Prime Drink Group Announces Its Intent to Acquire Relax Downlow, The Latest Brand to Collaborate with Lane Hutson

- With this acquisition, Prime is entering the fast-growing relaxation beverage market, which is expected to reach $1.3 billion by 2030, with a projected CAGR of more than 15%1.

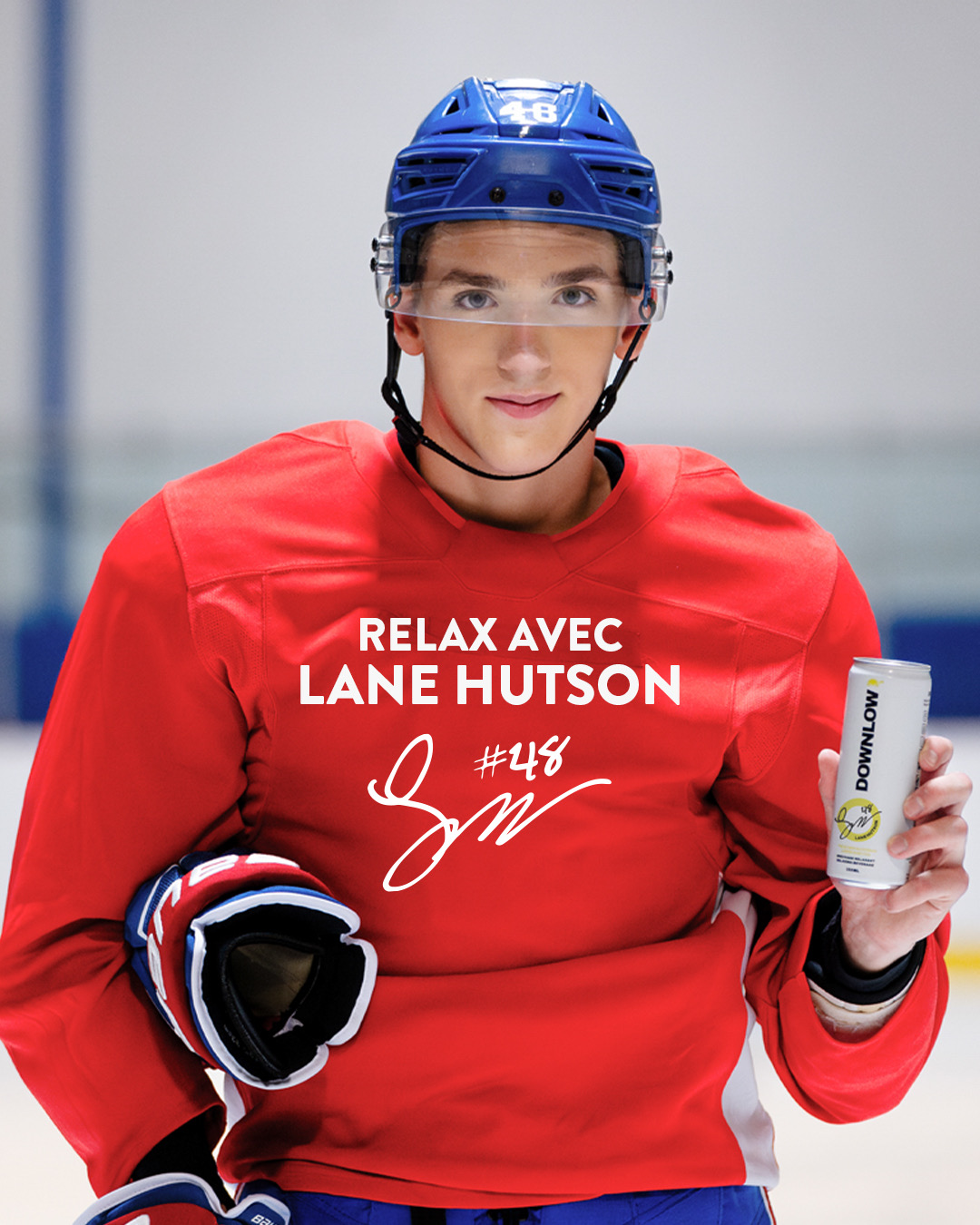

- Lane Hutson, NHL star player, becomes the official ambassador of Relax Downlow.

- Relax Downlow has just launched its first flavors, Citrus Iced Tea and Tropical Punch, in the largest chain of convenience stores in Quebec and in the upscale hotel sector.

MONTREAL, April 07, 2025 (GLOBE NEWSWIRE) — Prime Drink Group Corp. (CSE: PRME) (“Prime” or the “Company”) is pleased to announce that it has entered into a binding letter of intent dated April 3, 2025, to acquire a 70% interest in 9375-4208 Quebec Inc. (the “Target”), a corporation governed by the laws of Quebec (the “Proposed Transaction”). The Target is the owner of Relax Downlow, a brand of recovery functional beverages developed in Quebec and approved by Health Canada as a natural health product.

| A strong debut with Lane Hutson as official ambassador Relax Downlow has recently launched its first flavors, Citrus Iced Tea and Tropical Punch, in the largest convenience store chain in Quebec and in the upscale hotel sector. To support the launch, Lane Hutson, NHL star player, who recently set the Montreal Canadiens franchise record for highest assists in a single season by a rookie defenseman, becomes the face of Relax Downlow. Several exclusive publications and media appearances are planned in the coming weeks. Marketing powered by the Prime ecosystem |  |

“This acquisition marks a new chapter for Prime, as we carry on our mission to innovate in the functional beverage sector by adding a revolutionary local brand with strong potential to our portfolio,” said Olivier Primeau, VP Marketing, Strategic Vision and Acquisitions at Prime. “We are also very proud to be partnering with Lane to launch Relax Downlow, which we believe will soon become a leading brand.”

The founders of Relax Downlow will retain a minority stake in the company. Steven Levac, Founder and President of Relax Downlow, commented on the transaction: “I am very excited to be working with Olivier Primeau and the entire Prime team to take Relax Downlow to the next level. This brand, which I have wholeheartedly built with my partner Dario, is now well on its way to becoming a must-have in Quebec and beyond.”

“We are thrilled to have Relax Downlow as part of Prime’s portfolio of brands. It will benefit from Prime’s powerful media network. This is Prime’s first foray into the better-for-you beverage market. We intend, with our innovation team, to continue exploring this market, which reflects the constantly evolving needs of our current and future customers,” added Alexandre Côté, President and CEO of Prime.

About Relax Downlow

In an ever-changing world that is increasingly fast-paced, dynamic and stressful, we are at the dawn of a new movement with Relax Downlow, a beverage line designed to revitalize the body and reduce stress. Designed for athletes, but also for anyone looking for a natural and enjoyable way to relax, these beverages meet the needs of a demanding daily life.

Relax Downlow is a relaxing, natural beverage that is caffeine-free, sugar-free and gluten-free. It is specifically formulated to help athletes recover by promoting relaxation and rest after intense physical and mental exertion. It offers a unique blend of over 20 active ingredients, including BCAAs, amino acids, electrolytes, antioxidants, vitamins and minerals, and contains only 2 calories.

Summary of Transaction

In consideration for the acquisition of the Target, Prime will make the following payments to the shareholders of the Target (the “Target Shareholders”) upon the closing of the Proposed Transaction (the “Closing”):

- $255,000 to the Target Shareholders, to be paid by the issuance of common shares in the capital of the Company (the “Prime Shares”) at a deemed price equal to the 10-day volume-weighted average trading price, subject to the applicable pricing policies of the Canadian Securities Exchange (“CSE”) at the time of issuance.

- $95,000 in a lump sum cash payment.

(collectively, the “Consideration”).

All dollar figures provided herein are in Canadian dollars unless otherwise stated.

The Prime Shares being issued pursuant to the Consideration will be issued under prospectus exemptions pursuant to National Instrument 45-106 – Prospectus and Registrations Exemptions (“NI 45-106”) and may be subject to an applicable statutory hold period along with any other resale restrictions imposed under applicable securities laws or the policies of the Canadian Securities Exchange (the “CSE”). The Proposed Transaction would not constitute a “Major Acquisition” under the policies of the CSE and the Company does not anticipate requiring shareholder approval in connection with the Proposed Transaction under the policies of the CSE.

The Proposed Transaction is subject to completion of due diligence by Prime on the Target, the entering into a definitive agreement with respect to the Proposed Transaction, the approval of the CSE, and the satisfaction of conditions customary for a transaction of this nature.

Given that Steven Levac is an employee of the Company and an officer of the Target, it is anticipated that the Proposed Transaction would constitute a “related party transaction” as defined under Multilateral Instrument 61-101 Protection of Minority Securityholders (“MI 61-101”). The Company expects the Proposed Transaction would be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the securities being issued to such insider in connection with the Proposed Transaction, nor the consideration for the securities being paid to such insider would exceed 25% of the Company’s market capitalization.

About Prime Drink Group

Prime Drink Group Corp (CSE: PRME) is a Québec-based corporation focused on becoming a leading diversified holding company in the beverage, influencer media and hospitality sectors.

For further information, please contact:

Jean Gosselin, Secretary

Phone: (514) 394-7717

Email: info@prime-group.ca

Forward-Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations (including negative and grammatical variations) of such words and phrases or state that certain acts, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

Forward-looking information in this press release may include, without limitation, statements relating to: (i) the completion of the Proposed Transaction on the terms described herein; (ii) the entry into a definitive agreement with respect to the Proposed Transaction; (iii) the anticipated benefits of the combined companies; (iv) the strategic and marketing vision of the combined companies; (v) the availability of an exemption under MI 61-101; (vii) the completion of satisfactory due diligence of the Target by the Company; and (viii) the receipt of all necessary approvals with respect to the Proposed Transaction.

These statements are based upon assumptions that are subject to significant risks and uncertainties, including risks regarding the beverage industry, management’s ability to integrate Target’s business into the Company’s business and execute its business plan, market conditions, general economic factors, management’s ability to execute its business plan, sufficient due diligence being provided by Target, no adverse change in applicable regulations, changes in consumer marketing and product preferences, and the equity markets generally. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance of Prime may differ materially from those anticipated and indicated by these forward-looking statements. Any number of factors could cause actual results to differ materially from these forward-looking statements as well as future results. Although Prime believes that the expectations reflected in forward-looking statements are reasonable, they can give no assurances that the expectations of any forward-looking statements will prove to be correct. Except as required by law, Prime disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/37df9a29-0848-4e31-8a96-10bc05582ee7

1 Zion Market Research, May 30, 2023.

![]()