITDA is calculated as earnings before interest expense, interest income, income taxes, depreciation and amortization, stock-based compensation expense and non-recurring impact transactions, if any.

| Q3 2025 | Q3 2024 | YTD 2025 | YTD 2024 | |||||||||

| Net income | $ | 3,290 | $ | 1,631 | $ | 2,806 | $ | 6,415 | ||||

| Income tax | 1,149 | (303 | ) | 1,437 | 488 | |||||||

| Financing costs | 973 | 636 | 2,655 | 1,583 | ||||||||

| Interest income | (909 | ) | – | (1,428 | ) | – | ||||||

| Foreign exchange loss (gain) | (213 | ) | 343 | 47 | 412 | |||||||

| Share-based compensation | 646 | 414 | 1,722 | 501 | ||||||||

| Gain on disposal of assets | – | (3 | ) | (3 | ) | |||||||

| Depreciation and Amortization | 2,404 | 1,430 | 6,322 | 4,228 | ||||||||

| EBITDA – excluding restructuring and transaction costs | 7,340 | 4,148 | 13,561 | 13,624 | ||||||||

| Restructuring and transaction costs | 639 | – | 1,886 | 69 | ||||||||

| Adjusted EBITDA | $ | 7,979 | $ | 4,148 | $ | 15,447 | $ | 13,693 | ||||

| Adjusted EBITDA margin | 25 | % | 21 | % | 21 | % | 22 | % | ||||

Gross profit is defined as revenue less cost of total revenue. Gross profit margin is defined as gross profit divided by total revenue.

| Q3 2025 | Q3 2024 | YTD 2025 | YTD 2024 | |||||||||

| Revenue | $ | 31,298 | $ | 19,550 | $ | 73,816 | $ | 63,183 | ||||

| Cost of sales | 12,719 | 9,293 | 30,357 | 31,973 | ||||||||

| Gross profit | $ | 18,579 | $ | 10,257 | $ | 43,459 | $ | 31,210 | ||||

| Gross profit margin | 59 | % | 52 | % | 59 | % | 49 | % | ||||

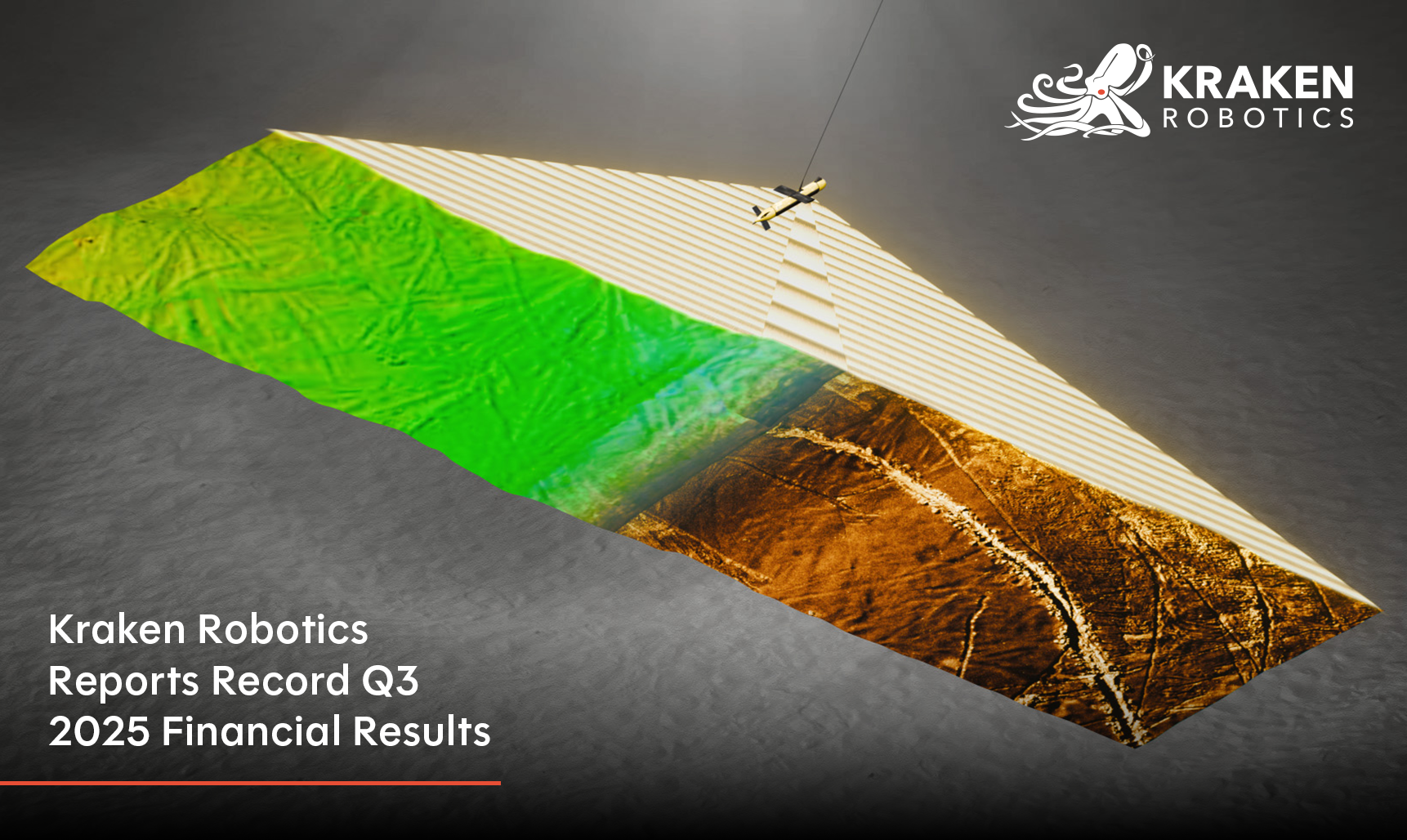

Figure 1: Kraken Robotics’ KATFISH towed synthetic aperture sonar system maps the ocean floor in high resolution for defence, offshore energy, and marine research applications.

ABOUT KRAKEN ROBOTICS INC.

Kraken Robotics Inc. (TSX.V: PNG) (OTCQB: KRKNF) is transforming subsea intelligence through 3D imaging sensors, power solutions, and robotic systems. Our products and services enable clients to overcome the challenges in our oceans – safely, efficiently, and sustainably.

Kraken’s synthetic aperture sonar, sub-bottom imaging, and LiDAR systems offer best-in-class resolution, providing critical insights into ocean safety, infrastructure, and geology. Our revolutionary pressure tolerant batteries deliver high energy density power for UUVs and subsea energy storage.

Kraken Robotics is headquartered in Canada with offices in North America, South America, and Europe, supporting clients in more than 30 countries worldwide.

LINKS:

SOCIAL MEDIA:

LinkedIn www.linkedin.com/company/krakenrobotics

Twitter www.twitter.com/krakenrobotics

Facebook www.facebook.com/krakenroboticsinc

YouTube www.youtube.com/channel/UCEMyaMQnneTeIr71HYgrT2A

Instagram www.instagram.com/krakenrobotics

FORWARD LOOKING STATEMENTS

The Company and its management believe that the statements regarding 2025 revenue and adjusted EBITDA contained in this press release are reasonable as of the date hereof, are based on management’s current views, strategies, expectations, assumptions and forecasts, and have been calculated using accounting policies that are generally consistent with the Company’s current accounting policies. These statements are considered future-oriented financial outlooks and financial information (collectively, “FOFI”) under applicable securities laws. These statements and any other FOFI included herein have been approved by management of the Company as of the date hereof. Such FOFI are provided for the purposes of presenting information about management’s current expectations and goals relating to the Company’s expected growth in its Products and Services groups. However, because this information is highly subjective and subject to numerous risks, including the risks discussed in the disclaimer for forward looking statements below, it should not be relied on as necessarily indicative of future results. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the FOFI prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although management of the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any FOFI, whether as a result of new information, future events or otherwise, except as required by securities laws.

Certain information in this news release constitutes forward-looking statements. When used in this news release, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. In particular, this news release contains forward-looking statements with respect to, among other things, business objectives, expected growth, results of operations, performance, business projects and opportunities and financial results. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such statements reflect the Company’s current views with respect to future events based on certain material factors and assumptions and are subject to certain risks and uncertainties, including without limitation, changes in market, competition, governmental or regulatory developments, general economic conditions and other factors set out in the Company’s public disclosure documents. Many factors could cause the Company’s actual results, performance or achievements to vary from those described in this news release, including without limitation those listed above. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking statements prove incorrect, actual results may vary materially from those described in this news release and such forward-looking statements included in, or incorporated by reference in this news release, should not be unduly relied upon. Such statements speak only as of the date of this news release. The Company does not intend, and does not assume any obligation, to update these forward-looking statements. The forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange Inc. nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release, and the OTCQB has neither approved nor disapproved the contents of this press release.

For further information:

Erica Hasenfus, Director of Marketing

erica.hasenfus@krakenrobotics.com

Joe MacKay, Chief Financial Officer

(416) 303-0605

jmackay@krakenrobotics.com

Greg Reid, President & CEO

(416) 818-9822

greid@krakenrobotics.com

Sean Peasgood, Investor Relations

(647) 955-1274

sean@sophiccapital.com

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/63113014-9ad5-41c5-a70a-ff4aa59e71cd

![]()