Magna Mining Continues to Intersect Copper and Precious Metal Bearing Veins in Multiple Drill Holes at Levack Mine’s R2 Target in Sudbury, Including 25.0% Copper, 34.7 g/t Pt+Pd+Au, and 151 g/t Silver over 0.4 metres

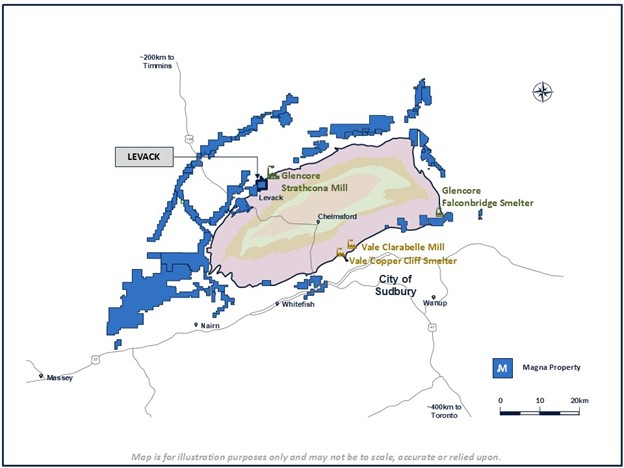

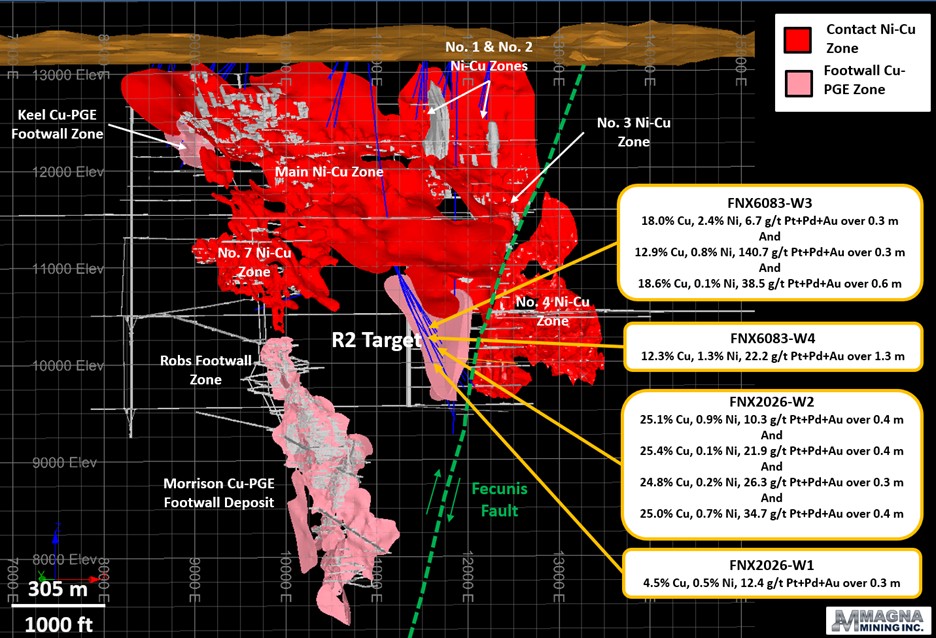

SUDBURY, Ontario, Dec. 09, 2025 (GLOBE NEWSWIRE) — Magna Mining Inc. (TSXV: NICU) (OTCQX: MGMNF) (FSE: 8YD) (“Magna” or the “Company”) is pleased to provide an update on exploration activities and assay results from ongoing exploration at the past-producing Levack Mine, located in the North Range of the Sudbury Basin, northeastern Ontario, Canada (Figure 1). Today’s release incorporates the results from four diamond drill holes which tested the R2 target, with all four holes intersecting multiple veins containing high grade copper (“Cu”) and precious metals, including platinum (“Pt”), palladium (“Pd”), gold (“Au), and silver (“Ag”). Mineralization within the R2 target area has now been intersected over a vertical extent of greater than 200 metres and remains open up-dip towards the No. 3 Footwall Zone and at depth and to the west towards the Morrison Footwall Cu-PGE Deposit.

| Highlights from the new assay results include: | ||

| • | FNX6083-W3 | 12.9% Cu, 140.7 g/t Pt+Pd+Au and 78.0 g/t Ag over 0.3 metres, from 955.7 metres down hole |

| And | 18.6% Cu, 38.5 g/t Pt+Pd+Au and 105.0 g/t Ag over 0.6 metres, from 1,027.1 metres down hole | |

| • | FNX6083-W4 | 12.3% Cu, 22.2 g/t Pt+Pd+Au and 78.9 g/t Ag over 1.3 metres, from 1,211.2 metres down hole |

| • | FNX2026-W1 | 4.5% Cu, 12.4 g/t Pt+Pd+Au and 30.0 g/t Ag over 0.3 metres, from 1,096.7 metres down hole |

| • | FNX2026-W2 | 24.8% Cu, 26.3 g/t Pt+Pd+Au and 153.0 g/t Ag over 0.3 metres, from 1,069.4 metres down hole |

| And | 25.0% Cu, 34.7 g/t Pt+Pd+Au and 151.0 g/t Ag over 0.4 metres, from 1,083.4 metres down hole | |

Dave King, SVP Exploration and Geoscience stated, “Diamond drilling on the R2 exploration target has continued to intersect multiple high-grade copper and precious metal veins, and further our understanding of the footwall breccias and the geological controls on sulphide veining. Although the individual vein intersections reported today are narrow, we continue to believe the R2 mineralization is part of a regionally significant footwall Cu-precious metals system centered near the Fecunis fault. The R2 mineralization may be associated with the Levack No. 3 Footwall Zone and the Morrison Footwall Cu-PGE Deposit, as well as other known footwall Cu-precious metals deposits located on the east side of the Fecunis fault. Given the optimal geological conditions, footwall veins can thicken quickly over short distances resulting in significant sulphide concentrations. We continue to focus our exploration efforts on defining and extending mineralization at the R2 target, as well as exploring for other, new Cu-precious metals footwall systems at Levack.”

The four diamond drill holes in today’s press release were designed to test the depth potential of the R2 target area below the mineralization intersected in previously released holes FNX6038-W1 and FNX6038-W2 (see news releases dated August 28, 2025 and October 23, 2025). Drillholes FNX6083-W4 and FNX6083-W3 are additional wedge holes drilled from the same surface drill hole platform and were successful in extending the mineralization at depth by 25 metres and 75 metres below FNX6083-W1, respectively. Of note, drillhole FNX6038-W3 encountered a total of nine mineralized intervals between 930 metres and 1,207 metres down hole, with intercepts ranging from 0.3 metres to 3.2 metres and including 18.6% Cu, 15.4 g/t Au, 20.0 g/t Pd, 3.0 g/t Pt, and 105 g/t Ag over 0.6 metres. Drillhole FNX6083-W4 encountered two closely spaced veins which returned 12.3% Cu, 1.3% Ni, 6.7 g/t Pt, 13.9 g/t Pd, 1.6 g/t Au, and 78.9 g/t Ag over 1.3 metres.

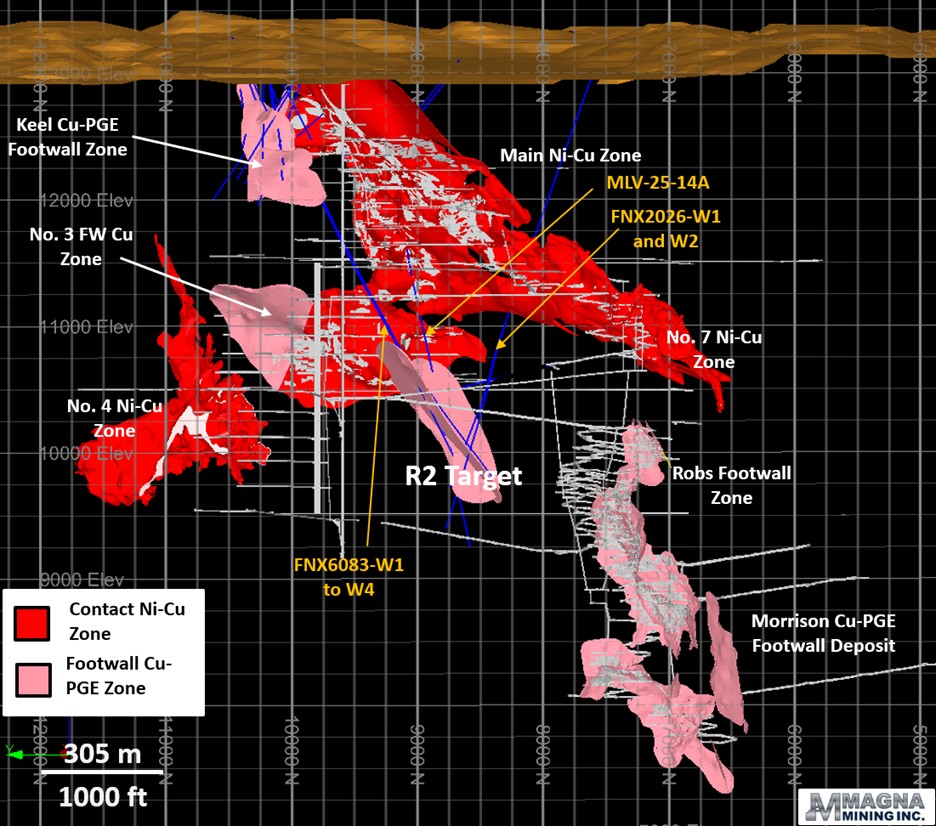

Drillholes FNX2026-W1 and FNX2026-W2 are wedge holes drilled from another historical surface drill platform and designed to investigate the R2 target via a different orientation (Figure 3). Drillhole FNX2026-W1 encountered six mineralized intervals approximately 25 metres to the southwest of FNX6038-W3, characterized by lower grade copper results relative to other R2 drillholes but impressive precious metals grades, including 4.5% Cu, 0.5% Ni, 3.4 g/t Pt, 6.5 g/t Pd, 2.5 g/t Au, and 30.0 g/t silver over 0.3 metres. These intercepts are currently interpreted to represent a different vein orientation than the veins identified elsewhere in the R2 target. Drillhole FNX2026-W2 targeted beneath FNX6083-W1 from a different orientation, and encountered four high grade veins over a 35 metre interval, each of which showed strong enrichment in copper and precious metals, such as 25.4% Cu, 4.7 g/t Pt, 16.8 g/t Pd, 0.4 g/t Au, and 185 g/t Ag over 0.4 metres, as well as 25.0% Cu, 15.3 g/t Pt, 14.7 g/t Pd, 4.8 g/t Au, and 151 g/t Ag over 0.4 metres. The mineralized veins in the R2 target area are characterized by high-grade precious metals values, similar to those observed at the Morrison Footwall Cu-PGE deposit, located 600 metres to the southwest.

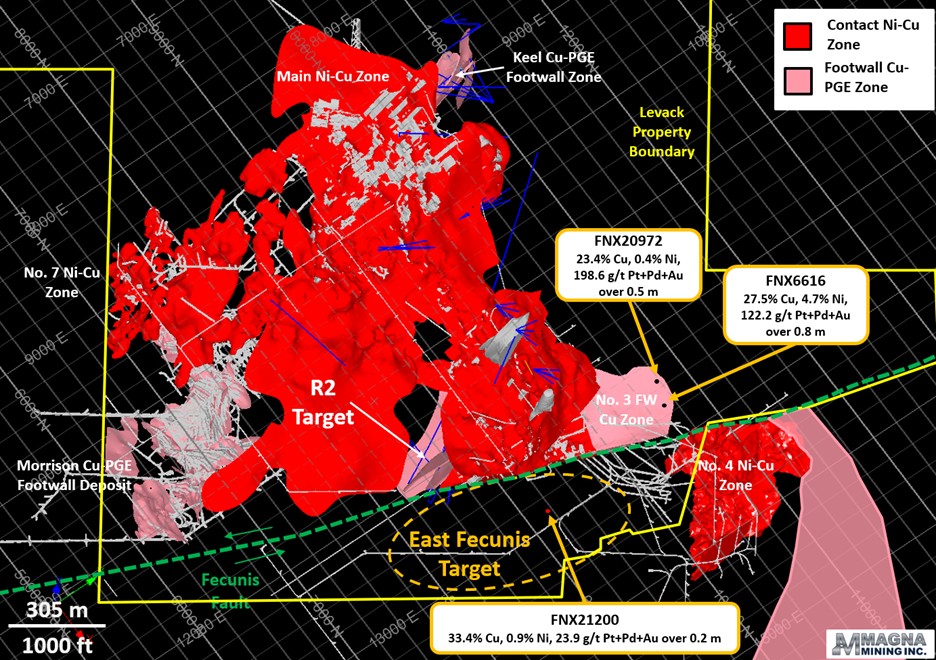

Drilling at the R2 target to date has identified a mineralized zone with at least two principal vein orientations over a vertical extent of approximately 215 metres and a strike length of up to approximately 85 metres and remains open up-dip towards the No. 3 Footwall Zone, and at depth to the west towards the Morrison Footwall Cu-PGE Deposit. Both the nature of the Sudbury Breccia host lithology and the structural setting appear to be important controls on vein thickness, distribution and orientation. The R2 mineralization is interpreted to be part of the regionally significant footwall Cu-precious metals system centered near the Fecunis fault. The R2 mineralization may be associated with the Levack No. 3 Footwall Zone and Morrison Footwall Cu-PGE Deposit, as well as known footwall Cu-precious metals deposits on the east side of the Fecunis fault. The historical intersection in drillhole FNX21200, grading 33.4% Cu and 23.9 g/t Pt+Pd+Au over 0.2 metres, may represent a fault offset continuation of the R2 footwall system on the east side of the Fecunis fault (Figure 4). Diamond drilling continues at Levack with two surface and two underground drill rigs to expand the R2 target area, as well as test for the faulted offset of R2 east of the Fecunis fault and other prospective targets in the footwall environment.

Figure 1: Location of Magna Mining’s Properties, Including the Levack Mine and Key Sudbury Infrastructure

Figure 2: 3D Longitudinal View Looking North, Showing the Levack Mine Mineralized Zones in Relation to the R2 Target and Current Drilling

Figure 3: 3D Vertical Section Looking East, Showing the Levack Mine Mineralized Zones in Relation to the R2 Target and Current Drilling

Figure 4: 3D Plan View Looking Down the Fecunis Fault, Showing the Levack Mine Mineralized Zones in Relation to the R2 Target and East Fecunis Exploration Target

Table 1: Summary of Drillhole Results

| Drillhole | Property | Zone | From (m) | To (m) | Length (m) | Cu % | Ni % | Co % | Pt g/t | Pd g/t | Au g/t | Ag g/t | Pt+Pd+Au g/t | NiEq | CuEq | |

| FNX6083-W3 | Levack | R2 Target | 930.90 | 931.26 | 0.36 | 3.16 | 0.32 | 0.01 | 0.14 | 0.75 | 1.95 | 15.00 | 2.84 | 2.68 | 4.78 | |

| and | 942.36 | 943.10 | 0.74 | 4.55 | 0.64 | 0.01 | 0.75 | 1.82 | 0.68 | 31.00 | 3.25 | 3.56 | 6.34 | |||

| and | 948.47 | 951.68 | 3.21 | 3.54 | 0.47 | 0.01 | 0.52 | 1.76 | 0.66 | 27.21 | 2.94 | 2.83 | 5.03 | |||

| including | 950.76 | 951.10 | 0.34 | 17.97 | 2.39 | 0.03 | 0.91 | 5.58 | 0.18 | 122.00 | 6.67 | 12.67 | 22.56 | |||

| and | 955.26 | 955.96 | 0.70 | 6.67 | 0.54 | 0.01 | 27.89 | 31.90 | 2.01 | 41.43 | 61.80 | 13.05 | 23.24 | |||

| Including | 955.66 | 955.96 | 0.30 | 12.94 | 0.82 | 0.02 | 63.96 | 73.25 | 3.53 | 78.00 | 140.74 | 28.00 | 49.86 | |||

| and | 965.72 | 966.20 | 0.48 | 1.35 | 0.17 | 0.00 | 1.91 | 2.14 | 17.12 | 26.00 | 21.17 | 6.54 | 11.64 | |||

| and | 1000.86 | 1001.74 | 0.88 | 0.66 | 0.04 | 0.00 | 7.19 | 6.51 | 1.21 | 33.00 | 14.91 | 2.67 | 4.76 | |||

| and | 1027.11 | 1027.70 | 0.59 | 18.62 | 0.11 | 0.00 | 3.03 | 20.02 | 15.43 | 105.00 | 38.48 | 17.95 | 31.97 | |||

| and | 1122.87 | 1123.17 | 0.30 | 5.20 | 0.18 | 0.00 | 0.21 | 2.95 | 0.10 | 36.00 | 3.26 | 3.42 | 6.09 | |||

| and | 1206.90 | 1207.40 | 0.50 | 6.28 | 0.60 | 0.00 | 6.53 | 13.19 | 0.65 | 40.00 | 20.37 | 6.86 | 12.22 | |||

| FNX6083-W4 | Levack | R2 Target | 870.16 | 870.58 | 0.42 | 6.14 | 0.08 | 0.00 | 0.04 | 7.66 | 0.47 | 32.00 | 8.17 | 4.61 | 8.20 | |

| and | 1211.16 | 1212.43 | 1.27 | 12.31 | 1.34 | 0.01 | 6.71 | 13.92 | 1.57 | 78.86 | 22.20 | 11.14 | 19.83 | |||

| including | 1211.16 | 1211.69 | 0.53 | 16.52 | 3.07 | 0.03 | 10.84 | 19.15 | 2.56 | 97.00 | 32.55 | 16.49 | 29.36 | |||

| and including | 1212.13 | 1212.43 | 0.30 | 22.68 | 0.20 | 0.00 | 8.40 | 24.37 | 1.82 | 161.00 | 34.59 | 17.52 | 31.19 | |||

| FNX2026-W1 | Levack | R2 Target | 1048.03 | 1048.33 | 0.30 | 3.86 | 0.17 | 0.01 | 0.48 | 1.98 | 0.18 | 24.00 | 2.64 | 2.63 | 4.68 | |

| and | 1076.70 | 1077.00 | 0.30 | 0.58 | 0.11 | 0.00 | 7.16 | 3.72 | 1.40 | 25.00 | 12.28 | 2.34 | 4.17 | |||

| and | 1093.55 | 1093.85 | 0.30 | 2.15 | 1.47 | 0.02 | 0.83 | 4.34 | 2.06 | 17.00 | 7.23 | 3.78 | 6.72 | |||

| and | 1096.66 | 1097.00 | 0.34 | 4.53 | 0.51 | 0.01 | 3.44 | 6.45 | 2.52 | 30.00 | 12.41 | 5.02 | 8.93 | |||

| and | 1110.09 | 1110.39 | 0.30 | 0.40 | 0.06 | 0.00 | 6.77 | 4.26 | 1.14 | 7.00 | 12.17 | 2.15 | 3.82 | |||

| and | 1113.20 | 1113.62 | 0.42 | 0.26 | 0.07 | 0.00 | 10.92 | 7.31 | 0.35 | 5.00 | 18.58 | 2.86 | 5.09 | |||

| FNX2026-W2 | Levack | R2 Target | 1050.00 | 1050.39 | 0.39 | 25.10 | 0.87 | 0.01 | 2.38 | 7.66 | 0.30 | 140.00 | 10.34 | 15.72 | 28.00 | |

| and | 1065.99 | 1069.74 | 3.75 | 4.98 | 0.35 | 0.00 | 2.64 | 3.53 | 0.27 | 34.87 | 6.44 | 3.92 | 6.98 | |||

| including | 1065.99 | 1066.40 | 0.41 | 25.41 | 0.14 | 0.00 | 4.74 | 16.75 | 0.36 | 185.00 | 21.85 | 16.90 | 30.09 | |||

| and including | 1069.43 | 1069.74 | 0.31 | 24.82 | 0.24 | 0.00 | 8.08 | 17.18 | 1.04 | 153.00 | 26.30 | 17.40 | 30.98 | |||

| and | 1083.37 | 1085.04 | 1.67 | 6.82 | 0.37 | 0.01 | 5.10 | 4.52 | 2.35 | 42.90 | 11.97 | 6.03 | 10.73 | |||

| including | 1083.37 | 1083.80 | 0.43 | 25.04 | 0.68 | 0.01 | 15.26 | 14.71 | 4.75 | 151.00 | 34.72 | 19.64 | 34.97 |

Important Notes

All lengths are downhole length. True widths are uncertain at this time.

Ni Eq % = (Ni% x 85% Recovery 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Ni $/lb.

Cu Eq % = (Ni% x 85% Recovery 2204 x Ni Price $/lb) + (Cu% x 96% Recovery x 2204 x Cu Price $/lb) + (Co% x 56% Recovery x 2204 x Co Price $/lb) + (Pt gpt x 69% Recovery / 31.1035 x Pt $/oz) +(Pd gpt x 68% Recovery / 31.1035 x Pd $/oz) + (Au gpt x 68% Recovery / 31.1035 x Au $/oz))/2204 x Cu $/lb.

Metal prices in US$: $7.30/lb Ni, $4.10/lb Cu, $15.00/lb Co, $1,000/oz Pt, $1,050/oz Pd and $2,200/oz Au.

Table 2: Drillhole Collar Coordinates

| BHID | Easting | Northing | Elevation | Azimuth | Dip | Depth (m) |

| FNX6083-W3 | 471667 | 5167000 | 398 | 116 | 63 | 1295 |

| FNX6083-W4 | 471667 | 5167000 | 398 | 116 | 63 | 1325 |

| FNX2026-W1 | 472101 | 5166287 | 339 | 358 | 67 | 1250 |

| FNX2026-W2 | 472101 | 5166287 | 339 | 358 | 67 | 1153 |

*Drillhole Coordinates are in Coordinate System NAD 83 Zone 17

Qualified Person for Technical Information

The scientific and technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under National Instrument 43-101.

Quality Assurance and Control

Sample QA/QC procedures for Magna have been designed to meet or exceed industry standards. Drill core is collected from the diamond drill and placed in sealed core trays for transport to Magna’s core facilities. Levack drilling utilizes NQ sized core and McCreedy West utilizes BQTK sized core. The core is then logged, and samples marked in intervals of up to 1.5m. Levack drill core is split and sampled ½ core, and McCreedy West is whole core sampled. Samples are then put into plastic bags with 10 bagged samples being placed into rice bags for transport to SGS Laboratories in Garson, Ontario for preparation, which are then shipped to Lakefield, Ontario for analysis. Samples are submitted in batches of 50 with 4 QA/QC samples including, 2 certified reference material standards and 2 samples of blank material.

Cautionary Statement on Forward-Looking Statements

All statements, other than statements of historical fact, contained or incorporated by reference in this press release constitute “forward-looking statements” and “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. Generally, these forward-looking statements can be identified by the use of forward-looking terminology, such as “may”, “might”, “potential”, “expect”, “anticipate”, “estimate”, “believe”, “can”, “could”, “should”, “would”, “will”, “interpreted”, “continue”, “intend”, “plan”, “forecast”, “prospective”, “significant” or other similar words or phrases or variations thereof. Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, economic, technical and other risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements, including risks and uncertainties relating to the failure of additional drilling to support assumptions, expectations or estimates of potential mineralization, metal tonnes or grade, such as those related to the Morrison Deposit, the failure of additional drilling to support additional expansion or delineation of estimated resources, the lack of availability of drill rigs or drill platforms to implement exploration or other programs or the failure to proceed as quickly as planned with additional exploration or other drilling, continued delays for assay results, the failure to proceed as quickly as planned with or to complete additional development as anticipated, such as the development of a ramp from the surface of, or recommissioning of the hoisting plant at, the Levack Mine, the failure to proceed as quickly as planned with a restart of mining at the Levack Mine, assuming there will be any restart, and other risks disclosed in the Company’s annual management discussion and analysis, available on the SEDAR+ website (at: www.sedarplus.ca). Although the Company has attempted to identify important risks, uncertainties, contingencies and factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements, there can be no certainty or assurance that the Company has accurately or adequately captured, accounted for or disclosed all such risks, uncertainties, contingencies or factors. Readers should place no reliance on forward-looking statements as actual results, performance or achievements may be materially different from those expressed or implied by such statements. Resource exploration and development, and mining operations, are highly speculative, characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge will not eliminate. Forward-looking statements speak only as of the date they are made. The Company does not undertake to update any forward-looking statements, whether as a result of new information or future events or otherwise, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

About Magna Mining Inc.

Magna Mining Inc. is a producing mining company with a strong portfolio of copper, nickel, and platinum group metals (PGM) assets located in the world-class Sudbury mining district of Ontario, Canada. The Company’s primary asset is the McCreedy West Mine, currently in production, supported by a pipeline of highly prospective past-producing properties including Levack, Crean Hill, Podolsky, and Shakespeare. Magna Mining is strategically positioned to unlock long-term shareholder value through continued production, exploration upside, and near-term development opportunities across its asset base.

Additional corporate and project information is available at www.magnamining.com and through the Company’s public filings on the SEDAR+ website at www.sedarplus.ca.

For further information, please contact:

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Executive Vice President

705-482-9667

Email: info@magnamining.com

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e9297943-6d03-4fc4-8642-e2539cc4f698

https://www.globenewswire.com/NewsRoom/AttachmentNg/9129192b-e26b-4a5e-8ad8-6e7546b36f30

https://www.globenewswire.com/NewsRoom/AttachmentNg/6fa5618e-f183-4455-9d0d-b55d7accac9f

https://www.globenewswire.com/NewsRoom/AttachmentNg/d86ac205-8d0a-4456-a177-7d015e843715

![]()