Abcourt Begins a Drilling Campaign to Enhance the Mining Potential at Depth at the Sleeping Giant Mine

ROUYN-NORANDA, Quebec, Oct. 02, 2024 (GLOBE NEWSWIRE) — Abcourt Mines Inc. (“Abcourt” or the “Corporation”) (TSX Venture: ABI) (OTCQB: ABMBF) is pleased to announce that it will undertake a drilling program to enhance the deep mining potential of the Sleeping Giant mine.

The 3D model of the mineral resource estimate made by InnovExplo in December 2022 shows the presence of several high-grade mineralized veins towards the lower levels of the mine.

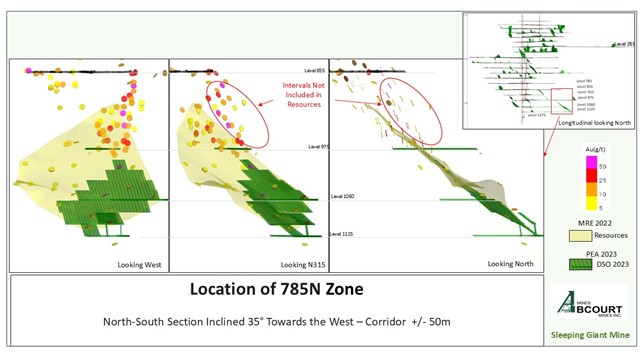

The Preliminary Economic Assessment carried out by InnovExplo in June 2023 made it possible to optimize several production sites in the same sector. Several of these workings belong to the 785N zone located east of the mine at the bottom of level 785. (figure 1).

Figure 1: Location of 785N Zone.

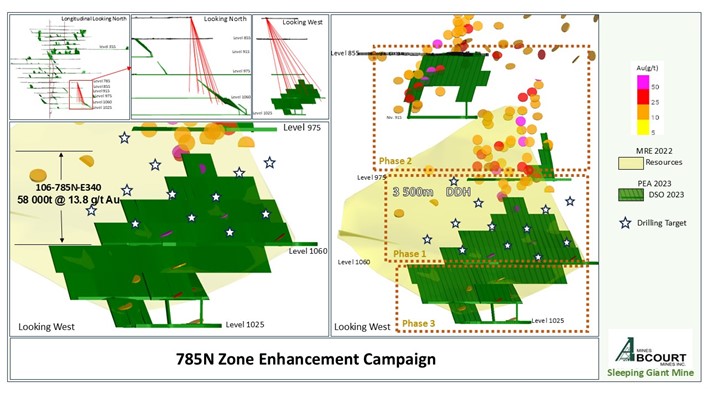

The 785N zone is made up of several parallel mineralized veins oriented north south. The dip of these veins varies between 30 and 40 degrees towards the east. The development campaign for zone 785N will be carried out in 3 phases: (figure 2).

Figure 2: 785N Zone Enhancement Campaign.

Phase 1: 3,500m drilling campaign from level 785:

The objective of this drilling campaign is to increase the level of confidence in the potential of the 106-785N-E340 stope by reducing the spacing between drilling to justify the development of access galleries to the stope.

The main mineralized intervals intercepted in the stope are:

64.7 g/t Au over 1 meter in hole 66-1127A-11,

50.2 g/t Au over 1 meter in hole 66-1141-11 and,

52.9 g/t Au over 0.5 meter in hole e 66-1022-10.

According to the Preliminary Economic Assessment carried out by InnovExplo in June 2023, the tonnes and grades of the 106-785N-E340 stope are estimated at 58,052t at 13.8 g/t Au. (See technical notes*)

According to the Mineral Resource Estimation of December 2022, the 106-785N-E340 stope belongs to the inferred resources category.

Phase 2: Reassessment of the Potential of the upper part of zone 785N:

By interpreting the 3D model of the veins in the upper part of zone 785N, we notice:

- A high local concentration of drilling holes in the central part,

- The presence of several interesting, mineralized intervals greater than 10 g/t gold,

- Several of these mineralized intervals are not included in the December 2022 Mineral Resource Estimation.

The second phase consists of optimizing the modeling of the veins in the upper part of the 785N zone and redoing it to reassess its economic interest.

Phase 2 will be done at the same time as phase 1.

Phase 3: Definition Drilling Campaign:

Definition drilling will be done from drilling bays which will be developed at the same time as the access drifts to the production stope. Additional drift development work will be planned to cover the maximum area of the 785N zone by drilling.

Next Steps:

- Rehabilitation and preparation work on the level 785 access drift has begun to allow the installation of the drill.

- A night shift will be added from October 15, 2024 to double the drilling rate.

- Abcourt is studying the possibility of adding a second drill for this campaign in order to continue its initial drilling program to define the production sites in accordance with the production start-up plan.

Pascal Hamelin, President and CEO, comments: “With the addition of a second underground shift, we will be able to increase the pace at all levels. Whether in drilling, interpretation, design, development and mining extraction. Drilling in the 785N zone will allow us to better define a zone with very high potential and test the lateral and extensions at depth of this high-grade zone.”

* Technical Notes:

All technical information contained in this press release comes from the technical report of the of then mineral resources Estimation made by InnovExplo in December 2022 (MRE 2022) as well as the technical report of the Preliminary Economic Assessment also made by InnovExplo in June 2023 (PEA 2023).

Notes to the 2022 MRE

- The independent and qualified persons for the 2022 MRE, as defined by NI 43-101 are Olivier Vadnais-Leblanc, P. Geo. and Eric Lecomte, ing, all from InnovExplo Inc.

- These mineral resources are not mineral reserves because they do not have demonstrated economic viability. The results are presented undiluted and are considered to have reasonable prospects of economic viability. The 2022 MRE follows the CIM Standards.

- The estimate encompasses 846 mineralized lenses that were modelled using a minimal geological width of 0.5m using Genesis software.

- A density value of 2.85 g/cm3 (based on measurements and mine et mill reconciliation) was assigned to all mineralized zones.

- High-grade capping supported by statistical analysis was done on composites data and established at 95 g/t Au for all mineralized zones. Composites (0.5 m) were calculated within the zones using the grade of the adjacent material when assayed or a value of zero when not assayed.

- The exigence of a Reasonable Prospect of Eventual Economical Extraction is fulfilled by the use of cut-off grades based on reasonable mining parameters and locally constrained within Deswik Stope Optimizer shapes using a minimal mining width of 1.7 m for both potential methods. It is reported at a rounded cut-off grade of 4.25 g/t Au using the long-holes (LH) method, and 5.0 g/t Au, using the Room and Pillars (R&P) method. The cut-off grades were calculated using the following parameters: mining cost = C$213.96/t (LH) to C$261.56/t (R&P); processing cost = C$35.10/t; G&A = C$22.09/t; gold price = US$1,650.00/oz and USD:CAD exchange rate = 1.30. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The estimate was completed using a sub-block model in Surpac 2022. A 4m x 4m x 4m parent block size was used (1m x 1m x 1m sub-blocked). Grade interpolation was obtained by Inverse Distance Squared (ID2) using hard boundaries.

- The mineral resource estimate is classified as Indicated and Inferred. The Inferred category is defined with a minimum of three (3) drill holes within the areas where the drill spacing is less than 75 m and shows reasonable geological and grade continuity. The Indicated mineral resource category is defined with a minimum of four (4) drill holes within the areas where the drill spacing is less than 30 m and shows reasonable geological and grade continuity.

- The number of metric tonnes was rounded to the nearest hundred, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348) rounded to the nearest hundred.

- The independent and qualified persons for the 2022 MRE are not aware of any known environmental, permitting, legal, political, title-related, taxation, socio-political, or marketing issues that could materially affect the Mineral Resource Estimate.

Qualified Persons

Mohamed Haithem Bennia, geo, superintendent geology of the Sleeping Giant mine, wrote, collected, verified and approved the technical information contained in this press release.

Pascal Hamelin, Eng, President and Chief Executive Officer of the Corporation, has verified and approved the technical information contained in this press release.

Mr. Hamelin and Mr. Bennia are qualified persons under Regulation 43-101.

About Abcourt Mines Inc.

Abcourt Mines Inc. is a Canadian gold exploration Corporation with properties strategically located in northwestern Quebec, Canada. Abcourt 100% owns the Sleeping Giant mill and mine where it concentrates its activities. The Sleeping Giant mine has a mining lease, as well as environmental certificates of authorization to extract up to 750 tonnes per day from its underground mine.

For more information about Abcourt Mines Inc., please visit our website and view our filings under Abcourt’s profile on www.sedarplus.ca.

| Pascal Hamelin | Dany Cenac Robert, Investor Relations |

| President and Chief Executive Officer | Reseau ProMarket Inc., |

| T : (819) 768-2857 | T : (514) 722-2276, ext 456 |

| Email :phamelin@abcourt.com | Email : dany.cenac-robert@reseaupromarket.com |

FORWARD-LOOKING STATEMENTS

Certain information contained in this news release may constitute “forward-looking information” within the meaning of Canadian securities legislation. Generally, forward-looking information can be identified by using forward-looking terminology, such as “plans”, “aims”, “expects”, “projects”, “intends”, “anticipates”, “estimates”, “could”, “should”, “likely”, or variations of such words and phrases or statements specifying that certain acts, events or results “may”, “should”, “will” or “be achieved” or other expressions Similar. Forward-looking statements are based on Abcourt’s estimates and are subject to known and unknown risks, uncertainties and other factors that may cause Abcourt’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements or information. Forward-looking statements are subject to business, economic and uncertainties and other factors that could cause actual results to differ materially from these forward-looking statements, including the relevant assumptions and risk factors set forth in Abcourt’s public filings, which are available on SEDAR at www.sedarplus.ca. There can be no assurance that these statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Although Abcourt believes that the assumptions and factors used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on such statements. Except as required by applicable securities laws, Abcourt disclaims any intention or obligation to update or revise any such forward-looking statements or information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/565da984-d6db-478d-b026-523a0cb94912

https://www.globenewswire.com/NewsRoom/AttachmentNg/4de1c7d8-9bb8-4fa4-ad07-7e8fc1b93d2b

![]()