G2 Goldfields Drilling Continues to Expand High-Grade Gold Resource at OKO

- Drilling intersects new gold mineralisation south of existing pit shells, including a high-grade intercept of 39.3 g/t Au over 2.7m and 2.1 g/t Au over 30m.

- Significant gold mineralisation intercepted down-plunge of current gold resource including 4.0 g/t Au over 23.5m within 2.4 g/t Au over 50m.

- Major drill program initiated with five rigs committed to expanding gold zones.

- Greenfields exploration ongoing with assays pending from new target areas.

TORONTO, Jan. 06, 2026 (GLOBE NEWSWIRE) — G2 Goldfields Inc. (“G2” or the “Company”) (TSX: GTWO; OTCQX: GUYGF) is pleased to announce new assay results from the Company’s ongoing diamond drill program at the OKO Project, Guyana (“OKO” or the “Project”). In December 2025, G2 released key findings from an independent Preliminary Economic Assessment (“PEA”) [see press release dated December 18, 2025]. The PEA outlined a combined open pit and underground operation with a 14-year mine life with total gold production estimated at 3.2 million ounces at all-in sustaining costs¹ (“AISC”) of US$1,191 per ounce. Gold production is estimated at 298,000 ounces per annum during years 3 through 10. The OKO gold project will contribute significantly to Guyana’s economy through payments of royalties, taxes, and employment opportunities.

Assay results are reported hereunder for 16 new diamond drill holes totalling 5,997 metres (“m”). Highlights of the results are compiled in Table 1, with a complete table of results available here.

Table 1 – Highlights of Drilling Results: Border/Ghanie Gold Zones

| DRILL HOLE | FROM (METRES) | TO (METRES) | INT. (METRES) | GRADE (G/T AU) | GRADE x DH WIDTH | |

| GDD247 | 58.5 | 88.5 | 30.0 | 2.1 | 61.8 | |

| GDD251A | 151.0 | 161.5 | 10.5 | 2.6 | 27.6 | |

| GDD251A | 222.5 | 242.0 | 19.5 | 2.3 | 44.9 | |

| GDD251A | 268.4 | 290.7 | 22.3 | 1.1 | 23.5 | |

| GDD256A² | 862.0 | 912.0 | 50.0 | 2.4 | 120.4 | |

| Incl. | 862.0 | 885.5 | 23.5 | 4.0 | 95.0 | |

| GDD258 | 185.5 | 188.2 | 2.7 | 39.3 | 106.6 | |

| GDD260² | 533.0 | 538.0 | 5.0 | 5.5 | 27.3 | |

| GDD262³ | 333.5 | 352.0 | 18.5 | 2.1 | 38.2 | |

Notes to Table 1: The intercepts reported are down-hole widths. True widths are estimated between 62% and 98% of reported down-hole widths. Gold grades are uncapped.

² Additional assays pending.

³ Additional assays pending. Standard Failure in min zone.

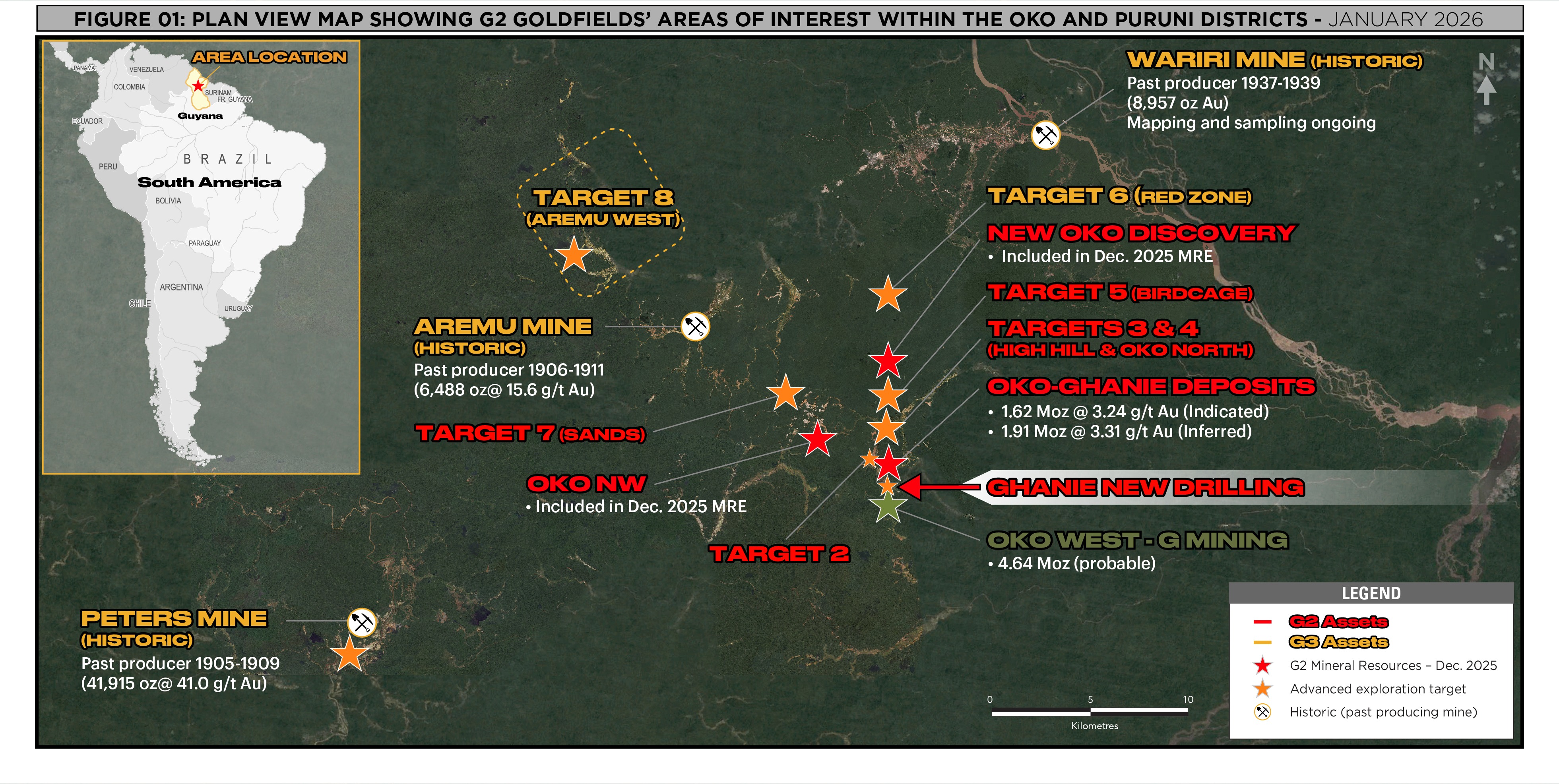

Figure 1 – District Plan View of Targets

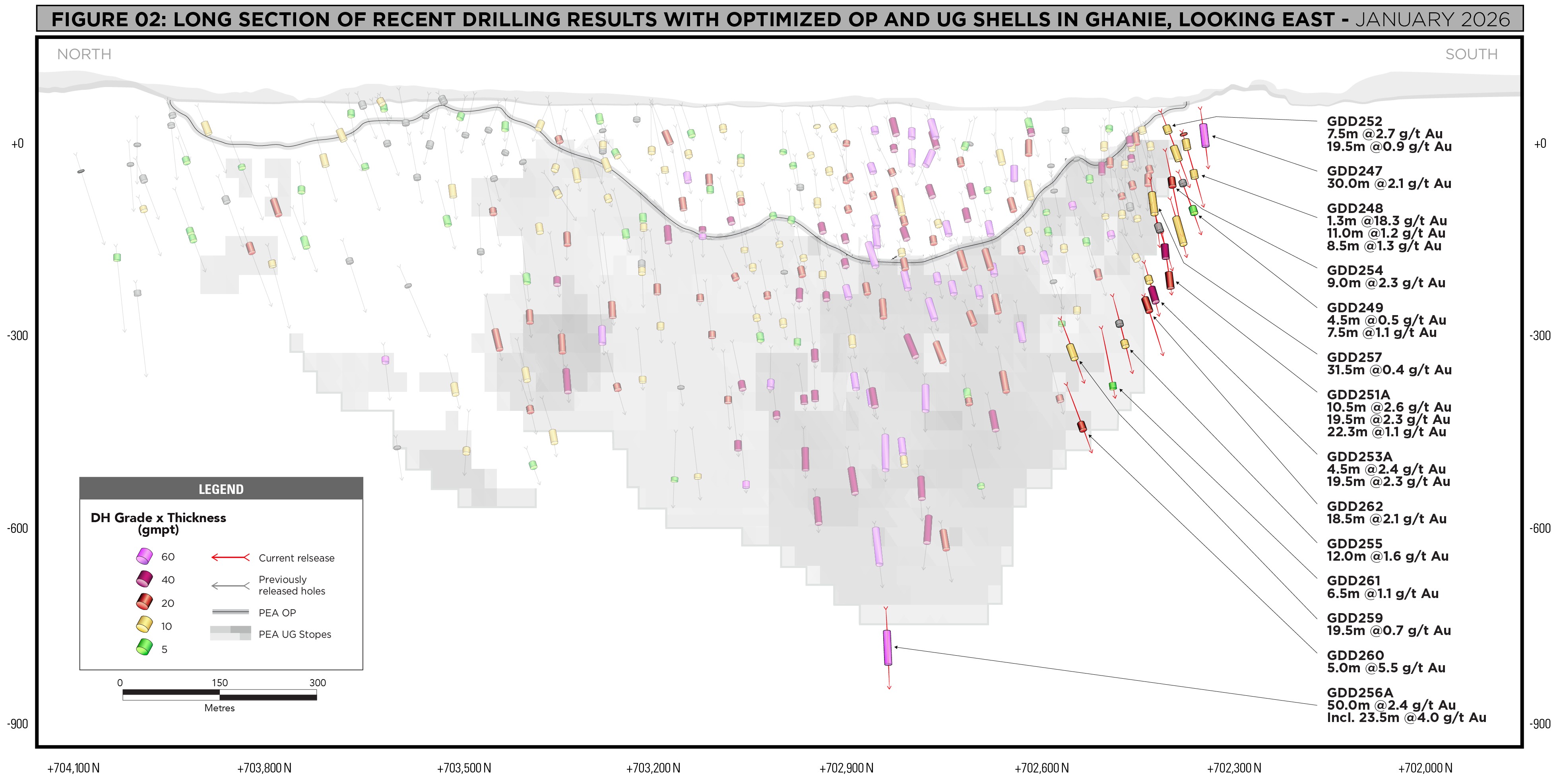

All of the drill holes, with the exception of hole GDD256A, targeted the “Border Zone” area located south of the Ghanie open pit shell, as defined in the PEA. The program successfully intercepted near-surface gold mineralisation in hole GDD247, which returned 30.0m @ 2.1 g/t Au from 58.5m downhole, as well as deeper gold mineralisation encountered in hole GDD260, which assayed 5.5 g/t Au over 5.0m from 533m downhole. Multiple gold intercepts occurred in several of the drill holes at more moderate depths, with hole GDD251A returning 10.5m at 2.6 g/t Au, 19.5m at 2.3 g/t Au and 22.3m at 1.1 g/t Au. Exceptionally high-grade gold was intercepted in hole GDD258, which returned 39.3 g/t Au over 2.7m.

Figure 2 –Ghanie/Border Deposit Oblique View Long Section

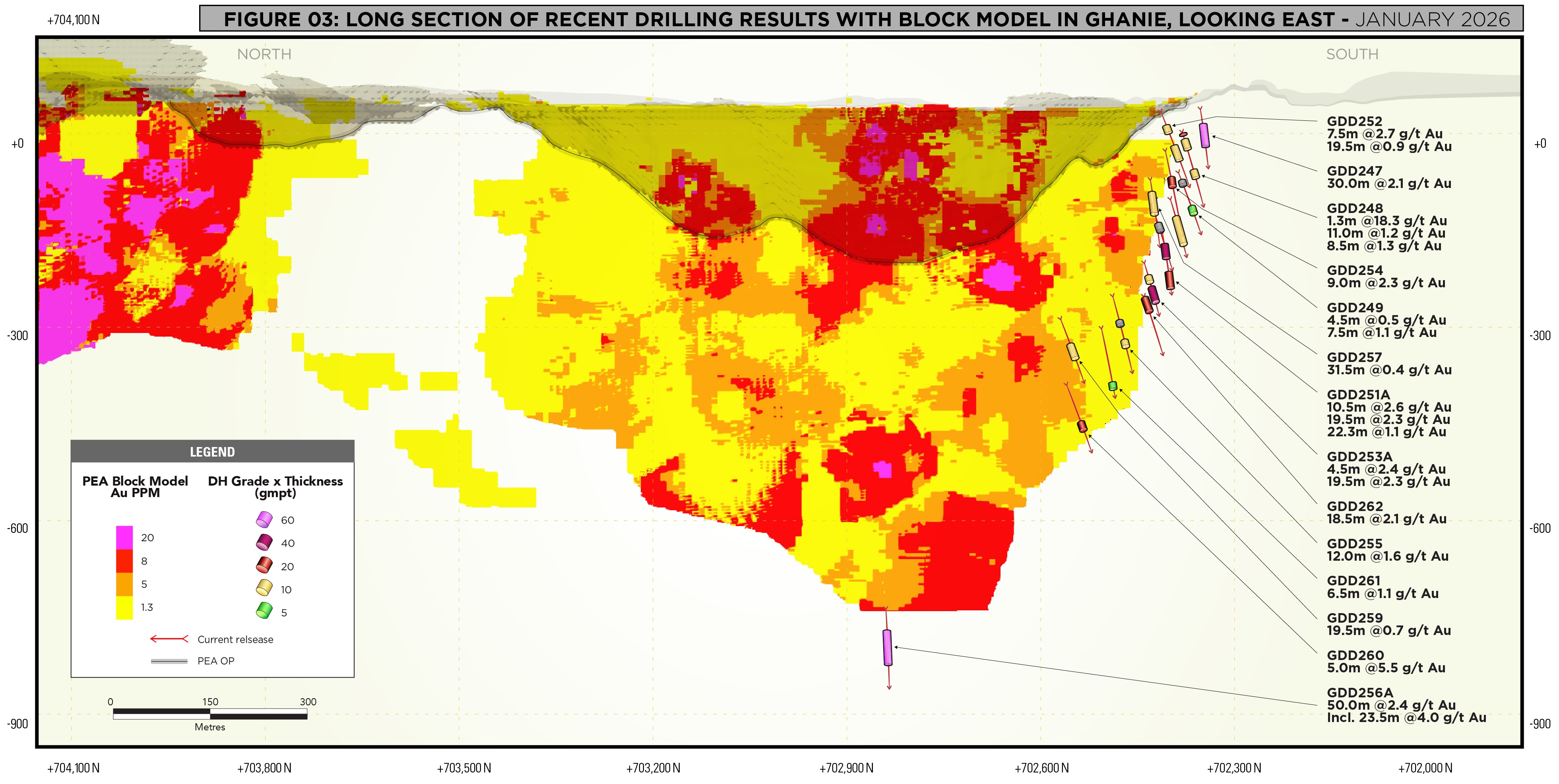

Diamond drill hole GDD256A was designed to test for deeper down-plunge mineralisation from the more central part of the Ghanie resource area and was drilled to a final depth of 963m. Between 862m and 912m downhole, a broad zone of gold mineralisation assaying 2.4 g/t Au over 50.0m was intercepted, including a higher-grade interval of 4.0 g/t Au over 23.5m. This now represents the deepest intercept in the Ghanie deposit and the deepest drill hole on the Oko Project to date. The intercept is within the principal Ghanie shear zone which occurs on the hanging wall contact of the relatively rigid Ghanie diorite and less competent magnetite diorite host rocks, as predicted by the geological model. This intercept confirms the depth extension potential of the Ghanie gold system, demonstrating economic widths and grades well beyond the limits of the current mineral resource estimate.

Figure 3 – OMZ & Ghanie Deposits Long Section Looking East: HG Blocks with Mining Constraints

Daniel Noone, CEO of G2, stated, “These results continue to demonstrate the ongoing expansion of gold resources at the Oko Project, with mineralisation remaining open in multiple directions. With five rigs focused on the Ghanie/Border target areas, alongside continued greenfields exploration across the district, we are excited about the potential for additional gold discoveries in the greater Oko district. G2 will continue to unlock shareholder value by aggressively exploring and de-risking its portfolio of gold projects.”

Endnotes

- Reference “AISC” is a non-GAAP financial measure. This measure is intended to provide additional information to investors. It does not have any standardized meanings under IFRS®, and therefore may not be comparable to other issuers and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS®. Refer to the Non-GAAP Financial Measures section of this document.

QA/QC

Drill core is logged and sampled in a secure core storage facility located on the Project site, Guyana. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to MSALABS Guyana, in Georgetown, Guyana, which is an accredited mineral analysis laboratory, for analysis. Samples from sections of core with obvious gold mineralisation are analysed for total gold using an industry-standard 500g metallic screen fire assay (MSALABS method MSC 550). All other samples are analysed for gold using standard Fire Assay-AA with atomic absorption finish (MSALABS method; FAS-121). Samples returning over 10.0 g/t gold are analysed utilizing standard fire assay gravimetric methods (MSALABS method; FAS-425). Certified gold reference standards, blanks, and field duplicates are routinely inserted into the sample stream, as part of G2 Goldfield’s QA/QC program. No QA/QC issues were noted with the results reported herein.

About G2 Goldfields Inc.

G2 Goldfields finds and develops gold deposits in Guyana. The founders and principals of the Company have been directly responsible for the discovery of more than 11 million ounces of gold in the prolific and underexplored Guiana Shield. G2 continues this legacy of exploration excellence and success. Total combined open pit and underground resources across all 5 discoveries to date include:

- 1,910,300 oz. Au – Inferred contained within 17,970,000 tonnes @ 3.31 g/t Au

- 1,620,600 oz. Au – Indicated contained within 15,571,000 tonnes @ 3.24 g/t Au

The mineral resource was prepared by Micon International Limited with an effective date of November 20, 2025. The Oko district has been a prolific alluvial goldfield since its initial discovery in the 1870s, and modern exploration techniques continue to reveal the considerable potential of the district.

Additional information about the Company is available on SEDAR+ (www.sedarplus.ca) and the Company’s website (www.g2goldfields.com).

On behalf of the Board of G2 Goldfields Inc.

“Daniel Noone”

CEO & Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: +1.416.628.5904 x.1150

Email: j.wagenaar@g2goldfields.com

Cautionary Notes and Forward-Looking Statements

This news release contains certain forward-looking statements, including, but not limited to, statements about the PEA and mineral resource, the estimated annual and total production, anticipated grade, estimated AISC, life of mine and other future financial or operating performance of G2 and the Project, multiple drill holes in the Ghanie/Border resource area with zones remaining open down plunge, the commitment of five drill rigs to the Ghanie/Border area, the continued greenfields exploration of multiple targets, and expectations regarding the Company’s business and the Project. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements, including the risk factors set out in the Company’s annual information form for the year ended May 31, 2025. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. The Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

The PEA is preliminary in nature and includes Indicated and Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized.

Non-GAAP Financial Measures

G2 has included certain non-GAAP financial measures in this press release, such as AISC, which is not a measure recognized under IFRS® and does not have a standardized meaning prescribed by IFRS®. As a result, this measure may not be comparable to similar measures reported by other companies. This measure is intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS®. Non-GAAP financial measures used in this press release and common to the gold mining industry are defined below. As the Project is not in production, G2 does not have historical non-GAAP financial measures or historical comparable measures under IFRS®, and therefore the foregoing prospective non-GAAP financial measures or ratios presented may not be reconciled to the nearest comparable measure under IFRS®.

All-In Sustaining Costs and All-In Sustaining Costs per Ounce

All-in sustaining costs and all-in sustaining costs per ounce are reflective of all of the expenditures that are required to produce an ounce of gold from operations. All-in sustaining costs reported in the PEA include total cash costs, sustaining capital expenditures, closure costs, but exclude corporate general and administrative costs. All-in sustaining costs per ounce is calculated as all-in sustaining costs divided by payable gold ounces. All-in sustaining Costs capture the important components of the Project’s production and related costs and are used by G2 and investors to understand projected cost performance at the Project.

Figures accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/7b90d2ad-ca2b-4f42-9c82-41d5707b439d

https://www.globenewswire.com/NewsRoom/AttachmentNg/25e3fddb-79db-4f20-932a-2074e13a3b83

https://www.globenewswire.com/NewsRoom/AttachmentNg/2d736f61-1ce4-4aa9-a2e1-3e24b24126a5

![]()