Koryx Copper Announces Further Positive Drill Results at the Haib Copper Project, Southern Namibia

Highlights

| • Assays reported for a further 17 drill holes for 5,556m of diamond drilling. | |

| • Results received are consistent and confirm mineralisation in the Target areas with Cu grades in line with and in some cases above the average mineral resource estimate (“MRE”): | |

| • Best intercepts received are as follows: | |

| • HM96: | 40m @ 0.37% Cu (4 to 44m) |

| 116m @ 0.36% Cu (228 to 344m) | |

| • HM76: | 50m @ 0.33% Cu (102 to 152m) |

| 7m @ 0.37% Cu (216 to 223m) | |

| • HM78: | 36m @ 0.33% Cu (86 to 122m) |

| • HM79: | 96m @ 0.31% Cu (74 to 170m) |

| • HM81: | 12m @ 0.49% Cu (182 to 194m) |

| • HM83: | 34m @ 0.35% Cu (10 to 44m) |

| • HM84: | 38m @ 0.33% Cu (4 to 42m) |

| • HM86: | 30m @ 0.33% Cu (68 to 98m) |

| 92m @ 0.32% Cu (252 to 344m) | |

| • HM91: | 52m @ 0.36% Cu (18 to 70m) |

| 46m @ 0.34% Cu (126 to 172m) | |

| • HM100: | 30m @ 0.33% Cu (180 to 210m) |

| 10m @ 0.48% Cu (374 to 384m) | |

| • Four additional man portable rigs have arrived in Namibia and are in transit to the site and will commence drilling in October, bringing the total rig count to eight rigs on the resource drill program and 2 rigs on Geotech drilling. | |

| • Relogging and geological interpretation focussed on lithology, structure and modelling of Mo and Au by-products was completed and is currently being used for updated models. | |

VANCOUVER, British Columbia, Oct. 28, 2025 (GLOBE NEWSWIRE) — Koryx Copper Inc. (“Koryx” or the “Company“) (TSX-V: KRY) is pleased to announce assay results from 17 drill holes (5,556m) received as part of the Phase 2 and 3 drill program for its 2025 exploration and project development strategy on the wholly-owned Haib Copper Project (“Haib” or the “Project”) in southern Namibia. Haib is an advanced-stage Cu/Mo/Au project that is envisaged to produce a copper concentrate via a conventional crushing/milling/flotation metallurgical process, with the potential for additional copper production via heap leaching.

Heye Daun, Koryx Copper’s President and CEO commented: “The recent batch of 17 assay results represents a good spread of locations across the entire mineralised system, and from each of the four defined Target areas. Encouragingly, the holes continue to yield consistently positive results and support the mineral resource at Haib. The site geological team has made notable progress with building an updated geological model, having completed the relogging of all available drill core, updated the database, and under the guidance of our expert consultants, have reinterpreted the entire lithological and structural model for the deposit.

We are now integrating all this information and with this updated geological model we now have a much better understanding of the controls and distribution of copper and molybdenum grade. The new model also allows the geologists to improve, and more accurately estimate, the overall mineral resource. These updated models are currently being reviewed with the intention of updating and publishing the updated MRE before the end of 2025, aiming to realise the upside from the drill results received since the previous estimate in August 2024”.

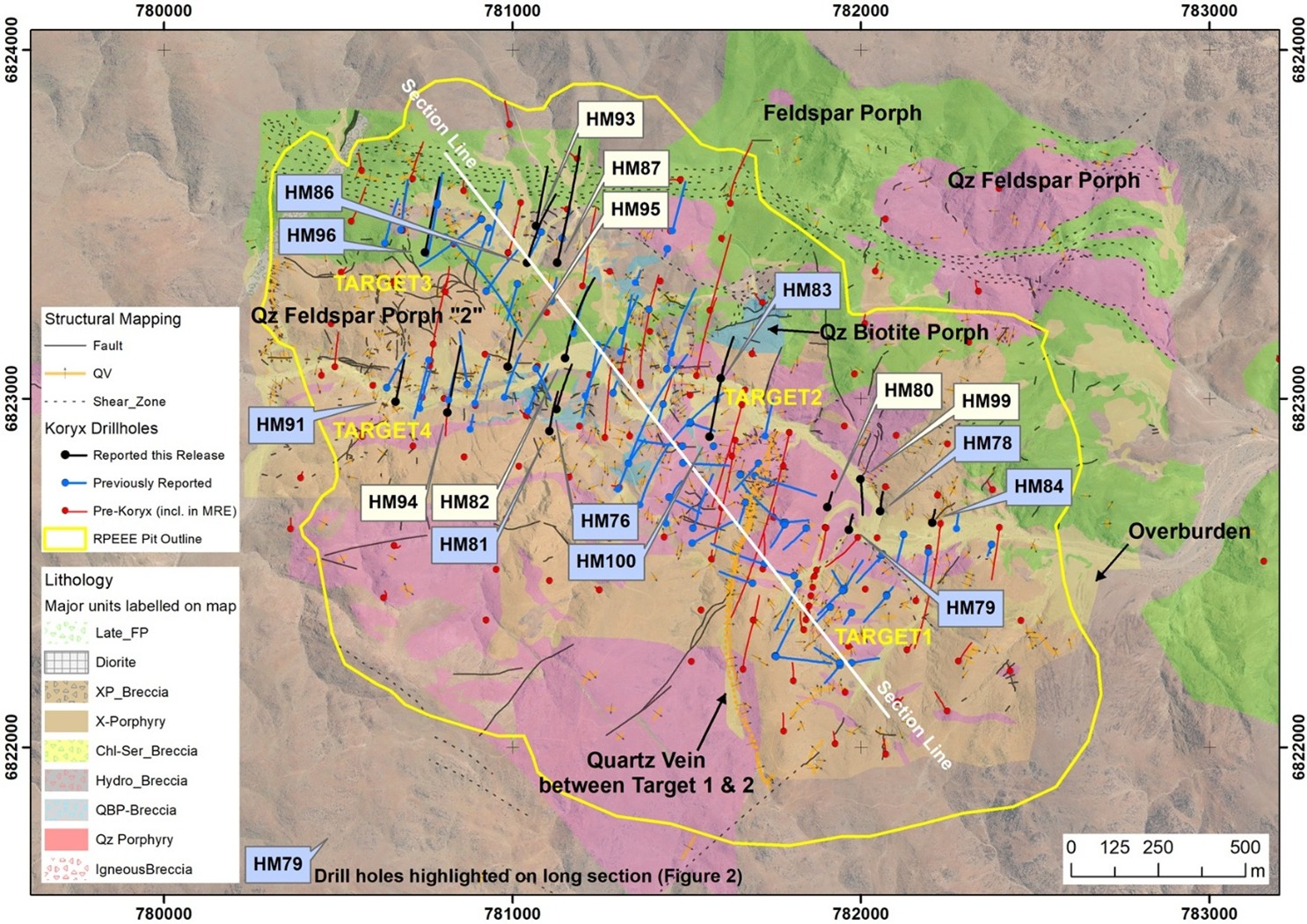

Figure 1: Plan view indicating the seventeen recent drill hole locations. The holes indicated in blue are shown on the long section below

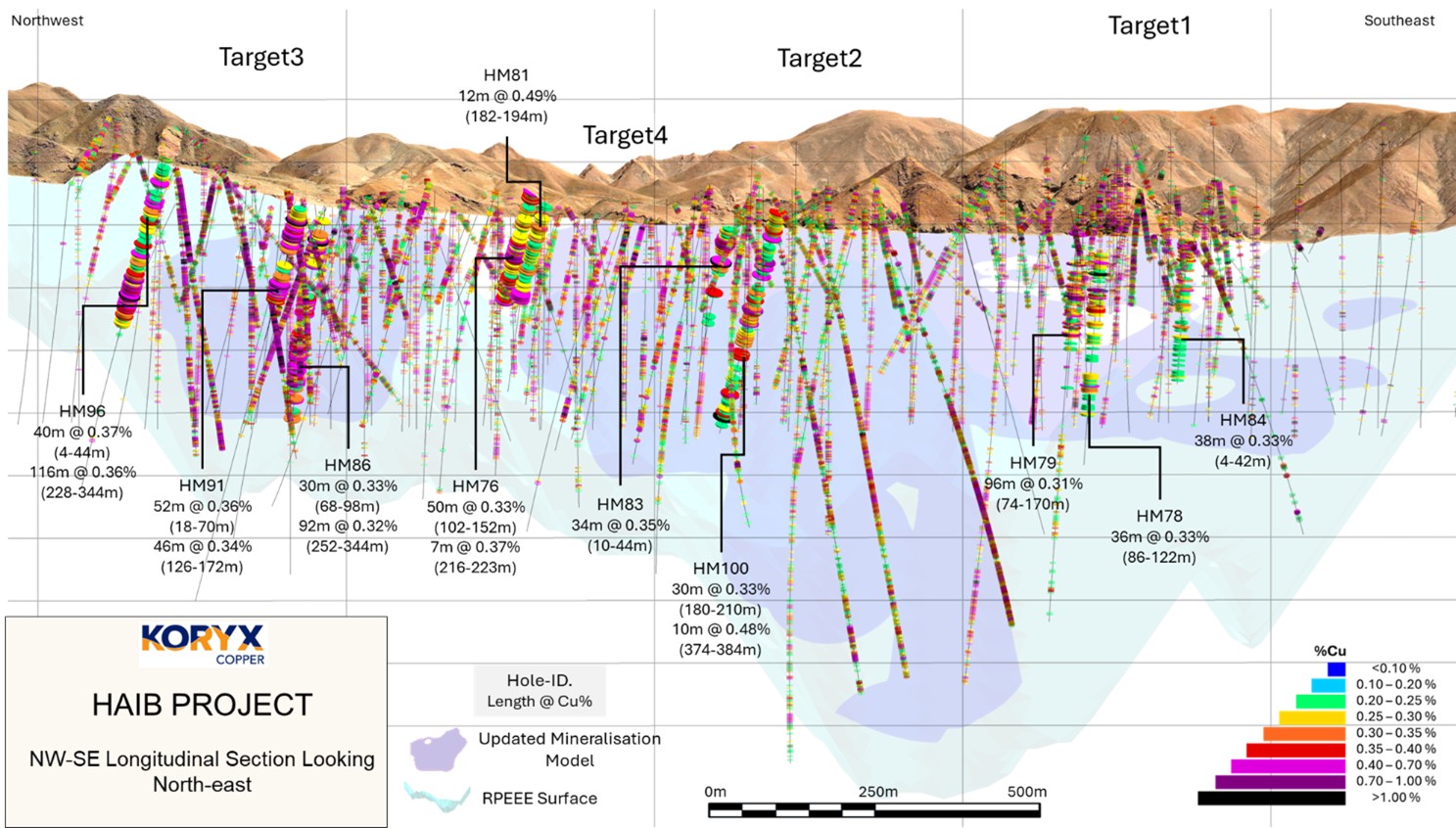

Figure 2. Long section looking northeast showing ten selected holes of the reported 17 hole intersections relative to the model for Cu mineralization

Discussion of Drill Results

Target 1 Results:

Recent results at Target 1 have further refined the mineralisation model. HM78 and HM79, drilled northwards from the Volstruis River, confirmed the shallow-dipping copper mineralisation with results consistent with expectations. However, HM99, drilled north of HM79 on the same section line, returned lower grades, indicating that mineralisation does not extend as far north as previously modelled—likely due to an unrecognised fault. HM80, located 40m west of HM79, confirmed the expected narrowing of mineralisation near the Quartz Vein boundary with Target 2, showing it occurs further south than predicted and suggesting a small reduction in tonnage. HM84, drilled 150m east of HM78, successfully closed sample spacing and delivered results in line with the current model, strengthening confidence in continuity.

Target 2 Results

Drilling at Target 2 continues to confirm strong copper mineralisation. HM83, drilled northwards from the Volstruis River, outlined the northern limit of the zone with 34m of well-developed near-surface copper, including 8m at 0.64% Cu, and a second mineralised interval from 64m to 80m. Grades taper off below 80m, helping define the depth extent of mineralisation in this area. HM100, drilled centrally, successfully closed spacing and returned results in line with expectations, further strengthening confidence in continuity across the target.

Target 3 Results

Drilling at Target 3 has provided further definition of mineralisation controls and boundaries. HM86, drilled near the northeastern edge, confirmed copper within porphyritic andesites, with grades increasing at a shallower depth than predicted by the model. HM87, located 90m east of HM86 where Target 3 overlaps with Target 2, returned lower than expected grades, with the anticipated broad >0.2% Cu zone absent—likely due to faulting or a local change in dip towards the northeast. HM93, drilled along the northern edge, refined the position of the shear zone that defines the mineralisation boundary, showing it to be slightly further south than modelled. HM96, drilled in the west, successfully closed spacing in this area with results consistent with expectations, strengthening confidence in continuity.

Target 4 Results

Drilling at Target 4 has confirmed extensions of mineralisation and highlighted areas of potential tonnage gain. HM76, drilled between Targets 2 and 4 along the Volstruis River, intersected strong copper and molybdenum mineralisation, including >200 ppm Mo over 160m with multiple samples exceeding 2,000ppm. HM81, drilled down dip, correlated well with HM76 at depth, confirming continuity of the deeper Cu-Mo zones. HM82, drilled north of HM76 across the river structure, returned low near-surface grades but showed increasing copper and scattered high-grade molybdenum at depth. Infill holes HM91 and HM94, drilled in the centre of the target, generally aligned with the model, though HM91 revealed a 46m zone averaging 0.34% Cu outside the current high-grade domain, indicating wider-than-expected mineralisation, while HM94 returned slightly lower-than-forecast copper due to porphyritic andesite dominance as opposed to breccia, which is more typical here. HM95, on the eastern edge, intersected deeper copper zones beyond the model, representing a potential tonnage increase.

Table of Significant Intersections

| Hole# | Zone | From (m) | To (m) | Width (m)1 | Cu (%) | Mo (%) | Au (g/t) |

| HM76 | Entire Hole | 1 | 223 | 221 | 0.24 | 0.015 | 0.017 |

| Main | 1 | 22 | 21 | 0.34 | 0.004 | 0.016 | |

| Main | 102 | 152 | 50 | 0.33 | 0.022 | 0.024 | |

| Including | 124 | 136 | 12 | 0.47 | 0.062 | 0.029 | |

| Main | 174 | 202 | 28 | 0.31 | 0.013 | 0.018 | |

| Main | 216 | 223 | 7 | 0.37 | 0.005 | 0.03 | |

| HM78 | Entire Hole | 0 | 369 | 369 | 0.21 | 0.001 | 0.026 |

| Main | 60 | 62 | 2 | 3.75 | 0.002 | 0.184 | |

| Main | 86 | 122 | 36 | 0.33 | 0.001 | 0.039 | |

| Main | 240 | 250 | 10 | 0.31 | 0.004 | 0.041 | |

| HM79 | Entire Hole | 0 | 270 | 270 | 0.2 | 0.001 | 0.03 |

| Main | 2 | 6 | 4 | 0.55 | 0.004 | 0.026 | |

| Main | 74 | 170 | 96 | 0.31 | 0.002 | 0.044 | |

| Including | 102 | 110 | 8 | 0.78 | 0.011 | 0.057 | |

| HM80 | Entire Hole | 0 | 260 | 260 | 0.14 | 0.001 | 0.027 |

| Main | 0 | 14 | 14 | 0.36 | 0 | 0.068 | |

| HM81 | Entire Hole | 0 | 220 | 220 | 0.19 | 0.012 | 0.015 |

| Main | 182 | 194 | 12 | 0.49 | 0.011 | 0.033 | |

| HM82 | Entire Hole | 0 | 506 | 506 | 0.12 | 0.004 | 0.016 |

| Main | 206 | 212 | 6 | 0.41 | 0.004 | 0.028 | |

| Main | 250 | 268 | 18 | 0.31 | 0.01 | 0.035 | |

| HM83 | Entire Hole | 0 | 195 | 195 | 0.19 | 0.001 | 0.011 |

| Main | 10 | 44 | 34 | 0.35 | 0.002 | 0.017 | |

| Including | 28 | 36 | 8 | 0.64 | 0.005 | 0.026 | |

| Main | 64 | 80 | 16 | 0.41 | 0.002 | 0.019 | |

| HM84 | Entire Hole | 0 | 240 | 240 | 0.23 | 0.002 | 0.024 |

| Main | 4 | 42 | 38 | 0.33 | 0.001 | 0.034 | |

| Including | 12 | 20 | 8 | 0.46 | 0.002 | 0.043 | |

| Main | 82 | 88 | 6 | 0.37 | 0.001 | 0.035 | |

| HM86 | Entire Hole | 0 | 425 | 425 | 0.19 | 0.001 | 0.017 |

| Main | 68 | 98 | 30 | 0.33 | 0.002 | 0.03 | |

| Including | 76 | 82 | 6 | 0.62 | 0.004 | 0.073 | |

| Including | 94 | 96 | 2 | 0.58 | 0.002 | 0.032 | |

| Main | 184 | 216 | 32 | 0.3 | 0.001 | 0.028 | |

| Including | 214 | 216 | 2 | 0.59 | 0.003 | 0.033 | |

| Main | 252 | 344 | 92 | 0.32 | 0.002 | 0.021 | |

| HM87 | Entire Hole | 0 | 615 | 615 | 0.09 | 0.001 | 0.025 |

| HM91 | Entire Hole | 0 | 246 | 246 | 0.2 | 0.002 | 0.017 |

| Main | 18 | 70 | 52 | 0.36 | 0.005 | 0.019 | |

| Including | 20 | 26 | 6 | 0.69 | 0.002 | 0.02 | |

| Including | 46 | 58 | 12 | 0.61 | 0.001 | 0.018 | |

| Main | 126 | 172 | 46 | 0.34 | 0.004 | 0.019 | |

| HM93 | Entire Hole | 0 | 320 | 320 | 0.08 | 0.001 | 0.01 |

| Main | 106 | 116 | 10 | 0.3 | 0.001 | 0.009 | |

| HM94 | Entire Hole | 0 | 389 | 389 | 0.14 | 0.008 | 0.014 |

| Main | 148 | 166 | 18 | 0.32 | 0.044 | 0.014 | |

| HM95 | Entire Hole | 0 | 223 | 223 | 0.2 | 0.005 | 0.01 |

| Main | 20 | 26 | 6 | 0.56 | 0.001 | 0.031 | |

| Main | 38 | 48 | 10 | 0.31 | 0.001 | 0.016 | |

| Main | 168 | 174 | 6 | 0.31 | 0.016 | 0.003 | |

| Main | 202 | 223 | 21 | 0.31 | 0.014 | 0.011 | |

| HM96 | Entire Hole | 0 | 441 | 441 | 0.22 | 0.003 | 0.013 |

| Main | 4 | 44 | 40 | 0.37 | 0.005 | 0.017 | |

| Including | 12 | 18 | 6 | 0.51 | 0.007 | 0.019 | |

| Including | 34 | 40 | 6 | 0.61 | 0.002 | 0.028 | |

| Main | 228 | 344 | 116 | 0.36 | 0.004 | 0.02 | |

| Including | 270 | 276 | 6 | 0.57 | 0.001 | 0.036 | |

| Including | 282 | 290 | 8 | 0.54 | 0.002 | 0.027 | |

| Including | 302 | 308 | 6 | 1.27 | 0.006 | 0.041 | |

| HM99 | Entire Hole | 0 | 202 | 201 | 0.16 | 0.002 | 0.047 |

| Main | 130 | 132 | 2 | 2.09 | 0.027 | 0.027 | |

| Main | 168 | 170 | 2 | 0.91 | 0.016 | 0.069 | |

| HM100 | Entire Hole | 2 | 413 | 411 | 0.21 | 0.004 | 0.014 |

| Main | 180 | 210 | 30 | 0.33 | 0.007 | 0.022 | |

| Including | 182 | 186 | 4 | 0.66 | 0.016 | 0.027 | |

| Main | 338 | 346 | 8 | 0.3 | 0.001 | 0.019 | |

| Main | 374 | 384 | 10 | 0.48 | 0.008 | 0.029 | |

| Including | 382 | 384 | 2 | 1.27 | 0.028 | 0.072 |

- Widths are interval widths and not true widths. The reported intervals are calculated using the following parameters:

- Only % Cuwas used to determine the intervals

- The target composite grade is ≥0.30% Cu.

- Composites start and end with samples ≥0.30% Cu.

- Grades between 0.20% and 0.30% are included in interval but generally constitute <40% of the interval.

- Consecutive samples between 0.20% and 0.30% should be fewer than 5 samples (10m).

- Grades below 0.20% are included but generally constitute <20% of the interval.

- Consecutive grades <0.2% should be fewer than 2 samples (4m).

Resource Modelling Update

The large batch of results reported above have been extremely useful in providing the information to further define the structural complexity of the system, as well as updating both the lithological and mineralisation models, particularly in areas where significant faulting has been encountered. The full set of multielement assays and gold assays have now been added to the database for review and statistical analysis during the remainder of October, with the intention of producing an updated MRE by the end of the year.

The MRE update is expected to demonstrate the upside from the successful drilling campaigns on the copper resource and significant increase in the number of molybdenum assays for estimate, as well as the potential inclusion of gold for the first time as a discreet model.

The increased density of drill results throughout all areas of the mineralised system is also expected to improve the resource classification in the new block model by converting Inferred material to the Indicated category. The team expects that with a better understanding of the Inferred material that is expected to remain following the update, a detailed drill plan can then be developed to target converting the resource to Indicated category in preparation for the pre-feasibility study publication in 2026.

While the logging and core interpretation used to update the new geological models and MRE will assist with guiding the future drill planning in the different Target areas, with the arrival of four new drill rigs in October the team are looking forward to accelerating the drill program to execute the remaining program in the first half of 2026.

RSU Issuance

The Company has approved the grant of up to an aggregate of 4,135,000 restricted share units (each, an “RSU”) to certain key executives, officers, consultants and directors of the Company pursuant to the Company’s Omnibus Plan, of which 1/2 of the RSUs will vest 12 months from the date of issuance, and then one-quarter each after 18 and 24 months. Each RSU represents the right to receive, once vested, one common share in the capital of the Company for every RSU held, or the cash equivalent thereof based on the fair market value of the shares of the Company calculated in accordance with the terms of the Omnibus Plan.

The grant of RSUs is subject to any necessary regulatory approvals and requirements of the Exchange.

Quality Control

All drill core was logged, photographed, and cut in half with a diamond saw. Half of the core was bagged and sent to ALS Laboratories Ltd. in Johannesburg, South Africa for analysis (SANAS Accredited Testing Laboratory, No. T0387) and ActLabs in Canada, while the other half was quartered with one quarter archived and stored on site for verification and reference purposes while the other quarter will be used for metallurgical test work. 33 elements are analyzed by Induced Coupled Plasma (ICP) utilizing a 4-acid digestion and gold is assayed for using a 30g fire assay method. Duplicate samples, blanks, and certified standards are included with every batch and are actively used to ensure proper quality assurance and quality control (“QA/QC”) The QA/QC frequency is 1 in 20 for each of blanks, duplicates and standards.

Qualified Person

Mr. Dean Richards Pr.Sci.Nat., MGSSA – BSc. (Hons) Geology is the Qualified Person for the Haib Copper Project and has reviewed and approved the scientific and technical information in this news release and is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No. 400190/08).Mr. Richards is independent of the Company and its mineral properties and is a Qualified Person for the purposes of National Instrument 43-101.

About Koryx Copper Inc.

Koryx Copper Inc. is a Canadian copper development Company focused on advancing the 100% owned Haib Copper Project in Namibia whilst also building a portfolio of copper exploration licenses in Zambia. Haib is a large, advanced (PEA-stage) copper/molybdenum porphyry deposit in southern Namibia with a long history of exploration and project development by multiple operators. More than 80,000m of drilling has been conducted at Haib since the 1970’s with significant exploration programs led by companies including Falconbridge (1964), Rio Tinto (1975) and Teck (2014). Extensive metallurgical testing and various technical studies have also been completed at Haib to date.

Additional studies are underway aiming to demonstrate Haib as a future long-life, low-cost, low-risk open pit, sulphide flotation copper project with the potential for additional copper production from heap leaching. Haib has a current mineral resource of 511Mt @ 0.33% Cu and 51 ppm Mo for 1,668kt of contained copper and 25.9kt contained Mo in the Indicated category and 308.9Mt @ 0.31% Cu and 40 ppm Mo for 949Mt of contained copper and 12.4kt contained Mo in the Inferred category (0.15% Cu cut-off).

Mineralization at Haib is typical of a porphyry copper deposit and it is one of only a few examples of a Paleoproterozoic porphyry copper deposit in the world and one of only two in southern Africa (both in Namibia). Due to its age, the deposit has been subjected to multiple metamorphic and deformation events but still retains many of the classic mineralization and alteration features typical of these deposits. The mineralization is dominantly chalcopyrite with minor bornite and chalcocite present and only minor secondary copper minerals at surface due to the arid environment.

Further details of the Haib Copper Project are available in the corresponding technical report titled, “NI 43-101 Technical Report – August 2024 Mineral Resource Estimate for the Haib Copper Project, Namibia” dated effective August 31, 2024 (the “Technical Report“). The Technical Report and other information is available on the Company’s website at https://koryxcopper.com and under the Company’s profile on SEDAR+ at www.sedarplus.ca.

On behalf of the Board of Directors

“Heye Daun”

President, CEO and Director

Additional information is also available by contacting the Company:

Julia Becker

Corporate Communications

jbecker@koryxcopper.com

+1-604-785-0850

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the use of proceeds from the Company’s recently completed financings and the future or prospects of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect “, “is expected “, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results, performance, or achievements to be materially different from those expressed or implied by forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, other factors may cause results not to be as anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Other factors which could materially affect such forward-looking information are described in the risk factors in the Company’s most recent annual management discussion and analysis. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/154fd63e-37ff-42d0-b398-fbb927815a47

https://www.globenewswire.com/NewsRoom/AttachmentNg/729ac8c4-0628-4c39-83ca-810d5effdf42

![]()