Recursion Reports Third Quarter 2025 Financial Results and Provides Business Update

- Achieved $30 million milestone from Roche and Genentech for delivering a whole-genome map of microglial immune cells—the second neuro map designed to accelerate treatments for a wide range of neurological diseases

- With this achievement, Recursion will have reached over $500 million in milestone and upfront payments across all its partnerships and collaborations

- Approximately $785 million of cash and cash equivalents (unaudited) as of October 9, 2025- runway through the end of 2027, without additional financing

SALT LAKE CITY, Nov. 05, 2025 (GLOBE NEWSWIRE) — Recursion (Nasdaq: RXRX) a leading clinical stage TechBio company decoding biology to radically improve lives, today reported business updates and financial results for its third quarter ended September 30, 2025.

Recursion will host a (L)earnings Call on November 5, 2025 at 8:00 am ET / 6:00 am MT / 1:00 pm GMT from Recursion’s X, LinkedIn, and YouTube accounts giving analysts, investors, and the public the opportunity to ask questions of the company by submitting questions here: https://forms.gle/TQ4vgUTLKsFmikcu6.

“Recursion continues to deliver on our internal pipeline, our strategic partnerships and the continued building and refinement of the Recursion OS. On the partnership front, we are proud to announce that with the option of our second neuro map in the Roche and Genentech collaboration, we’ve achieved over $500 million in upfront and milestone payments from our partners to date as we continue to deliver novel insights and advance programs for some of the toughest disease areas,” said Chris Gibson, Co-Founder and CEO of Recursion. “This is only the beginning of the returns we expect to see on the investment in our platform. With a strong cash runway through the end of 2027, we look forward to delivering on our pipeline and proving that building an end-to-end AI-enabled platform—combining massive proprietary datasets with industry-leading supercomputing capabilities and sophisticated AI models—is the critical infrastructure we need to realize real change in our industry.”

Summary of Business Highlights

Portfolio – Internal and Partnered Programs

“Our progress this quarter underscores the power of translating the Recursion OS into meaningful pipeline momentum,” said Najat Khan, Chief R&D and Chief Commercial Officer of Recursion. “We continued to advance our clinical programs, with REC-4881 in the TUPELO study moving toward additional data later this year. We also progressed REC-617 into its first combination study and nominated REC-7735 as a new development candidate. On the partnered side, the delivery of our first-in-kind microglia map with Roche and Genentech highlights how phenomics can open new frontiers in neuroscience and other complex disease areas. These are the kinds of bold but pragmatic steps — in our own programs and through collaborations — that will be essential as we work to turn our platform insights into transformative medicines for patients.”

Internal Pipeline Updates:

- REC-617 (CDK7):

- Recursion announced progress in its ELUCIDATE Phase 1/2 trial evaluating REC-617, a precision-designed oral CDK7 inhibitor. The monotherapy dose-escalation study established the maximum tolerated dose (MTD) at 10 mg once-daily, demonstrating a manageable safety profile and preliminary anti-tumor activity consistent with the December 2024 update.

- As of September 29, 2025, 29 heavily pre-treated patients with advanced solid tumors had received REC-617 across six dose levels. Treatment was generally well tolerated, with the most common dose-limiting toxicities (DLTs) being nausea and thrombocytopenia. Grade ≥3 treatment-related adverse events (TRAEs) occurred in 27.6% of patients (n=8), with no Grade 4/5 TRAEs reported. Only 6.9% (n=2) discontinued due to a TRAE. Importantly, REC-617 demonstrated rates of GI-related toxicities consistent with best-in-class potential. Specifically, common GI toxicities with REC-617 treatment were diarrhea (69%), nausea (41%), and vomiting (28%). Toxicities reported for samuraciclib treatment also included diarrhea (82%), nausea (77%), and vomiting (80%) (Coombes et al, 2023).

- REC-617 has shown early anti-tumor activity, including one confirmed partial response and five cases of stable disease. Pharmacokinetic data support dose-proportional exposure, rapid absorption, and a short half-life (~5 hours), in line with its design as a selective, reversible CDK7 inhibitor.

- The ELUCIDATE study has now expanded into 2L+ platinum-resistant ovarian cancer (PROC), with a Phase 2 monotherapy cohort ongoing and a Phase 1 combination arm initiated. Combination regimens include bevacizumab plus paclitaxel or pegylated liposomal doxorubicin (PLD). Recursion is also leveraging Recursion OS insights to explore additional indications and dosing regimens for expansion cohorts.

- REC-7735 (PI3Kα H1047R):

- Recursion announced progress on REC-7735, with nomination as a Development Candidate and IND-enabling studies now underway. REC-7735 is a precision-designed PI3K⍺ H1047R inhibitor generated using the Recursion OS. In preclinical studies, REC-7735 demonstrated significant tumor regressions at low doses, outperforming approved agents, while maintaining high selectivity (>100-fold) over wild-type PI3K⍺ to reduce the risk of dose-limiting hyperglycemia.

- With a differentiated preclinical efficacy and tolerability profile, REC-7735 has the potential to be a best-in-class PI3K⍺ H1047R inhibitor for breast and other solid tumors harboring this mutation.

Upcoming Milestones:

- REC-4881 (MEK1/2): Additional data in FAP from the Phase 2 TUPELO study expected in December 2025

- REC-1245 (RBM39): Early Phase 1 safety and PK monotherapy data expected in 1H26

- REC-3565 (MALT1): Early Phase 1 safety and PK monotherapy data expected in 1H27

- REC-102 (ENPP1): Potential Phase 1 initiation expected in 2H26

- REC-7735 (PI3Kα H1047R): Potential Phase 1 initiation expected in 2H26

- Recursion is well on track for over $100 million in milestone payments by end of 2026

- Programs are advancing towards potential development candidate designation over the next 12 months

- Multiple neuroscience target validation programs advancing by leveraging the Recursion OS

Partnered Discovery Updates:

With the acceptance of the second neuro map and the $30 million milestone from Roche and Genentech, Recursion has now achieved more than $500 million in upfront and milestone payments from its partners. This milestone places Recursion among a small group of pre-commercial biotechnology companies to achieve such scale, underscoring the strength of its partnership strategy. These collaborations not only support the maintenance and expansion of the Recursion OS, but also provide access to insights from leading biopharma companies and the potential for future milestone payments exceeding $10 billion, as well as royalties across indications Recursion may not pursue independently.

- Roche and Genentech: Recursion announced that it has achieved a second $30 million milestone from its partner, Roche and Genentech. The payment follows the acceptance of a novel whole-genome phenotypic map (“phenomap”) of microglial cells, which are critical for brain health and implicated in a wide range of neurodegenerative and neuroinflammatory diseases.

- The milestone is part of a larger ongoing 10+ year collaboration to discover novel targets and develop potential therapeutic treatments for up to 40 programs in neuroscience and gastrointestinal oncology.

- Together, Recursion, Roche and Genentech have identified a number of biological insights from the first neuroscience-focused phenomap, that could become novel targets of interest.

- Roche and Genentech have already optioned an initial program in gastrointestinal oncology with additional potential targets/programs under exploration based off of 4 whole-genome GI oncology phenomaps accepted by the partner to date.

- To date, Recursion has achieved $213 million in upfront and milestone payments through the collaboration.

- Sanofi: Recursion and Sanofi continue to advance multi-target collaboration for up to 15 best-in-class or first-in-class programs across oncology and immunology, with $130 million in upfront and milestone payments achieved to date. Each program has the potential for over $300 million in milestone payments.

- Sanofi continues to leverage combined Recursion OS 2.0, including phenomics, to identify new program opportunities.

- Recursion and Sanofi are further advancing and expanding their joint pipeline across oncology and immunology.

- Several programs are continuing to advance towards potential lead series and development candidate designation over the next 12 months.

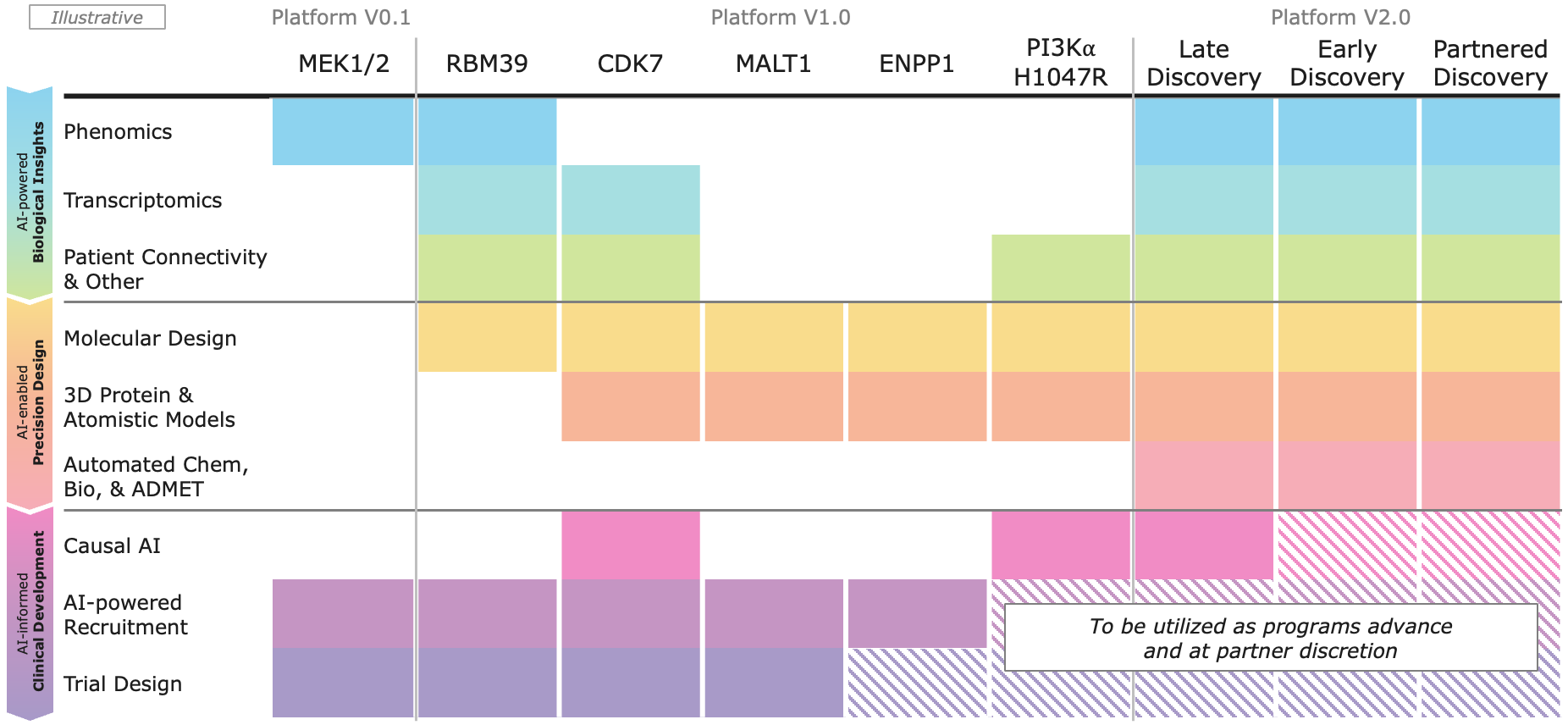

Platform

Recursion OS 2.0: The platform is continuing to drive program development by integrating AI across multimodal biology, precision design, and clinical development—enabling faster, more efficient, and more innovative drug discovery and development.

Third Quarter 2025 Financial Results

- Cash Position: Cash, cash equivalents and restricted cash were $667.1 million as of September 30, 2025 compared to $603.0 million as of December 31, 2024. As of October 9, 2025, cash and cash equivalents was approximately $785 million (unaudited), following receipt of $387.5 million in net proceeds from the Company’s At-the-Market (ATM) facility during the third and fourth quarters of 2025, which is now fully utilized and completed. Based on current operating plans and with no additional financing, the Company’s expected cash runway extends through the end of 2027.

- Revenue: Total revenue, consisting primarily of revenue from collaboration agreements, was $5.2 million for the third quarter of 2025, compared to $26.1 million for the third quarter of 2024. The year over year change was primarily due to achievement of a $30 million milestone payment for the first phenomap from Roche and Genentech in August 2024, with the second $30 million milestone under the agreement achieved in October 2025, for which the company expects to recognize a portion as revenue in the fourth quarter of 2025.

- Research and Development Expenses: Research and development expenses were $121.1 million for the third quarter of 2025, compared to $74.6 million for the third quarter of 2024. The increase was primarily driven by the increase in acquired IPR&D purchases related to the acquisition of full rights to REC-102, Recursion’s ENPP1 inhibitor, as well as the Company’s business combination with Exscientia in November 2024.

- General and Administrative Expenses: General and administrative expenses were $41.6 million for the third quarter of 2025 compared to $37.8 million for the third quarter of 2024. The increase compared to the prior period was primarily due to the inclusion of G&A expenses from the business combination with Exscientia.

- Net Loss: Net loss was $162.3 million for the third quarter of 2025, compared to a net loss of $95.8 million for the third quarter of 2024.

- Operational cash flows: Net cash used in operating activities was $325.7 million for the nine months ended September 30, 2025, compared to net cash used in operating activities of $243.7 million for the nine months ended September 30, 2024. The increase in cash used in operating activities was primarily driven by the inclusion of Exscientia’s operations, for which the business combination with Recursion closed in November 2024. This also included severance payments of $7.7 million in association with the restructuring activities announced in June 2025.

About Recursion

Recursion (NASDAQ: RXRX) is a clinical stage TechBio company leading the space by decoding biology to radically improve lives. Enabling its mission is the Recursion OS, a platform built across diverse technologies that continuously generate one of the world’s largest proprietary biological and chemical datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale — up to millions of wet lab experiments weekly — and massive computational scale — owning and operating one of the most powerful supercomputers in the world, Recursion is uniting technology, biology and chemistry to advance the future of medicine.

Recursion is headquartered in Salt Lake City, where it is a founding member of BioHive, the Utah life sciences industry collective. Recursion also has offices in Montréal, New York, London, and the Oxford area. Learn more at www.recursion.com, or connect on X and LinkedIn.

Media Contact

media@recursion.com

Investor Contact

investor@recursion.com

| Recursion Pharmaceuticals Inc | ||||||||||||||

| Consolidated Statements of Operations (unaudited) | ||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||

| Revenue | ||||||||||||||

| Operating revenue | $ | 4,983 | $ | 26,082 | $ | 38,905 | $ | 53,977 | ||||||

| Grant revenue | 192 | — | 238 | 316 | ||||||||||

| Total revenue | 5,175 | 26,082 | 39,143 | 54,293 | ||||||||||

| Operating costs and expenses | ||||||||||||||

| Cost of revenue | 14,687 | 12,079 | 56,678 | 32,444 | ||||||||||

| Research and development | 121,062 | 74,600 | 379,331 | 216,087 | ||||||||||

| General and administrative | 41,628 | 37,757 | 142,932 | 100,998 | ||||||||||

| Total operating costs and expenses | 177,377 | 124,436 | 578,941 | 349,529 | ||||||||||

| Loss from operations | (172,202 | ) | (98,354 | ) | (539,798 | ) | (295,236 | ) | ||||||

| Other income, net | 9,952 | 2,679 | 3,005 | 9,347 | ||||||||||

| Loss before income tax benefit | (162,250 | ) | (95,675 | ) | (536,793 | ) | (285,889 | ) | ||||||

| Income tax benefit (expense) | (3 | ) | (167 | ) | 156 | 1,134 | ||||||||

| Net loss | $ | (162,253 | ) | $ | (95,842 | ) | $ | (536,637 | ) | $ | (284,755 | ) | ||

| Per share data | ||||||||||||||

| Net loss per share of Class A, B and Exchangeable common stock, basic and diluted | $ | (0.36 | ) | $ | (0.34 | ) | $ | (1.27 | ) | $ | (1.12 | ) | ||

| Weighted-average shares (Class A, B and Exchangeable) outstanding, basic and diluted | 446,988,046 | 282,583,048 | 422,642,653 | 253,447,099 | ||||||||||

| Recursion Pharmaceuticals Inc | ||||||

| Condensed Consolidated Balance Sheets (unaudited) | ||||||

| (in thousands) | ||||||

| September 30, | December 31, | |||||

| 2025 | 2024 | |||||

| Assets | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ | 659,836 | $ | 594,350 | ||

| Restricted cash | 3,136 | 3,045 | ||||

| Other receivables | 21,910 | 49,166 | ||||

| Prepaid data assets | — | 29,601 | ||||

| Other current assets | 29,223 | 38,107 | ||||

| Total current assets | 714,105 | 714,269 | ||||

| Restricted cash, non-current | 4,173 | 5,629 | ||||

| Property and equipment, net | 111,706 | 141,063 | ||||

| Operating lease right-of-use assets | 47,812 | 65,877 | ||||

| Financing lease right-of-use assets | 21,726 | 26,273 | ||||

| Intangible assets, net | 322,344 | 335,855 | ||||

| Goodwill | 162,042 | 148,873 | ||||

| Deferred tax assets | 957 | 1,934 | ||||

| Other assets, non-current | 14,661 | 8,825 | ||||

| Total assets | $ | 1,399,526 | $ | 1,448,598 | ||

| Liabilities and stockholders’ equity | ||||||

| Current liabilities | ||||||

| Accounts payable | $ | 13,935 | $ | 21,613 | ||

| Accrued expenses and other liabilities | 53,102 | 81,872 | ||||

| Accrued data liability | 20,258 | — | ||||

| Unearned revenue | 47,364 | 61,767 | ||||

| Operating lease liabilities | 11,525 | 13,795 | ||||

| Notes payable and financing lease liabilities | 8,919 | 8,425 | ||||

| Total current liabilities | 155,103 | 187,472 | ||||

| Unearned revenue, non-current | 111,204 | 118,765 | ||||

| Operating lease liabilities, non-current | 50,028 | 67,250 | ||||

| Notes payable and financing lease liabilities, non-current | 11,902 | 19,022 | ||||

| Deferred tax liabilities | 23,312 | 16,575 | ||||

| Other liabilities, non-current | 1,029 | 4,732 | ||||

| Total liabilities | 352,578 | 413,816 | ||||

| Commitments and contingencies | ||||||

| Stockholders’ equity | ||||||

| Common stock (Class A, B and Exchangeable) | 5 | 4 | ||||

| Additional paid-in capital | 2,980,729 | 2,473,698 | ||||

| Accumulated deficit | (1,967,879 | ) | (1,431,283 | ) | ||

| Accumulated other comprehensive income (loss) | 34,093 | (7,637 | ) | |||

| Total stockholders’ equity | 1,046,948 | 1,034,782 | ||||

| Total liabilities and stockholders’ equity | $ | 1,399,526 | $ | 1,448,598 | ||

Forward-Looking Statements

This document contains information that includes or is based upon “forward-looking statements” within the meaning of the Securities Litigation Reform Act of 1995, including, without limitation, those regarding the impact of the acceptance of the second whole-genome neuro map of microglia immune cells on future developments and potential treatments; Recursion’s ability to discover and develop medicines and the occurrence or realization of near-term milestones; the timing of data readouts and other milestones; the impact of preclinical data on trial outcomes; Recursion’s future as a leader in TechBio and ability to deliver better treatments to patients faster; expectations relating to early and late stage discovery, preclinical, and clinical programs, including timelines for commencement of and enrollment in studies, data readouts, and progression toward IND-enabling studies; expectations and developments with respect to licenses and collaborations, including option exercises by partners and the amount and timing of potential milestone payments, and the acceleration of progress across multiple partnered programs; prospective products and their potential future indications and market opportunities; developments with Recursion OS, including achieving future returns on investment in the platform and the ability to discover and develop new medicines and provide insights into patient populations; financial position and cash runway; and all other statements that are not historical facts. Forward-looking statements may or may not include identifying words such as “plan,” “will,” “expect,” “anticipate,” “intend,” “believe,” “potential,” “continue,” and similar terms. These statements are subject to known or unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such statements, including but not limited to: challenges inherent in pharmaceutical research and development, including the timing and results of preclinical and clinical programs, where the risk of failure is high and failure can occur at any stage prior to or after regulatory approval due to lack of sufficient efficacy, safety considerations, or other factors; our ability to leverage and enhance our drug discovery platform; our ability to obtain financing for development activities and other corporate purposes; the success of our collaboration activities; our ability to obtain regulatory approval of, and ultimately commercialize, drug candidates; our ability to obtain, maintain, and enforce intellectual property protections; cyberattacks or other disruptions to our technology systems; our ability to attract, motivate, and retain key employees and manage our growth; inflation and other macroeconomic issues; and other risks and uncertainties such as those described under the heading “Risk Factors” in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. All forward-looking statements are based on management’s current estimates, projections, and assumptions, and Recursion undertakes no obligation to correct or update any such statements, whether as a result of new information, future developments, or otherwise, except to the extent required by applicable law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a27beed1-a02d-407c-8746-90f1049d36c4

https://www.globenewswire.com/NewsRoom/AttachmentNg/eb02cb40-c067-40ee-84a9-3bc102b98e59

![]()