Galaxy Entertainment Group Q2 & Interim Results 2025

Leading Macau’s Non-Gaming Diversification Through MICE, Entertainment And Sporting Events

Q2 2025 Group Adjusted EBITDA of $3.6 Billion, Up 12% Year-on-Year & Up 8% Quarter-on-Quarter

Announced Interim Dividend of $0.70 Per Share

Capella at Galaxy Macau Exclusive Private Preview Well Received by Its High Value Customers

HONG KONG, Aug. 12, 2025 (GLOBE NEWSWIRE) — Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three-month and six-month periods ended 30 June 2025. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

Mr. Francis Lui, Chairman of GEG said:

“Today I am pleased to report solid performance for the Macau market and GEG in Q2 and the first half of 2025. Despite global tariff disruptions, continued economic slowdown and regional competition, Macau remained resilient in Q2 2025 with Gross Gaming Revenue (‘GGR’) growing 8% year-on-year and 6% quarter-on-quarter to $59.3 billion. GEG delivered solid results and growth in market share under competitive market conditions. We managed to drive every segment of the business, particularly the premium mass.

For the first half of 2025, the Group reported Net Revenue of $23.2 billion, up 8% year-on-year. Adjusted EBITDA was $6.9 billion, up 14% year-on-year. For Q2, the Group’s Net Revenue was $12.0 billion, up 10% year-on-year and up 8% quarter-on-quarter. Adjusted EBITDA was $3.6 billion, up 12% year-on-year and up 8% quarter-on-quarter. The ultra-luxury Capella at Galaxy Macau, our latest addition to GEG’s hotel portfolio, offered exclusive previews in May and contributed to our strong performance over the Golden Week. In June we hosted K-pop star G-Dragon and Hong Kong acclaimed singer Jacky Cheung at our Galaxy Arena, which led to a record high number of a single-day visitation of over 123,000 to Galaxy Macau™.

The Group’s balance sheet remains healthy and liquid, with cash and liquid investments of $30.7 billion as of 30 June 2025 with minimal debt. This financial strength allows us to fund our development pipeline, explore overseas opportunities and return capital to shareholders via dividends. The previously announced final dividend of $0.50 per share was paid in June and today the Board announced an interim dividend of $0.70 per share, payable in October 2025. This again demonstrates our confidence in the medium to longer term outlook for Macau in general and GEG specifically.

We continue to compete through our exceptional products and service and ongoing property enhancements, including our retail, food & beverage, multiple hotels and the Grand Resort Deck. More importantly, we continue to leverage the competitive edge of our MICE facilities and Galaxy Arena. Over the past two years it was proven that entertainment shows and events played a key role in driving new and repeat customers to Macau. During the first half of 2025, we have held a total of approximately 190 entertainment, sports and MICE events, and experienced a 65% year-on-year increase in the foot traffic at Galaxy Macau™.

In Q2, we hosted multiple mega entertainment events such as in April the ITTF World Cup Macao 2025, one of the world’s most prestigious table tennis events. In May we hosted the Wakin Chau World Tour and K-pop star BTS’s j-hope. In June we had K-pop group BIGBANG’s G-Dragon and the acclaimed Hong Kong singer Jacky Cheung’s concerts, all experienced overwhelming customer demand. Post Q2 in July we hosted one of America’s hottest comedy stars Jimmy O. Yang’s first live performance in Macau, and in August we hosted ‘King of Asian Pop’ Eason Chan’s Concert. These entertainment events contributed significantly to our business. In November we will support the National Games and host its Table Tennis Competition in Galaxy Arena. We remain optimistic about mega events tourism in the second half of the year.

We previously advised that we had completed the full rollout of smart tables. We are now commencing to experience the benefits of this technology and are leveraging the knowledge gained from the data to provide a better customer experience.

In June, GEG announced that the Waldo Casino will cease operation by the end of this year due to commercial considerations. GEG’s employees working at the Waldo Casino will be reallocated to its other properties and casinos. Related departments will discuss the best options with the team members and provide them with a series of vocational training programs to assist them in adapting to their new working environment. GEG would like to thank the Macau residents, patrons and the community for their support to the Waldo Casino over the years.

GEG recently won two prestigious awards at the Global Gaming Awards Asia-Pacific 2025, including the ‘Integrated Resort of the Year’ for Galaxy Macau™ and the ‘Casino Operator of the Year’ for the Group for the second consecutive year. Additionally, in The MICHELIN Guide Hong Kong Macau 2025 List, four of our restaurants collectively earned five MICHELIN stars. In the Forbes Travel Guide 2025 List, Galaxy Macau™ proved its unrivalled position as an integrated resort with the most Five-Star hotels under one roof of any luxury resort company worldwide for the third consecutive year. These recognitions from the international community are testaments to GEG’s outstanding achievements in promoting the sustainable development of integrated tourism, leisure and the gaming industry.

Recently the all-suite Capella at Galaxy Macau offered exclusive previews in May to our most distinguished VIPs, offering stays by invitation only and we expect its full opening in the coming months. The exclusive preview of Capella at Galaxy Macau has been well received by the market and has been helping us to attract ultra-high value customers.

On the development front we are progressing well with the construction of Phase 4. Construction of the Super Structure and the external facade has been completed and we are progressing to the next stage of development which is fitting out the building. We have entered into a new contract for the internal fitting out works of the approximately 600,000 sqm Phase 4 development which includes multiple high-end hotel brands that are new to Macau, together with an approximately 5,000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is targeted to complete in 2027. We also continue to evaluate development opportunities in the Greater Bay Area and overseas markets on a case-by-case basis, including Thailand.

After examining the economic situation and the actual operations of the gaming industry, the Macau Government announced in June that it has lowered its GGR estimate for 2025 from MOP240 billion to MOP228 billion. We acknowledge that there are shorter term challenges including the slowing global economy and potential tariffs impact, however we remain confident in the medium to longer term outlook for Macau. As always, GEG remains fully committed to making a positive contribution to the Macau’s leisure and tourism industry.

Finally, I would like to thank all our team members who deliver ‘World Class, Asian Heart’ service each and every day and contribute to the success of the Group.”

| Q2 & INTERIM 2025 RESULTS HIGHLIGHTS GEG: Well Positioned for Future Growth

Galaxy Macau™: Primary Driver to Group Earnings

StarWorld Macau: Continuing with Major Property Upgrades

Broadway Macau™, City Clubs and Construction Materials Division (“CMD”)

Balance Sheet: Remained Healthy and Liquid

Development Update: Capella at Galaxy Macau offered exclusive private previews in May; Continue ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau; Progressing with Phase 4

|

Macau Market Overview

Based on DICJ reporting, Macau’s GGR for the first half of 2025 was up 4% year-on-year to $115.3 billion. Q2 2025 GGR was up 8% year-on-year and up 6% quarter-on-quarter to $59.3 billion, representing 83% of 2019 level.

In the first half of 2025, visitor arrivals to Macau were 19.2 million, up 15% year-on-year, of which overnight visitors and same-day visitors grew by 3% and 26% year-on-year respectively. Mainland visitor arrivals were 13.8 million, up 19% year-on-year. Among the Mainland visitors, 867,492 travelled under the “one trip per week measure”, 241,257 under the “multiple-entry measure” and 72,149 under the “tourist group multi-entry measure”. Visitors from the nine Pearl River Delta cities in the Greater Bay Area rose by 26% year-on-year to 7 million, driven by an upsurge of 57% in the number of visitors from Zhuhai. International visitors totaled 1.3 million, up 15% year-on-year. GEG has continued to work with Macao Government Tourism Office (“MGTO”) to actively promote Macau as a tourism destination. We have marketing offices in Tokyo, Seoul and Bangkok.

Group Financial Results

1H 2025

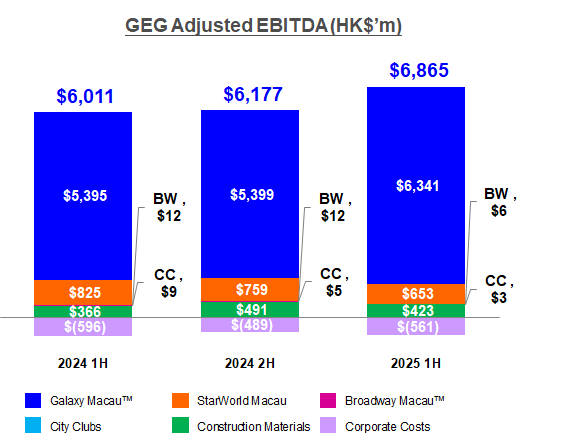

In 1H 2025, Group Net Revenue was $23.2 billion, up 8% year-on-year. Adjusted EBITDA was $6.9 billion, up 14% year-on-year. NPAS was $5.2 billion, up 19% year-on-year. Galaxy Macau™’s Adjusted EBITDA was $6.3 billion, up 18% year-on-year. StarWorld Macau’s Adjusted EBITDA was $653 million, down 21% year-on-year. Broadway Macau™’s Adjusted EBITDA was $6 million, versus $12 million in 1H 2024.

In 1H 2025, GEG experienced good luck in its gaming operation, which increased its Adjusted EBITDA by approximately $737 million. Normalized 1H 2025 Adjusted EBITDA was $6.1 billion, up 3% year-on-year.

The Group’s total GGR in 1H 2025 was $22.9 billion, up 15% year-on-year. Mass GGR was $17.0 billion, up 6% year-on-year. VIP GGR was $4.4 billion, up 63% year-on-year. Electronic GGR was $1.5 billion, up 20% year-on-year.

| Group Key Financial Data | ||

| (HK$’m) | 1H 2024 | 1H 2025 |

| Revenues: | ||

| Net Gaming | 16,776 | 18,578 |

| Non-gaming | 3,089 | 3,165 |

| Construction Materials | 1,605 | 1,503 |

| Total Net Revenue | 21,470 | 23,246 |

| Adjusted EBITDA | 6,011 | 6,865 |

| Gaming Statistics1 | ||

| (HK$’m) | 1H 2024 | 1H 2025 |

| Rolling Chip Volume2 | 84,612 | 102,139 |

| Win Rate % | 3.2% | 4.3% |

| Win | 2,690 | 4,391 |

| Mass Table Drop3 | 63,841 | 67,266 |

| Win Rate % | 25.1% | 25.3% |

| Win | 16,019 | 17,041 |

| Electronic Gaming Volume | 41,413 | 54,171 |

| Win Rate % | 3.0% | 2.8% |

| Win | 1,258 | 1,514 |

| Total GGR Win4 | 19,967 | 22,946 |

Q2 2025

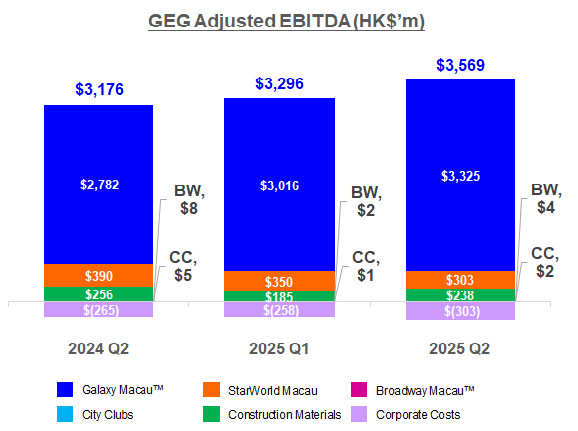

In Q2 2025, Group Net Revenue was $12.0 billion, up 10% year-on-year and up 8% quarter-on-quarter. Adjusted EBITDA was $3.6 billion, up 12% year-on-year and up 8% quarter-on-quarter. Galaxy Macau™’s Adjusted EBITDA was $3.3 billion, up 20% year-on-year and up 10% quarter-on-quarter. StarWorld Macau’s Adjusted EBITDA was $303 million, down 22% year-on-year and down 13% quarter-on-quarter. Broadway Macau™’s Adjusted EBITDA was $4 million, versus $8 million in Q2 2024 and $2 million in Q1 2025.

Latest twelve months Group Adjusted EBITDA was $13.0 billion, up 13% year-on-year and up 3% quarter-on-quarter.

In Q2 2025, GEG experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $407 million. Normalized Q2 2025 Adjusted EBITDA was $3.2 billion, down 1% year-on-year and up 7% quarter-on-quarter.

Summary Table of GEG Q2 & 1H 2025 Adjusted EBITDA and Adjustments:

| in HK$’m | Q2 2024 | Q1 2025 | Q2 2025 | YoY | QoQ | 1H 2024 | 1H 2025 | |

| Adjusted EBITDA | 3,176 | 3,296 | 3,569 | 12% | 8% | 6,011 | 6,865 | |

| Luck5 | (20) | 330 | 407 | – | – | 43 | 737 | |

| Normalized Adjusted EBITDA | 3,196 | 2,966 | 3,162 | (1)% | 7% | 5,968 | 6,128 |

The Group’s total GGR in Q2 2025 was $12.0 billion, up 16% year-on-year and up 10% quarter-on-quarter. Mass GGR was $8.8 billion, up 6% year-on-year and up 7% quarter-on-quarter. VIP GGR was $2.4 billion, up 73% year-on-year and up 22% quarter-on-quarter. Electronic GGR was $785 million, up 19% year-on-year and up 8% quarter-on-quarter.

| Group Key Financial Data | |||||||||||||||||

| (HK$’m) | |||||||||||||||||

| Q2 2024 | Q1 2025 | Q2 2025 | 1H 2024 | 1H 2025 | |||||||||||||

| Revenues: | |||||||||||||||||

| Net Gaming | 8,595 | 8,922 | 9,656 | 16,776 | 18,578 | ||||||||||||

| Non-gaming | 1,483 | 1,557 | 1,608 | 3,089 | 3,165 | ||||||||||||

| Construction Materials | 840 | 723 | 780 | 1,605 | 1,503 | ||||||||||||

| Total Net Revenue | 10,918 | 11,202 | 12,044 | 21,470 | 23,246 | ||||||||||||

| Adjusted EBITDA | 3,176 | 3,296 | 3,569 | 6,011 | 6,865 | ||||||||||||

| Gaming Statistics6 | |||||||||||||||||

| (HK$’m) | |||||||||||||||||

| Q2 2024 | Q1 2025 | Q2 2025 | 1H 2024 | 1H 2025 | |||||||||||||

| Rolling Chip Volume7 | 46,155 | 46,375 | 55,764 | 84,612 | 102,139 | ||||||||||||

| Win Rate % | 3.0% | 4.3% | 4.3% | 3.2% | 4.3% | ||||||||||||

| Win | 1,391 | 1,978 | 2,413 | 2,690 | 4,391 | ||||||||||||

| Mass Table Drop8 | 32,370 | 32,190 | 35,076 | 63,841 | 67,266 | ||||||||||||

| Win Rate % | 25.6% | 25.6% | 25.1% | 25.1% | 25.3% | ||||||||||||

| Win | 8,291 | 8,230 | 8,811 | 16,019 | 17,041 | ||||||||||||

| Electronic Gaming Volume | 22,370 | 25,562 | 28,609 | 41,413 | 54,171 | ||||||||||||

| Win Rate % | 2.9% | 2.9% | 2.7% | 3.0% | 2.8% | ||||||||||||

| Win | 658 | 729 | 785 | 1,258 | 1,514 | ||||||||||||

| Total GGR Win9 | 10,340 | 10,937 | 12,009 | 19,967 | 22,946 | ||||||||||||

Balance Sheet and Dividend

The Group’s balance sheet remains healthy and liquid. As of 30 June 2025, cash and liquid investments were $30.7 billion and the net position was $30.3 billion after debt of $0.4 billion. Our strong balance sheet combined with substantial cash flow from operations allows us to return capital to shareholders via dividends and to fund our development pipeline. The Group paid the previously announced final dividend of $0.50 per share in June 2025. Subsequently the GEG Board announced an interim dividend of $0.70 per share to be paid on or about 31 October 2025.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to the Group’s revenue and earnings. Net Revenue in 1H 2025 was $19.1 billion, up 13% year-on-year. Adjusted EBITDA was $6.3 billion, up 18% year-on-year. In 1H 2025, Galaxy Macau™ experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $755 million. Normalized 1H 2025 Adjusted EBITDA was $5.6 billion, up 3% year-on-year.

In Q2 2025, Galaxy Macau™’s Adjusted EBITDA was $3.3 billion, up 20% year-on-year and up 10% quarter-on-quarter. In Q2 2025, Galaxy Macau™ experienced good luck in its gaming operations which increased its Adjusted EBITDA by approximately $410 million. Normalized Q2 2025 Adjusted EBITDA was $2.9 billion, up 3% year-on-year and up 9% quarter-on-quarter.

The combined nine hotels occupancy was 98% for 1H and Q2 2025.

| Galaxy Macau™ Key Financial Data | |||||

| (HK$’m) | Q2 2024 | Q1 2025 | Q2 2025 | 1H 2024 | 1H 2025 |

| Revenues: | |||||

| Net Gaming | 7,347 | 7,762 | 8,567 | 14,234 | 16,329 |

| Hotel / F&B / Others | 971 | 1,052 | 1,105 | 2,027 | 2,157 |

| Mall | 326 | 335 | 328 | 697 | 663 |

| Total Net Revenue | 8,644 | 9,149 | 10,000 | 16,958 | 19,149 |

| Adjusted EBITDA | 2,782 | 3,016 | 3,325 | 5,395 | 6,341 |

| Adjusted EBITDA Margin | 32% | 33% | 33% | 32% | 33% |

| Gaming Statistics10 | |||||

| (HK$’m) | Q2 2024 | Q1 2025 | Q2 2025 | 1H 2024 | 1H 2025 |

| Rolling Chip Volume11 | 44,577 | 44,371 | 54,859 | 82,010 | 99,230 |

| Win Rate % | 2.9% | 4.4% | 4.4% | 3.1% | 4.4% |

| Win | 1,287 | 1,941 | 2,391 | 2,530 | 4,332 |

| Mass Table Drop12 | 24,647 | 25,270 | 27,416 | 49,119 | 52,686 |

| Win Rate % | 28.6% | 27.8% | 28.0% | 27.4% | 27.9% |

| Win | 7,047 | 7,027 | 7,669 | 13,453 | 14,696 |

| Electronic Gaming Volume | 14,772 | 16,333 | 18,435 | 27,551 | 34,768 |

| Win Rate % | 3.5% | 3.5% | 3.3% | 3.7% | 3.4% |

| Win | 524 | 570 | 611 | 1,011 | 1,181 |

| Total GGR Win | 8,858 | 9,538 | 10,671 | 16,994 | 20,209 |

StarWorld Macau

StarWorld Macau’s Net Revenue was $2.4 billion in 1H 2025, down 10% year-on-year. Adjusted EBITDA was $653 million, down 21% year-on-year. In 1H 2025, StarWorld Macau experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $18 million. Normalized 1H 2025 Adjusted EBITDA was $671 million, down 14% year-on-year.

In Q2 2025, StarWorld Macau’s Adjusted EBITDA was $303 million, down 22% year-on-year and down 13% quarter-on-quarter. In Q2 2025, StarWorld Macau experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $3 million. Normalized Q2 2025 Adjusted EBITDA was $306 million, down 14% year-on-year and down 16% quarter-on-quarter.

Hotel occupancy was 100% for 1H 2025 and Q2 2025.

| StarWorld Macau Key Financial Data | |||||

| (HK$’m) | Q2 2024 | Q1 2025 | Q2 2025 | 1H 2024 | 1H 2025 |

| Revenues: | |||||

| Net Gaming | 1,190 | 1,118 | 1,047 | 2,425 | 2,165 |

| Hotel / F&B / Others | 128 | 119 | 119 | 256 | 238 |

| Mall | 5 | 5 | 5 | 11 | 10 |

| Total Net Revenue | 1,323 | 1,242 | 1,171 | 2,692 | 2,413 |

| Adjusted EBITDA | 390 | 350 | 303 | 825 | 653 |

| Adjusted EBITDA Margin | 29% | 28% | 26% | 31% | 27% |

| Gaming Statistics13 | |||||

| (HK$’m) | Q2 2024 | Q1 2025 | Q2 2025 | 1H 2024 | 1H 2025 |

| Rolling Chip Volume14 | 1,578 | 2,004 | 905 | 2,602 | 2,909 |

| Win Rate % | 6.5% | 1.8% | 2.4% | 6.1% | 2.0% |

| Win | 104 | 37 | 22 | 160 | 59 |

| Mass Table Drop15 | 7,467 | 6,734 | 7,501 | 14,223 | 14,235 |

| Win Rate % | 16.2% | 17.4% | 14.8% | 17.5% | 16.1% |

| Win | 1,207 | 1,174 | 1,112 | 2,490 | 2,286 |

| Electronic Gaming Volume | 6,325 | 8,351 | 9,284 | 11,370 | 17,635 |

| Win Rate % | 1.8% | 1.8% | 1.7% | 1.8% | 1.7% |

| Win | 113 | 146 | 162 | 206 | 308 |

| Total GGR Win | 1,424 | 1,357 | 1,296 | 2,856 | 2,653 |

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. Broadway Macau™’s Net Revenue was $97 million for 1H 2025, down 3% year-on-year. Adjusted EBITDA was $6 million for 1H 2025 versus $12 million in 1H 2024. In Q2 2025, Broadway Macau™’s Adjusted EBITDA was $4 million, versus $8 million in Q2 2024 and $2 million in Q1 2025.

City Clubs

City Clubs contributed $3 million of Adjusted EBITDA to the Group’s earnings for 1H 2025, versus $9 million in 1H 2024. Q2 2025 Adjusted EBITDA was $2 million, versus $5 million in Q2 2024 and $1 million in Q1 2025.

GEG announced that the Waldo Casino will cease operation by the end of this year due to commercial considerations. GEG’s employees working at the Waldo Casino will be reallocated to its other properties and casinos. Related departments will discuss the best options with the team members and provide them with a series of vocational training programs to assist them in adapting to their new working environment. GEG would like to thank the Macau residents, patrons and the community for their support to the Waldo Casino over the years. As always, GEG remains fully committed to making a positive contribution to the Macau’s leisure and tourism industry.

Construction Materials Division (“CMD”)

CMD continued to deliver solid results and contributed Adjusted EBITDA of $423 million in 1H 2025, up 16% year-on-year. In Q2 2025, CMD’s Adjusted EBITDA was $238 million, down 7% year-on-year and up 29% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests including adding new F&B and retail offerings at Galaxy Macau™. We are also ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau.

At StarWorld Macau we have commenced implementing a range of major upgrades, that includes the main gaming floor, the lobby arrival experience and increasing the F&B options. We have completed the upgrade of Level 3 and StarWorld Macau now hosts one of the largest scale LTG terminals in Macau.

Cotai – The Next Chapter

Capella at Galaxy Macau is the 10th hotel brand in GEG’s portfolio. We offered exclusive previews commencing in May 2025 and we anticipate to have the property fully opened to the public in the coming months. Capella at Galaxy Macau is an all-suite gilded residence, located within Asia’s most luxurious and award-winning resort. Showcasing new standards of bespoke, accentuated luxury, Capella at Galaxy Macau sets the scene for the most discerning of guests to forge authentic connections with Macau – Asia’s entertainment hub with a rich history of culture, UNESCO-world heritage gastronomy and a gateway to the vibrant Greater Bay Area. This 17-storey property offers 95 ultra-luxury signature suites and Capella Penthouses. Each of the Capella Penthouses includes a light-filled balcony with a private infinity-edge pool, outdoor lounge and sunroom, entertainment lounge and hidden Winter Garden, among a series of unique features. Capella at Galaxy Macau is the ultimate expression of elegance, bespoke luxury and refined hospitality. It promises to bring a new level of elegance and ultra-luxury to Macau.

On the development front we are progressing well with the construction of Phase 4. Construction of the Super Structure and the external facade has been completed and we are progressing to the next stage of development which is fitting out the building. We have entered into a new contract for the internal fitting out works of the approximately 600,000 sqm Phase 4 development which includes multiple high-end hotel brands that are new to Macau, together with an approximately 5,000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is targeted to complete in 2027. We remain highly confident about the future of Macau where Phases 3 & 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Selected Major Awards in 1H 2025

| AWARD | PRESENTER |

| GEG | |

| Casino Operator of the Year | Global Gaming Awards Asia-Pacific 2025 |

| 11th Outstanding Corporate Social Responsibility Award Ceremony – Outstanding Corporate Social Responsibility Award | Mirror Post of Hong Kong |

| 2025 Macao International Environmental Co-operation Forum & Exhibition – Green Booth Award | Macau Fair & Trade Association and Macao Low Carbon Development Association |

| Best Cohesive Partnership Award | Trip.com |

| GALAXY MACAU™ | |

| Integrated Resort of the Year | Global Gaming Awards Asia-Pacific 2025 |

MICHELIN One-Star Restaurant

MICHELIN Selected Restaurants

| The MICHELIN Guide Hong Kong Macau 2025 |

Five-Star Hotel

Five-Star Restaurant

Five-Star Spa

| 2025 Forbes Travel Guide |

2025 Black Pearl Restaurant Guide One Diamond

Hotel Awards Appreciation Event

| Mei Tuan |

SCMP 100 Top Tables 2025

| South China Morning Post |

| Macau Green Hotel Awards – Gold Award – Hotel Okura Macau | Environmental Protection Bureau of the Macao SAR Government |

| STARWORLD MACAU | |

| MICHELIN Two-Star Restaurant – Feng Wei Ju | The MICHELIN Guide Hong Kong Macau 2025 |

| 2025 Black Pearl Restaurant Guide One Diamond – Feng Wei Ju | Mei Tuan |

| SCMP 100 Top Tables 2025 – Feng Wei Ju | South China Morning Post |

| Broadway Macau™ | |

| Hotel Awards Appreciation Event – Popular Hotel – Broadway Macau™ | Mei Tuan |

| Macau Green Hotel Awards – Silver Award – Broadway Hotel | Environmental Protection Bureau of the Macao SAR Government |

| Overseas Popularity Award – Broadway Macau™ | Trip.com |

| Traveller Review Awards 2025 Winner – Broadway Macau™ | Booking.com |

| Construction Materials Division | |

| Carbon Reduction Action – Participation as Collaborating Partner of Carbon Reduction Action – Certificate | Environmental Campaign Committee |

Outlook

Looking forward we continue to remain laser focused on our customer service standards. Our target is to ensure that each customer interaction is memorable and exceptional. We continue to progressively upgrade our resort facilities to ensure that they remain world-class amenities and highly competitive. We continue to yield all our existing assets including hotels, food and beverage, retail, resort and cinema facilities. Costs are being carefully managed to deliver operating leverage as we continue to grow the top line.

We previously advised that we had completed the full rollout of smart tables. We are now commencing to experience the benefits of this technology and are leveraging the knowledge gained from the data to provide a better customer experience.

Large scale entertainment is providing a significant boost to foot traffic across our resorts. Mega entertainment events have resulted in a substantial increase in gaming, retail, food and beverage and hotel revenues. We are working hard to continue to build the Galaxy Arena brand as a world-class entertainment arena and to attract even more large scale mega entertainment events into the future. In November we will support the National Games and host its Table Tennis Competition in Galaxy Arena. We remain optimistic about mega events tourism in the second half of the year.

The recent exclusive preview of Capella at Galaxy Macau has been exceptionally well received by its high value customers, and we will progressively open all the remaining facilities over the coming months. On the development front we are progressing well with the construction of Phase 4. Construction of the Super Structure and the external facade has been completed and we are progressing to the next stage of development which is fitting out the building. We have entered into a new contract for the internal fitting out works of the approximately 600,000 sqm Phase 4 development which includes multiple high-end hotel brands that are new to Macau, together with an approximately 5,000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is targeted to complete in 2027.

Originally Thailand’s Parliament was scheduled to debate the Entertainment Complex Bill on 9 July 2025. However, the Parliament decided to withdraw the Bill from discussion. We await further updates on the potential progress of the Entertainment Complex Bill. We believe that an integrated resort in Bangkok would be highly accretive to our resort portfolio. We continue to remain very interested in Thailand.

The state of the world economy and ongoing discussions on tariffs, whilst gaining significant media coverage has to date not impacted gaming revenue as much as some analysts had previously predicted. Macau still rates in the top three destinations of choice by Chinese travelers.

International customer development continues to be a priority and we are leveraging our marketing offices in Tokyo, Seoul and Bangkok. In the first half of 2025 international visitor arrivals to Macau grew 15% year-on-year to 1.3 million.

We remain confident in the outlook for Macau. The reasons for this confidence include the ongoing improvement in transportation infrastructure making it easier to travel to and from Macau, as well as within Macau. That includes the recent extension of Macau LRT’s new line connecting the Hengqin Port and the commencement of Macau International Airport expansion and reclamation project, among others. The opening of the fourth Macau-Taipa bridge in late-2024 further improved travel within Macau.

We remain confident in the medium to longer term outlook for Macau. In the interim we will continue to leverage our resorts assets and staff to grow the business, and to support Macau’s development into the World Centre of tourism and leisure.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group Limited (“GEG” or the “Company”) and its subsidiaries (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. The Group primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. GEG is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG through its subsidiary, Galaxy Casino S.A., is one of the three original concessionaires in Macau when the gaming industry was liberalized in 2002. In 2022, GEG was awarded a new gaming concession valid from January 1, 2023, to December 31, 2032. GEG has a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

The Group operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award-winning premium property.

The Group has the largest development pipeline of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will be more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG also considers opportunities in the Greater Bay Area and internationally. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

____________________________________

1 Gaming statistics are presented before deducting commission and incentives.

2 Reflects sum of promoter and inhouse premium direct.

3 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

4 Total GGR win includes gaming win from City Clubs.

5 Reflects luck adjustments associated with our rolling chip program.

6 Gaming statistics are presented before deducting commission and incentives.

7 Reflects sum of promoter and inhouse premium direct.

8 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

9 Total GGR win includes gaming win from City Clubs.

10 Gaming statistics are presented before deducting commission and incentives.

11 Reflects sum of promoter and inhouse premium direct.

12 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

13 Gaming statistics are presented before deducting commission and incentives.

14 Reflects sum of promoter and inhouse premium direct.

15 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/630f381e-20ef-484b-9511-f4aa42746a5a

https://www.globenewswire.com/NewsRoom/AttachmentNg/6868d789-ac9a-4801-a459-7c6dcc8721d0

CONTACT: For Media Enquiries: Galaxy Entertainment Group - Investor Relations Mr. Peter J. Caveny / Ms. Yoko Ku / Ms. Crystal Chan Tel: +852 3150 1111 Email: ir@galaxyentertainment.com

![]()