Canadian North Resources Inc. Reports Financial Results and Operational Update for the Second Quarter Ended June 30, 2024

Highlights:

- Filed the new National Instrument 43-101 Technical Report that defines the large and high-grade Mineral Resources at the Ferguson Lake Project (Table 1). 80% of the Indicated Mineral Resource is Open Pit, which provides a solid Mineral Resource base for the initial development of a potential large mine.

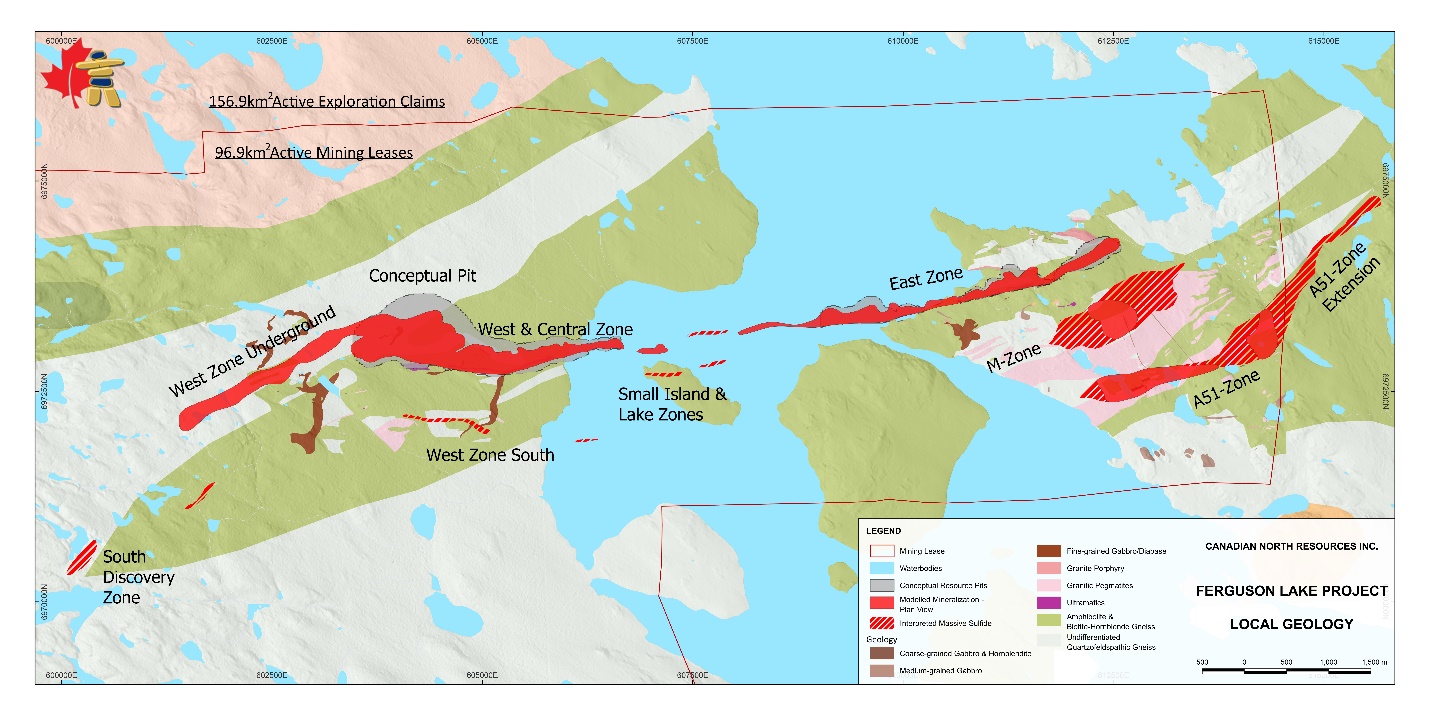

- Planned geophysical programs for generating new exploration targets with significant resource upside potential along strike and down dip of the 15 km long main mineralized horizon and on additional zones including M-Zone, A51-Zone, West Zone Extension, West Zone South and South Discovery Zone (Figure 1).

- Based on the new Technical Report, planned new metallurgical tests, community engagement programs and economic evaluation and infrastructure and environmental studies for low-carbon footprint mine development at the Ferguson Lake Project.

TORONTO, Aug. 27, 2024 (GLOBE NEWSWIRE) — Canadian North Resources Inc. (“Canadian North” or the “Company”) (TSXV: CNRI; OTCQX: CNRSF; FSE: EO0 (E-O-zero)) is pleased to report its operational and financial results for the second quarter ended June 30, 2024.

Dr. Kaihui Yang, the President and CEO, commented: ”During this quarter, we filed the new National Instrument 43-101 Technical Report that demonstrates the Ferguson Lake project is one of the highest-grade and largest undeveloped copper, nickel, cobalt, palladium and platinum projects in North America (Refer to “Independent Technical Report on the Mineral Resource Estimate for the Ferguson Lake Project, Nunavut, Canada (“the Technical Report”)”, prepared by SRK Consulting and Ronacher McKenzie Geoscience Inc., effective March 19, 2024, filed by the Company to the System for Electronic Document Analysis and Retrieval (“SEDAR+”) through the Internet at https://www.sedarplus.ca/landingpage/ on May 3, 2024. The Technical Report has also been posted on the Company’s website at www.cnresources.com).”

“The Technical Report indicates the definition of substantial Mineral Resources (Table 1) and 80% of the Indicated Mineral Resource is Open Pit (Figure 1), which provides a solid Mineral Resource base for the initial development of a potential large mine. We are conducting follow-up metallurgical testing, including new technologies such as bio-hydrometallurgy, and have started the Community Engagement programs, reconnaissance access, infrastructure and environmental studies for a low-carbon footprint mine development plan at the Ferguson Lake Project.”

“The Technical Report indicates high potential for resource expansion along the strike and down dip of the 15-main mineralized horizon and within a number of undefined mineralization zones and prospective areas. We have planned the geological and geophysical evaluation programs to identify targets along the confirmed the high-grade mineralized zones at the Ferguson Lake Project.”

Figure 1, Geological map showing mineralization zones. The Mineral Resources incorporate West, Central and East Zones.

Table 1: Mineral Resource Statement*, Ferguson Lake Project, Nunavut, SRK Consulting (Canada) Inc., March 19, 2024

| Mineral Resource Statement, Ferguson Lake Project, Canada. SRK Consulting (Canada)., March 19, 2024 | |||||||||||||

| Mining Method | Category | Tonnes (Mt) | Grade | Material Content | |||||||||

| NSR | Cu | Ni | Co | Pd | Pt | Cu | Ni | Co | Pd | Pt | |||

| (US$/t) | (%) | (%) | (%) | g/t | g/t | (Mlbs) | (Mlbs) | (Mlbs) | (‘000oz) | (‘000oz) | |||

| Open Pit | Indicated | 52.7 | 149 | 0.65 | 0.43 | 0.05 | 0.97 | 0.17 | 755.7 | 497.2 | 57.7 | 1,647 | 295 |

| Inferred | 4.0 | 159 | 0.65 | 0.50 | 0.06 | 0.88 | 0.17 | 56.7 | 43.4 | 5.3 | 111 | 21 | |

| Underground | Indicated | 13.5 | 243 | 1.13 | 0.61 | 0.07 | 1.60 | 0.29 | 336.8 | 181.0 | 21.6 | 692 | 124 |

| Inferred | 21.9 | 231 | 1.04 | 0.60 | 0.07 | 1.53 | 0.26 | 501.0 | 289.7 | 34.4 | 1,081 | 184 | |

| Total | Indicated | 66.1 | 168 | 0.75 | 0.47 | 0.05 | 1.10 | 0.19 | 1,092.5 | 678.2 | 79.3 | 2,340 | 419 |

| Inferred | 25.9 | 220 | 0.98 | 0.58 | 0.07 | 1.43 | 0.25 | 557.8 | 333.1 | 39.6 | 1,192 | 205 | |

Mineral Resource Estimation Notes

- The Mineral Resource estimation work including construction of geological solids, grade estimation, associated sensitivity analyses, and Mineral Resource classification was completed by Joycelyn Smith, P.Geo. (PGO#2963), under supervision of Mr. Glen Cole, P.Geo. (PGO#1416), an appropriate independent Qualified Person as this term is defined in National Instrument 43-101.

- The Mineral Resources have been estimated in conformity with generally accepted Canadian Institute of Mining (CIM) Estimation of Mineral Resource and Mineral Reserves Best Practices Guidelines (November 2019) and are reported in accordance with the Canadian Securities Administrators’ National Instrument (NI) 43-101.

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate.

- A total of 18 massive sulphide and two low-sulphide platinum group element (LSPGE) domains were modeled within an overall host gabbroic intrusion to constrain the mineralization.

- The Mineral Resources for the Ferguson Lake Project are estimated based 756 boreholes (approximately 226,167 metres) as of November 2, 2023, including 129 boreholes (approximately 35,775 meters) added to the deposit model out of the 39,270 metres completed since the previous Mineral Resource update as on June 13, 2022 (refer to “Independent Technical Report, Updated Mineral Resource Estimate, Ferguson Lake Project, Nunavut, Canada, Prepared by Ronacher McKenzie Geoscience Inc. and Francis Minerals Ltd.” filed by the Company to Sedar.com on July 13, 2022).

- All composites have been capped where appropriate.

- The Mineral Resources for the Ferguson Lake Project were estimated using Leapfrog Edge™ software. The estimation parameters consider 3 passes estimated by Ordinary Kriging with progressively relaxed criteria, including a requirement of 3-4 boreholes in the first pass, 2-3 boreholes in the second pass and at least 4 composites in the third pass. Massive sulphide domains were estimated with hard boundaries, and LSPGE domains were estimated with limited (10m) soft boundaries.

- The block classification strategy considers drillhole spacing, geologic confidence and continuity of category. Indicated Mineral Resources were defined for blocks inside geological resource solids estimated within the first two passes and having a nominal drillholes spacing less than 150 metres. Classification results were smoothed to improve continuity.

- Mineral Resources are reported in relation to a conceptual pit shell and underground mining shapes. Open pit Mineral Resources include all blocks inside the conceptual shell. Underground mineral resources include blocks not meeting open pit reporting requirements contained within conceptual mining shapes.

- Open pit Mineral Resources are reported at a NSR cut-off value of US$33.00 and underground Mineral Resources are reported at a NSR cut-off value of US$96.00. Cut-off values are based on a price of US$4.00 per pound of copper, US$9.00 per pound of nickel, US$22.00 per pound of cobalt, US$1,250 per ounce of palladium, and US$1,150 per ounce of platinum, and recoveries of 95 percent for copper, 51 percent for nickel, 89 percent for cobalt, 76 percent for palladium and 60 percent for platinum for massive sulphide material, and 78 percent for copper, 29 percent for nickel, 48 percent for cobalt, 60 percent for palladium and 70 percent for platinum for LSPGE material, for open pit and underground resources.

- The reported Mineral Resource is inclusive of East, Central and West zones along the 15km-long main mineralized horizon.

Quarter 2 of 2024 Highlights:

- The Company ended the quarter with cash and cash equivalents of $3,775,557

- The Company engaged in the following activities in the second quarter:

- April 3, 2024, the Company provided an update for the metallurgical testing programs. Metallurgical flotation and gravity test results indicate the reasonable probability of producing three payable copper, nickel and PGM bearing concentrates from the various types of mineralized materials that comprise its National instrument 43-101 Mineral Resource of the Ferguson Lake Project, suggesting a potential low-capital cost option for the project development. Alternatively, hydrometallurgy is considered as an effective option albeit with higher capital and operating cost. The Company will focus on follow-up investigations using new technologies for metal extraction.

- April 5, 2024, the Company announced that it has filed with the TSX Venture Exchange a Notice of Intention to Make a Normal Course Issuer Bid (“NCIB”) which will commence on April 10, 2024 and terminate on April 9, 2025 or the earlier of the date all shares which are subject to the Normal Course Issuer Bid are purchased. In the opinion of the Board of Directors of the Company, the market price of the Common Shares does not accurately reflect the value of those shares. As a result, the Company intends to repurchase CNRI’s Common Shares that may become available for purchase at prices, which make them an appropriate use of funds of the Company. The Company intends to attempt to acquire up to an aggregate of 5,726,380 of its Common Shares over the next 12-month period, representing approximately 5% of the issued and outstanding Common Shares of CNRI.

- April 24, 2024, the Company filed the annual financial results and operational updates for 2023. During the year, the Company raised over $17 million for exploration, with cash and cash equivalents of $5,540,312 at the year end. The Company completed an aggressive exploration program with 21,126 meters drilled in 2023 for a cumulative total of 39,270 meters in 145 holes of new diamond drilling to the project database for the updated Mineral Resources estimation reported on March 19, 2024. The statement of the updated Mineral Resources demonstrates the Ferguson Lake project is one of the highest-grade and largest undeveloped critical mineral projects in North America. The Company plans to continue drilling to expand the mineral resources and to conduct follow-up metallurgical testing, commence economic evaluation, infrastructure and environmental studies for a low-carbon footprint mine development plan at the Ferguson Lake Project.

- May 6, 2024, the Company filed the Independent Technical Report on the Mineral Resources Estimation for the Ferguson Lake project. The Technical Report supports the definition of the large and high-grade Mineral Resource at the Ferguson Lake Project, including 52.7Mt of high-grade open pit Indicated Mineral Resources at 0.65% Cu, 0.43% Ni, 0.05% Co, 0.97g/t Pd and 0.17% Pt, which provides a solid Mineral Resource base for the initial development of a potential large mine. Mineral Resources are estimated for West, Central and East Zones along the 15km-long main mineralized horizon. The Mineral Resource model indicates potential for continued Mineral Resource expansion along strike and at depth over the mineralized horizon. Significant resource upside potential outside the main mineralized zone is also anticipated when sufficient grid definition drilling is completed on additional zones including M-Zone, A51-Zone, A51 Zone Extension, West Zone South and South Discovery Zone.

- May 27, the Company reported the financial results and operational update for the first quarter ended March 31, 2024. During the quarter, the Company planned geological and geophysical programs and identified new targets with significant resource upside potential along strike and down dip of the 15 km long main mineralized horizon and on additional zones including M-Zone, A51-Zone, A51 Zone Extension, Small Island and Lake Zone, West Zone South and South Discovery Zone. The Company also planned new metallurgical tests, economic evaluation and infrastructure and environmental studies for low-carbon footprint mine development at the Ferguson Lake Project.

- June 19, the Company announced the voting results for the election of its Board of Directors at its Annual and Special Meeting of Shareholders held on June 18, 2024.

For the quarter ended June 30, 2024, the Company reported a net loss and comprehensive loss of $1,227,973 or $0.01 per share.

For the quarter end Financial Statement and Management’s Discussion and Analysis, please see the Company website at www.cnresources.com or on SEDAR.

Qualified Person:

Dr. Trevor Boyd, P.Geo. and Technical Advisor for Canadian North Resources, a qualified person as defined by Canadian National Instrument 43-101 standards, has reviewed the technical content of this news release and has approved its dissemination.

About Canadian North Resources Inc.

Canadian North Resources Inc. is an exploration and development company focusing on the critical metals for the clean-energy, electric vehicles, battery and high-tech industries. The company is advancing its 100% owned Ferguson Lake nickel, copper, cobalt, palladium, and platinum project in the Kivalliq Region of Nunavut, Canada.

The Ferguson Lake mining property contains a substantial National Instrument 43-101 compliant Mineral Resource Estimate announced on March 19 2024, which include Indicated Mineral Resources of 66.1 million tonnes (Mt) containing 1,093 million pounds (Mlb) copper at 0.75%, 678Mlb nickel at 0.47%, 79.3Mlb cobalt at 0.05%, 2.34 million ounces (Moz) palladium at 1.10gpt and 0.419Moz platinum at 0.19gpt; and Inferred Mineral Resources of 25.9Mt containing 558Mlb copper at 0.98%, 333Mlb nickel at 0.58%, 39.6Mlb cobalt at 0.07%, 1.192Moz palladium at 1.43gpt and 0.205Moz platinum at 0.25gpt. In particular, 80% of the Indicated Mineral Resources is Open Pit with 52.7Mt at 0.65% Cu, 0.43% Ni, 0.05% Co, 0.97g/t Pd and 0.17% Pt, which provides a solid Mineral Resource base for the initial development of a potential large mine. The Mineral Resource model indicates significant potential for resource expansion along strike and at depth over the 15 km long mineralized belt and a number of undefined mineralization zones and prospective areas. (Refer to “Independent Technical Report on the Mineral Resource Estimate for the Ferguson Lake Project, Nunavut, Canada (“the Technical Report”)”, prepared by SRK Consulting and Ronacher McKenzie Geoscience Inc., effective March 19, 2024, filed by the Company to the System for Electronic Document Analysis and Retrieval (“SEDAR+”) through the Internet at https://www.sedarplus.ca/landingpage/ on May 3, 2024. The Technical Report has also been posted on the Company’s website at www.cnresources.com.)

For further information please visit the website at www.cnresources.com, or contact:

Dr. Kaihui Yang, President and CEO

Phone: 905-696-8288 (Canada) 1-888-688-8809 (Toll-Free)

Email: info@cnresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, including statements which may contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions, and statements related to matters which are not historical facts, are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management’s expectations regarding the Company’s future growth, results of operations, performance, business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.

These factors should be considered carefully, and readers should not place undue reliance on the Company’s forward-looking statements. The Company believes that the expectations reflected in the forward-looking statements contained in this news release and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to release publicly any future revisions to forward-looking statements to reflect events or circumstances after the date of this news or to reflect the occurrence of unanticipated events, except as expressly required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/062988b1-73df-44c4-8e99-57e6bfe2d378

![]()