Aya Gold & Silver Delivers Robust Boumadine PEA Highlighting High Return, Rapid Payback and a Capital-Efficient Project

MONTREAL, Nov. 04, 2025 (GLOBE NEWSWIRE) — Aya Gold & Silver Inc. (TSX: AYA; OTCQX: AYASF) (“Aya” or the “Corporation”) is pleased to announce the results of its 2025 Boumadine Preliminary Economic Assessment (the “PEA” or the “Study”) for the Boumadine Project (the “Project” or “Boumadine”) located in the Kingdom of Morocco. The PEA was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) by independent Qualified Persons, notably Lycopodium Minerals Canada Ltd and WSP Canada Inc. Please note that all financial figures in this press release are expressed in United States dollars, unless otherwise noted.

2025 PEA Highlights

Table 1: Boumadine Economic Highlights

| Base Case | Spot Prices 2 | |||||||||||

| Project Economics | Units | Pre-tax | Post-tax | Post-tax | ||||||||

| Gold Price | $/oz | $2,800 | $2,800 | $4,000 | ||||||||

| Silver Price | $/oz | $30 | $30 | $48 | ||||||||

| Initial Capital Expenditures | $M | $446 | $446 | $446 | ||||||||

| AISC1 | $/oz AuEq | $1,021 | $1,021 | $1,068 | ||||||||

| Net Present Value (NPV5%)1 | $B | 2.2 | 1.5 | 3.0 | ||||||||

| Internal Rate of Return (“IRR”) | % | 69% | 47% | 77% | ||||||||

| Payback | Years | 1.3 | 2.1 | 1.2 | ||||||||

| NPV:Capex 3 | – | 5.0 | 3.3 | 6.6 | ||||||||

| Revenue | $B | 7.0 | 7.0 | 10.1 | ||||||||

| Free Cash Flow (FCF)1 | $B | 2.8 | 2.0 | 3.8 | ||||||||

| ||||||||||||

Robust Project Economics based on an 11-year mine life:

- On a post-tax basis: NPV5% of $1.5 billion, an IRR of 47%, and a payback period of 2.1 years at Base Case prices, increasing to $3.0 billion NPV5%, 77% IRR, and 1.2 years payback at Spot Prices.

- On a pre-tax basis: NPV5% of $2.2 billion, IRR of 69%, and payback period of 1.3 years under the Base Case prices, increasing to $4.5 billion NPV5%, 107% IRR, and 0.7 years payback at Spot Prices.

- Attractive Scale, High Grade, Low Capex and Competitive All-in Sustaining Costs (“AISC”):

- Attractive scale with average annual production of 401 thousand ounces (“koz”) gold-equivalent (“AuEq”) in years 1 to 5 and 328 koz AuEq per year over the life-of-mine (“LOM”).

- On a silver-equivalent (“AgEq”) basis, this corresponds to an average annual production of approximately 37.5 million ounces (“Moz”) AgEq, in years 1 to 5 and 30.6 Moz AgEq over the LOM.

- Low initial capital cost of $446 million, including $96 million in contingency

- Highly efficient capital project with a post-tax NPV5% to Capex ratio of 3.3:1 (Base Case prices); and NPV5%to Capex ratio of 6.6:1 at Spot Prices.

- LOM total cash costs of $928/oz AuEq and AISC of $1,021/oz AuEq.

- Processing: 8,000 tpd conventional flotation plant producing three gold- and silver-bearing concentrates – zinc, lead, and pyrite.

- Year 1 to 5 average head grade of 4.76 g/t AuEq, or 443 g/t AgEq.

- LOM average head grade of 3.85 g/t AuEq, or 358 g/t AgEq.

- This study does not include 140,000 metres (“m”) 2025 ongoing drilling campaign.

- Existing mining license on the property; feasibility study targeted for completion in late 2027.

“The Boumadine PEA confirms a highly robust, capital-efficient project that is already significantly de-risked given its conventional flowsheet and high-value concentrates,” said Benoit La Salle, President and CEO. “With industry-leading low initial capex of $446 million, a post-tax NPV of $3.0 billion at spot prices and $1.5 billion under our base case prices, both delivering industry-leading returns on invested capital, Boumadine ranks among the most attractive undeveloped precious metal projects globally. Importantly, this PEA includes only the known mineralized zones on the Boumadine mining license, which represents a small portion of our total land package. With Boumadine‘s mining license already in place, we are advancing development while continuing to drill, unlocking the broader district-scale potential,” said Benoit La Salle, President & CEO.

Table 2: General Project Parameters

| Units | Year 1-5 | LOM | ||

| General | ||||

| Mine Life | Years | – | 11.1 | |

| Open Pit Strip Ratio1 | – | 19.4 | 20.9 | |

| Throughput Capacity | tpd | 8,000 | 8,000 | |

| Total Tonnes Processed | Mt | 13.9 | 31.1 | |

| Open-pit | Mt | 10.4 | 19.4 | |

| Underground | Mt | 3.5 | 11.6 | |

| 1. Strip Ratio is the ratio of waste to mineralized material in open pit production. | ||||

Table 3: Processing and Production Highlights

| Units | Year 1-5 | LOM | ||

| Processed Grade | ||||

| Gold | g/t | 3.15 | 2.43 | |

| Silver | g/t | 85.8 | 72.5 | |

| Zinc | % | 2.05 | 1.91 | |

| Lead | % | 0.66 | 0.70 | |

| AuEq | g/t | 4.76 | 3.85 | |

| AgEq | g/t | 443 | 358 | |

| Production | ||||

| Gold | koz | 1,351 | 2,337 | |

| Silver | koz | 36,894 | 69,874 | |

| Zinc | Mlbs | 468 | 975 | |

| Lead | Mlbs | 166 | 392 | |

| AuEq | koz | 2,006 | 3,643 | |

| AgEq | koz | 187,261 | 340,038 | |

| Avg. Annual AuEq Production | koz/y | 401 | 328 | |

| Avg. Annual AgEq Production | koz/y | 37,452 | 30,611 | |

| Recoveries | ||||

| Gold | % | 96.1% | 96.1% | |

| Silver | % | 96.4% | 96.4% | |

| Zinc | % | 74.7% | 74.7% | |

| Lead | % | 82.0% | 82.0% | |

Cautionary statement: Readers are cautioned that the PEA is preliminary in nature, it includes inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

PEA Overview

Project Location

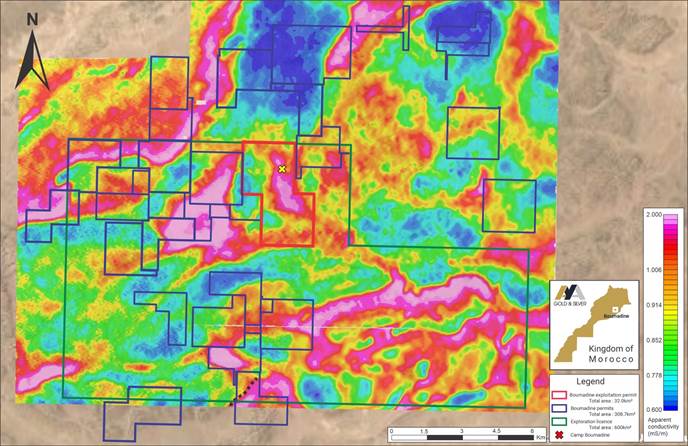

The Boumadine property is located in the Province of Errachidia, Kingdom of Morocco, approximately 220 kilometer (“km”) east of the City of Ouarzazate and 70 km southwest of the City of Errachidia. Boumadine’s land package covers 339 km², with an additional 600 km² under exploration authorization, for a total area encompassing 31 permits and licenses. The Mineral Resource estimate (“MRE”) underpinning this PEA is derived from an area of 32 km² within a single mining license, as illustrated in Figure 1.

Figure 1: Map of Boumadine Mining Permits Overlaid with Apparent Conductivity at 175Hz

Mineral Resource Estimate

The MRE in the PEA is based on the “Technical Report and Updated Mineral Resource Estimate of the Boumadine Polymetallic Project, Kingdom Of Morocco”, published on March 31, 2025, which includes 142,268 m of drilling. Since then, Aya has completed approximately 130,000 m of drilling, which is not included in this MRE.

Table 4 : Boumadine MRE, as of February 24, 2025 (1-12)

| Cutoff | Tonnes | Average Grade | Contained Metal | |||||||||||||

| Ag | Au | Cu | Pb | Zn | AgEq | AuEq | Ag | Au | Cu | Pb | Zn | AgEq | AuEq | |||

| NSR US$/t | (kt) | (g/t) | (g/t) | (%) | (%) | (%) | (g/t) | (g/t) | (koz) | (koz) | (kt) | (kt) | (kt) | (koz) | (koz) | |

| Pit-constrained Indicated | 95 | 3,920 | 94 | 2.99 | 0.13 | 0.84 | 2.95 | 476 | 5.30 | 11,881 | 377 | 5 | 33 | 116 | 60,051 | 667 |

| Pit-constrained Inferred | 95 | 14,258 | 90 | 2.89 | 0.10 | 0.81 | 2.38 | 450 | 5.00 | 41,135 | 1,325 | 14 | 115 | 339 | 206,29 | 2,293 |

| Out-of-pit Indicated | 125 | 1,249 | 80 | 2.11 | 0.08 | 0.87 | 2.32 | 358 | 3.98 | 3,216 | 85 | 1 | 11 | 29 | 14,382 | 160 |

| Out-of-pit Inferred | 125 | 14,938 | 74 | 2.39 | 0.07 | 0.82 | 1.85 | 357 | 3.97 | 35,669 | 1,148 | 10 | 122 | 276 | 171,39 | 1,905 |

| Total Indicated | 95/ 125 | 5,169 | 91 | 2.78 | 0.12 | 0.85 | 2.80 | 448 | 4.98 | 15,097 | 462 | 6 | 44 | 145 | 74,433 | 827 |

| Total Inferred | 95/ 125 | 29,196 | 82 | 2.63 | 0.08 | 0.82 | 2.11 | 402 | 4.47 | 76,804 | 2,469 | 25 | 237 | 615 | 377,68 | 4,198 |

| ||||||||||||||||

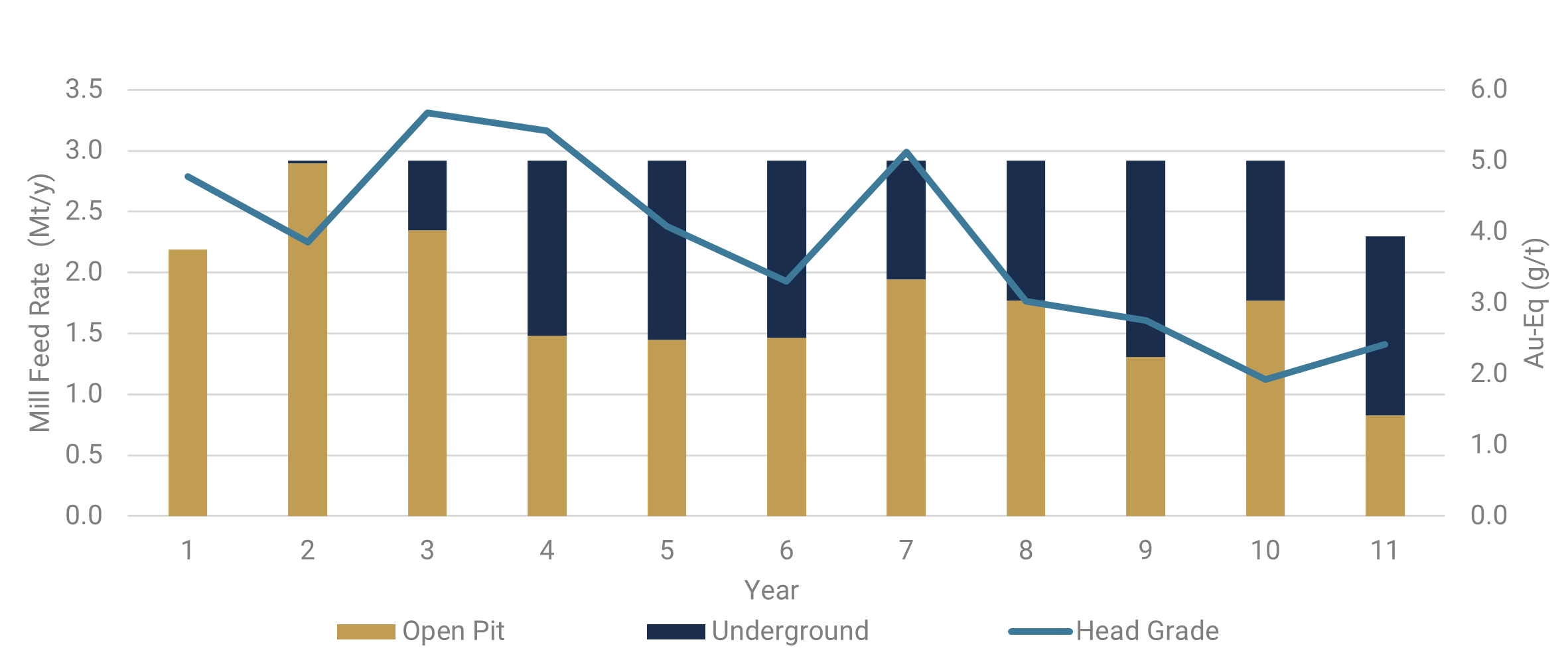

Mining Operations

The PEA envisions a combined open pit and underground mining operation. The Boumadine LOM plan will consist of the simultaneous mining of several open pits in Central, North and South zones concurrent with underground operations that are scheduled between Year 2 and Year 11. The overall strategy is to achieve an average production rate to maintain a processing throughput of 8,000 tpd over the LOM.

The mine plan is shown in Figure 2 below.

Figure 2: 3D Plan of the open pit and UG stopes

The open pit mineral resource used in the LOM plan is contained within six (6) open pits (two in the south, three in the north, and one in the central area) over a strike length of 6 km and is mainly located above 350 m depth from surface. The open pit mining activity, including drill and blast, loading, and haulage is based on a contract-mining operation, with a mining capacity of 50 million tonnes (“Mt”) of total material moved per year. Approximately 20 Mt of pre-stripping is expected during construction to ensure the ramp-up.

Underground mining will begin in year two of operations. Three distinct underground mines will be operated: the North, Central and South zones. The North and Central underground mines are independent from the open pits, with dedicated declines which will be developed from surface to access high-grade areas of the North and Central areas early in the LOM. The underground mining method will be longitudinal modified avoca long hole stoping. It is contemplated that all development will be executed by a mining contractor, while mineralized inventory mining activities will be carried out by Aya.

Figure 3: Boumadine Mill Feed by Mining Source

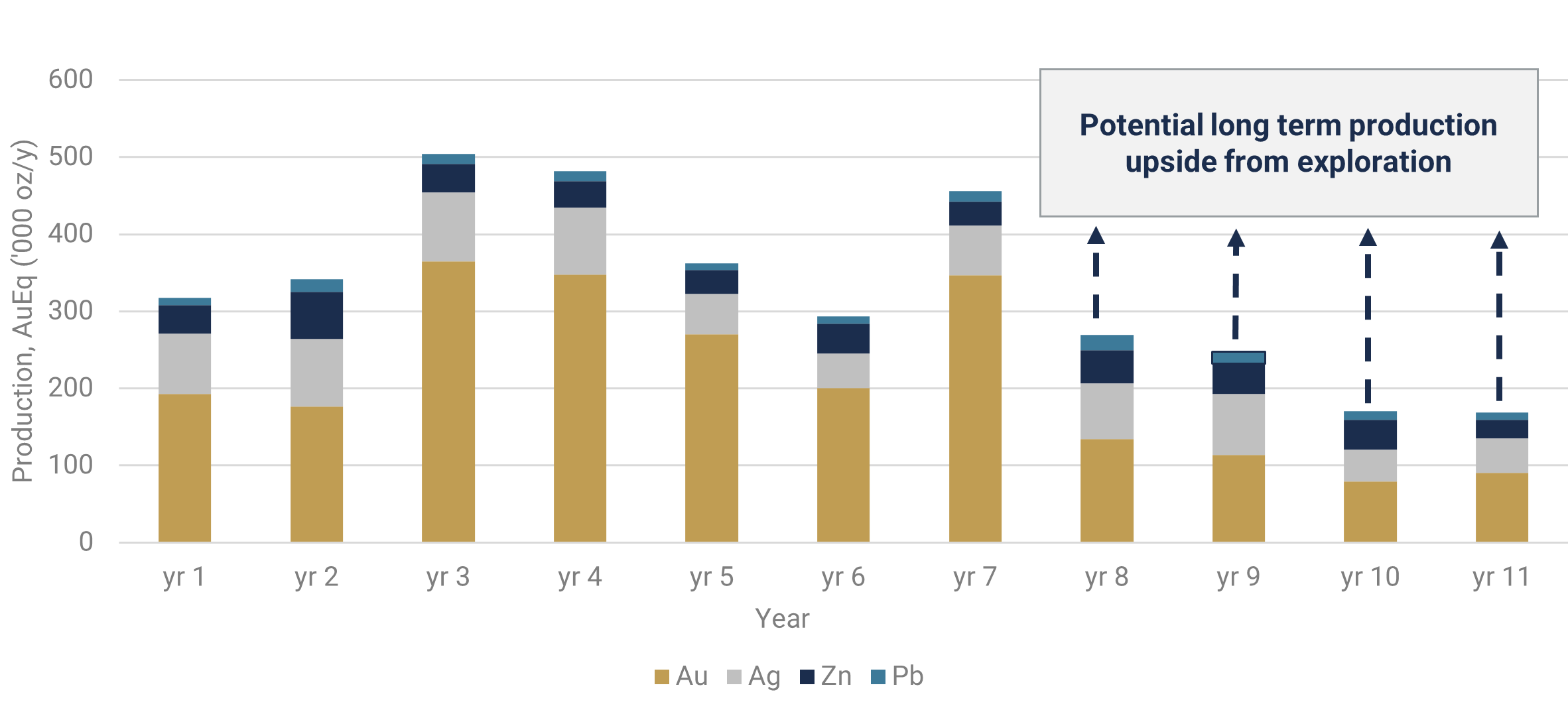

An average of 401 koz AuEq per year over the first 5 years of operations will be produced, with the majority of mineralized inventory coming from the open pits. Significant drilling has been completed since February 24, 2025, the effective date of the MRE, which is expected to contribute to resource upside to support higher levels of production towards the end of the expected mine life and to extend the overall LOM.

Figure 4: Boumadine Annual Production Profile

Processing

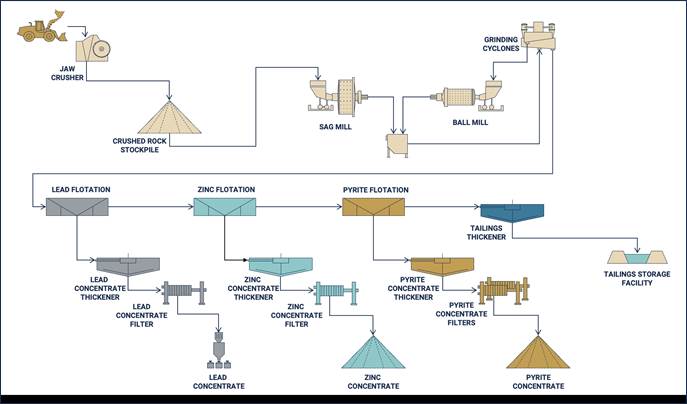

The flotation plant will process 8,000 tpd, for an annual throughput capacity of 2.9 Mt per year. The mine plan prioritizes strong feed grades to the mill during the initial years of production. During Years 1 to 5, high-grade material is processed, with an average grade of 4.76 g/t AuEq. From Year 8 onward, lower-grade, stockpiled material will be processed. Production during the first five years averages approximately 401koz AuEq annually.

A conventional flotation plant is planned for processing, with crushing, grinding and three flotations circuits to produce separate, saleable concentrates of zinc, lead, and pyrite. All three concentrates contain payable silver and gold. The comminution circuit consists of a primary jaw crusher, stockpile, and a semi-autogeneous (“SAG”) mill and ball mill (“SAB”) grinding circuit. The 6.1 MW SAG mill and 6.1 MW ball mill in closed circuit with hydrocyclones will produce a ground material with a P80 of 58 microns (µm).

Both the lead and zinc circuits consist of rougher flotation, classification, regrinding, and cleaner flotation to produce high value concentrates. The pyrite flotation circuit includes a rougher flotation circuit. All concentrates require thickening and filtration for transportation. The lead concentrate will be shipped in big bags while the zinc and pyrite concentrates will be shipped in bulk. Flotation tailings will be thickened and stored in a tailings storage facility.

Figure 5: Simplified Processing Flowsheet

Figure 6: 3D rendering of proposed processing plant

Metallurgy

Extensive metallurgical testwork, led by SGS Lakefield between 2018 and 2025, is the foundation of the PEA and confirms a conventional flotation-based flowsheet with excellent metallurgical performance. The program included composite and variability samples, locked-cycle flotation tests, and comprehensive crushing and grinding studies, which validated the process efficiency and repeatability across mineralized domains. Total flotation recoveries are: 96.1% for gold, 96.4% for silver, 74.7% for zinc and 82.0% for lead.

Flotation demonstrates strong recoveries and concentrates quality, supporting a robust development scenario centered on concentrate sales. Complementary roaster and leaching testwork on the pyrite concentrate, conducted over several years, has also confirmed oxidation and precious metal recovery potential, suggesting a path for a roaster expansion in the future. Lab scale test results showed a total processing recovery (lead and zinc flotation, then pyrite flotation, roasting and leaching) up to 79% for gold and 85% for silver, with an average recovery of 63% for gold and 80% for silver.

The combination of high recoveries, conventional processing, and multiple commercialization pathways positions Boumadine as a technically sound and highly economic development project with significant long-term upside.

Tailings Management

The tailings storage facility (“TSF”) is designed to accommodate approximately 18.5 Mt of flotation tailings generated over the LOM. The TSF is expected to be a valley-storage facility, utilizing the natural topography of the area and will be formed by a single earth-filled embankment, with a total footprint including the tailings deposition area of 70 ha. The TSF will be fully lined and contained with downstream phased construction, as per international standards, reiterating our commitment to the Global International Standards on Tailing Management (“GISTM”).

The design contemplates a five-phase staged construction approach, with each phase expanding the facility every two years. This approach reduces initial capital requirements, optimizes sustaining capital expenditures over the LOM, and enhances operational flexibility and environmental performance. The design also considers water management strategies for both the operational and closure phases. Process water from the TSF will be reclaimed and recycled to the plant to minimize freshwater consumption. Ongoing technical studies and field investigations will inform future refinement the design.

Infrastructure

A comprehensive logistics assessment was conducted in collaboration with a Moroccan based logistics company specializing in bulk transportation. The logistics study evaluated multiple transportation alternatives, including road, and rail to Boumadine. The base case selected for the PEA involves contractor operated road haulage of concentrate on national roadways to the Port of Nador-West, approximately 640 km from Boumadine. Capital costs included in the PEA includes warehousing facilities for concentrate storage at the port.

In addition to the transport network, the Project will require the construction of a dedicated 72-km electrical power line and substation to provide reliable grid power. The cost associated with the electrical infrastructure was evaluated by the state-owned utility, ONEE, and is included in the overall capital cost estimate.

Water supply

Water will be sourced from nearby towns and water wells. Treated city wastewater from several treatment plants will be pumped to the mine to be used for mineral processing. Additionally, several water dams are present in the region and the possibility to add a pipeline to one of these dams as a secondary water source will be evaluated in the feasibility study.

Capital Expenditures

The project capital cost estimate was compiled by Lycopodium, with input from WSP for mining, Epoch for the TSF and local firms for water supply, logistics and power.

Initial capital expenditures are estimated at $446M, including a contingency of $96M. These costs are summarized in Table 5. The total construction period is estimated to be two years. Average annual sustaining capital over the LOM is estimated to be $30M, which includes underground mine development costs.

Table 5: Capital Expenditures

| Capital Expenditures ($M) | Initial | Sustaining | Total | |||

| Direct Costs | 288 | 340 | 628 | |||

| Open Pit Mining | 54 | 58 | 112 | |||

| Underground Mining | – | 250 | 250 | |||

| Processing Plant | 167 | – | 167 | |||

| Shipping Infrastructure | 11 | – | 11 | |||

| Electrical Line | 17 | – | 17 | |||

| Raw Water Supply | 30 | – | 30 | |||

| Tailings Storage Facility | 9 | 22 | 31 | |||

| TSF Closure Costs | – | 9 | 9 | |||

| Indirect Costs | 63 | – | 63 | |||

| Subtotal | 351 | 340 | 691 | |||

| Contingency | 96 | – | 96 | |||

| Total | 446 | 340 | 786 | |||

The Boumadine PEA capital cost estimate is based on a contractor mining model, reflecting the lower upfront capital requirements and added fleet flexibility needed to support the pre-production ramp-up. Similarly, the start of underground mining activities has been scheduled to follow the start-up of operations, deferring a portion of the capital expenditures and simplifying the start of the mining operations.

Operating Costs

The PEA outlines an average cash cost of $109/t milled, or $928/oz AuEq produced. The AISC is estimated at $1,021/oz AuEq produced, positioning the project competitively within the industry cost curve. Operating cost estimates in Table 6 have been developed from first principles and benchmarked against comparable projects with similar mining methods, processing flowsheets, and geographic location. Concentrate-related costs, including refining, transportation, penalties, and treatment charges, are fully incorporated into the financial model. A 3% royalty to the state-owned Office National des Hydrocarbures et des Mines is included and taxes have been applied in accordance with current legislation.

Table 6: Operating Cost Breakdown

| Operating Costs | Year 1-5 | LOM | ||

| Cost per Tonne Milled | ||||

| Mining | $/t milled | 48.93 | 42.83 | |

| Processing | $/t milled | 17.28 | 17.28 | |

| G&A | $/t milled | 5.43 | 5.58 | |

| Tailings, Environmental and Water Management | $/t milled | 0.46 | 0.48 | |

| Total On-site Operating Costs | $/t milled | 72.10 | 66.16 | |

| Product shipping | $/t milled | 38.70 | 35.56 | |

| Royalties | $/t milled | 8.52 | 6.75 | |

| Mining Tax | $/t milled | 0.36 | 0.32 | |

| Total Cash Cost | $/t milled | 119.68 | 108.78 | |

| OP Sustaining Capital | $/t milled | 3.06 | 1.87 | |

| UG Sustaining Capital | $/t milled | 7.95 | 8.06 | |

| TSF Sustaining Capital | $/t milled | 0.95 | 1.01 | |

| Total Costs including Sustaining | $/t milled | 131.65 | 119.72 | |

| Operating Cost per Ounce | ||||

| Total Cash Costs1 | $/oz AuEq | 827 | 928 | |

| Total AISC2 | $/oz AuEq | 910 | 1021 | |

| ||||

Concentrate Marketing

Aya has marketed and received three potential off-take agreements for the concentrates from Boumadine, providing preliminary terms for lead, zinc, and pyrite. The pyrite concentrate has generated strong attention due to its gold and silver grade and high sulfur content. Rising global demand for sulfuric acid—driven by fertilizer, chemical, and battery metals has tightened supply and improved pricing and offtake conditions for sulfur-rich feedstocks.

Table 7 highlights concentrate grades, and average payables per metal.

Table 7: Concentrate Grade, Recovery and Payables Summary

| Gold | Silver | Zinc | Lead | ||

| Grade | g/t | g/t | % | % | |

| Processed Grade | 2.43 | 73 | 1.91 | 0.70 | |

| Lead Concentrate | 29.9 | 1,892 | – | 29.6 | |

| Zinc Concentrate | 1.0 | 134 | 57.4 | – | |

| Pyrite Concentrate | 4.8 | 84 | – | – | |

| Recovery | % | % | % | % | |

| Lead Concentrate | 23.8 | 50.4 | – | 82 | |

| Zinc Concentrate | 1.0 | 4.6 | 74.7 | – | |

| Pyrite Concentrate | 71.4 | 41.4 | – | – | |

| Global Recovery | 96.1 | 96.4 | 74.7 | 82.0 | |

| Payable | 69% | 77% | 85% | 90% | |

Proposals received support the payables used in the PEA financial model, including gold and silver credits across all concentrates. Terms are comparable between offers and within current industry values. The average payable for all metals is 73% on an AuEq basis.

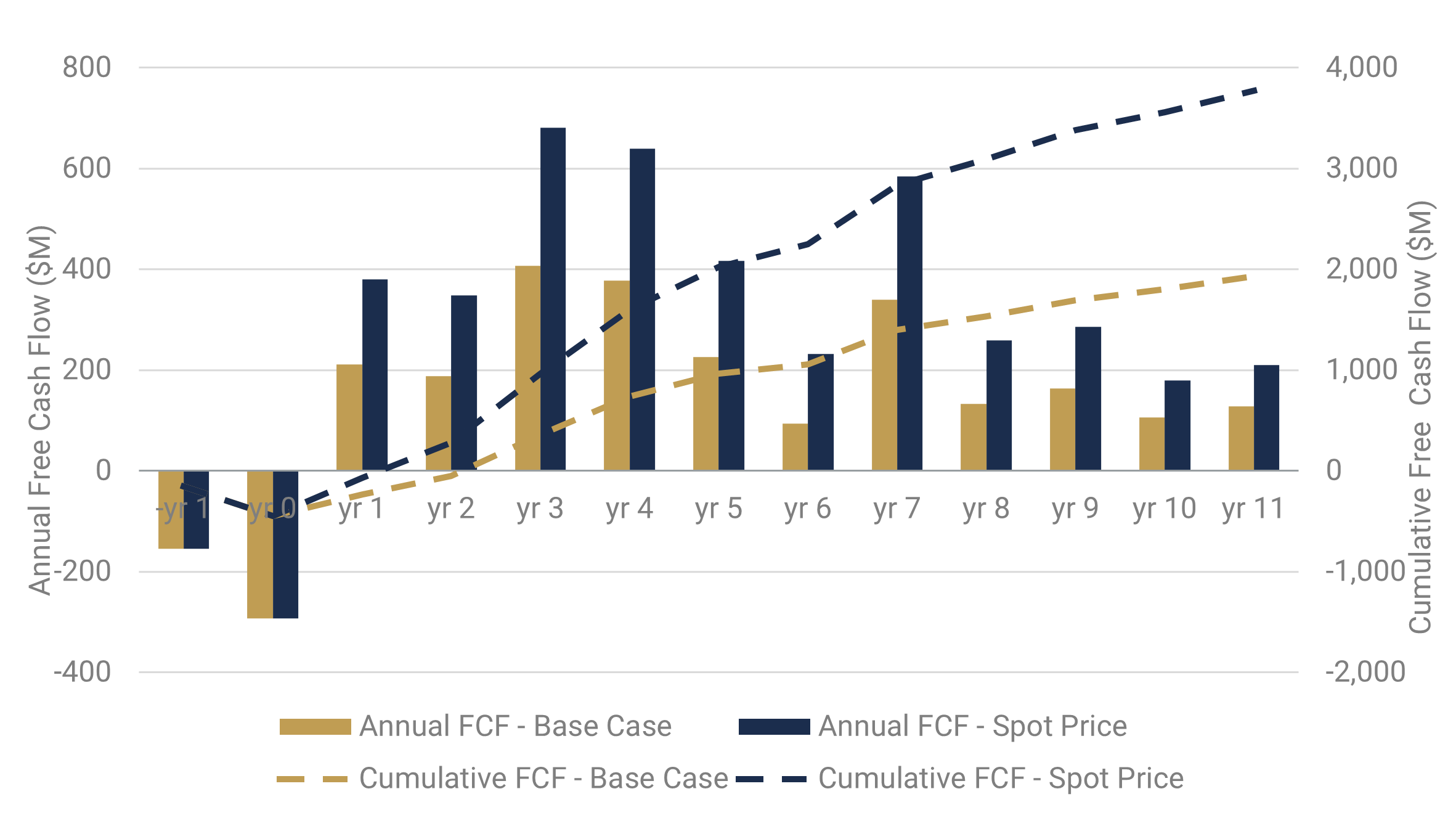

Economic Analysis

The PEA provides an after-tax NPV5% of $1.5 billion, an IRR of 47% and a payback period of 2.1 years from first production at base case consensus long-term gold price of $2,800/oz. The economic model also incorporates price assumptions of $30/oz silver, $1.20/lb zinc and $1.00/lb lead.

Table 8: Project Economics Summary

| Project Economics | Units | Base Case | ||

| Pre-tax | Post-tax | |||

| Gold Price | $/oz | 2,800 | 2,800 | |

| Silver price | $/oz | 30 | 30 | |

| Zinc | $/lb | 1.20 | 1.20 | |

| Lead Price | $/lb | 1.00 | 1.00 | |

| NPV5% | $B | 2.2 | 1.5 | |

| IRR | % | 69% | 47% | |

| Payback | Years | 1.3 | 2.1 | |

| NPV: Capex | – | 5.0 | 3.3 | |

| Revenue LOM | $B | 7.0 | – | |

| EBITDA LOM | $B | 3.4 | – | |

| Cumulative FCF LOM | $B | 2.8 | 2.0 | |

| Avg. Annual Revenue | $M/y | 629 | – | |

| Avg. Annual EBITDA | $M/y | 308 | – | |

| Avg. Annual FCF | $M/y | 254 | 176 | |

| ||||

Figure 7: Annual Free Cash Flow over the LOM

Sensitivity Analysis

Table 9 presents the sensitivity of after-tax IRR and NPV5%, with varying gold and silver prices. It should be noted that sensitivities apply to the financial model only; pit selection, cut-off grade and processing schedules are based on a $2,200/oz gold price and would likely be redesigned.

Table 9: Sensitivity Analysis to Commodity Prices of Gold and Silver

| Parameter | Units | Downside | Base Case | Spot Prices1 | Upside1 | Upside1 | |

| Commodity Price Sensitivity | |||||||

| Gold Price | $/oz | 2,000 | 2,800 | 4,000 | 7,000 | 17,250 | |

| Silver Price | $/oz | 20 | 30 | 48 | 80 | 200 | |

| NPV5% Pre-Tax | $M | 803 | 2,224 | 4,479 | 9,581 | 27,451 | |

| NPV5% Post-Tax | $M | 490 | 1,475 | 2,963 | 6,330 | 18,123 | |

| IRR Pre-Tax | % | 36% | 69% | 107% | 174% | 337% | |

| IRR Post-Tax | % | 22% | 47% | 77% | 128% | 256% | |

| LOM Revenue | $M | 5,162 | 6,991 | 9,896 | 16,464 | 39,473 | |

| LOM EBITDA | $M | 1,693 | 3,418 | 6,156 | 12,346 | 34,032 | |

| FCF-Unlevered (Pre-Tax) | $M | 1,049 | 2,824 | 5,642 | 12,012 | 34,331 | |

| FCF-Unlevered (Post-Tax) | $M | 714 | 1,958 | 3,818 | 8,022 | 22,751 | |

| Payback Period (Pre-Tax) | Years | 2.3 | 1.3 | 0.7 | 0.4 | 0.1 | |

| Payback Period (Post-Tax) | Years | 3.1 | 2.1 | 1.2 | 0.6 | 0.2 | |

| NPV5%:CAPEX (Post-Tax) | – | 1.1 | 3.3 | 6.6 | 14.2 | 40.6 | |

| 1. Assumed Spot Prices as of 31/10/2025. Upside gold price assumptions referenced from Michael Oliver (October 2025) and Pierre Lassonde, Wealthion podcast, October 2, 2025 — $7,000/oz and $17,250/oz, respectively. | |||||||

Exploration Potential at Boumadine

Significant potential exists to expand mineralization beyond the limits of the current PEA study. The Boumadine Main Trend (5.4 km), Tizi Zone (2.0 km), and Imariren Zone (1.2 km) remain open in all directions, highlighting strong opportunities for resource growth. Follow-up drilling is also planned at the newly discovered 8 km Asirem trend, underscoring the broader scale of the mineralized system. A 140,000-metre drilling program is underway, with roughly half focused on extending and infilling the known trends and the remainder directed toward greenfield exploration. This program is designed to expand the mineralized footprint beyond the PEA boundaries and to define additional zones that could support future development phases.

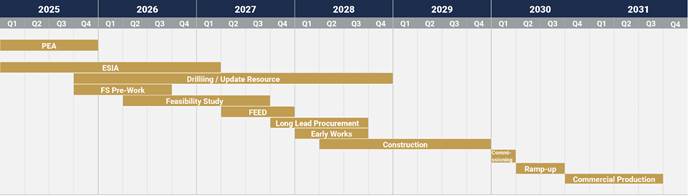

Next Steps

Upon completion of the PEA, the following actions are required to successfully advance the project:

- Definition and Exploration Program: A 360,000 m drilling campaign is planned over the next two years, focused on Mineral Resource definition and expansion, with the objective of converting inferred Mineral Resources into indicated Mineral Resources required for the feasibility study and expanding known mineralized zones to further improve project economics.

- Feasibility Study: Commencement of a feasibility study, targeting completion and public disclosure by year-end 2027.

- Environmental and Social Assessment: The Environment and Social Impact Assessment (“ESIA”) work completed to date will form the foundation for a more detailed ESIA, expected to be completed along with the feasibility study.

- Roaster Optionality: Continued assessment is underway to determine if an additional investment in a roaster achieves greater economic return. Further test work is required, along with determining strategic location.

Figure 8: Preliminary Schedule for Boumadine Project Development from PEA to Commercial Production

Conference Call Details

Aya will host a live webinar today to discuss the results with analysts, shareholders, and investors at 10:00 a.m. ET, which will be followed by a live Q&A session.

Participants may join the event via webcast at the following link: https://www.icastpro.ca/t9bhpo.

Aya encourages all participants to register in advance.

A replay will be available following the webinar through the same link or in the “Events” section of the Corporation’s website at www.ayagoldsilver.com.

Qualified Persons

The scientific and technical information contained in this press release has been reviewed for accuracy, compliance with National Instrument 43-101, and approved by Preetham Nayak P.Eng, Senior Study Manager for Lycopodium Minerals Canada Ltd, Benjamin Berson, P.Eng, Lead Mining Engineer for WSP and Eugene Puritch, P.Eng, FEC, CET from P&E Consultants Inc, Raphael Beaudoin, P. Eng, Vice-President, Operations, and by David Lalonde, B. Sc, P. Geo, Vice-President Exploration, each a Qualified Person as defined in NI 43-101, for accuracy and compliance with National Instrument 43-101.

The independent Qualified Persons for the PEA, as defined by NI 43-101, are

- Preetham Nayak P.Eng., Senior Study Manager for Lycopodium Minerals Canada Ltd

- Ruan Venter, P.Eng., Principal Process Engineer for Lycopodium Minerals Canada Ltd

- Zuned Shaikh P.Eng., Lead Mechanical Engineer for Lycopodium Minerals Canada Ltd

- Benjamin Berson, P.Eng, Lead Mining Engineer for WSP

- Alex Pheiffer, PrSciNat, ESIA Lead, from SLR Consulting France SAS

- George Papageorgiou PrEng, PhD, MSc, BSc, Eng (Civil), Wits, from Epoch Resources (Pty) Ltd

- Eugene Puritch, P.Eng, FEC, CET from P&E Consultants Inc.

- Antoine Yassa, P.Geo. from P&E Consultants Inc.

- Fred Brown, P.Geo. from P&E Consultants Inc.

- Jarita Barry, P.Geo. from P&E Consultants Inc.

- William Stone, PhD, P.Geo. from P&E Consultants Inc.

- Cortney Palleske, M.A.Sc., P.Eng, Principal Geomechanics Consultant from RockEng

Technical Report

The complete NI 43-101 Technical Report pertaining to the PEA will be filed within 45 days and will be available on Aya’s website and on SEDAR+ (www.sedarplus.ca).

The PEA is preliminary in nature, and it includes inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and, as such, there is no certainty that the PEA results will be realized.

About Aya Gold & Silver Inc.

Aya Gold & Silver Inc. is a rapidly growing, Canada-based silver producer with operations in the Kingdom of Morocco.

The only TSX-listed pure silver mining company, Aya operates the high-grade Zgounder Silver Mine and is exploring its properties along the prospective Anti-Atlas Fault, several of which have hosted past-producing mines and historical resources.

Aya’s management team has been focused on maximizing shareholder value by anchoring sustainability at the heart of its operations, governance, and financial growth plans.

For additional information, please visit Aya’s website at www.ayagoldsilver.com.

Or contact

| Benoit La Salle, FCPA, MBA President & CEO Benoit.lasalle@ayagoldsilver.com | Alex Ball VP, Corporate Development & IR alex.ball@ayagoldsilver.com |

Forward-Looking Statements

This press release contains “forward-looking statements” or “forward looking information” within the meaning of applicable securities laws and other statements that are not historical facts. Forward-looking statements are included to provide information about management’s current expectations, estimates and projections regarding Aya’s future growth and business prospects (including the timing and development of deposits and the success of exploration activities) and other opportunities as of the date of this press release.

All statements, other than statements of historical fact included in this press release, regarding the Corporation’s strategy, future operations, technical assessments, prospects, plans and objectives of management are forward-looking statements that involve risks and uncertainties. Wherever possible, words such as “anticipate”, “expect”, “plan”, “believe”, “objective”, “estimate”, “assume”, “intend”, and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will”, or are “likely” to be taken, occur or be achieved, have been used to identify such forward-looking information. Forward-looking statements in this press release include, but are not limited to statements with respect to: the PEA, notably those under the highlights, and the results of the PEA discussed in this press release, including, without limitation, project economics, financial and operational parameters such as expected throughput, production, processing methods, cash costs, all-in sustaining costs, other costs, capital expenditures, free cash flow, NPV, IRR, payback period and LOM, upside potential, opportunities for growth and expected next steps in the development of the Project; the mine design; the timing of the feasibility study; the timing of the ESIA; the release date and content of the technical report pertaining to the PEA; the future price of gold and silver; the estimation of mineral resources and the realization of mineral resource estimates; the off-take agreements for the concentrates from the Project; and requirements for additional capital.

Forward-looking information is based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Corporation to be materially different from future results, performance or achievements expressed or implied by such information or statements. There can be no assurance that such information or statements will prove to be accurate. Key assumptions upon which the Corporation’s forward-looking information is based include without limitation, assumptions regarding development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Corporation’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Forward-looking statements are also subject to risks and uncertainties facing the Corporation’s business, any of which could have a material adverse effect on the Corporation’s business, financial condition, results of operations and growth prospects. Some of the risks the Corporation faces and the uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements include, among others: the inherent risks involved in exploration and development of mineral properties, including (1) there being no significant disruptions affecting the operations of the Corporation whether due to artisanal miners, access to water, extreme weather events and other or related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; (2) permitting, development, operations and production from the Project being consistent with the Corporations’ expectations; (3) political and legal developments in the Kingdom of Morocco being consistent with its current expectations; (4) the exchange rate between the U.S. dollar and the Moroccan Dirham being approximately consistent with current levels; (5) certain price assumptions for gold and silver; (6) prices for diesel, process reagents, fuel oil, electricity and other key supplies being approximately consistent with current levels; (7) production and cost of sales forecasts meeting expectations; (8) the accuracy of the current mineral resource estimates of the Corporation; (9) labour and materials costs increasing on a basis consistent with the Corporation’s current expectations; and (10) asset impairment (or reversal) potential, being consistent with the Corporation’s current expectations.

In addition, readers are directed to carefully review the detailed risk discussion in the Corporation’s Annual Information Form and Management’s Discussion & Analysis for the year ended December 31, 2024 filed on SEDAR+, which discussions are incorporated by reference in this news release, for a fuller understanding of the risks and uncertainties that affect the Corporation’s business and operations.

Although the Corporation believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. As such, these risks are not exhaustive; however, they should be considered carefully. If any of these risks or uncertainties materialize, actual results may vary materially from those anticipated in the forward-looking statements found herein. Due to the risks, uncertainties, and assumptions inherent in forward-looking statements, readers should not place undue reliance on forward-looking statements.

Forward-looking statements contained herein are presented for the purpose of assisting investors in understanding the Corporation’s business plans, financial performance and condition and may not be appropriate for other purposes.

The forward-looking statements contained herein are made only as of the date hereof. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law. The Corporation qualifies all of its forward-looking statements by these cautionary statements.

Non-IFRS and Other Financial Measures

This press release includes certain performance measures commonly used in the mining industry that are not defined under IFRS. These measures do not have any standardized meaning under IFRS and may not be comparable to similar measures used by other companies. They are provided to assist readers in evaluating the Corporation’s performance and should not be considered in isolation or as a substitute for IFRS measures.

The non-IFRS financial measures and non-IFRS financial ratios used in this press release and common to the mining industry are defined below:

All-in Sustaining Costs and All-in Sustaining Costs Per Ounce-of-Gold-Equivalent Produced

AISC is a non-IFRS financial measure. AISC reported in the PEA includes cash costs, sustaining capital, closure costs, and salvage, but excludes corporate general and administrative costs, income taxes, and financing costs. AISC presented on a per- ounce-of-gold-produced basis is a non-IFRS financial ratio and is based on the metal prices assumed in the PEA. These measures capture the important components of the Corporation’s anticipated production and related costs and are used to indicate anticipated cost performance of the Corporation’s operations.

Cash Costs, Cash Costs Per Tonne Milled and Cash Costs Per Ounce-of-Gold-Equivalent Produced

Cash costs is a non-IFRS financial measure which includes mine-site operating costs such as mining, processing, and direct site G&A, product shipping, royalties and mining taxes. Cash costs exclude sustaining capital, corporate G&A, exploration, reclamation, and financing costs. Cash costs presented on a per-ounce-of-gold-equivalent produced basis is a non-IFRS financial ratio which is calculated as cash costs divided by anticipated production expressed in in ounces of gold equivalent. These measures capture the important components of the Corporation’s anticipated production and related costs and are used to indicate anticipated cost performance of the Corporation’s operations.

EBITDA

EBITDA is a non-IFRS financial measure which is calculated as net income before interest, taxes, depreciation, and amortization, and is an alternate measure of profitability to net income. This measure is used by the Corporation to show anticipated operating performance by eliminating the impact of non-operational or non-cash items.

Free Cash Flow

FCF is a non-IFRS financial measured defined as cash from operating activities, less initial and sustaining capital expenditures, operating costs, royalties, and taxes. This measure is used by the Corporation to measure the anticipated cash flow available to the Corporation.

As the Project is not currently in production, the Corporation does not have historical equivalent measures to compare and cannot perform a reconciliation with historical measures.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/95b5f731-ef28-43cb-b2b0-b958b211d3ae

https://www.globenewswire.com/NewsRoom/AttachmentNg/223dcad0-02d6-4e16-9897-c17839c8dd1d

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ded1399-3ac9-4b33-bd58-14f3466ed35f

https://www.globenewswire.com/NewsRoom/AttachmentNg/9adc2328-9b37-435a-8c7a-fbc3b45e1352

https://www.globenewswire.com/NewsRoom/AttachmentNg/d439803d-73d2-4959-a499-9d15ae321572

https://www.globenewswire.com/NewsRoom/AttachmentNg/db42bccd-2361-428e-8b06-b5136298d96f

https://www.globenewswire.com/NewsRoom/AttachmentNg/37a20cf8-b3fc-465f-989f-139526d1ece0

https://www.globenewswire.com/NewsRoom/AttachmentNg/f36bd5f1-9c55-4762-ba09-6ef694c9e761

![]()