Galaxy Entertainment Group Reports Q4 & Annual 2024 Results

Leading Macau’s Non-Gaming Diversification Through Mice, Entertainment Events And Live Sports

Capella At Galaxy Macau Fitting Out – Mid Year Opening

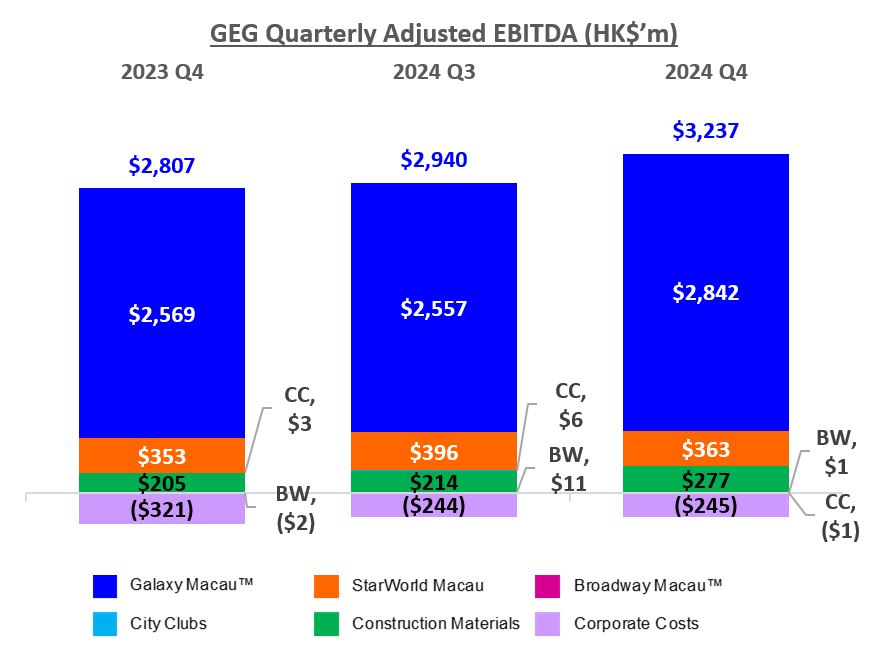

Q4 2024 Group Adjusted EBITDA Up 15% YoY And Up 10% QoQ To $3.2 Billion

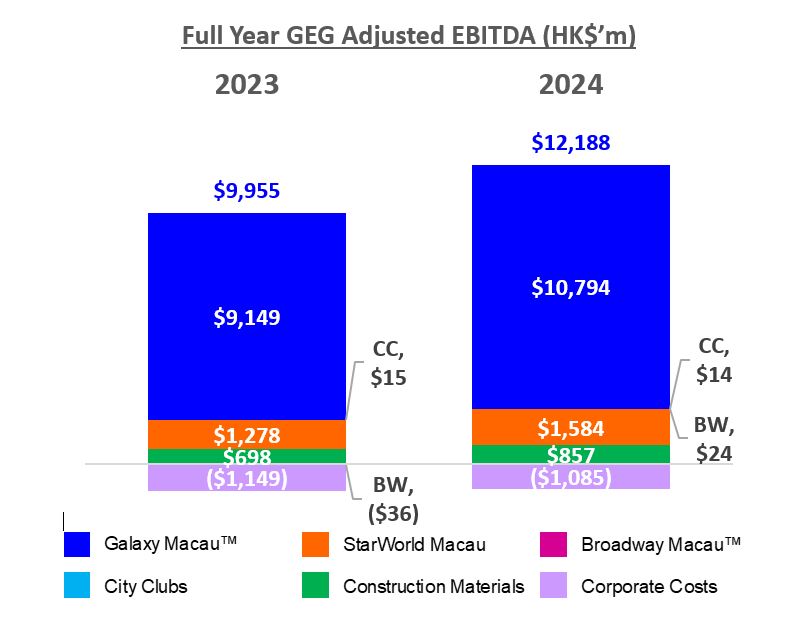

FY2024 Group Adjusted EBITDA Up 22% YoY To $12.2 Billion

FY2024 Group NPAS Up 28% YoY to $8.8 Billion

Recommends A Final Dividend Of $0.50 Per Share

HONG KONG, Feb. 27, 2025 (GLOBE NEWSWIRE) — Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three-month and twelve-month periods ended 31 December 2024. (All amounts are expressed in HKD unless otherwise stated)

Mr. Francis Lui, Chairman of GEG said,

“Before I update you on GEG’s performance in 2024, I would like firstly to acknowledge the passing of Dr. Lui Che Woo in November 2024. As the founding Chairman of GEG his vision was to build GEG into a globally recognized Asia’s leading gaming and entertainment corporation. He certainly achieved his vision and he was an inspiration to us all.

Throughout 2024 we continued to drive every segment of the business in particular the premium mass which remains the main profit driver. In a competitive market we continue to allocate resources with discipline and focus on their most efficient use. GEG believes in competing with excellent products and service and not on price. Our efforts are reflected in the Group achieving full year Adjusted EBITDA of $12.2 billion, up 22% year-on-year. Full year Net Profit Attributable to Shareholders (“NPAS”) was $8.8 billion, up 28% year-on-year.

We have a strong, healthy and liquid balance sheet with cash and liquid investments of $31.3 billion, with minimal debt of $4.2 billion giving a net position of $27.1 billion. This financial strength allows GEG to fund our development pipeline, actively explore international development opportunities and return capital to shareholders via dividends. On 25 October 2024, we paid an interim dividend of $0.50 per share which was an increase from $0.30 per share paid in April 2024. Subsequently the GEG Board recommends a final dividend of $0.50 per share payable in June 2025. These dividends demonstrate our continued confidence in the longer-term outlook of Macau and for the Company.

GEG has been working with the MGTO to actively promote Macau as an international tourist destination. We previously announced the opening of offices in Tokyo, Seoul and Bangkok. In 2024 international visitor arrivals to Macau increased by 66% year-on-year to 2.4 million. We will continue to work with the MGTO and support this important initiative.

During the year we have seen entertainment and events play an important role in driving new and repeat customers to Macau. It has been estimated that during 2023 Macau in total hosted 240 concerts which generated an estimated MOP1.1 billion in ticket sales. The Galaxy International Convention Center (“GICC”) and Galaxy Arena have played an important role in this emerging trend, in 2024 GEG hosted approximately 460 shows and events, including numerous major events such as Andy Lau World Tour, Ultimate Fighting Championship (“UFC”), International Table Tennis Federation (“ITTF”) World Cup and Women’s Volleyball Nations League, among others.

Looking forward in 2025, we will host a number of major sporting and entertainment events such as the world-renowned legendary Italian tenor, Andrea Bocelli at Galaxy Arena this March and the ITTF World Cup 2025 in April. Further, Hong Kong famous singer Mr. Jacky Cheung will bring his 10th concert tour to Galaxy Arena in June. We are also hosting the scheduled Extraordinary General Assemblies and Conference of the Fédération Internationale de l’Automobile (FIA) which is to be co-hosted by Automobile General Association Macao-China (“AAMC”) and GEG this June at GICC, marking the first time of this world class annual event in Asia.

GEG is well positioned to continue to capitalize on this trend of increased entertainment in Macau and our experience over the past year has been that major events drive a significant increase in visitors to our resorts resulting in increased gaming activity, retails sales, food and beverage revenue and hotel demand. Galaxy Arena is the largest indoor arena in Macau with 16,000 seating capacity.

In May 2024, the Central Government further expanded the Individual Visit Scheme (“IVS”) to 59 eligible cities with a total combined population of approximately 500 million people. Starting in 2025, Zhuhai residents are able to apply for a “one-trip-per-week” visa to Macau, and Hengqin residents are eligible for multiple visa entries to Macau. We view this as a positive development and look forward to further policy relaxations in the future. Macau’s light rail transit system (“LRT”) opened a new line from the Hengqin port to Cotai in December 2024, which we believe will complement the visa relaxation and encourage Zhuhai residents to visit Macau more frequently.

On the development front, we continue to progress with the fitting out of Capella at Galaxy Macau and the construction of Phase 4 which has a strong focus on non-gaming, primarily targeting entertainment and family facilities, and also includes gaming.

During the year we deployed smart tables across all of our casinos. We expect this technology to enhance the overall operating efficiency and customer management. In addition, we continue to make enhancements to our resorts including adding new F&B and retail offerings at Galaxy Macau™. In the recently announced Forbes Travel Guide 2025 List, Galaxy Macau™ proved its unrivalled position as the integrated resort with the most Five-Star hotels under one roof of any luxury resort company worldwide for the third consecutive year. Galaxy Macau™ was also named Best Integrated Resort in the Asia Pacific region for consecutive years by Inside Asian Gaming since the award inauguration. At StarWorld Macau we are evaluating a range of major upgrades, that includes the main gaming floor, the lobby arrival experience and increasing the F&B options. We have completed the upgrade of Level 3 and StarWorld Macau now hosts one of the largest scale Live Table Games (“LTG”) terminals in Macau.

We welcomed President Xi Jinping visit to Macau in December 2024 and the inauguration of Mr. Sam Hou Fai as the Chief Executive of Macau SAR. GEG will continue to work closely with the Government to diversify Macau’s economy and develop Macau into the World Centre of Tourism and Leisure.

Finally, I would like to thank all our team members who deliver ‘World Class, Asian Heart’ service each and every day and contribute to the success of the Group.”

Q4 & FULL YEAR 2024 RESULTS HIGHLIGHTS

GEG: Well Positioned for Future Growth

- Full Year Group Net Revenue of $43.4 billion, up 22% year-on-year

- Full Year Group Adjusted EBITDA of $12.2 billion, up 22% year-on-year

- Full Year Group NPAS of $8.8 billion, up 28% year-on-year

- Q4 Group Net Revenue of $11.3 billion, up 9% year-on-year and up 6% quarter-on-quarter

- Q4 Group Adjusted EBITDA of $3.2 billion, up 15% year-on-year and up 10% quarter-on-quarter

- Played unlucky in Q4 which decreased Adjusted EBITDA by approximately $35 million, normalized Q4 Adjusted EBITDA was $3.3 billion, up 12% year-on-year and up 5% quarter-on-quarter

Galaxy Macau™: Primary Driver to Group Earnings

- Full Year Net Revenue of $34.5 billion, up 24% year-on-year

- Full Year Adjusted EBITDA of $10.8 billion, up 18% year-on-year

- Q4 Net Revenue of $9.1 billion, up 12% year-on-year and up 9% quarter-on-quarter

- Q4 Adjusted EBITDA of $2.8 billion, up 11% year-on-year and up 11% quarter-on-quarter

- Played unlucky in Q4 which decreased Adjusted EBITDA by approximately $27 million, normalized Q4 Adjusted EBITDA of $2.9 billion, up 7% year-on-year and up 5% quarter-on-quarter

- Hotel occupancy for Q4 across the seven hotels was 98%

StarWorld Macau: Continuing with Major Property Upgrades

- Full Year Net Revenue of $5.3 billion, up 15% year-on-year

- Full Year Adjusted EBITDA of $1.6 billion, up 24% year-on-year

- Q4 Net Revenue of $1.3 billion, up 3% year-on-year and down 4% quarter-on-quarter

- Q4 Adjusted EBITDA of $363 million, up 3% year-on-year and down 8% quarter-on-quarter

- Played unlucky in Q4 which decreased Adjusted EBITDA by approximately $8 million, normalized Q4 Adjusted EBITDA of $371 million, up 6% year-on-year and down 3% quarter-on-quarter

- Hotel occupancy for Q4 was 100%

Broadway Macau™, City Clubs and Construction Materials Division (“CMD”)

- Broadway Macau™: Full Year Adjusted EBITDA of $24 million, versus $(36) million in 2023. Q4 Adjusted EBITDA was $1 million, versus $(2) million in Q4 2023 and $11 million in Q3 2024

- City Clubs: Full Year Adjusted EBITDA of $14 million, down 7% year-on-year. Q4 Adjusted EBITDA was $(1) million, versus $3 million in Q4 2023 and $6 million in Q3 2024.

- CMD: Full Year Adjusted EBITDA of $857 million, up 23% year-on-year. Q4 Adjusted EBITDA was $277 million, up 35% year-on-year and up 29% quarter-on-quarter

Balance Sheet: Maintain a Healthy and Liquid Balance Sheet

- As at 31 December 2024, cash and liquid investments were $31.3 billion and the net position was $27.1 billion after debt of $4.2 billion

- Paid two dividends totaled $0.80 per share in 2024

- The GEG Board recommends a final dividend of $0.50 per share payable in June 2025

Development Update: Capella at Galaxy Macau is targeted to open in mid-2025; Continue ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau; Progressing with Phase 4

- Capella at Galaxy Macau is targeted to open in mid-2025

- Cotai Phase 3 – Ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau

- Cotai Phase 4 – Our efforts are firmly focused on the development of Phase 4 which has a strong focus on non-gaming, primarily targeting entertainment, family facilities and also includes gaming

- International – Continuously exploring opportunities in overseas markets

Macau Market Overview

Based on DICJ reporting, Macau’s Gross Gaming Revenue (“GGR”) for full year 2024 was $220.2 billion, up 24% year-on-year, and represented 78% of 2019 level. GGR in Q4 2024 was $55.8 billion, up 6% year-on- year and up 3% quarter-on-quarter.

In 2024, visitor arrivals to Macau were 34.9 million, up 24% year-on-year, recovering to 89% of 2019. Mainland visitor arrivals to Macau were 24.5 million, up 29% year-on-year, with IVS visitors of 12.3 million, up 16% year-on-year. GEG has been working with the MGTO to actively promote Macau as an international tourist destination. We previously announced the opening of offices in Tokyo, Seoul and Bangkok. During the year international visitor arrivals to Macau increased by 66% from 1.5 million in 2023 to 2.4 million in 2024. We will continue to work with the MGTO and support this important initiative.

Group Financial Results

Full Year 2024

The Group posted Net Revenue of $43.4 billion, up 22% year-on-year. Adjusted EBITDA was $12.2 billion, up 22% year-on-year. NPAS was $8.8 billion, up 28% year-on-year. Galaxy Macau™’s Adjusted EBITDA was $10.8 billion, up 18% year-on-year. StarWorld Macau’s Adjusted EBITDA was $1.6 billion, up 24% year-on-year. Broadway Macau™’s Adjusted EBITDA was $24 million, versus $(36) million in 2023.

In 2024, GEG played unlucky in its gaming operation which decreased its Adjusted EBITDA by approximately $157 million. Normalized Adjusted EBITDA was $12.3 billion, up 22% year-on-year.

Summary table of GEG Q4 and full year 2024 Adjusted EBITDA and adjustments:

| in HK$’m | Q4 2023 | Q3 2024 | Q4 2024 | YoY | QoQ | FY 2023 | FY 2024 | YoY | |

| Adjusted EBITDA | 2,807 | 2,940 | 3,237 | 15% | 10% | 9,955 | 12,188 | 22% | |

| Luck1 | (103) | (165) | (35) | – | – | (162) | (157) | – | |

| Normalized Adjusted EBITDA | 2,910 | 3,105 | 3,272 | 12% | 5% | 10,117 | 12,345 | 22% |

The Group’s total GGR in 2024 was $41.1 billion, up 30% year-on-year. Mass GGR was $33.1 billion, up 25% year-on-year. VIP GGR was $5.3 billion, up 55% year-on-year. Electronic GGR was $2.7 billion, up 52% year-on-year.

Group Key Financial Data

| (HK$’m) | 2023 | 2024 |

| Revenues: | ||

| Net Gaming | 27,290 | 33,826 |

| Non-gaming | 5,396 | 6,425 |

| Construction Materials | 2,998 | 3,181 |

| Total Net Revenue | 35,684 | 43,432 |

| Adjusted EBITDA | 9,955 | 12,188 |

| Gaming Statistics2 (HK$’m) | ||

| 2023 | 2024 | |

| Rolling Chip Volume3 | 117,660 | 180,879 |

| Win Rate % | 2.9% | 2.9% |

| Win | 3,447 | 5,329 |

| Mass Table Drop4 | 107,531 | 127,823 |

| Win Rate % | 24.6% | 25.9% |

| Win | 26,486 | 33,112 |

| Electronic Gaming Volume | 50,884 | 95,380 |

| Win Rate % | 3.5% | 2.8% |

| Win | 1,780 | 2,704 |

| Total GGR Win5 | 31,713 | 41,145 |

_________________________

1 Reflects luck adjustments associated with our rolling chip program.

2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects sum of promoter and inhouse premium direct.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

Balance Sheet and Dividends

The Group’s balance sheet remains healthy and liquid. As of 31 December 2024, cash and liquid investments were $31.3 billion and the net position was $27.1 billion after debt of $4.2 billion. Our strong balance sheet combined with substantial cash flow from operations allows us to return capital to shareholders via dividends and to fund our development pipeline.

GEG paid two dividends of $0.30 and $0.50 per share in April and October 2024 respectively. Subsequently the GEG Board recommends a final dividend of $0.50 per share payable in June 2025. This attests to our confidence in Macau, our financial strength and our future earnings potential.

Q4 2024

The Group’s Net Revenue was $11.3 billion, up 9% year-on-year and up 6% quarter-on-quarter. Adjusted EBITDA was $3.2 billion, up 15% year-on-year and up 10% quarter-on-quarter. Galaxy Macau™’s Adjusted EBITDA was $2.8 billion, up 11% year-on-year and up 11% quarter-on-quarter. StarWorld Macau’s Adjusted EBITDA was $363 million, up 3% year-on-year and down 8% quarter- on-quarter. Broadway Macau™’s Adjusted EBITDA was $1 million, versus $(2) million in Q4 2023 and $11 million in Q3 2024.

During Q4 2024, GEG played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $35 million. Normalized Adjusted EBITDA was $3.3 billion, up 12% year- on-year and up 5% quarter-on-quarter.

The Group’s total GGR in Q4 2024 was $11.0 billion, up 19% year-on-year and up 9% quarter-on- quarter. Mass GGR was $8.7 billion, up 11% year-on-year, up 4% quarter-on-quarter. VIP GGR was $1.5 billion, up 69% year-on-year and up 40% quarter-on-quarter. Electronic GGR was $780 million, up 54% year-on-year and up 17% quarter-on-quarter.

Group Key Financial Data

| (HK$’m) | Q4 2023 | Q3 2024 | Q4 2024 | FY2023 | FY2024 |

| Revenues: | |||||

| Net Gaming | 7,961 | 8,197 | 8,853 | 27,290 | 33,826 |

| Non-gaming | 1,580 | 1,666 | 1,670 | 5,396 | 6,425 |

| Construction Materials | 778 | 805 | 771 | 2,998 | 3,181 |

| Total Net Revenue | 10,319 | 10,668 | 11,294 | 35,684 | 43,432 |

| Adjusted EBITDA | 2,807 | 2,940 | 3,237 | 9,955 | 12,188 |

| Gaming Statistics6 | |||||

| (HK$’m) | Q4 2023 | Q3 2024 | Q4 2024 | FY2023 | FY2024 |

| Rolling Chip Volume7 | 34,599 | 44,459 | 51,808 | 117,660 | 180,879 |

| Win Rate % | 2.6% | 2.5% | 3.0% | 2.9% | 2.9% |

| Win | 909 | 1,100 | 1,539 | 3,447 | 5,329 |

| Mass Table Drop8 | 30,696 | 31,726 | 32,256 | 107,531 | 127,823 |

| Win Rate % | 25.5% | 26.4% | 27.0% | 24.6% | 25.9% |

| Win | 7,826 | 8,386 | 8,707 | 26,486 | 33,112 |

| Electronic Gaming Volume | 16,383 | 26,503 | 27,464 | 50,884 | 95,380 |

| Win Rate % | 3.1% | 2.5% | 2.8% | 3.5% | 2.8% |

| Win | 508 | 666 | 780 | 1,780 | 2,704 |

| Total GGR Win9 | 9,243 | 10,152 | 11,026 | 31,713 | 41,145 |

_________________________

6 Gaming statistics are presented before deducting commission and incentives.

7 Reflects sum of promoter and inhouse premium direct.

8 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

9 Total GGR win includes gaming win from City Clubs.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. In 2024, Net Revenue was $34.5 billion, up 24% year-on-year. Adjusted EBITDA was $10.8 billion, up 18% year-on-year. Galaxy Macau™ played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $212 million. Normalized 2024 Adjusted EBITDA was $11.0 billion, up 18% year-on- year.

In Q4 2024, Galaxy Macau™’s Net Revenue was $9.1 billion, up 12% year-on-year and up 9% quarter-on-quarter. Adjusted EBITDA was $2.8 billion, up 11% year-on-year and up 11% quarter- on-quarter. Galaxy Macau™ played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $27 million. Normalized Q4 2024 Adjusted EBITDA was $2.9 billion, up 7% year-on-year and up 5% quarter-on-quarter.

The combined seven hotels occupancy was 98% for Q4 and full year 2024.

Galaxy Macau™ Key Financial Data

| (HK$’m) | |||||

| Q4 2023 | Q3 2024 | Q4 2024 | FY2023 | FY2024 | |

| Revenues: | |||||

| Net Gaming | 6,781 | 6,934 | 7,665 | 22,911 | 28,833 |

| Hotel / F&B / Others | 1,046 | 1,125 | 1,127 | 3,246 | 4,279 |

| Mall | 364 | 347 | 348 | 1,560 | 1,392 |

| Total Net Revenue | 8,191 | 8,406 | 9,140 | 27,717 | 34,504 |

| Adjusted EBITDA | 2,569 | 2,557 | 2,842 | 9,149 | 10,794 |

| Adjusted EBITDA Margin | 31% | 30% | 31% | 33% | 31% |

| Gaming Statistics10 | |||||

| (HK$’m) | |||||

| Q4 2023 | Q3 2024 | Q4 2024 | FY2023 | FY2024 | |

| Rolling Chip Volume11 | 33,874 | 42,887 | 50,862 | 115,566 | 175,759 |

| Win Rate % | 2.6% | 2.4% | 3.0% | 2.9% | 2.9% |

| Win | 880 | 1,027 | 1,522 | 3,383 | 5,079 |

| Mass Table Drop12 | 23,692 | 24,591 | 25,443 | 80,774 | 99,153 |

| Win Rate % | 27.7% | 29.0% | 29.3% | 27.0% | 28.3% |

| Win | 6,570 | 7,123 | 7,465 | 21,775 | 28,041 |

| Electronic Gaming Volume | 10,650 | 16,743 | 17,792 | 35,542 | 62,086 |

| Win Rate % | 3.9% | 2.9% | 3.4% | 4.2% | 3.4% |

| Win | 418 | 490 | 611 | 1,499 | 2,112 |

| Total GGR Win | 7,868 | 8,640 | 9,598 | 26,657 | 35,232 |

_________________________

10 Gaming statistics are presented before deducting commission and incentives.

11 Reflects sum of promoter and inhouse premium direct.

12 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

StarWorld Macau

In 2024, StarWorld Macau’s Net Revenue was $5.3 billion, up 15% year-on-year. Adjusted EBITDA was $1.6 billion, up 24% year-on-year. StarWorld Macau played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $55 million. Normalized 2024 Adjusted EBITDA was $1.5 billion, up 20% year-on-year.

In Q4 2024, StarWorld Macau’s Net Revenue was $1.3 billion, up 3% year-on-year and down 4% quarter-on-quarter. Adjusted EBITDA was $363 million, up 3% year-on-year and down 8% quarter- on-quarter. StarWorld Macau played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $8 million in Q4 2024. Normalized Adjusted EBITDA was $371 million, up 6% year-on-year and down 3% quarter-on-quarter.

Hotel occupancy was 100% for Q4 and full year 2024.

StarWorld Macau Key Financial Data

| (HK$’m) | |||||

| Q4 2023 | Q3 2024 | Q4 2024 | FY2023 | FY2024 | |

| Revenues: | |||||

| Net Gaming | 1,122 | 1,205 | 1,152 | 4,154 | 4,782 |

| Hotel / F&B / Others | 127 | 126 | 131 | 468 | 513 |

| Mall | 6 | 6 | 6 | 22 | 23 |

| Total Net Revenue | 1,255 | 1,337 | 1,289 | 4,644 | 5,318 |

| Adjusted EBITDA | 353 | 396 | 363 | 1,278 | 1,584 |

| Adjusted EBITDA Margin | 28% | 30% | 28% | 28% | 30% |

| Gaming Statistics13 | |||||

| (HK$’m) | Q4 2023 | Q3 2024 | Q4 2024 | FY2023 | FY2024 |

| Rolling Chip Volume14 | 725 | 1,572 | 946 | 2,094 | 5,120 |

| Win Rate % | 4.0% | 4.7% | 1.8% | 3.1% | 4.9% |

| Win | 29 | 73 | 17 | 64 | 250 |

| Mass Table Drop15 | 6,748 | 6,884 | 6,620 | 25,709 | 27,727 |

| Win Rate % | 18.0% | 17.8% | 18.4% | 17.7% | 17.8% |

| Win | 1,217 | 1,226 | 1,220 | 4,553 | 4,936 |

| Electronic Gaming Volume | 4,533 | 8,511 | 8,660 | 11,170 | 28,541 |

| Win Rate % | 1.6% | 1.8% | 1.8% | 1.9% | 1.8% |

| Win | 72 | 155 | 155 | 214 | 516 |

| Total GGR Win | 1,318 | 1,454 | 1,392 | 4,831 | 5,702 |

_________________________

13 Gaming statistics are presented before deducting commission and incentives.

14 Reflects sum of promoter and inhouse premium direct.

15 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. In 2024, Net Revenue for Broadway Macau™ was $220 million, up 114% year-on- year. Adjusted EBITDA was $24 million, versus $(36) million in 2023. In Q4 2024, Net Revenue for Broadway Macau™ was $58 million, up 53% year-on-year and down 6% quarter-on-quarter. Adjusted EBITDA was $1 million, versus $(2) million in Q4 2023 and $11 million in Q3 2024.

City Clubs

In 2024, City Clubs’ Net Revenue was $209 million, down 6% year-on-year. Adjusted EBITDA was

$14 million, down 7% year-on-year. In Q4 2024, City Clubs’ Net Revenue was $36 million, down 37% year-on-year and down 38% quarter-on-quarter. Adjusted EBITDA was $(1) million, versus $3 million in Q4 2023 and $6 million in Q3 2024.

Construction Materials Division (“CMD”)

CMD contributed Adjusted EBITDA of $857 million for full year 2024, up 23% year-on-year. In Q4, Adjusted EBITDA was $277 million, up 35% year-on-year and up 29% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests with a particular focus on adding new and innovative F&B and retail offerings. At StarWorld Macau we are evaluating a range of major upgrades, that includes the main gaming floor, the lobby arrival experience and increasing the F&B options. We have completed the upgrade of Level 3 and StarWorld Macau now hosts one of the largest scale LTG terminals in Macau.

Cotai – The Next Chapter

The targeted opening of Capella at Galaxy Macau is in mid-2025. The 17-storey property offers approximately 100 ultra-luxury sky villas and suites. Each Sky Villa features a light-filled balcony with a transparent infinity-edge pool, outdoor lounge, sunroom and hidden winter garden, among others. Capella at Galaxy Macau promises to bring a new level of elegance and luxury to Macau.

We are ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau. We are now firmly focused on the development of Phase 4, which is already well under way. Phase 4 will include multiple high-end hotel brands new to Macau, together with an up to 5000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is approximately 600,000 square meters of development and is scheduled to complete in 2027. We remain highly confident about the future of Macau where Phases 3 & 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Selected Major Awards for 2024

| AWARD | PRESENTER |

| GEG | |

| Casino Operator of the Year | Global Gaming Awards Asia-Pacific 2024 |

| Sustainability Award | International Gaming Awards 2024 |

| GALAXY MACAU™ | |

MICHELIN One-Star Restaurant

Selected Restaurants

| The MICHELIN Guide Hong Kong Macau 2024 |

Five Star Hotel

Five-Star Restaurant

Five-Star Spa

| 2024 Forbes Travel Guide |

Dianping Must Stay List:

Black Pearl Restaurant Guide 2024 – One Diamond

| Mei Tuan |

2024 IAG Academy IR Awards

| Inside Asian Gaming |

| Macau Energy Saving Activity 2023 – Energy Saving Concept Award – Galaxy Macau™ | CEM – Companhia de Electricidade de Macau |

| Macao Green Hotel Awards – Gold Award – Galaxy Hotel™ | Environmental Protection Bureau of the Macau SAR Government |

Wine Spectator’s 2024 Restaurant Best of Award of Excellence (Two Glasses):

| Wine Spectator’s Restaurant Awards |

| STARWORLD MACAU | |

| MICHELIN Two-Star Restaurant – Feng Wei Ju | The MICHELIN Guide Hong Kong Macau 2024 |

Black Pearl Restaurant Guide 2024 – One Diamond

| Mei Tuan |

| SCMP 100 Top Tables 2024 – Feng Wei Ju | South China Morning Post |

| Tatler Dining Awards 2024 – Tatler Dining 20 Macau Awards – Feng Wei Ju | Tatler Dining |

| My Favorite Hotel Restaurant in Macau – Feng Wei Ju | U Magazine |

| Trip.com Best Gourmet Award 2024 – Feng Wei Ju (Platinum Award) | Trip.com |

| My Favorite Hotel Restaurant – Feng Wei Ju My Favorite Buffets – Temptation | iFood Award |

Golden Phoenix Tree China Restaurant Guide 2024

| ifeng food festival |

| BROADWAY MACAU™ | |

| Macau Energy Saving Activity 2023 – Energy Saving Award (Hotel Group B) – 1st Runner Up | CEM – Companhia de Electricidade de Macau |

| CONSTRUCTION MATERIALS DIVISION | |

| Caring Company Scheme – 20 Years Plus Caring Company Logo | The Hong Kong Council of Social Service |

Good MPF Employer Award 2023-24

| The Mandatory Provident Fund Schemes Authority |

| Hong Kong Green Organization Recognition – Wastewise Certificate – Excellent Level 2023 Hong Kong Awards for Environmental Excellence – Certificate of Participation | Environmental Campaign Committee |

| BOCHK Corporate Low-Carbon Environmental Leadership Awards 2023 – EcoPartner | Bank of China (Hong Kong), Federation of Hong Kong Industries |

23rd Hong Kong Occupational Safety & Health Award

Housekeeping Best Practices Award – All Industries – Bronze Award | Labour Department / Occupational Safety and Health Council |

Outlook

We welcomed President Xi Jinping visit to Macau in December 2024 and the inauguration of Mr. Sam Hou Fai as the Chief Executive of Macau SAR. We are confident that the Central Government will continue to support Macau by favorable policies and the Macau’s new Chief Executive will keep on with the stable development and economic diversification of Macau. GEG has committed non- gaming investment of over MOP33 billion under the new concession to further diversify Macau’s tourism attraction. As always GEG supports and will contribute to the Government’s vision and goal to develop Macau into a World Centre of Tourism and Leisure.

Further to the IVS relaxation in mid-2024, beginning in 2025 Zhuhai and Hengqin residents are eligible to apply for one-trip-per-week and multiple-entries visas respectively to Macau. We believe these can help to facilitate additional travel demand from the Mainland. The continuously improving infrastructure connecting Macau and its nearby areas, such as the Macau LRT extending a new line to the Hengqin port in December 2024, also enhances the convenience of transportation and encourages more frequent visitor travels.

To capture the increasing and new tourism demand, GEG continues to enrich our resort’s non-gaming product offerings. We continue to ramp up our GICC and Galaxy Arena. In 2024 GEG hosted approximately 460 shows and events, including numerous major events such as Andy Lau World Tour, UFC, ITTF World Cup and Women’s Volleyball Nations League, among others. GEG is strategically placed to continue capitalizing on this trend of increased entertainment in Macau. Galaxy Arena is Macau’s largest indoor arena with 16,000 seating capacity. In 2025 we will continue bringing to Macau a wide-range of shows and events, including the world-renowned legendary Italian tenor, Andrea Bocelli at Galaxy Arena this March and the ITTF World Cup 2025 in April. Further, Hong Kong famous singer Mr. Jacky Cheung will bring his 10th concert tour to Galaxy Arena in June. We are also hosting the scheduled Extraordinary General Assemblies and Conference of the Fédération Internationale de l’Automobile (FIA) which is to be co-hosted by AAMC and GEG this June at GICC, marking the first time of this world class annual event in Asia.

In addition, we continue to expand our capacity in Macau. We are currently fitting-out our 10th hotel

– Capella at Galaxy Macau. The property will offer approximately 100 ultra-luxury sky villas and suites and is targeted to open in mid-2025. We are also firmly focused on the development of Phase 4 which is well under way. Phase 4 will include multiple high-end hotel brands new to Macau, together with an up to 5000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is scheduled to complete in 2027.

GEG continues to collaborate closely with MGTO to actively promote Macau and develop high-value international tourism. We have already opened overseas business development offices in Tokyo, Seoul and Bangkok.

In the meanwhile, we continue to evaluate development opportunities in the Greater Bay Area and overseas on a case by case basis.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group Limited (“GEG” or the “Company”) and its subsidiaries (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. The Group primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. GEG is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG through its subsidiary, Galaxy Casino S.A., is one of the three original concessionaires in Macau when the gaming industry was liberalized in 2002. In 2022, GEG was awarded a new gaming concession valid from January 1, 2023, to December 31, 2032. GEG has a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

The Group operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award-winning premium property. Galaxy Macau™ was named Best Integrated Resort in the Asia Pacific region for consecutive years by Inside Asian Gaming since the award inauguration and won the most Five-Star hotels under one roof of any luxury resort company worldwide for the third consecutive year in the Forbes Travel Guide 2025 List.

The Group has the largest development pipeline of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will be more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG also considers opportunities in the Greater Bay Area and internationally. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/57608ded-42cf-4605-b451-e3bb7941ad76

https://www.globenewswire.com/NewsRoom/AttachmentNg/74874b19-6393-48d0-b6bc-8e900bbf645e

CONTACT: For Media Enquiries: Galaxy Entertainment Group - Investor Relations Mr. Peter Caveny / Ms. Yoko Ku / Ms. Joyce Fung Tel: +852 3150 1111 Email: ir@galaxyentertainment.com

![]()