Vornado Realty Trust to Purchase 623 Fifth Avenue

Vornado Realty Trust

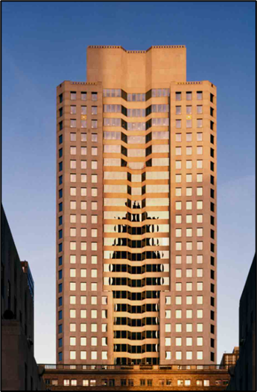

623 Fifth Avenue

NEW YORK, Aug. 25, 2025 (GLOBE NEWSWIRE) — Vornado Realty Trust (NYSE:VNO) announced today that it has entered into an agreement to purchase the 623 Fifth Avenue office condominium, a 36-story, 382,500 rentable square foot building situated above the flagship Saks Fifth Avenue department store, for $218 million. The building’s location provides for excellent light and air and sweeping, protected views of Midtown including Rockefeller Center and St. Patrick’s Cathedral.

The building is currently 75% vacant and Vornado intends to completely reposition and redevelop it into a premier, best-in-class, Class A boutique office building. The fully transformed 623 Fifth Avenue building will complement Vornado’s nearby Plaza District and Park Avenue holdings of 280 Park Avenue, 350 Park Avenue, 595 Madison Avenue, 640 Fifth Avenue, 689 Fifth Avenue and 1290 Avenue of the Americas.

Vornado expects to close the acquisition in September 2025 and complete the redevelopment for delivery to tenants in 2027.

Vornado Realty Trust is a fully-integrated equity real estate investment trust.

C O N T A C T

Thomas J. Sanelli

(212) 894-7000

Certain statements contained herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Our future results, financial condition and business may differ materially from those expressed in these forward-looking statements. You can find many of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “may” or other similar expressions in this press release. For a discussion of factors that could materially affect the outcome of our forward-looking statements and our future results and financial condition, see “Risk Factors” in Part I, Item 1A, of our Annual Report on Form 10-K for the year ended December 31, 2024. Currently, some of the factors are interest rate fluctuations and the effects of inflation on our business, financial condition, results of operations, cash flows, operating performance and the effect that these factors have had and may continue to have on our tenants, the global, national, regional and local economies and financial markets and the real estate market in general.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/348c405b-31ea-4fbb-b0c1-f11fa056e59d

![]()