Koryx Copper Announces Further Highly Encouraging Drill Results at the Haib Copper Project, Southern Namibia

| Highlights | |||||

| • | Completed 29 drill holes out of a planned 37 holes in Phase 2 for 8,647m of diamond drilling. | ||||

| • | Many results received have higher Cu grade than average MRE over large intercepts and include: | ||||

| • | HM62: | 572m @ 0.33% Cu (0 to 572m) | |||

| incl. 68m @ 0.53% Cu (76 to 114m) | |||||

| incl. 34m @ 0.42% Cu (188 to 222m) | |||||

| incl. 110m @ 0.41% Cu (232 to 342m) | |||||

| incl. 54m @ 0.41% Cu (452 to 506m) | |||||

| • | HM51: | 112m @ 0.32% Cu (20 to 132m) | |||

| 12m @ 0.58% Cu and 0.09g/t Au (202 to 214m) | |||||

| • | HM64: | 28m @ 0.42% Cu (44 to 72m) | |||

| 26m @ 0.66% Cu and 0.05g/t Au (88 to 114m) | |||||

| 48m @ 0.46% Cu (370 to 418m) | |||||

| • | HM58: | 92m @ 0.34% Cu (48 to 140m) | |||

| • | HM66: | 12m @ 0.41% Cu (68 to 80m) | |||

| 20m @ 0.38% Cu (164 to 184m) | |||||

| • | HM67: | 30m @ 0.36% Cu (78 to 108m) | |||

| incl. 8m @ 0.54% Cu (96 to 104m) | |||||

| • | Four additional man portable rigs expected to commence drilling second half of 2025, complementing the two track mounted and two skid rigs currently turning | ||||

| • | Work is ongoing to produce updated geological model which will improve mineral resource estimation later in 2025, and will include enhancements in lithology, structure and modelling of Mo and Au by-products | ||||

| • | Met testwork, infrastructure, environmental and permitting studies proceeding as planned | ||||

VANCOUVER, British Columbia, May 26, 2025 (GLOBE NEWSWIRE) — Koryx Copper Inc. (“Koryx” or the “Company“) (TSX-V: KRY) is pleased to announce assay results from 12 drill holes (3,603m) received as part of the Phase 2 drill program for its 2025 exploration and project development strategy on the wholly-owned Haib Copper Project (“Haib” or the “Project”) in southern Namibia. Haib is an advanced-stage copper/molybdenum/gold project that is envisaged to produce a copper concentrate via a conventional crushing/milling/flotation metallurgical process, with the potential for additional copper production via heap leaching.

Heye Daun, Koryx Copper’s President and CEO commented: “We are very encouraged by the latest drill results which demonstrates that the Haib copper/molybdenum project continues to incrementally improve, albeit at a slightly slower drilling and assaying pace than we expected earlier this year. We now have a bulked-up technical team in place, with additional drill rigs expected to arrive within the next few weeks, which should improve our drilling rate from the 2nd half of the year. In parallel with the drilling, we are making very significant progress with the various met testwork components towards demonstrating the feasibility of a large-scale conventional sulfide flotation concentration flowsheet. Together with the various engineering specialists we have also made exceptional progress with the ancillary studies related to tailings deposition, site infrastructure, power and water supply, and concentrate transportation, all towards an updated technical report to be published late in 2025.”

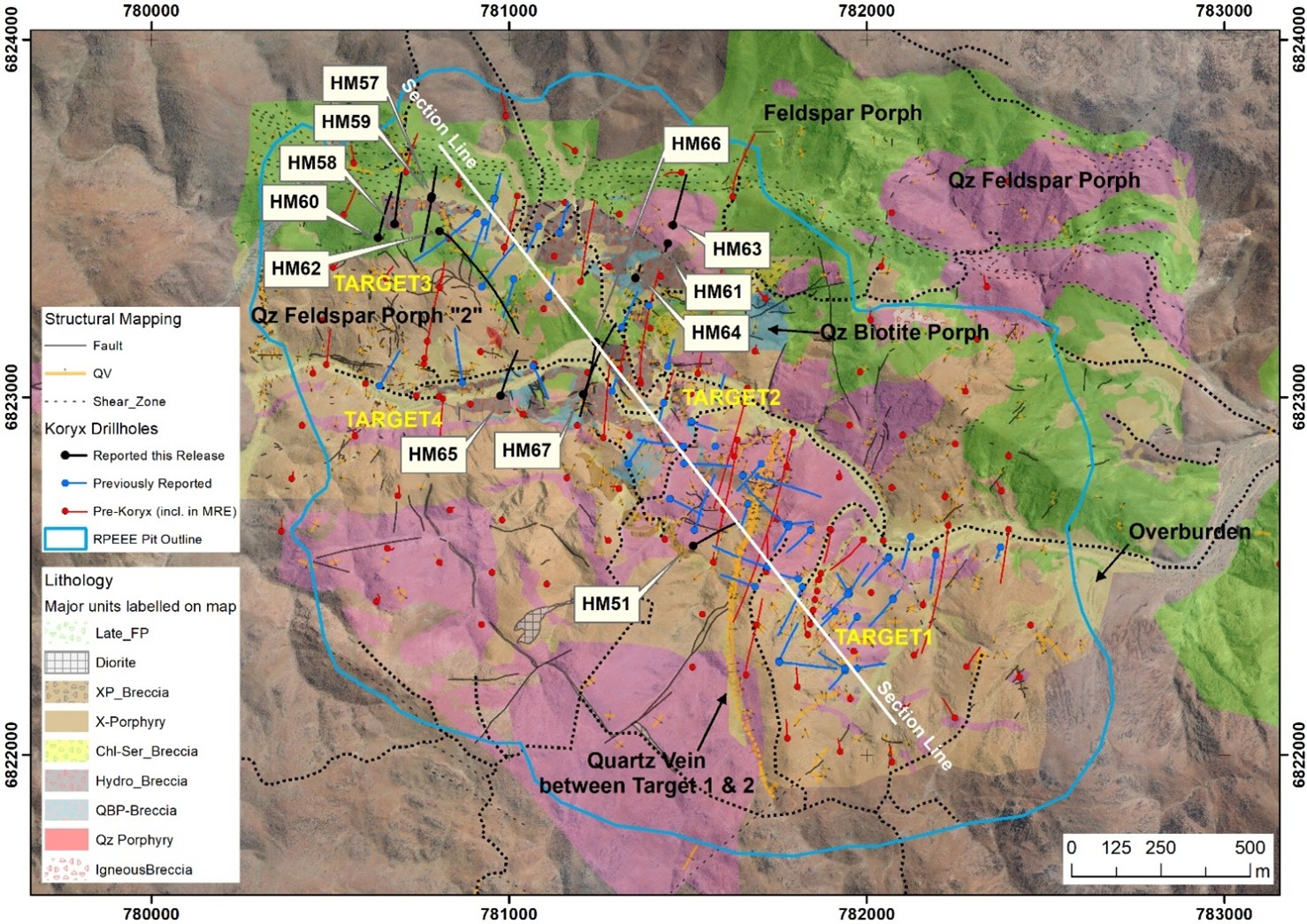

Figure 1: Plan view indicating the twelve recent drill hole locations

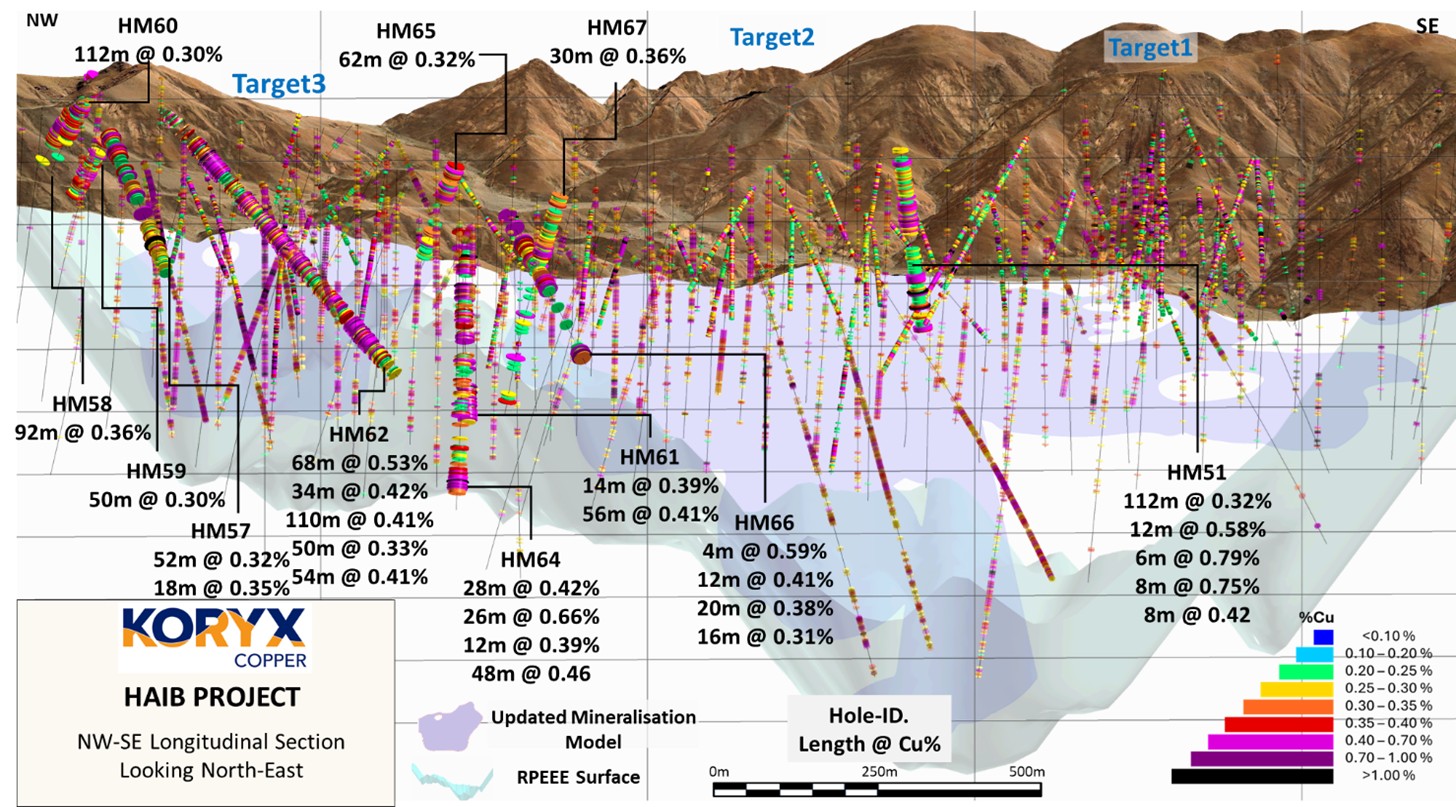

Figure 2. Long section looking northeast showing the twelve reported drill hole intersection depths relative to the model for Cu mineralization (true widths of the mineralization are unknown)

Discussion of Drill Results

Target 2 Results

HM51 was drilled to provide more detail on the contact of the shallow mineralization identified here by previous drilling. Results show the shallow mineralization is present resulting in an approximate 50m horizontal expansion of the model in this area. Mo grades are relatively high averaging >140ppm for over 92m from 202m down-the-hole demonstrating the need for a separate model for Mo mineralization within the system.

Transition Area between Target 2 and Target 4 Results

Three of the reported holes (HM65, HM66 and HM67) were drilled in the transition area between Target 2 and Target 4, two in the east and one in the west. The eastern holes correlated very well with existing results and did not produce any material changes to tonnage or Cu grade in this area. Mo grades are shown to be relatively high, maintaining >100ppm over 150m but are disassociated with Cu. In the west, higher grade Cu mineralization is shown to extend to surface over an area 40m wider than previously modelled. Mo grades are high, averaging over 180ppm for the full 200m of HM65.

Target 3 Results

Five of the reported holes were drilled in the west of Target 3 to close the sample spacing and better define the geometry of the western and northern limits of the Target 3 mineralization here. Results indicate the following:

- The major vertical shear zone that is the northern limit for Target 3 is further north here than previously modelled resulting in a tonnage and grade gain.

- The structural complexity increases near the western limit of Target 3 where the high-grade mineralization is broken into two wide sub-vertical lobes.

- HM62 was thought to have been deflected from its planned trace into and subparallel to a mineralized domain or structure. However, comparison with historical data shows it has intersected an area drilled by 4 holes that did not intersect any meaningful grade. It has therefore resulted in a tonnage and grade gain.

Transition Area between Target 3 and Target 2 Results

Three holes (HM61, HM63 and HM64) were drilled to the north of Target 2. Mineralization has been shown to be present here which aligns with an eastward projection of the Target 3 mineralization and the purpose of these holes was to test this. Results for HM61 and HM64 show high grade mineralization is present in two wide zones (~100m and 50m wide) separated by a lower grade zone. HM63 shows that the shear zone that defines the northern limit of mineralization is slightly further south than previously modelled.

Interpretation of Results

The success of the drill program is demonstrated by the continuous nature of Cu mineralization within the system. The successful drill holes being reported have either generated wide mineralized intercepts in line with our expectation for the model or have intersected Cu grades above the average grade of the existing resource model for Haib. HM63 was drilled outside the higher-grade domain between possible structures to test the eastward extension of mineralization in the north of Target 2. It did not produce any significant intersections but confirmed the existing model while improving the resolution of the eastern limit of mineralization.

The high grade Cu mineralization of Target 3 extends northwestwards with high grade Cu mineralization at or near surface. The southern limit of Target 3 also extends further southwards towards Target 4 than previously modelled. Mo is relatively well developed in Target 3, increasing with depth and uncorrelated with Cu. Target 2 mineralization extends further westwards than modelled, particularly in the intersection areas with Target 3 and Target 4.

Target 2 is the best mineralized with respect to Mo showing multiple wide high grade (>0.01%) zones that extend to surface. Two meter intercepts of Mo grades exceeding 0.1% and even >0.3% Mo are regularly intersected here.

The majority of the reported intercepts are in the shallow to middle reaches of the resource pit, with a number of the drill holes demonstrating higher grade Cu intercepts from surface. These intercepts will upgrade shallow areas of the block model and are expected to produce a slight increase in the tonnage and the grade of the overall resource.

The effects of the improved resources in the shallow areas of the block model are expected to provide opportunities for selective starter pit mining in the initial years of the mine schedule.

Drill Program and Modelling Update

The team had initially planned to drill 55,000m over the Phase 2, 3 and 4 programs up until the end of 2025 which required additional man portable rigs to be mobilized during Q2 2025, and rigs operating on double shift to achieve the meter rate required. The overall schedule has been pushed back due to the delayed delivery of 4 of the newly manufactured man portable rigs, and many of the drill sites not being suitable for safe night-time drilling because of the rugged nature of the terrain. In the current schedule the Phase 2 program is now expected to be completed by mid-year, and the Phase 3 program by the end of Q1 2026. Compared with the original drill plan, Koryx now expects to complete 28,000m by the end of 2025, with much of the drilling being completed in the second half of the year. The final Phase 4 infill drilling program to convert the entire mineral resource to Indicated category will then begin in 2026 Q2 and be completed by the end of 2026.

The key objectives of the drill programs are to firstly target higher grade areas of the system, and secondly to perform full multi-element assays to model potential byproducts, in particular Mo and finally to improve geological modelling.

The Phase 2 drill results indicate that inclined drilling on modelled structural corridors has the potential to provide continuity of improved grades, especially in the Target 2 and Target 3 areas that have been tested to date.

The improved multi-element assay coverage of the deposit is defining byproduct potential and assisting with better lithological characterization in the geological model. The wide and consistently mineralized Cu intercepts continue to return areas of Mo mineralization which are not well correlated with the Cu but occur in distinct vein sets. Additional logging and Mo assays will define a Mo-specific model.

A revised geology model is being developed that integrates lithological, geochemical and structural insights from recent drilling. Relogging of historical drill holes is ongoing to reflect the improved logging systems and ensuring consistency in the new geological model. This will improve our ability to identify and target higher-grade areas with greater precision. Drill planning will be adapted continuously as new and improved geological information becomes available. The ultimate aim of this improved geological modelling exercise is to ensure consistency, enhance geological domaining, and ultimately produce an improved geological model and mineral resource estimate for the Haib project.

Table of Significant Intersections (True Widths of the Mineralization are Unknown)

| Hole# | Zone | From (m) | To (m) | Width (m)1 | Cu (%) | Mo (%) | Au (g/t) |

| HM51 | Entire Hole | 0 | 293.2 | 293.2 | 0.29 | 0.007 | 0.026 |

| Main | 20 | 132 | 112 | 0.32 | 0.005 | 0.026 | |

| Including | 88 | 98 | 10 | 0.48 | 0.001 | 0.034 | |

| Including | 112 | 124 | 12 | 0.53 | 0.002 | 0.035 | |

| Main | 202 | 214 | 12 | 0.58 | 0.012 | 0.085 | |

| Main | 228 | 234 | 6 | 0.79 | 0.015 | 0.034 | |

| Main | 248 | 256 | 8 | 0.75 | 0.018 | 0.067 | |

| Main | 284 | 292 | 8 | 0.42 | 0.029 | 0.051 | |

| HM57 | Entire Hole | 0 | 299.3 | 299.3 | 0.20 | 0.003 | 0.019 |

| Main | 2 | 54 | 52 | 0.32 | 0.003 | 0.025 | |

| Including | 10 | 16 | 6 | 0.63 | 0.001 | 0.033 | |

| Main | 130 | 134 | 4 | 0.41 | 0.000 | 0.025 | |

| Main | 216 | 234 | 18 | 0.35 | 0.005 | 0.021 | |

| HM58 | Entire Hole | 0 | 193.5 | 193.5 | 0.24 | 0.003 | 0.014 |

| Main | 48 | 140 | 92 | 0.34 | 0.004 | 0.014 | |

| Including | 54 | 60 | 6 | 0.53 | 0.004 | 0.020 | |

| Including | 100 | 116 | 16 | 0.49 | 0.009 | 0.018 | |

| HM59 | Entire Hole | 0 | 119.1 | 119.1 | 0.24 | 0.002 | 0.013 |

| Main | 46 | 96 | 50 | 0.30 | 0.003 | 0.014 | |

| Including | 60 | 68 | 8 | 0.43 | 0.005 | 0.020 | |

| HM60 | Entire Hole | 0 | 182.8 | 182.8 | 0.23 | 0.002 | 0.014 |

| Main | 0 | 112 | 112 | 0.30 | 0.003 | 0.017 | |

| Including | 64 | 68 | 4 | 0.68 | 0.005 | 0.024 | |

| HM61 | Entire Hole | 0 | 341.7 | 341.7 | 0.20 | 0.003 | 0.015 |

| Main | 178 | 184 | 6 | 0.37 | 0.002 | 0.022 | |

| Main | 194 | 208 | 14 | 0.39 | 0.002 | 0.026 | |

| Main | 240 | 244 | 4 | 0.41 | 0.003 | 0.023 | |

| Main | 280 | 336 | 56 | 0.41 | 0.006 | 0.025 | |

| HM62 | Entire Hole | 0 | 572.0 | 572.0 | 0.33 | 0.009 | 0.019 |

| Main | 16 | 20 | 4 | 0.43 | 0.001 | 0.027 | |

| Main | 28 | 32 | 4 | 0.43 | 0.001 | 0.033 | |

| Main | 76 | 144 | 68 | 0.53 | 0.006 | 0.028 | |

| Including | 102 | 108 | 6 | 0.97 | 0.003 | 0.043 | |

| Including | 110 | 122 | 12 | 0.67 | 0.006 | 0.034 | |

| Including | 124 | 136 | 12 | 0.69 | 0.005 | 0.036 | |

| Including | 138 | 142 | 4 | 0.66 | 0.043 | 0.030 | |

| Main | 188 | 222 | 34 | 0.42 | 0.021 | 0.022 | |

| Including | 190 | 194 | 4 | 0.74 | 0.028 | 0.033 | |

| Main | 232 | 342 | 110 | 0.41 | 0.008 | 0.021 | |

| Including | 252 | 256 | 4 | 0.66 | 0.019 | 0.029 | |

| Including | 280 | 292 | 12 | 0.63 | 0.002 | 0.034 | |

| Including | 300 | 306 | 6 | 0.57 | 0.004 | 0.022 | |

| Including | 328 | 334 | 6 | 0.67 | 0.006 | 0.023 | |

| Main | 378 | 428 | 50 | 0.33 | 0.017 | 0.020 | |

| Including | 408 | 414 | 6 | 0.48 | 0.066 | 0.031 | |

| Main | 452 | 506 | 54 | 0.41 | 0.006 | 0.025 | |

| Including | 464 | 470 | 6 | 0.60 | 0.005 | 0.044 | |

| Including | 490 | 494 | 4 | 0.70 | 0.004 | 0.035 | |

| Including | 498 | 506 | 8 | 0.50 | 0.005 | 0.033 | |

| HM63 | Entire Hole | 0 | 227.2 | 227.2 | 0.06 | 0.011 | 0.008 |

| HM64 | Entire Hole | 0 | 443.9 | 443.9 | 0.24 | 0.009 | 0.014 |

| Main | 44 | 72 | 28 | 0.42 | 0.003 | 0.028 | |

| Including | 44 | 46 | 2 | 1.08 | 0.004 | 0.042 | |

| Including | 58 | 62 | 4 | 0.59 | 0.002 | 0.054 | |

| Including | 68 | 72 | 4 | 0.57 | 0.009 | 0.038 | |

| Main | 88 | 114 | 26 | 0.66 | 0.013 | 0.045 | |

| Including | 90 | 96 | 6 | 0.81 | 0.006 | 0.058 | |

| Including | 98 | 104 | 6 | 0.90 | 0.019 | 0.058 | |

| Including | 108 | 112 | 4 | 0.85 | 0.029 | 0.059 | |

| Main | 134 | 146 | 12 | 0.39 | 0.016 | 0.014 | |

| Main | 202 | 216 | 14 | 0.31 | 0.080 | 0.017 | |

| Main | 290 | 296 | 6 | 0.38 | 0.025 | 0.023 | |

| Main | 370 | 418 | 48 | 0.46 | 0.021 | 0.026 | |

| Including | 390 | 394 | 4 | 0.67 | 0.028 | 0.036 | |

| Including | 398 | 412 | 14 | 0.78 | 0.014 | 0.046 | |

| HM65 | Entire Hole | 0 | 200.4 | 200.4 | 0.20 | 0.018 | 0.009 |

| Main | 22 | 84 | 62 | 0.32 | 0.016 | 0.013 | |

| Including | 72 | 78 | 6 | 0.55 | 0.007 | 0.018 | |

| HM66 | Entire Hole | 0 | 359.3 | 359.3 | 0.15 | 0.009 | 0.000 |

| Main | 36 | 40 | 4 | 0.59 | 0.000 | 0.000 | |

| Main | 68 | 80 | 12 | 0.41 | 0.013 | 0.000 | |

| Main | 164 | 184 | 20 | 0.38 | 0.015 | 0.000 | |

| Main | 328 | 344 | 16 | 0.31 | 0.001 | 0.000 | |

| HM67 | Entire Hole | 0 | 372.1 | 372.1 | 0.16 | 0.014 | 0.014 |

| Main | 40 | 48 | 8 | 0.31 | 0.024 | 0.009 | |

| Main | 78 | 108 | 30 | 0.36 | 0.026 | 0.055 | |

| Including | 96 | 104 | 8 | 0.54 | 0.004 | 0.168 |

| 1. | Widths are interval widths and not true widths. True widths of the mineralization are unknown. The reported intervals are calculated using the following parameters: | ||

| a. | Only Cu(%) was used to determine the intervals | ||

| b. | The target composite grade is ≥0.30% Cu. | ||

| c. | Composites start and end with samples ≥0.30% Cu. | ||

| d. | Grades between 0.20% and 0.30% are included in interval but generally constitute <40% of the interval. | ||

| e. | Consecutive samples between 0.20% and 0.30% should be fewer than 5 samples (10m). | ||

| f. | Grades below 0.20% are included but generally constitute <20% of the interval. | ||

| g. | Consecutive grades <0.2% should be fewer than 2 samples (4m). | ||

Quality Control

All drill core was logged, photographed, and cut in half with a diamond saw. Half of the core was bagged and sent to ALS Laboratories Ltd. in Johannesburg, South Africa for analysis (SANAS Accredited Testing Laboratory, No. T0387), while the other half was quartered with one quarter archived and stored on site for verification and reference purposes while the other quarter will be used for metallurgical test work. 33 elements are analyzed by Induced Coupled Plasma (ICP) utilizing a 4-acid digestion and gold is assayed for using a 30g fire assay method. Duplicate samples, blanks, and certified standards are included with every batch and are actively used to ensure proper quality assurance and quality control (“QA/QC”) The QA/QC frequency is 1 in 20 for each of blanks, duplicates and standards.

Qualified Person

Mr. Dean Richards Pr.Sci.Nat., MGSSA – BSc. (Hons) Geology is the Qualified Person for the Haib Copper Project and has reviewed and approved the scientific and technical information in this news release and is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No. 400190/08).Mr. Richards is independent of the Company and its mineral properties and is a Qualified Person for the purposes of National Instrument 43-101.

AGM Results

The Company is pleased to confirm that all items of business presented to the Company’s shareholders pursuant to the Company’s management information circular dated April 7, 2025 (the “Circular“) at its Annual General & Special Meeting (the “Meeting“) held on May 22, 2025 were duly approved by shareholder resolutions passed at the Meeting.

Pursuant to the Meeting, Heye Daun, Alan Friedman, Alfredo Luis Riviere and Charles Loots were re-elected as directors; MNP LLP was appointed as auditors of the Company; and the Company’s amended and restated omnibus securities based plan (the “Plan“, as described in the Circular) was approved, including disinterest shareholders approval of the grant of 2,750,000 restricted share units under the Plan.

About Koryx Copper Inc.

Koryx Copper Inc. is a Canadian copper development Company focused on advancing the 100% owned Haib Copper Project in Namibia whilst also building a portfolio of copper exploration licenses in Zambia. Haib is a large, advanced (PEA-stage) copper/molybdenum porphyry deposit in southern Namibia with a long history of exploration and project development by multiple operators. More than 80,000m of drilling has been conducted at Haib since the 1970’s with significant exploration programs led by companies including Falconbridge (1964), Rio Tinto (1975) and Teck (2014). Extensive metallurgical testing and various technical studies have also been completed at Haib to date.

Additional studies are underway aiming to demonstrate Haib as a future long-life, low-cost, low-risk open pit, sulphide flotation copper project with the potential for additional copper production from heap leaching. Haib has a current mineral resource of 414Mt @ 0.35% Cu for 1,459Mt of contained copper in the Indicated category and 345Mt @ 0.33% Cu for 1136Mt of contained copper in the Inferred category (0.25% Cu cut-off).

Mineralization at Haib is typical of a porphyry copper deposit and it is one of only a few examples of a Paleoproterozoic porphyry copper deposit in the world and one of only two in southern Africa (both in Namibia). Due to its age, the deposit has been subjected to multiple metamorphic and deformation events but still retains many of the classic mineralization and alteration features typical of these deposits. The mineralization is dominantly chalcopyrite with minor bornite and chalcocite present and only minor secondary copper minerals at surface due to the arid environment.

Further details of the Haib Copper Project are available in the corresponding technical report titled, “NI 43-101 Technical Report – August 2024 Mineral Resource Estimate for the Haib Copper Project, Namibia” dated effective August 31, 2024 (the “Technical Report“). The Technical Report and other information is available on the Company’s website at https://koryxcopper.com and under the Company’s profile on SEDAR+ at www.sedarplus.ca.

ON BEHALF OF THE BOARD OF DIRECTORS

“Heye Daun”

President, CEO and Director

Additional information is also available by contacting the Company:

Julia Becker

Corporate Communications

jbecker@koryxcopper.com

+1-604-785-0850

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the use of proceeds from the Company’s recently completed financings and the future or prospects of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect “, “is expected “, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results, performance, or achievements to be materially different from those expressed or implied by forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, other factors may cause results not to be as anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Other factors which could materially affect such forward-looking information are described in the risk factors in the Company’s most recent annual management discussion and analysis. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4291431b-bbb8-4d98-a843-4ce0931d4c94

https://www.globenewswire.com/NewsRoom/AttachmentNg/902736a3-40a5-4f13-b6f3-b20553a86373

![]()