Surebet Definitively Proven To Be Part of a Large-Scale Tier-1 Reduced Intrusion Related Gold System With Tremendous Upside Remaining, Golden Triangle, B.C.

Highlights Of The Geological Study Completed By The Colorado School Of Mines:

- A detailed geological study was recently completed by the Colorado School of Mines utilizing a compilation of drill holes and geological data. Conclusions of the geological study confirms a new interpretation of the ore forming process of high-grade gold mineralization at Surebet and confirms common causative Reduced Intrusion Related Gold (RIRG) source with tremendous untapped discovery potential.

- High-grade gold mineralization at Surebet occurs in two different settings, both containing visible gold in remarkably high percentages of the drill hole intersections. Of particular note is that the visible gold is fine to coarse grained, and includes up to abundant visible gold, with an increase of coarseness and abundance in vertical distribution. Which is consistent with the assessment that the system is getting richer as it is drilled deeper, and both styles of high-grade gold mineralization are open in all directions:

- Shear hosted veins up to 39 meters wide where gold occurs as native or alloys with bismuth and tellurium within quartz-sulphide veins hosted in sedimentary and volcanic rock units.

- Multiple millimeter to centimeter wide quartz veinlets where gold occurs with bismuth, tellurium, and molybdenite within felsic to intermediate dykes.

- 12 vertically stacked gold mineralized shear-hosted veins within the sedimentary and volcanic rock units have been confirmed through drilling and modelling at Surebet with grades up to 34.52 g/t AuEq (34.47 Au and 3.96 Ag) over 39.00 meters. These stacked layers are up to 39 meters wide within a 1.8 km2 area that remains open showing the excellent additional blue-sky potential.

- Multiple high-grade gold intervals from reduced intrusion related porphyritic felsic to intermediate feeder dykes assayed up to 12.03 g/t AuEq (11.84 g/t Au and 15.61 g/t Ag) over 10.00 meters. The gold mineralized feeder dykes are up to 25 meters wide and exposed along strike at surface for up to 1,500 meters and remain open, strongly indicating close proximity to a gold-rich Motherlode RIRG source (previously announced March 13, 2025).

- Dating of volcanic-hosted gold mineralization related to the shear hosted veins resulted in an age of 50.7 ± 1.0 Ma. This result overlaps with the U-Pb zircon age of 52.0 ± 1.5 Ma obtained for the mineralized felsic to intermediate dykes. The overlap in mineralization age for both shear-hosted gold-rich veins and gold-bearing dykes suggests a common causative intrusion as the source of mineralization.

- Eocene age (56 to 34 Ma) mineralization has been neglected in the southern part of the Golden Triangle, where most of the known deposits are thought to be Jurassic age (201 to 145 Ma). The discovery of abundant Eocene age mineralization at Surebet shows the tremendous untapped discovery potential that is left on the Golddigger property.

- Recent research by the Colorado School of Mines has indicated the presence of two stages of gold mineralization in the gold-rich veins at Surebet within the shear hosted veins and the felsic to intermediate dykes:

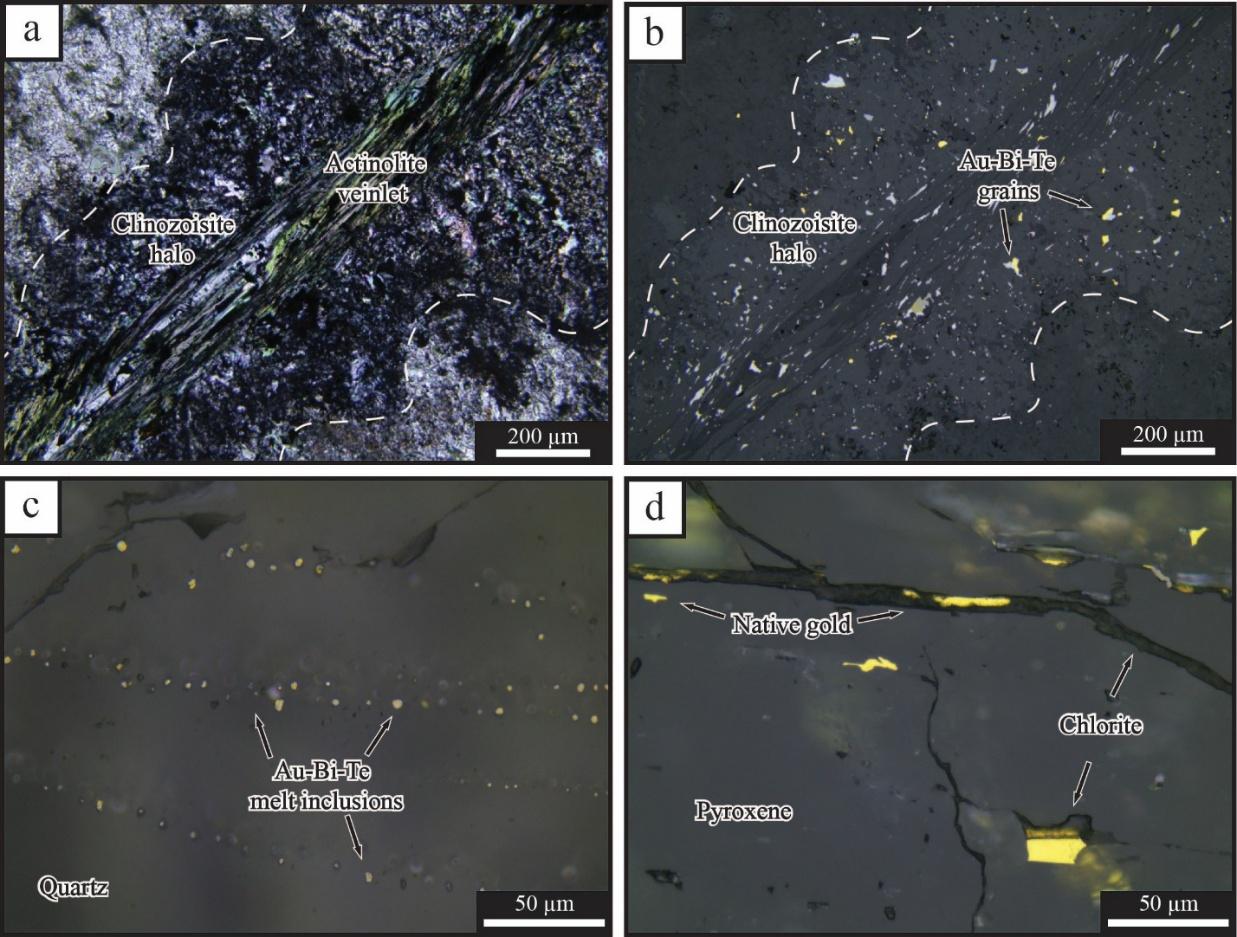

- The first stage of gold mineralization resulted in the deposition of native bismuth, bismuth tellurides, and the gold-bismuth mineral maldonite and is associated with calc-silicate alteration including actinolite. This early mineralization occurs primarily in quartz veins crosscutting gold-bearing dykes and the volcanic rocks.

- The later assemblage of gold mineralization crosscuts the early stage and is associated with chlorite alteration. This late stage of gold makes up most gold observed in the shear-hosted veins.

- The paragenetic relationships of minerals are consistent with alteration occurring from a cooling hydrothermal system in both the shear and dyke hosted veins. This provides further evidence that the dykes and shear-hosted gold veins at Surebet may be related to a causative intrusion at depth that may have acted as the heat source for the hydrothermal system and likely contributed significant free gold.

- At Surebet, multiple gold-bismuth-tellurium grains have textural characteristics which indicate that they were entrapped as melt droplets within the host quartz. Fluid inclusions associated with these melt droplets provide evidence for the contemporaneous occurrence of phase separation of the CO2-rich magmatic-hydrothermal fluids, a process not previously described in the scientific literature.

Microphotographs of gold assemblages and associated alteration found at Surebet. a. Transmitted light image of the gold bearing actinolite veinlet with clinozoisite halo associated with early gold mineralization. b. Reflected light image of actinolite veinlet from frame a. showing the association between the gold-bismuth-tellurium grains, actinolite, and clinozoisite. c. Reflected light image of early-stage gold-bismuth-tellurium grains which were entrapped as a melt and healed along a microfracture in quartz. d. Reflected light image of late gold and associated chlorite cutting pyroxene.

An accompanying infographic is available at: https://www.globenewswire.com/NewsRoom/AttachmentNg/319220d6-7595-41c1-a20e-7fa434b92050

- Confirmation of high gold grades over broad intervals in the recently discovered RIRG system characterized by considerable amounts of visible gold, bismuth, bismuth tellurides and molybdenum mineralization in the felsic to intermediate porphyritic dykes on Surebet materially increases the size potential of the various gold zones at the Surebet discovery.

- During only 15 months of boots on the ground, strong gold mineralization has been confirmed in 100% of 243 widespread drill holes containing >300 intercepts to date within a 1.8 km2 area. The multiple stacked gold veins and widespread gold-rich reduced intrusion feeder dykes, confirms the continuity of the widths and grades at Surebet demonstrating this world-class gold-rich system has tremendous additional untapped expansion potential remaining.

TORONTO, April 24, 2025 (GLOBE NEWSWIRE) — Goliath Resources Limited (TSX-V: GOT) (OTCQB: GOTRF) (FSE: B4IF) (the “Company” or “Goliath”) is pleased to report the results of the geological study completed by the Colorado School of Mines which confirms new ore forming process of high-grade gold mineralization and common causative Reduced Intrusion Related Gold (RIRG) source with tremendous untapped discovery potential at Surebet on its 100% controlled Golddigger Property (the “Property”), Golden Triangle, B.C. Two stages of gold mineralization clearly associated with a RIRG system as well as overlap in mineralization and alteration ages for shear hosted veins and dykes, and paragenetic relationships of minerals consistent with alteration occurring from a cooling hydrothermal system, strongly indicate a common RIRG feeder source at Surebet.

Roger Rosmus, Founder and CEO of Goliath Resources, states: “Since our initial discovery at Surebet of an extensive outcropping zone of gold mineralization, followed by drilling below to make a discovery of a series of stacked gently dipping high-grade gold veins, and then a series of vertical dykes through the stacked veins, our understanding of the overall system has been aided by the great work by the team at the Colorado School of Mines. The 2024 drilling season was our best ever, highlighted by visible gold in 92% of the holes drilled, including fine-grained to coarse-grained and abundant visible gold that got better as we drilled deeper into the discovery. Another important milestone in 2024 was our success drilling into a series of near vertical dykes, also with visible gold and high-grade gold assays, that come up through the gently dipping stacked veins. All of our drilling and geological work enabled us to provide a remarkable amount of material and data for the team at the Colorado School of Mines to enhance the modeling, interpretation and thesis of what has caused the high-grade gold mineralization we have drilled into with great success so far. In a general sense, we have determined that we have a series of gently dipping high-grade veins with vertical RIRG zones (also with high-grade gold) through the veins. Which have enriched the veins, and there is a likelihood that they are all coming from a common source. When you consider how widespread the high-grade gold mineralization is in the veins and RIRG zones, the source is potentially extremely large. The more drilling and scientific studies we do at the Surebet discovery, the better it gets, and we are still high in the system that is open in all directions, and we are delighted with the prospect with what can be found as we continue to laterally and drill deeper for the source of the high-grade gold system.”

Gold mineralization at Surebet occurs in two different setting: 1) shear hosted veins up to 39 meters wide where gold occurs as native or alloys with bismuth and tellurium within quartz-sulphide veins hosted in sedimentary and volcanic rock units and 2) multiple millimeter to centimeter wide quartz veinlets where gold occurs with bismuth, tellurium, and molybdenite within felsic to intermediate dykes. Direct dating of volcanic-hosted sulphide mineralization related to the shear hosted veins resulted in an age of 50.7 ± 1.0 Ma. This result overlaps with the U-Pb zircon age of 52.0 ± 1.5 Ma obtained for the mineralized felsic to intermediate dykes. The overlap in mineralization age for both shear-hosted veins and gold-bearing dykes suggests a common causative intrusion as the source of mineralization observed at Surebet. Petrographic and fluid inclusion analysis carried out on samples from the mineralized shear-hosted veins in an earlier phase of the project indicated that the fluid responsible for the gold mineralization at Surebet is of magmatic origin (previously announced February 2, 2023) further corroborating the hypothesis of a common magmatic source for the mineralization. Eocene age (56 to 34 Ma) mineralization has been neglected in the southern part of the Golden Triangle, where most of the known deposits are thought to be Jurassic age (201 to 145 Ma). The discovery of abundant Eocene age mineralization at Surebet shows the tremendous untapped discovery potential that is left on the Golddigger property and surrounding areas. Structures and lithologies younger than Jurassic which have been historically overlooked now provide excellent targets for styles of gold mineralization which may have been overlooked.

New research has indicated the presence of two stages of gold mineralization in the gold-bearing veins at Surebet within the shear-hosted veins and the felsic to intermediate dykes. The first stage of gold mineralization resulted in the deposition of native bismuth, bismuth tellurides, and the gold-bismuth mineral maldonite. This stage of gold mineralization is associated with calc-silicate alteration including actinolite. This early mineralization occurs primarily in quartz veins crosscutting gold-bearing dykes and the volcanic rocks. Gold-bismuth-tellurium grains from this stage are commonly observed as inclusions along healed microfractures in quartz. The later assemblage of gold mineralization crosscuts the early stage and is associated with chlorite alteration. This late stage of gold makes up most gold observed in the shear-hosted veins at Surebet. Samples taken from an interval in hole GD-24-260 that assayed 34.52 g/t AuEq (34.47 Au and 3.96 Ag) over 39.00 meters (previously announced January 13, 2025) are found to have significant quantities of both the early and late gold stages, possibly explaining the high-grade observed. This overlap between dyke-typical and shear-hosted vein-typical mineralization further suggests both styles of gold are expressions of the same system.

The paragenetic relationships of minerals determined through petrographic work are consistent with alteration occurring from a cooling hydrothermal system in both the shear and dyke-hosted veins. This finding provides further evidence that the dykes at Surebet may be related to a causative intrusion at depth that may have acted as the heat source for the hydrothermal system and likely contributed significant metals. Additionally, the gold-bismuth-tellurium grains have textural characteristics which indicate that they were entrapped as melt droplets within the host quartz. Fluid inclusions associated with these melt droplets provide evidence for the contemporaneous occurrence of phase separation of the CO2-rich magmatic-hydrothermal fluids, a process not previously described in the scientific literature. Further research at the Colorado School of Mines will be focused on understanding this new mechanism for ore formation and its role in the formation of high-grade gold mineralization at Surebet.

During only 15 months of boots on the ground, strong gold mineralization has been confirmed with assays in 100% of 243 widespread drill holes containing >300 intercepts to date within a 1.8 km2 area with 20 holes contain intervals over 100 gram*meter Au (> 3 ounces*meter Au). Confirmation of multiple stacked gold veins and widespread gold-rich reduced intrusion feeder dykes, confirms the continuity of the widths and grades at Surebet demonstrating this world-class gold system has tremendous additional untapped expansion potential remaining.

Golddigger Property

The Golddigger Property is 100% controlled and covers an area of 91,518 hectares in the world class geological setting of the Eskay Rift, within 3 kilometers of the Red Line in the Golden Triangle of British Columbia. This area has hosted some of Canada’s greatest mines including Eskay Creek, Premier and Snip. Other significant and well-known deposits in the Golden Triangle include Brucejack, Copper Canyon, Galore Creek, Granduc, KSM, Red Chris, and Schaft Creek. Goliath controls 56 kilometers of the Red Line which is a geologic contact between Triassic age Stuhini rocks and Jurassic age Hazelton rocks used as key markers when exploring for gold-copper-silver mineralization.

The Surebet discovery has exceptional continuity and excellent metallurgy with gold recoveries of 92.2% with 48.8% of it as free gold from gravity alone at a 327-micrometer crush (no cyanide required to recover the gold). The metallurgy completed to date shows no deleterious elements are present such as mercury or arsenic.

The Property is in an excellent location in close proximity to the communities of Alice Arm and Kitsault where there is a permitted mill site on private property. It is situated on tide water with direct barge access to Prince Rupert (190 kilometers via the Observatory inlet/Portland inlet). The town of Kitsault is accessible by road (190 kilometers from Terrace, 300 kilometers from Prince Rupert) and has a barge landing, dock, and infrastructure capable of housing at least 300 people, including high-tension power.

Additional infrastructure in the area includes the Dolly Varden Silver Mine Road (only 7 kilometers to the East of the Surebet discovery) with direct road access to Alice Arm barge landing (18 kilometers to the south of the Surebet discovery) and high-tension power (25 kilometers to the east of Surebet discovery). The city of Terrace (population 16,000) provides access to railway, major highways, and airport with supplies (food, fuel, lumber, etc.), while the town of Prince Rupert (population 12,000) is located on the west coast and houses an international container seaport also with direct access to railway and an airport.

About CASERM (Center to Advance the Science of Exploration to Reclamation in Mining)

Goliath Resources is a paying member and active supporter of the Center to Advance the Science of Exploration to Reclamation in Mining (CASERM), which is one of the world’s largest research centers in the mining sector. CASERM is a collaborative research venture between Colorado School of Mines and Virginia Tech that is supported by a consortium of mining and exploration companies, analytical instrumentation and software companies, and federal agencies aiming to transform the way geoscience data is acquired and used across the mining value chain. The center forms part of the I-UCRC program of the National Science Foundation. Research focuses on the integration of diverse geoscience data to improve decision making across the mine life cycle, beginning with the exploration for subsurface resources continuing through mine operation as well as closure and environmental remediation. Over the past three years, Goliath Resources’ membership in CASERM has allowed world-class research to be performed on the Surebet project part of the Golddigger Property in British Columbia, Canada.

Qualified Person

Quinton Hennigh (Ph.D., P.Geo.) is the qualified person pursuant to National Instrument 43-101 Standards of Disclosure for Mineral Projects responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Hennigh is a technical advisor to Goliath Resources and has verified the data herein disclosed.

Approval of Shareholder Rights Plan

At Goliath’s annual and special meeting of shareholders held on March 17, 2025 (the “Meeting”), the Company’s shareholders (“Shareholders”) approved all of the resolutions put before the meeting including a resolution adopting a shareholder rights plan (the “Rights Plan”) which was initially adopted by the board of directors (“Board”) on February 7, 2025. In connection with the Rights Plan, the Company also entered into a rights plan agreement with Computershare Investor Services Inc. as rights agent dated February 7, 2025. The Rights Plan was adopted to ensure Shareholders are treated fairly and equally in connection with any unsolicited take-over bid or other acquisition of control of, or a significant interest in, the Company while providing the Board adequate time to consider and evaluate such a take-over bid or other acquisition and, if appropriate, identify, develop and negotiate any value-enhancing alternatives. The Rights Plan is substantially similar to the Company’s prior shareholder rights plan first adopted on December 11, 2020 and announced via press release on January 6, 2021. The Rights Plan has not been adopted in response to any specific take-over bid or other proposal to acquire control the Company, and the Company is not aware of any such pending or contemplated proposals.

Under the terms of the Rights Plan, one right (a “Right”) will be issued and attached to each common share in the capital of the Company (“Common Share”) outstanding as of the Effective Date, and a Right will also attach to each Common Share issued thereafter. The issuance of the Rights will not change the manner in which the Shareholders trade their Common Shares, and the Rights will automatically attach to Common Shares with no further action required by Shareholders.

Subject to its terms, the Rights issued under the Rights Plan become exercisable only if a person (an “Acquiring Person”), together with certain parties related to such Acquiring Person, acquires or announces its intention to acquire beneficial ownership of 20% or more of the outstanding Common Shares without complying with the “Permitted Bid” provisions of the Rights Plan or in circumstances where application of the Rights Plan is not waived in accordance with its terms. Following a transaction that results in a person becoming an Acquiring Person, the Rights entitle the holders thereof (other than the Acquiring Person and certain related parties) to purchase Common Shares for a nominal amount.

The description of the Rights Plan in this news release is qualified in its entirety by the full text of the Rights Plan, a copy of which is available on the Company’s SEDAR+ profile at www.sedarplus.ca. The Company’s management information circular, dated February 7, 2025, prepared in connection with the annual general and special meeting held on March 17, 2025, contains a summary of the Rights Plan.

Option Grant

The Company has granted a total of 300,000 stock options for a five year period to advisors and consultants priced at 1.61 per share which will vest immediately. The grant of the options are subject to the Company’s omnibus equity incentive plan.

About Goliath Resources Limited

Goliath Resources is an explorer of precious metals projects in the prolific Golden Triangle of northwestern British Columbia. All of its projects are in high quality geological settings and geopolitical safe jurisdictions amenable to mining in Canada. Goliath is a member and active supporter of CASERM which is an organization that represents a collaborative venture between Colorado School of Mines and Virginia Tech. Goliath’s key strategic cornerstone shareholders include Crescat Capital, McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), Mr. Rob McEwen, a Global Commodity Group based in Singapore, Mr. Eric Sprott and Mr. Larry Childress.

For more information please contact:

Goliath Resources Limited

Mr. Roger Rosmus

Founder and CEO

Tel: +1.416.488.2887

roger@goliathresources.com

www.goliathresourcesltd.com

Other

The reader is cautioned that grab samples are spot samples which are typically, but not exclusively, constrained to mineralization. Grab samples are selective in nature and collected to determine the presence or absence of mineralization and are not intended to be representative of the material sampled.

Oriented HQ-diameter or NQ-diameter diamond drill core from the drill campaign is placed in core boxes by the drill crew contracted by the Company. Core boxes are transported by helicopter to the staging area and then transported by truck to the core shack. The core is then re-orientated, meterage blocks are checked, meter marks are labelled, Recovery and RQD measurements taken, and primary bedding and secondary structural features including veins, dykes, cleavage, and shears are noted and measured. The core is then described and transcribed in MX Deposit™. Drill holes were planned using Leapfrog Geo™ and QGIS™ software and data from the 2017-2022 exploration campaigns. Drill core containing quartz breccia, stockwork, veining and/or sulphide(s), or notable alteration are sampled in lengths of 0.5 to 1.5 meters. Core samples are cut lengthwise in half, one-half remains in the box and the other half is inserted in a clean plastic bag with a sample tag. Standards, blanks and duplicates were added in the sample stream at a rate of 10%.

Grab, channels, chip and talus samples were collected by foot with helicopter assistance. Prospective areas included, but were not limited to, proximity to MINFile locations, placer creek occurrences, regional soil anomalies, and potential gossans based on high-resolution satellite imagery. The rock grab and chip samples were extracted using a rock hammer, or hammer and chisel to expose fresh surfaces and to liberate a sample of anywhere between 0.5 to 5.0 kilograms. All sample sites were flagged with biodegradable flagging tape and marked with the sample number. All sample sites were recorded using hand-held GPS units (accuracy 3-10 meters) and sample ID, easting, northing, elevation, type of sample (outcrop, subcrop, float, talus, chip, grab, etc.) and a description of the rock were recorded on all-weather paper. Samples were then inserted in a clean plastic bag with a sample tag for transport and shipping to the geochemistry lab. QA/QC samples including blanks, standards, and duplicate samples were inserted regularly into the sample sequence at a rate of 10%.

All samples are transported in rice bags sealed with numbered security tags. A transport company takes them from the core shack to the Paragon Geochemical labs facilities in Surrey, BC or ALS labs facilities in North Vancouver, BC. Paragon Geochemical is certified with both AC89-IAS and ISO/IEC Standard 17025:2017. Samples submitted to Paragon received gold and silver analysis by photon assay whereby the entire sample is crushed to approximately 70% passing 2 mm mesh. The entire crushed sample is riffle split and weighed into multiple (300-500g) jars that are submitted for photon assay. Photon assay uses high-energy X-rays (photons) to excite atomic nuclei within the jarred samples, causing them to emit secondary gamma rays, which are measured to identify and quantify the metals present. The assays from all jars are combined on a weight-averaged basis. ALS is either certified to ISO 9001:2008 or accredited to ISO 17025:2005 in all of its locations. At ALS samples were processed, dried, crushed, and pulverized before analysis using the ME-MS61 and Au-SCR21 methods. For the ME-MS61 method, a prepared sample is digested with perchloric, nitric, hydrofluoric, and hydrochloric acids. The residue is topped up with dilute hydrochloric acid and analyzed by inductively coupled plasma atomic emission spectrometry. Overlimits were re-analyzed using the ME-OG62 and Ag-GRA21 methods (gravimetric finish). For Au-SCR21 a large volume of sample is needed (typically 1-3kg). The sample is crushed and screened (usually to -106 micron) to separate coarse gold particles from fine material. After screening, two aliquots of the fine fraction are analysed using the traditional fire assay method. The fine fraction is expected to be reasonably homogenous and well represented by the duplicate analyses. The entire coarse fraction is assayed to determine the contribution of the coarse gold.

Widths are reported in drill core lengths and the true widths are estimated to be 80-90% and AuEq metal values are calculated using: Au 2797.16 USD/oz, Ag 31.28 USD/oz, Cu 4.25 USD/lbs, Pb 1955.58 USD/ton and Zn 2750.50 USD/ton on January 31st, 2025. There is potential for economic recovery of gold, silver, copper, lead, and zinc from these occurrences based on other mining and exploration projects in the same Golden Triangle Mining Camp where Goliath’s project is located such as the Homestake Ridge Gold Project (Auryn Resources Technical Report, Updated Mineral Resource Estimate and Preliminary Economic Assessment on the Homestake Ridge Gold Project, prepared by Minefill Services Inc. Bothell, Washington, dated May 29, 2020). Here, AuEq values were calculated using 3-year running averages for metal price, and included provisions for metallurgical recoveries, treatment charges, refining costs, and transportation. Recoveries for Gold were 85.5%, Silver at 74.6%, Copper at 74.6% and Lead at 45.3%. It will be assumed that Zinc can be recovered with the Copper at the same recovery rate of 74.6%. The quoted reference of metallurgical recoveries is not from Goliath’s Golddigger Project, Surebet Zone mineralization, and there is no guarantee that such recoveries will ever be achieved, unless detailed metallurgical work such as in a Feasibility Study can be eventually completed on the Golddigger Project.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor the OTCQB Venture Market accepts responsibility for the adequacy or accuracy of this release.

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on Goliath’s current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to, among other things, the ability of the Company to complete financings and its ability to build value for its shareholders as it develops its mining properties. Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to Goliath. Although such statements are based on management’s reasonable assumptions, there can be no assurance that the proposed transactions will occur, or that if the proposed transactions do occur, will be completed on the terms described above.

The forward-looking information contained in this release is made as of the date hereof and Goliath is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

This announcement does not constitute an offer, invitation, or recommendation to subscribe for or purchase any securities and neither this announcement nor anything contained in it shall form the basis of any contract or commitment. In particular, this announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States, or in any other jurisdiction in which such an offer would be illegal. The securities referred to herein have not been and will not be will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws and may not be offered or sold within the United States or to or for the account or benefit of a U.S. person (as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

![]()