Cygnus eyes two new mineralised gold prospects for resource growth

One of the prospects has a mineral resource and the other has returned high-grade intersections; Drilling to resume at Golden Eye gold-copper deposit this month

HIGHLIGHTS:

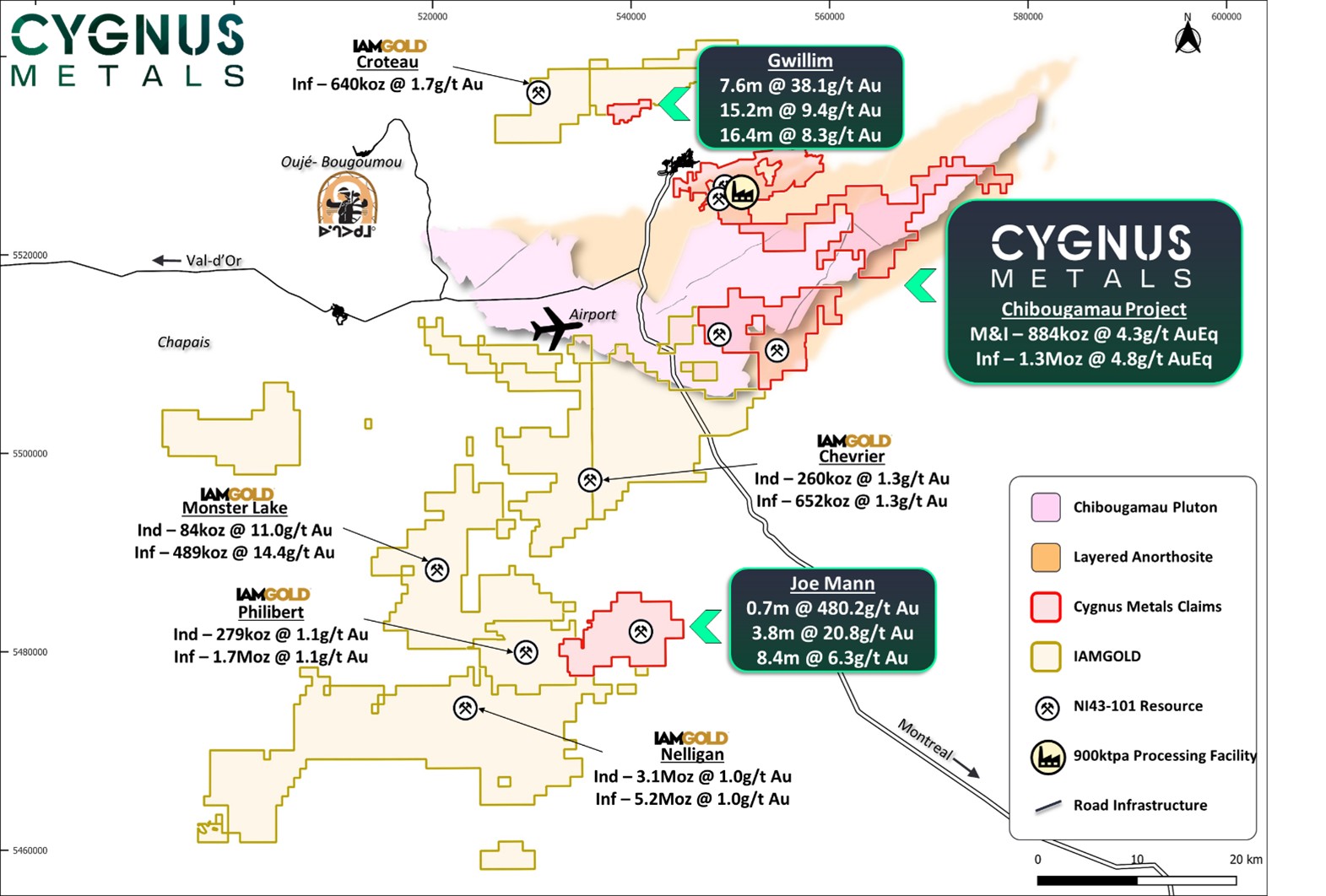

- Cygnus has identified two gold prospects with known mineralisation and plans a drilling campaign for Q2 (following standard permitting) as part of its push to continue growth of the Chibougamau Project resource base

- The Gwillim prospect, located just 12km from the Chibougamau processing facility, has returned several high-grade intersections which require follow up drilling. These intersections include:

- 7.6m @ 38.1g/t Au from 314.9m (87-KOD-18);

- 15.2m @ 9.4g/t Au from 155.1m (87-KOD-1); and

- 16.4m @ 8.3g/t Au from 168.3m (87-KOD-10).

- The Joe Mann prospect is a historic high-grade gold mine which produced 1.2Moz @ 8.3g/t Au.1 The project has an Inferred Resource of 0.7Mt at 6.0g/t Au for 143koz but significant regional potential remains near surface with intersections of:

- 0.7m @ 480.2g/t Au from 92.3m (H-118);

- 3.8m @ 20.8g/t Au from 287.2m (H-214); and

- 8.4m @ 6.3g/t Au from 175.6m (H-374).

- Joe Mann is ideally located in the middle of gold-rich ground that recently led to IAMGOLD’s acquisition of Northern Superior Resources for C$267.4M

- Cygnus believes these drill targets have significant potential to grow the current resource of the Chibougamau Project, which stands at 6.4Mt at 3.0% CuEq for 193kt CuEq (M&I) and 8.5Mt at 3.5% CuEq for 295kt CuEq (Inferred)

- At the Golden Eye deposit, drilling will resume later this month to test extensions below the current resource, which stands at 0.5Mt at 5.6g/t AuEq for 91koz AuEq (Indicated) and 1.2Mt at 4.6g/t AuEq for 182koz AuEq (Inferred)

- Assays are pending from follow up drilling on a new zone of shallow mineralisation at Cedar Bay which previously returned 28.9m at 2.5g/t AuEq (1.0g/t Au, 1.0% Cu & 12.0g/t Ag) (CDR-25-16)

| Cygnus Executive Chairman David Southam said: “These two new prospects clearly have substantial resource potential, with both hosting known gold mineralisation. “Resource growth is at the centre of our strategy for 2026 and these targets meet our criteria both in terms of the high-grades and the scope to extend the known mineralisation significantly. “Intersections of up to 480g/t (over 0.7m), less than 100m deep, in a gold price environment of US$4,500/oz, next to a historic high-grade gold mine and in an area subject to M&A demonstrates why we are so keen to pursue these opportunities.” | |

TORONTO, Jan. 19, 2026 (GLOBE NEWSWIRE) — Cygnus Metals Limited (ASX: CY5; TSXV: CYG; OTCQB: CYGGF) (“Cygnus” or the “Company”) is pleased to announce high priority gold drilling targets, with permit applications in progress, at its Chibougamau Copper-Gold Project in Quebec.

Cygnus is continuing to aggressively explore the highly prospective Chibougamau Project and grow resources in line with the Company’s value creation strategy. Two high priority drill targets have been identified which are both known to have significant high-grade gold mineralisation and little modern exploration.

The Gwillim Project (50% JV with Alamos Gold) is located 12km northwest of the Chibougamau processing facility and has several gold rich structures running through the project. The Gwillim mine was in production in the 1970s and 1980s and produced 39koz at a grade of 4.8g/t.1 The main target sits 500m to the south of the historic mine and has a number of wide, high-grade intercepts which require follow up. These intersections include:

- 7.6m @ 38.1g/t Au from 314.9m (87-KOD-18);

- 15.2m @ 9.4g/t Au from 155.1m (87-KOD-1); and

- 16.4m @ 8.3g/t Au from 168.3m (87-KOD-10).

Work is ongoing to compile the data and generate drill targets while the drill permit application is in process.

The Joe Mann Project is located 46km south of the Chibougamau processing facility and was a past producing mine which closed in 2007. Joe Mann was known for its high-grade, producing 1.2Moz at a grade of 8.3g/t Au.1 The deposit is still open below existing workings and contains an Inferred Resource of 0.7Mt at 6.0g/t Au for 143koz Au. The Joe Mann Project covers 62km2 and hosts a number of near-surface regional drilling targets that require follow up work, some of which with high-grade gold intersections like:

- 0.7m @ 480.2g/t Au from 92.3m (H-118);

- 3.8m @ 20.8g/t Au from 287.2m (H-214); and

- 8.4m @ 6.3g/t Au from 175.6m (H-374).

Cygnus recently flew detailed airborne magnetics over the project to assist with targeting. This is being used in conjunction with the existing drilling and planned IP surveys to plan follow-up drilling.

The Joe Mann Project is located in the heart of the area owned by Northern Superior Resources which was recently acquired by IAMGOLD’s for C$267.4M. This acquisition consolidates a number of significant resources in the area with IAMGOLD’s Nelligan gold deposit.

Cygnus is continuing its exploration strategy, focussed on resource growth and resource conversion, to drive the Chibougamau Project forward and deliver maximum returns to shareholders. In line with this strategy, drilling is expected to resume later this month at the Golden Eye deposit to test extensions below the current resource as well as converting more resources to the Indicated category. The current resource at Golden Eye includes an Indicated Resource of 0.5Mt at 5.6g/t AuEq for 91koz AuEq and Inferred Resource of 1.2Mt at 4.6g/t AuEq for 182koz AuEq.

The Chibougamau area has well-established infrastructure, giving the Project a significant headstart as a copper-gold development opportunity. This infrastructure includes a 900,000tpa processing facility, local mining town, sealed highway, airport, regional rail infrastructure and 25kV hydro power to the processing site. Significantly, the Chibougamau processing facility is the only processing facility within a 250km radius.

Figure 1: High priority gold targets at Joe Mann and Gwillim in the heart of IAMGOLD’s acquisition of Northern Superior. Cygnus has the only processing infrastructure in the region.

This announcement has been authorised for release by the Board of Directors of Cygnus.

| David Southam Executive Chair T: +61 8 6118 1627 E: info@cygnusmetals.com | Nicholas Kwong President & CEO T: +1 647 921 0501 E: info@cygnusmetals.com | Media: Paul Armstrong Read Corporate T: +61 8 9388 1474 |

About Cygnus Metals

Cygnus Metals Limited (ASX: CY5, TSXV: CYG, OTCQB: CYGGF) is a diversified critical minerals exploration and development company with projects in Quebec, Canada and Western Australia. The Company is dedicated to advancing its Chibougamau Copper-Gold Project in Quebec with an aggressive exploration program to drive resource growth and develop a hub-and-spoke operation model with its centralised processing facility. In addition, Cygnus has quality lithium assets with significant exploration upside in the world-class James Bay district in Quebec, and REE and base metal projects in Western Australia. The Cygnus team has a proven track record of turning exploration success into production enterprises and creating shareholder value.

Forward Looking Statements

This release may contain certain forward-looking statements and projections regarding estimates, resources and reserves; planned production and operating costs profiles; planned capital requirements; and planned strategies and corporate objectives. Such forward looking statements/projections are estimates for discussion purposes only and should not be relied upon. They are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond Cygnus’ control. Cygnus makes no representations and provides no warranties concerning the accuracy of the projections and disclaims any obligation to update or revise any forward-looking statements/projections based on new information, future events or otherwise except to the extent required by applicable laws. While the information contained in this release has been prepared in good faith, neither Cygnus or any of its directors, officers, agents, employees or advisors give any representation or warranty, express or implied, as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in this release. Accordingly, to the maximum extent permitted by law, none of Cygnus, its directors, employees or agents, advisers, nor any other person accepts any liability whether direct or indirect, express or limited, contractual, tortuous, statutory or otherwise, in respect of the accuracy or completeness of the information or for any of the opinions contained in this release or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this release.

End Notes

- Historic production statistics for the Chibougamau area are recorded in Leclerc. F, Harris. L. B, Bedard. J. H, Van Breeman. O and Goulet. N. 2012, Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada. Society of Economic Geologists, Inc. Economic Geology, v. 107, pp. 963–989.

Qualified Persons and Compliance Statements

The scientific and technical information in this announcement has been reviewed and approved by Mr Louis Beaupre, the Quebec Exploration Manager of Cygnus, a “qualified person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Exploration Results disclosed in this announcement are also based on and fairly represent information and supporting documentation compiled by Mr Beaupre. Mr Beaupre holds options and performance rights in Cygnus. Mr Beaupre is a member of the Ordre des ingenieurs du Quebec (P. Eng.), a Recognised Professional Organisation as recognised by the ASX, and has sufficient experience which is relevant to the style of mineralisation and type of deposits under consideration and to the activity which has been undertaken to qualify as a Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Beaupre consents to the inclusion in this release of the matters based on the information in the form and context in which they appear.

The information in this release that relates to the Mineral Resource Estimate for the Chibougamau Project reported in accordance with the JORC Code (2012 Edition) and NI 43-101 was released by Cygnus in an announcement titled ‘Major Resource Update’ released to the ASX on 17 September 2025 and subsequent technical report dated 31 October 2025 titled “NI 43-101 Technical Report Chibougamau Hub and Spoke Complex, Québec, Canada” prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the JORC Code (2012 Edition). Details of the Mineral Resource Estimate are included in Appendix B. The information in this announcement that relates to previously reported Exploration Results at the Company’s projects has been previously released by Cygnus in ASX Announcements as noted in the text and End Notes.

Individual grades for the metals included in the metal equivalents calculations for the Mineral Resource Estimate, as well as the price assumptions, metallurgical recoveries and metal equivalent calculations themselves, are in Appendix B of this release. It is the Company’s view that all elements in the copper and gold equivalent calculations have a reasonable potential to be recovered and sold.

Cygnus is not aware of any new information or data that materially affects the information in these announcements, and in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons’ findings are presented have not been materially modified from the original market announcements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

APPENDIX A – Significant Intersections from Exploration Drilling

Coordinates given in UTM NAD83 (Zone 18). Intercept lengths may not add up due to rounding to the appropriate reporting precision. Intersections are estimated to be 70% of true width.

| Hole ID | X | Y | Z | Azi | Dip | Depth (m) | From (m) | To (m) | Interval (m) | Au (g/t) |

| 87-KOD-18 | 539324.5 | 5534129 | 370.6715 | 175 | -65 | 380 | 314.9 | 322.5 | 7.6 | 38.1 |

| 87-KOD-1 | 539308.1 | 5534022 | 372.958 | 182 | -60 | 235 | 155.1 | 170.4 | 15.2 | 9.4 |

| 87-KOD-10 | 539275.2 | 5534006 | 374.5273 | 182 | -64 | 256 | 168.3 | 184.7 | 16.4 | 8.3 |

| H-118 | 539682 | 5482232 | 391 | 180 | -45 | 177 | 92.3 | 93.0 | 0.7 | 480.2 |

| H-214 | 539897 | 5481931 | 390 | 7 | -49 | 558 | 287.2 | 291.1 | 3.8 | 20.8 |

| H-374 | 536624.3 | 5480813 | 387.82 | 180 | -44 | 261 | 175.6 | 184.0 | 8.4 | 6.3 |

APPENDIX B – Mineral Resource Estimate for the Chibougamau Project as at 17 September 2025

| Cu Project | Classification | COG CuEq | Tonnage | Average Grade | Contained Metal | ||||||||

| Cu | Au | Ag | CuEq | AuEq | Cu | Au | Ag | CuEq | AuEq | ||||

| % | Mt | % | g/t | g/t | % | g/t | kt | koz | koz | kt | koz | ||

| Corner Bay | Indicated | 1.2 | 4.9 | 2.5 | 0.3 | 8.4 | 2.8 | 4.1 | 124 | 43 | 1,316 | 137 | 638 |

| Inferred | 5.4 | 2.7 | 0.2 | 8.9 | 3.0 | 4.3 | 146 | 41 | 1,543 | 159 | 744 | ||

| Devlin | Measured | 1.5 | 0.1 | 2.7 | 0.3 | 0.5 | 2.9 | 4.7 | 4 | 1 | 2 | 4 | 19 |

| Indicated | 0.6 | 2.0 | 0.2 | 0.2 | 2.1 | 3.4 | 13 | 4 | 5 | 13 | 69 | ||

| M&I | 0.8 | 2.1 | 0.2 | 0.3 | 2.3 | 3.6 | 16 | 5 | 7 | 17 | 88 | ||

| Inferred | 0.3 | 2.0 | 0.2 | 0.3 | 2.1 | 3.4 | 7 | 2 | 3 | 7 | 36 | ||

| Joe Mann | Inferred | 2.0 | 0.7 | 0.2 | 6.0 | – | 4.6 | 6.3 | 2 | 143 | – | 34 | 151 |

| Cedar Bay | Indicated | 1.8 | 0.3 | 1.6 | 6.0 | 9.9 | 6.4 | 8.1 | 4 | 50 | 82 | 16 | 67 |

| Inferred | 0.8 | 2.0 | 5.1 | 11.8 | 6.1 | 7.8 | 17 | 134 | 309 | 50 | 205 | ||

| Golden Eye | Indicated | 0.5 | 1.0 | 4.3 | 9.9 | 4.4 | 5.6 | 5 | 69 | 161 | 22 | 91 | |

| Inferred | 1.2 | 0.9 | 3.4 | 7.9 | 3.6 | 4.6 | 11 | 134 | 313 | 45 | 182 | ||

| Project | Classification | Tonnage | Average Grade | Contained Metal | |||||||||

| Cu | Au | Ag | CuEq | AuEq | Cu | Au | Ag | CuEq | AuEq | ||||

| Mt | % | g/t | g/t | % | g/t | kt | koz | koz | kt | koz | |||

| Hub and Spoke | Measured | 0.1 | 2.7 | 0.3 | 0.5 | 2.9 | 4.7 | 4 | 1 | 2 | 4 | 19 | |

| Indicated | 6.3 | 2.3 | 0.8 | 7.8 | 3.0 | 4.3 | 146 | 166 | 1,563 | 189 | 865 | ||

| M&I | 6.4 | 2.3 | 0.8 | 7.6 | 3.0 | 4.3 | 149 | 167 | 1,565 | 193 | 884 | ||

| Inferred | 8.5 | 2.1 | 1.7 | 7.9 | 3.5 | 4.8 | 182 | 454 | 2,168 | 295 | 1,318 | ||

Notes:

- Cygnus’ Mineral Resource Estimate for the Chibougamau Copper-Gold project, incorporating the Corner Bay, Devlin, Joe Mann, Cedar Bay, and Golden Eye deposits, is reported in accordance with the JORC Code and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) (2014) definitions in NI 43-101.

- Mineral Resources are estimated using a long-term copper price of US$9,370/t, gold price of US$2,400/oz, and silver price of US$30/oz, and a US$/C$ exchange rate of 1:1.35.

- Mineral Resources are estimated at a CuEq cut-off grade of 1.2% for Corner Bay and 1.5% CuEq for Devlin. A cut-off grade of 1.8 g/t AuEq was used for Cedar Bay and Golden Eye; and 2.0 g/t AuEq for Joe Mann.

- Corner Bay bulk density varies from 2.85 tonnes per cubic metre (t/m3) to 3.02t/m3 for the estimation domains and 2.0 t/m3 for the overburden. At Devlin, bulk density varies from 2.85 t/m3 to 2.90 t/m3. Cedar Bay, Golden Eye, and Joe Mann use a bulk density of 2.90 t/m³ for the estimation domains.

- Assumed metallurgical recoveries are as follows: Corner Bay copper is 93%, gold is 78%, and silver is 80%; Devlin copper is 96%, gold is 73%, and silver is 80%; Joe Mann copper is 95%, gold is 84%, and silver is 80%; and Cedar Bay and Golden Eye copper is 91%, gold is 87%, and silver is 80%.

- Assumptions for CuEq and AuEq calculations (set out below) are as follows: Individual metal grades are set out in the table. Commodity prices used: copper price of US$9,370/t, gold price of US$2,400/oz and silver price of US$30/oz. Assumed metallurgical recovery factors: set out above. It is the Company’s view that all elements in the metal equivalent calculations have a reasonable potential to be recovered and sold.

- CuEq Calculations are as follows: (A) Corner Bay = grade Cu (%) + 0.68919 * grade Au (g/t) + 0.00884 * grade Ag (g/t) ; (B) Devlin = grade Cu (%) + 0.62517 * grade Au (g/t) + 0.00862 * grade Ag (g/t); (C) Joe Mann = grade Cu (%) + 0.72774* grade Au (g/t); and (D) Golden Eye and Cedar Bay = grade Cu (%) + 0.78730* grade Au (g/t) + 0.00905 * grade Ag (g/t).

- AuEq Calculations are as follows: (A) Corner Bay = grade Au (g/t) + 1.45097* grade Cu(%)+0.01282* grade Ag (g/t); (B) Devlin = grade Au (g/t) + 1.59957* grade Cu(%)+0.01379* grade Ag (g/t); (C) Joe Mann = grade Au (g/t) + 1.37411* grade Cu (%); and (D) Cedar Bay and Golden Eye = grade Au (g/t) + 1.27016 * grade Cu (%) + 0.01149 * grade Ag (g/t).

- Wireframes were built using an approximate minimum thickness of 2 m at Corner Bay, 1.8 m at Devlin, 1.2 m at Joe Mann, and 1.5 m at Cedar Bay and Golden Eye.

- Mineral Resources are constrained by underground reporting shapes.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Totals may vary due to rounding.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e567388c-629b-4bdb-8764-1cf6ced932ac

A pdf accompanying this announcement is available at http://ml.globenewswire.com/Resource/Download/2a35d66c-da0c-4c22-8fef-005c02b0a2db

![]()