Beneficient Reports Results for Second Quarter Fiscal 2026

Second quarter results highlight improved cost management capital structure enhancements

DALLAS, Nov. 14, 2025 (GLOBE NEWSWIRE) — Beneficient (NASDAQ: BENF) (“Ben” or the “Company”), a technology-enabled platform providing exit opportunities and primary capital solutions and related trust and custody services to holders of alternative assets, today reported its financial results for the fiscal 2026 second quarter, which ended September 30, 2025.

Commenting on the fiscal 2026 second quarter results, interim Chief Executive Officer James Silk said: “The second quarter results demonstrate our disciplined approach to managing both our investment portfolio and operating expenses during a pivotal period for Beneficient. We reduced expenses, completed new primary capital transactions, generated additional liquidity through asset sales and brought the Company current on its SEC filings and certain Nasdaq listing requirements. These achievements reflect our disciplined execution and ongoing commitment to delivering value for our shareholders as we position the Company for long-term success.

“Our commitment to long-term shareholder value is further demonstrated by the decision to convert BCH Preferred Series A-1 held personally by myself and our board chairman into the Company’s Class A common stock, aligning leadership interests with those of our shareholders. Most importantly, Beneficient has regained compliance with Nasdaq’s periodic reporting requirement and market value of listed securities requirement, signaling renewed stability and a positive path forward.”

Second Quarter Fiscal 2026 and Recent Highlights (for the quarter ended September 30, 2025 or as noted):

- Reported investments with a fair value of $244.0 million, decreased from $291.4 million at the end of our prior fiscal year, which served as collateral for Ben Liquidity’s net loan portfolio of $223.1 million and $244.1 million, respectively.

- Operating expenses were $15.1 million in the second quarter of fiscal 2026, which included interest associated with a recognized loss contingency accrual of $1.7 million, as compared to $22.3 million in the second quarter of fiscal 2025, which included a non-cash goodwill impairment of $0.3 million. On a year-to-date basis, operating expenses for fiscal 2026 were $95.1 million, which included the accrual of a loss contingency accrual of $62.8 million and additional interest expense on the loss contingency accrual of $1.7 million, as compared to $(12.0) million, which included the release of a loss contingency accrual of $55.0 million and a non-cash goodwill impairment of $3.7 million.

- Excluding the non-cash goodwill impairment and the loss contingency accrual (release) along with associated interest expense on the loss contingency in each period, as applicable, operating expenses declined 38.8% to $13.4 million in the second quarter of fiscal 2026 as compared to $22.0 million in the same period of fiscal 2025. On a year-to-date basis, excluding the non-cash goodwill impairment, the loss contingency accrual (release), and associated interest expense on the loss contingency accrual in each period, as applicable, operating expenses were $30.6 million for the first half of fiscal 2026 as compared to $39.3 million for the first half of fiscal 2025.

- Further completed asset sales or equity redemptions of certain investments held by the Customer ExAlt Trusts, which has resulted in an aggregate of $46.4 million in gross proceeds on a year-to-date basis, which have been used to pay down certain debt and provide working capital.

- On October 15, 2025, as part of the Company’s plans to regain compliance with Nasdaq’s continued listing requirements, Beneficient Board Chairman Thomas Hicks and interim CEO James Silk elected to convert an aggregate of $52.6 million of personally held BCH Preferred Series A-1 holdings into shares of the Company’s Class A common stock. Additional details of the transaction are noted in the Company’s Quarterly Report on Form 10-Q for September 30, 2025.

- Announced that on October 29, 2025, we were notified by Nasdaq that the Company had (i) regained compliance with the Nasdaq periodic filing requirement and (ii) met the Nasdaq minimum $35 million market value of listed securities requirement as an alternative to Nasdaq’s minimum stockholders’ equity requirements.

Loan Portfolio

As a result of executing on our business plan of providing financing for liquidity, or early investment exits, for alternative asset marketplace participants, Ben organically develops a balance sheet comprised largely of loans collateralized by a well- diversified alternative asset portfolio that is expected to grow as Ben successfully executes on its core business.

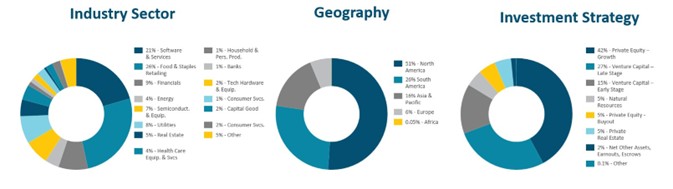

Ben’s balance sheet strategy for ExAlt Loan origination is built on the theory of the portfolio endowment model for the fiduciary financings we make by utilizing our patent-pending computer implemented technologies branded as OptimumAlt. Our OptimumAlt endowment model balance sheet approach guides diversification of our fiduciary financings across seven asset classes of alternative assets, over 11 industry sectors in which alternative asset managers invest, and at least six countrywide exposures and multiple vintages of dates of investment into the private funds and companies.

As of September 30, 2025, Ben’s loan portfolio was supported by a highly diversified alternative asset collateral portfolio providing diversification across approximately 190 private market funds and approximately 520 investments across various asset classes, industry sectors and geographies. This portfolio includes exposure to some of the most exciting, sought after private company names worldwide, such as a global manufacturer operating businesses in indoor air quality, safety, medical, energy and industrial markets, with over one hundred locations around the world; a designer and manufacturer of shaving products; a mobile banking services provider; a privately owned express intercity passenger rail system operator and owner of associated real estate; and a developer of an integrated e-commerce and fulfillment platform to sell wine direct-to-consumer, among others.

Figure 1: Portfolio Diversification

Diversification Using Principal Loan Balance, Net of Allowance for Credit Losses

As of September 30, 2025, the charts below present the ExAlt Loan portfolio’s relative exposure by certain characteristics (percentages determined by aggregate fiduciary ExAlt Loan portfolio principal balance net of allowance for credit losses, which includes the exposure to interests in certain of our former affiliates composing part of the Fiduciary Loan Portfolio).

As of September 30, 2025. The chart represents the characteristics of professionally managed funds and investments in the Collateral portfolio, which is comprised of a diverse portfolio of direct and indirect interests (through various investment vehicles, including, limited partnership interests and private and public equity and debt securities, which include our and our affiliates’ or our former affiliates’ securities), primarily in third-party, professionally managed private funds and investments. Loan balances used to calculate the percentages reported in the pie charts are loan balances, net of any allowance for credit losses, and as of September 30, 2025, the total allowance for credit losses was $358 million, for a total gross loan balance of $581 million and a loan balance net of allowance for credit losses of $223 million.

Business Segments: Second Quarter Fiscal 2026

Ben Liquidity

Ben Liquidity offers simple, rapid and cost-effective liquidity products through the use of our proprietary financing and trust structure, or the “Customer ExAlt Trusts,” which facilitate the exchange of a customer’s alternative assets for consideration.

- Ben Liquidity recognized $8.5 million of interest income for the fiscal second quarter, a decrease of 3.8% from the quarter ended June 30, 2025, primarily due to a higher percentage loans being placed on nonaccrual status, partially offset by the effects of compounding interest on the remaining loans.

- Operating loss for the fiscal second quarter was $0.8 million, an improvement from an operating loss of $6.0 million for the quarter ended June 30, 2025. The increase in operating performance was due to lower intersegment credit losses in the current fiscal period as compared to the quarter ended June 30, 2025 due in part because of the disposition of certain investments during the period, which generated loan payments at Ben Liquidity sooner than had been estimated in the prior period calculation of the intersegment credit losses.

Ben Custody

Ben Custody provides full-service trust and custody administration services to the trustees of certain of the Customer ExAlt Trusts, which own the exchanged alternative assets following liquidity transactions in exchange for fees payable quarterly calculated as a percentage of assets in custody.

- NAV of alternative assets and other securities held in custody by Ben Custody during the fiscal second quarter was $271.4 million as of September 30, 2025, compared to $338.2 million as of March 31, 2025. The decrease was driven by dispositions of certain alternative assets, distributions and unrealized losses on existing assets, principally related to adjustments to the relative share held in custody of the respective fund’s NAV based on updated financial information received from the funds’ investment manager or sponsor during the period or the fair value for investments deemed probable to be sold at an amount that differs from NAV, offset by $11.8 million of new originations.

- Revenues applicable to Ben Custody were $3.1 million for the fiscal second quarter, compared to $4.2 million for the quarter ended June 30, 2025. The decrease was a result of lower NAV of alternative assets and other securities held in custody at the beginning of the period when such fees are calculated along with certain upfront intersegment fees that are amortized into revenues over time being fully recognized in a prior period.

- Operating income for the fiscal second quarter decreased to $2.3 million from $3.1 million for the quarter ended June 30, 2025. The decrease was primarily due to the decline in revenues applicable to this operating segment as described above and employee and professional services expense, offset by slightly lower segment operating expenses.

Business Segments: Through Six Months Ended Fiscal 2026

Ben Liquidity

- Ben Liquidity recognized $17.3 million of interest income for the six months ended September 30, 2025, down 24.1% compared to the prior year period, primarily due to lower loans, net of the allowance for credit losses, resulting from higher levels of non-accrual loans and loan prepayments, partially offset by new loans originated.

- Operating loss was $6.8 million for the six months ended September 30, 2025, declining from operating income of $2.4 million in the prior year period. The decrease is partially a result of the lower revenues period over period plus an increase in intersegment credit losses in the current fiscal year as compared to the same period in the prior year.

Ben Custody

- Ben Custody revenues were $7.3 million for the six months ended September 30, 2025, down 32.5%, compared to the prior year period, primarily due to lower NAV of alternative assets and other securities held in custody along with certain upfront intersegment fees that are amortized into revenues over time being fully recognized in a prior period.

- Operating income was $5.4 million for the six months ended September 30, 2025 compared to operating income of $5.6 million in the prior year period. While revenues declined in the current year period as compared to the same period in the prior year, operating expenses declined by a similar amount primarily due to non-cash goodwill impairment in the prior year period of $3.4 million. No such impairment was recorded in the current year period.

- Adjusted operating income(1) for the six months ended September 30, 2025 was $5.4 million, compared to adjusted operating income(1) of $9.0 million in the prior year period with the decrease in adjusted operating income(1) primarily due to lower revenue related to lower NAV of alternative assets and other securities held in custody partially offset by slightly higher operating expenses during the current fiscal year period.

Capital and Liquidity

- As of September 30, 2025, the Company had cash and cash equivalents of $4.9 million and total debt of $104.0 million.

- Distributions received from alternative assets and other securities held in custody totaled $7.8 million for the six months ended September 30, 2025, compared to $12.5 million for the same period of fiscal 2025. Additionally, during six months ended September 30, 2025, we received proceeds of $37.2 million from the disposition of certain investments in alternative assets.

- Total investments (at fair value) of $244.0 million at September 30, 2025 supported Ben Liquidity’s loan portfolio.

(1) Represents a non-GAAP financial measure. For reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see Non-GAAP Reconciliations.

Consolidated Fiscal Second Quarter Results

Table 1 below presents a summary of selected unaudited consolidated operating financial information.

| Consolidated Fiscal Second Quarter Results ($ in thousands, except share and per share amounts) | Fiscal 2Q26 September 30, 2025 | Fiscal 1Q26 June 30, 2025 | Fiscal 2Q25 September 30, 2024 | Change % vs. Prior Quarter | YTD Fiscal 2026 | YTD Fiscal 2025 | Change % vs. Prior YTD | ||||||||||||

| GAAP Revenues | $ | (2,763 | ) | $ | (12,623 | ) | $ | 8,561 | 78.1 | % | $ | (15,386 | ) | $ | 18,607 | NM | |||

| Adjusted Revenues(1) | (2,759 | ) | (12,622 | ) | 8,734 | 78.1 | % | (15,381 | ) | 19,145 | NM | ||||||||

| GAAP Operating Income (Loss) | (17,864 | ) | (92,648 | ) | (13,715 | ) | 80.7 | % | (110,512 | ) | 30,623 | NM | |||||||

| Adjusted Operating Income (Loss)(1) | (12,588 | ) | (25,438 | ) | (6,611 | ) | 50.5 | % | (37,768 | ) | (11,337 | ) | NM | ||||||

| Basic Class A EPS | $ | (0.37 | ) | $ | (7.19 | ) | $ | 2.98 | NM | $ | (7.33 | ) | $ | 14.58 | NM | ||||

| Diluted Class A EPS | $ | (0.37 | ) | $ | (7.19 | ) | $ | 0.03 | NM | $ | (7.33 | ) | $ | 0.18 | NM | ||||

| Segment Revenues attributable to Ben’s Equity Holders(2) | 11,420 | 13,058 | 16,626 | (12.5)% | 24,478 | 32,861 | (25.5)% | ||||||||||||

| Adjusted Segment Revenues attributable to Ben’s Equity Holders(1)(2) | 11,420 | 13,058 | 16,626 | (12.5)% | 24,478 | 32,868 | (25.5)% | ||||||||||||

| Segment Operating Income (Loss) attributable to Ben’s Equity Holders | (8,084 | ) | (76,436 | ) | (9,192 | ) | 89.4 | % | (84,520 | ) | 35,672 | NM | |||||||

| Adjusted Segment Operating Income (Loss) attributable to Ben’s Equity Holders(1)(2) | $ | (2,812 | ) | $ | (9,227 | ) | $ | (2,261 | ) | 69.5 | % | $ | (11,781 | ) | $ | (6,814 | ) | (72.9)% | |

NM – Not meaningful.

(1) Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben’s Equity Holders and Adjusted Segment Operating Income (Loss) attributable to Ben’s Equity Holders are non-GAAP financial measures. For reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see Non-GAAP Reconciliations.

(2) Segment financial information attributable to Ben’s equity holders is presented to provide users of our financial information an understanding and visual aide of the segment information (revenues, operating income (loss), and adjusted operating income (loss)) that impacts Ben’s Equity Holders. “Ben’s Equity Holders” refers to the holders of Beneficient Class A and Class B common stock and Series B Preferred Stock as well as holders of interests in BCH, which represent noncontrolling interests. For a description of noncontrolling interests, see Item 2 of our Quarterly Report on Form 10-Q for the six months ended September 30, 2025, and Reconciliation of Business Segment Information Attributable to Ben’s Equity Holders to Net Income Attributable to Ben Common Holders. Such information is computed as the sum of the Ben Liquidity, Ben Custody and Corp/Other segments since it is the operating results of those segments that determine the net income (loss) attributable to Ben’s Equity Holders. See further information in table 5 and Non-GAAP Reconciliations.

Table 2 below presents a summary of selected unaudited consolidated balance sheet information.

| Consolidated Fiscal Second Quarter Results ($ in thousands) | Fiscal 2Q26 As of September 30, 2025 | Fiscal 4Q25 As of March 31, 2025 | Change % | ||||

| Investments, at Fair Value | $ | 243,978 | $ | 291,371 | (16.3)% | ||

| All Other Assets | 59,241 | 50,490 | 17.3% | ||||

| Goodwill and Intangible Assets, Net | 13,014 | 13,014 | —% | ||||

| Total Assets | $ | 316,233 | $ | 354,875 | (10.9)% | ||

Business Segment Information Attributable to Ben’s Equity Holders(1)

Table 3 below presents unaudited segment revenues and segment operating income (loss) for business segments attributable to Ben’s equity holders.

| Segment Revenues Attributable to Ben’s Equity Holders(1) ($ in thousands) | Fiscal 2Q26 September 30, 2025 | Fiscal 1Q26 June 30, 2025 | Fiscal 2Q25 September 30, 2024 | Change % vs. Prior Quarter | YTD Fiscal 2026 | YTD Fiscal 2025 | Change % vs. Prior YTD | |||||||||||

| Ben Liquidity | $ | 8,497 | $ | 8,837 | $ | 11,978 | (3.8)% | $ | 17,332 | $ | 22,827 | (24.1)% | ||||||

| Ben Custody | 3,081 | 4,183 | 5,386 | (26.3)% | 7,264 | 10,768 | (32.5)% | |||||||||||

| Corporate & Other | (158 | ) | 38 | (738 | ) | NM | (118 | ) | (734 | ) | 83.9 | % | ||||||

| Total Segment Revenues Attributable to Ben’s Equity Holders(1) | $ | 11,420 | $ | 13,058 | $ | 16,626 | (12.5)% | $ | 24,478 | $ | 32,861 | (25.5)% | ||||||

| Segment Operating Income (Loss) Attributable to Ben’s Equity Holders(1) ($ in thousands) | Fiscal 2Q26 September 30, 2025 | Fiscal 1Q26 June 30, 2025 | Fiscal 2Q25 September 30, 2024 | Change % vs. Prior Quarter | YTD Fiscal 2026 | YTD Fiscal 2025 | Change % vs. Prior YTD | |||||||||||

| Ben Liquidity | $ | (821 | ) | $ | (6,015 | ) | $ | 2,905 | 86.4 | % | $ | (6,838 | ) | $ | 2,391 | NM | ||

| Ben Custody | 2,292 | 3,128 | 4,329 | (26.7)% | 5,420 | 5,616 | (3.5)% | |||||||||||

| Corporate & Other | (9,555 | ) | (73,549 | ) | (16,426 | ) | 87.0 | % | (83,102 | ) | 27,665 | NM | ||||||

| Total Segment Operating Income (Loss) Attributable to Ben’s Equity Holders(1) | $ | (8,084 | ) | $ | (76,436 | ) | $ | (9,192 | ) | 89.4% | $ | (84,520 | ) | $ | 35,672 | NM | ||

NM – Not meaningful.

(1) Segment financial information attributable to Ben’s equity holders is presented to provide users of our financial information an understanding and visual aide of the segment information (revenues, operating income (loss), and adjusted operating income (loss)) that impacts Ben’s Equity Holders. “Ben’s Equity Holders” refers to the holders of Beneficient Class A and Class B common stock and Series B Preferred Stock as well as holders of interests in BCH, which represent noncontrolling interests. For a description of noncontrolling interests, see Item 2 of our Quarterly Report on Form 10-Q for the six months ended September 30, 2025, and Reconciliation of Business Segment Information Attributable to Ben’s Equity Holders to Net Income Attributable to Ben Common Holders. Such information is computed as the sum of the Ben Liquidity, Ben Custody and Corp/Other segments since it is the operating results of those segments that determine the net income (loss) attributable to Ben’s Equity Holders. See further information in table 5 and Non-GAAP Reconciliations.

Adjusted Business Segment Information Attributable to Ben’s Equity Holders(2)

Table 4 below presents unaudited adjusted segment revenue and adjusted segment operating income (loss) for business segments attributable to Ben’s equity holders.

| Adjusted Segment Revenues Attributable to Ben’s Equity Holders(1)(2) ($ in thousands) | Fiscal 2Q26 September 30, 2025 | Fiscal 1Q26 June 30, 2025 | Fiscal 2Q25 September 30, 2024 | Change % vs. Prior Quarter | YTD Fiscal 2026 | YTD Fiscal 2025 | Change % vs. Prior YTD | |||||||||||

| Ben Liquidity | $ | 8,497 | $ | 8,837 | $ | 11,978 | (3.8)% | $ | 17,332 | $ | 22,827 | (24.1)% | ||||||

| Ben Custody | 3,081 | 4,183 | 5,386 | (26.3)% | 7,264 | 10,768 | (32.5)% | |||||||||||

| Corporate & Other | (158 | ) | 38 | (738 | ) | NM | (118 | ) | (727 | ) | 83.8% | |||||||

| Total Adjusted Segment Revenues Attributable to Ben’s Equity Holders(1)(2) | $ | 11,420 | $ | 13,058 | $ | 16,626 | (12.5)% | $ | 24,478 | $ | 32,868 | (25.5)% | ||||||

| Adjusted Segment Operating Income (Loss) Attributable to Ben’s Equity Holders(1)(2) ($ in thousands) | Fiscal 2Q26 September 30, 2025 | Fiscal 1Q26 June 30, 2025 | Fiscal 2Q25 September 30, 2024 | Change % vs. Prior Quarter | YTD Fiscal 2026 | YTD Fiscal 2025 | Change % vs. Prior YTD | |||||||||||||

| Ben Liquidity | $ | (821 | ) | $ | (6,015 | ) | $ | 2,905 | 86.4 | % | $ | (6,838 | ) | $ | 2,396 | NM | ||||

| Ben Custody | 2,292 | 3,128 | 4,627 | (26.7)% | 5,420 | 9,043 | (40.1)% | |||||||||||||

| Corporate & Other | (4,283 | ) | (6,340 | ) | (9,793 | ) | 32.4 | % | (10,363 | ) | (18,253 | ) | 43.2 | % | ||||||

| Total Adjusted Segment Operating Income (Loss) Attributable to Ben’s Equity Holders(1)(2) | $ | (2,812 | ) | $ | (9,227 | ) | $ | (2,261 | ) | 69.5 | % | $ | (11,781 | ) | $ | (6,814 | ) | (72.9)% | ||

NM – Not meaningful.

(1) Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben’s Equity Holders and Adjusted Segment Operating Income (Loss) attributable to Ben’s Equity Holders are non-GAAP financial measures. For reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see Non-GAAP Reconciliations.

(2) Segment financial information attributable to Ben’s equity holders is presented to provide users of our financial information an understanding and visual aide of the segment information (revenues, operating income (loss), and adjusted operating income (loss)) that impacts Ben’s Equity Holders. “Ben’s Equity Holders” refers to the holders of Beneficient Class A and Class B common stock and Series B Preferred Stock as well as holders of interests in BCH, which represent noncontrolling interests. For a description of noncontrolling interests, see Item 2 of our Quarterly Report on Form 10-Q for the six months ended September 30, 2025, and Reconciliation of Business Segment Information Attributable to Ben’s Equity Holders to Net Income Attributable to Ben Common Holders. Such information is computed as the sum of the Ben Liquidity, Ben Custody and Corp/Other segments since it is the operating results of those segments that determine the net income (loss) attributable to Ben’s Equity Holders. See further information in table 5 and Non-GAAP Reconciliations.

Reconciliation of Business Segment Information Attributable to Ben’s Equity Holders to Net Income (Loss) Attributable to Ben Common Shareholders

Table 5 below presents reconciliation of operating income (loss) by business segment attributable to Ben’s Equity Holders to net income (loss) attributable to Ben common shareholders.

| Reconciliation of Business Segments to Net Income (Loss) to Ben Common Shareholders ($ in thousands) | Fiscal 2Q26 September 30, 2025 | Fiscal 1Q26 June 30, 2025 | Fiscal 2Q25 September 30, 2024 | YTD Fiscal 2026 | YTD Fiscal 2025 | |||||||||||

| Ben Liquidity | $ | (821 | ) | $ | (6,015 | ) | $ | 2,905 | $ | (6,838 | ) | $ | 2,391 | |||

| Ben Custody | 2,292 | 3,128 | 4,329 | 5,420 | 5,616 | |||||||||||

| Corporate & Other | (9,555 | ) | (73,549 | ) | (16,426 | ) | (83,102 | ) | 27,665 | |||||||

| Gain on liability resolution | — | — | 23,462 | — | 23,462 | |||||||||||

| Income tax expense (allocable to Ben and BCH equity holders) | (43 | ) | — | — | (43 | ) | (28 | ) | ||||||||

| Net loss attributable to noncontrolling interests – Ben | 9,191 | 15,984 | 3,067 | 25,175 | 10,254 | |||||||||||

| Noncontrolling interest guaranteed payment | (4,693 | ) | (4,624 | ) | (4,423 | ) | (9,317 | ) | (8,779 | ) | ||||||

| Net income (loss) attributable to Ben’s common shareholders | $ | (3,629 | ) | $ | (65,076 | ) | $ | 12,914 | $ | (68,705 | ) | $ | 60,581 | |||

Investor Webcast

Beneficient will host a webcast and conference call to review its second quarter financial results on November 18, 2025, at 8:00 am Eastern Standard Time. The webcast will be available via live webcast from the Investor Relations section of the Company’s website at https://shareholders.trustben.com under Events.

Replay

The webcast will be archived on the Company’s website in the investor relations section for replay for at least one year.

About Beneficient

Beneficient (Nasdaq: BENF) – Ben, for short – is on a mission to democratize the global alternative asset investment market by providing traditionally underserved investors − mid-to-high net worth individuals, small-to-midsized institutions and General Partners seeking exit options, anchor commitments and valued-added services for their funds− with solutions that could help them unlock the value in their alternative assets.

Its subsidiary, Beneficient Fiduciary Financial, L.L.C., received its charter under the State of Kansas’ Technology-Enabled Fiduciary Financial Institution (TEFFI) Act and is subject to regulatory oversight by the Office of the State Bank Commissioner.

For more information, visit www.trustben.com or follow us on LinkedIn.

Contacts

Investors:

Matt Kreps/214-597-8200/mkreps@darrowir.com

Michael Wetherington/214-284-1199/mwetherington@darrowir.com

investors@beneficient.com

Not an Offer of Securities

The information in this communication is for informational purposes only and shall not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. The securities that are the subject of the Transactions have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Disclaimer and Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to, among other things, demand for our solutions in the alternative asset industry, opportunities for market growth, our ability to identify and negotiate transactions, diversification and size of our loan portfolio and our ability to scale operations and provide shareholder value. These forward-looking statements are generally identified by the use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and, in each case, their negative or other various or comparable terminology. These forward-looking statements reflect our views with respect to future events as of the date of this document and are based on our management’s current expectations, estimates, forecasts, projections, assumptions, beliefs and information. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this document. It is not possible to predict or identify all such risks. These risks include, but are not limited to, our ability to consummate liquidity transactions on terms desirable for the Company, or at all, our ability to timely demonstrate compliance with the Nasdaq bid price requirement within the extension period granted by the Nasdaq Hearings Panel, our ability to cure any deficiencies in compliance with any other Nasdaq Listing Rules, our ability to obtain stockholder approval for a reverse stock split of the common stock, risks related to the substantial costs and diversion of management’s attention and resources due to these matters, and the risk factors that are described under the section titled “Risk Factors” in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document and in our SEC filings. We expressly disclaim any obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Table 6: CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

| Three Months Ended September 30, | Six Months Ended September 30, | ||||||||||||||

| (Dollars in thousands, except per share amounts) | 2025 | 2024 | 2025 | 2024 | |||||||||||

| Revenues | |||||||||||||||

| Investment income (loss), net | $ | (3,162 | ) | $ | 8,541 | $ | (15,938 | ) | $ | 19,569 | |||||

| Gain (loss) on financial instruments, net (related party of $(4), $(173), $(5) and $(538), respectively) | 211 | (179 | ) | 166 | (1,362 | ) | |||||||||

| Interest and dividend income | 10 | 12 | 20 | 24 | |||||||||||

| Trust services and administration revenues (related party of $8, $8, $15 and $15, respectively) | 178 | 187 | 366 | 376 | |||||||||||

| Total revenues | (2,763 | ) | 8,561 | (15,386 | ) | 18,607 | |||||||||

| Operating expenses | |||||||||||||||

| Employee compensation and benefits | 2,429 | 7,135 | 5,760 | 10,985 | |||||||||||

| Interest expense (related party of $3,140, $3,135, $6,457 and $6,189, respectively) | 4,898 | 4,320 | 8,313 | 8,608 | |||||||||||

| Professional services | 5,331 | 7,257 | 13,288 | 12,801 | |||||||||||

| Provision for credit losses | — | 476 | — | 1,000 | |||||||||||

| Loss on impairment of goodwill | — | 298 | — | 3,692 | |||||||||||

| Accrual (release) of loss contingency related to arbitration award | — | — | 62,831 | (54,973 | ) | ||||||||||

| Other expenses (related party of $714, $694, $1,428 and $1,388, respectively) | 2,443 | 2,790 | 4,934 | 5,871 | |||||||||||

| Total operating expenses | 15,101 | 22,276 | 95,126 | (12,016 | ) | ||||||||||

| Operating income (loss) | (17,864 | ) | (13,715 | ) | (110,512 | ) | 30,623 | ||||||||

| (Gain) loss on liability resolution | — | (23,462 | ) | — | (23,462 | ) | |||||||||

| Net income (loss) before income taxes | (17,864 | ) | 9,747 | (110,512 | ) | 54,085 | |||||||||

| Income tax expense | 43 | — | 43 | 28 | |||||||||||

| Net income (loss) | (17,907 | ) | 9,747 | (110,555 | ) | 54,057 | |||||||||

| Plus: Net loss attributable to noncontrolling interests – Customer ExAlt Trusts | 9,780 | 4,523 | 25,992 | 5,049 | |||||||||||

| Plus: Net loss attributable to noncontrolling interests – Ben | 9,191 | 3,067 | 25,175 | 10,254 | |||||||||||

| Less: Noncontrolling interest guaranteed payment | (4,693 | ) | (4,423 | ) | (9,317 | ) | (8,779 | ) | |||||||

| Net income (loss) attributable to Beneficient common shareholders | $ | (3,629 | ) | $ | 12,914 | $ | (68,705 | ) | $ | 60,581 | |||||

| Other comprehensive income (loss): | |||||||||||||||

| Unrealized (loss) gain on investments in available-for-sale debt securities | 92 | 26 | 92 | 5 | |||||||||||

| Total comprehensive income (loss) | (3,537 | ) | 12,940 | (68,613 | ) | 60,586 | |||||||||

| Less: comprehensive (loss) gain attributable to noncontrolling interests | 92 | 26 | 92 | 5 | |||||||||||

| Total comprehensive income (loss) attributable to Beneficient | $ | (3,629 | ) | $ | 12,914 | $ | (68,705 | ) | $ | 60,581 | |||||

| Net income (loss) per common share | |||||||||||||||

| Class A – basic | $ | (0.37 | ) | $ | 2.98 | $ | (7.33 | ) | $ | 14.58 | |||||

| Class B – basic | $ | (0.37 | ) | $ | 2.69 | $ | (7.33 | ) | $ | 14.80 | |||||

| Net income (loss) per common share | |||||||||||||||

| Class A – diluted | $ | (0.37 | ) | $ | 0.03 | $ | (7.33 | ) | $ | 0.18 | |||||

| Class B – diluted | $ | (0.37 | ) | $ | 0.03 | $ | (7.33 | ) | $ | 0.18 | |||||

Table 7: CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

| September 30, 2025 | March 31, 2025 | ||||||

| (Dollars and shares in thousands) | (unaudited) | ||||||

| ASSETS | |||||||

| Cash and cash equivalents | $ | 4,902 | $ | 1,346 | |||

| Investments, at fair value: | |||||||

| Investments held by Customer ExAlt Trusts (related party of nil and $5) | 243,978 | 291,371 | |||||

| Other assets, net (related party of $470 and $404) | 54,339 | 49,144 | |||||

| Intangible assets | 3,100 | 3,100 | |||||

| Goodwill | 9,914 | 9,914 | |||||

| Total assets | $ | 316,233 | $ | 354,875 | |||

| LIABILITIES, TEMPORARY EQUITY, AND EQUITY (DEFICIT) | |||||||

| Accounts payable and accrued expenses (related party of $16,143 and $14,733) | $ | 234,348 | $ | 156,770 | |||

| Other liabilities (related party of $24,874 and $19,360) | 29,861 | 24,381 | |||||

| Warrants liability | 365 | 227 | |||||

| Debt due to related parties | 103,960 | 117,896 | |||||

| Total liabilities | 368,534 | 299,274 | |||||

| Redeemable noncontrolling interests | |||||||

| Preferred Series A Subclass 0 Redeemable Unit Accounts, nonunitized | 90,526 | 90,526 | |||||

| Total temporary equity | 90,526 | 90,526 | |||||

| Shareholders’ equity (deficit): | |||||||

| Preferred stock, par value $0.001 per share, 250,000 shares authorized | |||||||

| Series A preferred stock, 0 and 0 shares issued and outstanding as of September 30, 2025 and March 31, 2025, respectively | — | — | |||||

| Series B preferred stock, 1,543 and 363 shares issued and outstanding as of September 30, 2025 and March 31, 2025, respectively | 2 | — | |||||

| Class A common stock, par value $0.001 per share, 5,000,000 and 5,000,000 shares authorized as of September 30, 2025 and March 31, 2025, respectively, 9,465 and 8,483 shares issued as of September 30, 2025 and March 31, 2025, respectively, and 9,456 and 8,474 shares outstanding as of September 30, 2025 and March 31, 2025, respectively | 9 | 8 | |||||

| Class B convertible common stock, par value $0.001 per share, 250 shares authorized, 239 and 239 shares issued and outstanding as of September 30, 2025 and March 31, 2025 | — | — | |||||

| Additional paid-in capital | 1,857,211 | 1,844,489 | |||||

| Accumulated deficit | (2,076,757 | ) | (2,008,052 | ) | |||

| Treasury stock, at cost (9 shares as of September 30, 2025 and March 31, 2025) | (3,444 | ) | (3,444 | ) | |||

| Accumulated other comprehensive income | 90 | (2 | ) | ||||

| Noncontrolling interests | 80,062 | 132,076 | |||||

| Total equity (deficit) | (142,827 | ) | (34,925 | ) | |||

| Total liabilities, temporary equity, and equity (deficit) | $ | 316,233 | $ | 354,875 | |||

Table 8: Non-GAAP Reconciliations

| (in thousands) | Three Months Ended September 30, 2025 | |||||||||||||||||

| Ben Liquidity | Ben Custody | Customer ExAlt Trusts | Corporate/ Other | Consolidating Eliminations | Consolidated | |||||||||||||

| Total revenues | $ | 8,497 | $ | 3,081 | $ | (2,783 | ) | $ | (158 | ) | $ | (11,400 | ) | $ | (2,763 | ) | ||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 4 | — | — | 4 | ||||||||||||

| Adjusted revenues | $ | 8,497 | $ | 3,081 | $ | (2,779 | ) | $ | (158 | ) | $ | (11,400 | ) | $ | (2,759 | ) | ||

| Operating income (loss) | $ | (821 | ) | $ | 2,292 | $ | (44,632 | ) | $ | (9,555 | ) | $ | 34,852 | $ | (17,864 | ) | ||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 4 | — | — | 4 | ||||||||||||

| Intersegment provision for credit losses on collateral comprised of interests in the GWG Wind Down Trust | — | — | — | — | — | — | ||||||||||||

| Goodwill impairment | — | — | — | — | — | — | ||||||||||||

| Accrual (release) of loss contingency related to arbitration award, including post-judgment interest | — | — | — | 1,656 | — | 1,656 | ||||||||||||

| Share-based compensation expense | — | — | — | 462 | — | 462 | ||||||||||||

| Legal and professional fees(1) | — | — | — | 3,154 | — | 3,154 | ||||||||||||

| Adjusted operating income (loss) | $ | (821 | ) | $ | 2,292 | $ | (44,628 | ) | $ | (4,283 | ) | $ | 34,852 | $ | (12,588 | ) | ||

(1) Includes legal and professional fees related lawsuits.

| (in thousands) | Three Months Ended June 30, 2025 | |||||||||||||||||

| Ben Liquidity | Ben Custody | Customer ExAlt Trusts | Corporate/ Other | Consolidating Eliminations | Consolidated | |||||||||||||

| Total revenues | $ | 8,837 | $ | 4,183 | $ | (12,851 | ) | $ | 38 | $ | (12,830 | ) | $ | (12,623 | ) | |||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 1 | — | — | 1 | ||||||||||||

| Adjusted revenues | $ | 8,837 | $ | 4,183 | $ | (12,850 | ) | $ | 38 | $ | (12,830 | ) | $ | (12,622 | ) | |||

| Operating income (loss) | $ | (6,015 | ) | $ | 3,128 | $ | (53,976 | ) | $ | (73,549 | ) | $ | 37,764 | $ | (92,648 | ) | ||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 1 | — | — | 1 | ||||||||||||

| Intersegment provision for credit losses on collateral comprised of interests in the GWG Wind Down Trust | — | — | — | — | — | — | ||||||||||||

| Goodwill impairment | — | — | — | — | — | — | ||||||||||||

| Accrual (release) of loss contingency related to arbitration award, including post-judgment interest | — | — | — | 62,831 | — | 62,831 | ||||||||||||

| Share-based compensation expense | — | — | — | 461 | — | 461 | ||||||||||||

| Legal and professional fees(1) | — | — | — | 3,917 | — | 3,917 | ||||||||||||

| Adjusted operating income (loss) | $ | (6,015 | ) | $ | 3,128 | $ | (53,975 | ) | $ | (6,340 | ) | $ | 37,764 | $ | (25,438 | ) | ||

(1) Includes legal and professional fees related to lawsuits.

| (in thousands) | Three Months Ended September 30, 2024 | |||||||||||||||||||||

| Ben Liquidity | Ben Custody | Customer ExAlt Trusts | Corporate/ Other | Consolidating Eliminations | Consolidated | |||||||||||||||||

| Total revenues | $ | 11,978 | $ | 5,386 | $ | 9,112 | $ | (738 | ) | $ | (17,177 | ) | $ | 8,561 | ||||||||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 173 | — | — | 173 | ||||||||||||||||

| Adjusted revenues | $ | 11,978 | $ | 5,386 | $ | 9,285 | $ | (738 | ) | $ | (17,177 | ) | $ | 8,734 | ||||||||

| Operating income (loss) | $ | 2,905 | $ | 4,329 | $ | (31,549 | ) | $ | (16,426 | ) | $ | 27,026 | $ | (13,715 | ) | |||||||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 173 | — | — | 173 | ||||||||||||||||

| Intersegment provision for credit losses on collateral comprised of interests in the GWG Wind Down Trust | — | — | — | — | — | — | ||||||||||||||||

| Goodwill impairment | — | 298 | — | — | — | 298 | ||||||||||||||||

| Share-based compensation expense | — | — | — | 3,364 | — | 3,364 | ||||||||||||||||

| Legal and professional fees(1) | — | — | — | 3,269 | — | 3,269 | ||||||||||||||||

| Adjusted operating income (loss) | $ | 2,905 | $ | 4,627 | $ | (31,376 | ) | $ | (9,793 | ) | $ | 27,026 | $ | (6,611 | ) | |||||||

(1) Includes legal and professional fees related to GWG Holdings bankruptcy, lawsuits, public relations, and employee matters.

| (in thousands) | Six Months Ended September 30, 2025 | ||||||||||||||||||||||

| Ben Liquidity | Ben Custody | Customer ExAlt Trusts | Corporate/ Other | Consolidating Eliminations | Consolidated | ||||||||||||||||||

| Total revenues | $ | 17,332 | $ | 7,264 | $ | (15,634 | ) | $ | (118 | ) | $ | (24,230 | ) | $ | (15,386 | ) | |||||||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 5 | — | — | 5 | |||||||||||||||||

| Adjusted revenues | $ | 17,332 | $ | 7,264 | $ | (15,629 | ) | $ | (118 | ) | $ | (24,230 | ) | $ | (15,381 | ) | |||||||

| Operating income (loss) | $ | (6,838 | ) | $ | 5,420 | $ | (98,608 | ) | $ | (83,102 | ) | $ | 72,616 | $ | (110,512 | ) | |||||||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 5 | — | — | 5 | |||||||||||||||||

| Intersegment provision for credit losses on collateral comprised of interests in the GWG Wind Down Trust | — | — | — | — | — | — | |||||||||||||||||

| Goodwill impairment | — | — | — | — | — | — | |||||||||||||||||

| Accrual (release) of loss contingency related to arbitration award, including post-judgment interest | — | — | — | 64,487 | — | 64,487 | |||||||||||||||||

| Share-based compensation expense | — | — | — | 923 | — | 923 | |||||||||||||||||

| Legal and professional fees(1) | — | — | — | 7,329 | — | 7,329 | |||||||||||||||||

| Adjusted operating income (loss) | $ | (6,838 | ) | $ | 5,420 | $ | (98,603 | ) | $ | (10,363 | ) | $ | 72,616 | $ | (37,768 | ) | |||||||

(1) Includes legal and professional fees related to lawsuits.

| (in thousands) | Six Months Ended September 30, 2024 | |||||||||||||||||||||

| Ben Liquidity | Ben Custody | Customer ExAlt Trusts | Corporate/ Other | Consolidating Eliminations | Consolidated | |||||||||||||||||

| Total revenues | $ | 22,827 | $ | 10,768 | $ | 18,965 | $ | (734 | ) | $ | (33,219 | ) | $ | 18,607 | ||||||||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 531 | 7 | — | 538 | ||||||||||||||||

| Adjusted revenues | $ | 22,827 | $ | 10,768 | $ | 19,496 | $ | (727 | ) | $ | (33,219 | ) | $ | 19,145 | ||||||||

| Operating income (loss) | $ | 2,391 | $ | 5,616 | $ | (61,178 | ) | $ | 27,665 | $ | 56,129 | $ | 30,623 | |||||||||

| Mark to market adjustment on interests in the GWG Wind Down Trust | — | — | 531 | 7 | — | 538 | ||||||||||||||||

| Intersegment provision for credit losses on collateral comprised of interests in the GWG Wind Down Trust | 5 | — | — | — | (5 | ) | — | |||||||||||||||

| Goodwill impairment | — | 3,427 | — | 265 | — | 3,692 | ||||||||||||||||

| Accrual (release) of loss contingency related to arbitration award, including post-judgment interest | — | — | — | (54,973 | ) | — | (54,973 | ) | ||||||||||||||

| Share-based compensation expense | — | — | — | 4,358 | — | 4,358 | ||||||||||||||||

| Legal and professional fees(1) | — | — | — | 4,425 | — | 4,425 | ||||||||||||||||

| Adjusted operating income (loss) | $ | 2,396 | $ | 9,043 | $ | (60,647 | ) | $ | (18,253 | ) | $ | 56,124 | $ | (11,337 | ) | |||||||

(1) Includes legal and professional fees related to GWG Holdings bankruptcy, lawsuits, public relations, and employee matters.

| Three Months Ended September 30, | Six Months Ended September 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||

| Operating Expenses Non GAAP Reconciliation | |||||||||||||||

| Operating expenses | $ | 15,101 | $ | 22,276 | $ | 95,126 | $ | (12,016 | ) | ||||||

| Plus (less): Accrual (release) of loss contingency related to arbitration award, including post-judgment interest | (1,656 | ) | — | (64,487 | ) | 54,973 | |||||||||

| Less: Goodwill impairment | — | (298 | ) | — | (3,692 | ) | |||||||||

| Operating expenses, excluding goodwill impairment and release of loss contingency related to arbitration award, including post-judgment interest | $ | 13,445 | $ | 21,978 | $ | 30,639 | $ | 39,265 | |||||||

Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben’s Equity Holders and Adjusted Segment Operating Income (Loss) attributable to Ben’s Equity Holders are non-GAAP financial measures. We present these non-GAAP financial measures because we believe it helps investors understand underlying trends in our business and facilitates an understanding of our operating performance from period to period because it facilitates a comparison of our recurring core business operating results. The non-GAAP financial measures are intended as a supplemental measure of our performance that is neither required by, nor presented in accordance with, U.S. GAAP. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of these non-GAAP financial measures may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate such items in the same way.

We define adjusted revenue as revenue adjusted to exclude the effect of mark-to-market adjustments on related party equity securities that were acquired both prior to and during the Collateral Swap, which on August 1, 2023, became interests in the GWG Wind Down Trust. Adjusted Segment Revenues attributable to Ben’s Equity Holders is the same as “adjusted revenues” related to the aggregate of the Ben Liquidity, Ben Custody, and Corporate/Other Business Segments, which are the segments that impact the net income (loss) attributable to all equity holders of Beneficient, including equity holders of Beneficient’s subsidiary, BCH.

Adjusted operating income (loss) represents GAAP operating income (loss), adjusted to exclude the effect of the adjustments to revenue as described above, credit losses on related party available-for-sale debt securities that were acquired in the Collateral Swap which on August 1, 2023, became interests in the GWG Wind Down Trust, and receivables from a related party that filed for bankruptcy and certain notes receivables originated during our formative transactions, non-cash asset impairment, share-based compensation expense, and legal, professional services, and public relations costs related to the GWG Holdings bankruptcy, lawsuits, and certain employee matters, including fees & loss contingency accruals (releases), including post judgment interests incurred in arbitration with a former director. Adjusted Segment Operating Income (Loss) attributable to Ben’s Equity Holders is the same as “adjusted operating income (loss)” related to the aggregate of the Ben Liquidity, Ben Custody, and Corporate/Other Business Segments, which are the segments that impact the net income (loss) attributable to all equity holders of Beneficient, including equity holders of Beneficient’s subsidiary, BCH.

These non-GAAP financial measures are not a measure of performance or liquidity calculated in accordance with U.S. GAAP. They are unaudited and should not be considered an alternative to, or more meaningful than, GAAP revenues or GAAP operating income (loss) as an indicator of our operating performance. Uses of cash flows that are not reflected in adjusted operating income (loss) or adjusted segment operating income (loss) attributable to Ben’s Equity Holders include capital expenditures, interest payments, debt principal repayments, and other expenses, which can be significant. As a result, adjusted operating income (loss) and/or adjusted segment operating income (loss) attributable to Ben’s Equity Holders should not be considered as a measure of our liquidity.

Because of these limitations, Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben’s Equity Holders, and Adjusted Segment Operating Income (Loss) attributable to Ben’s Equity Holders should not be considered in isolation or as a substitute for performance measures calculated in accordance with U.S. GAAP. We compensate for these limitations by relying primarily on our U.S. GAAP results and using Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben’s Equity Holders, and Adjusted Segment Operating Income (Loss) attributable to Ben’s Equity Holders on a supplemental basis. You should review the reconciliation of these non-GAAP financial measures set forth above and not rely on any single financial measure to evaluate our business.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1a806f76-5ffe-4635-88b4-dca93432b4b5

![]()