GoldHaven Announces Non-Brokered Private Placement

**NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES**

VANCOUVER, British Columbia, Jan. 14, 2025 (GLOBE NEWSWIRE) — GoldHaven Resources Corp. (“GoldHaven” or the “Company“) (CSE: GOH) (OTCQB: GHVNF) (FSE: 4QS) announces a non-brokered private placement of up to 8,000,000 units at $0.25 per unit (the “Offering”) for gross proceeds of up to $2,000,000.

Each Unit consists of one common share of the Company and one common share purchase warrant (a “Warrant”). Each Warrant will entitle its holder to purchase one common share in the capital of the Company (each, a “Warrant Share”) at a price of $0.50 per Warrant Share at any time prior to 24 months following the closing of the Offering.

If the Corporation’s common shares have a closing price on the Canadian Securities Exchange at or above a price of $0.75 per common share for a period of 10 consecutive trading days, the Corporation may give notice by news release that expiration of the Warrants will be accelerated to 30 days from the date of providing such notice.

Insiders may participate in the Offering and finder’s fees may be payable in connection with the Offering.

All securities issued in connection with the Offering will have a four-month and one day hold period in Canada from the closing of the Offering.

Net proceeds of the Offering will be used for exploration expenditures, administrative and general working capital.

Insiders of the Company participating in the foregoing offering will constitute a related party transaction as defined under Multilateral Instrument 61-101 — Protection of Minority Security Holders in Special Transactions (MI 61-101). Any such participation is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the securities acquired by the insiders, nor the consideration for the securities paid by such insiders, is expected to exceed 25 per cent of the company’s market capitalization. Net proceeds of the Offering will be used for general working capital.

None of the foregoing securities have been or will be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any applicable state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) or persons in the United States absent registration or an applicable exemption from such registration requirements. This press release does not constitute an offer to sell or the solicitation of an offer to buy nor will there be any sale of the foregoing securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

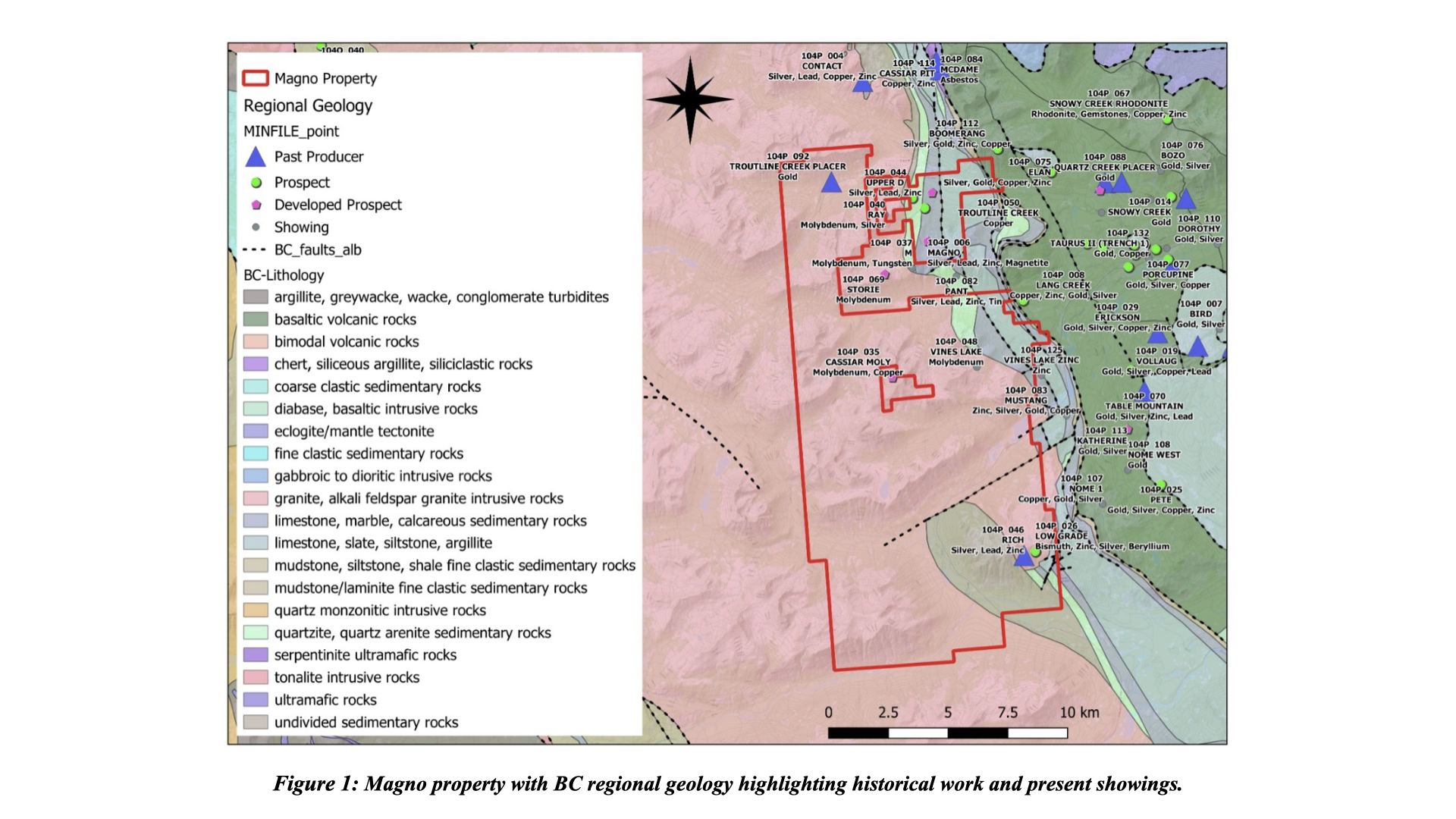

About GoldHaven’s 100% owned Magno Project:

The Company, through its wholly owned subsidiary Copper Peak Metals Inc., holds 100% ownership of the Magno mineral property in British Columbia. The Magno project is a district-scale, polymetallic property with 24 mineral tenures located in the Liard Mining Division, adjacent to the historic Cassiar mining district, in Cassiar BC, Canada.

British Columbia is a premier mining jurisdiction, hosting 16 of Canada’s 31 critical minerals and standing as the nation’s largest copper producer. It also holds vast gold resources, with an estimated 280 million ounces of in-ground gold, primarily within polymetallic porphyry deposits.

Northwestern British Columbia is a globally significant mining district, home to some of the richest porphyry copper and gold deposits in the world. This region’s Late Triassic to Early Jurassic tectono-magmatic activity created high-grade, large-scale deposits, positioning it as a major source of copper and precious metals.

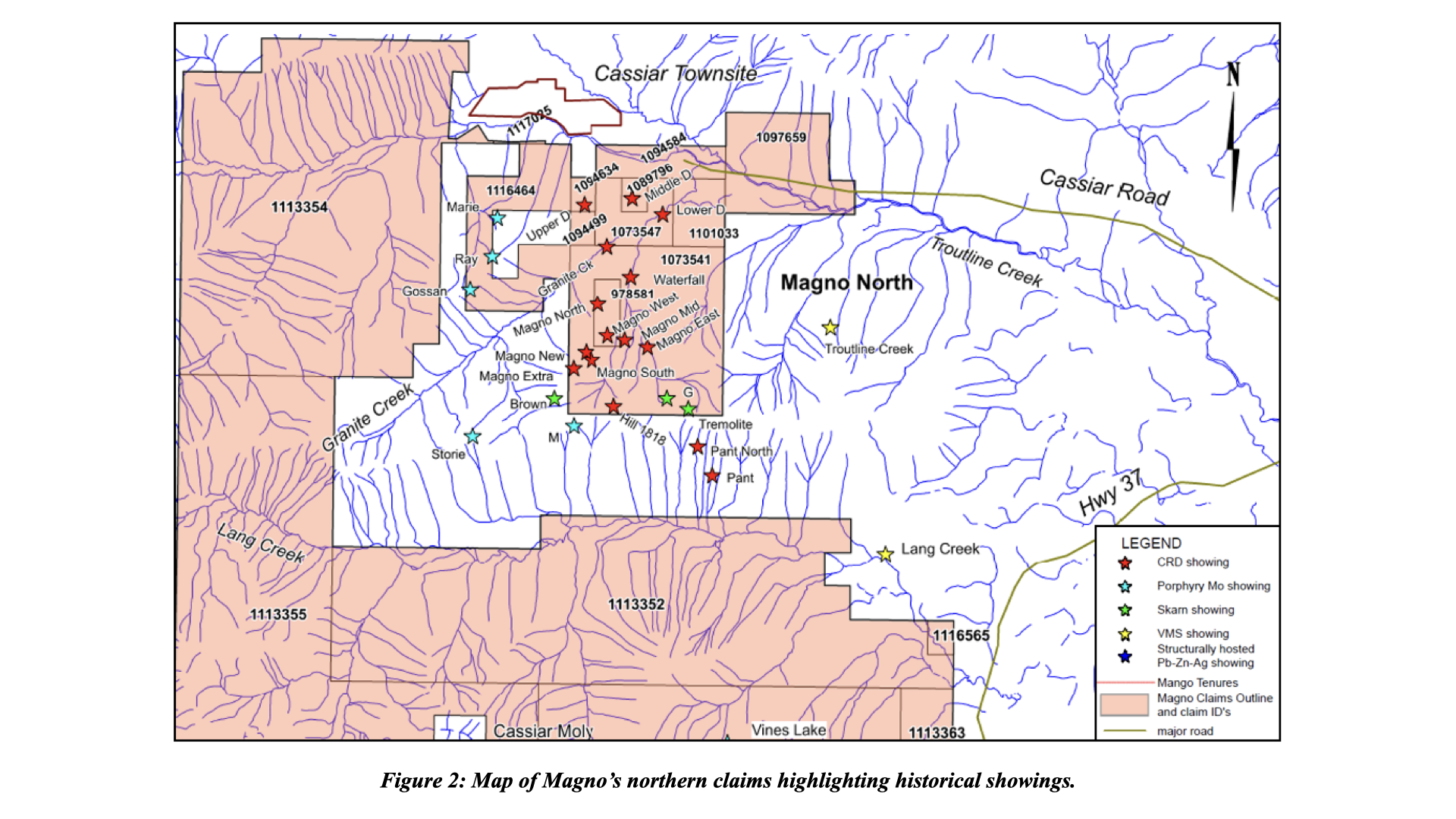

The northern portion of the property, Magno North, is located 3km south of the Cassiar Townsite and is primarily where the historic work has been conducted on the property. The Cassiar area is well endowed with various types of mineralization. Exploration has been conducted on the Magno Property since the 1950’s, which has included prospecting, soil and rock geochemistry ground geophysics and drilling. In 1970 and 1971 two adits totalling 522 metres, were emplaced into the Magno West zone.

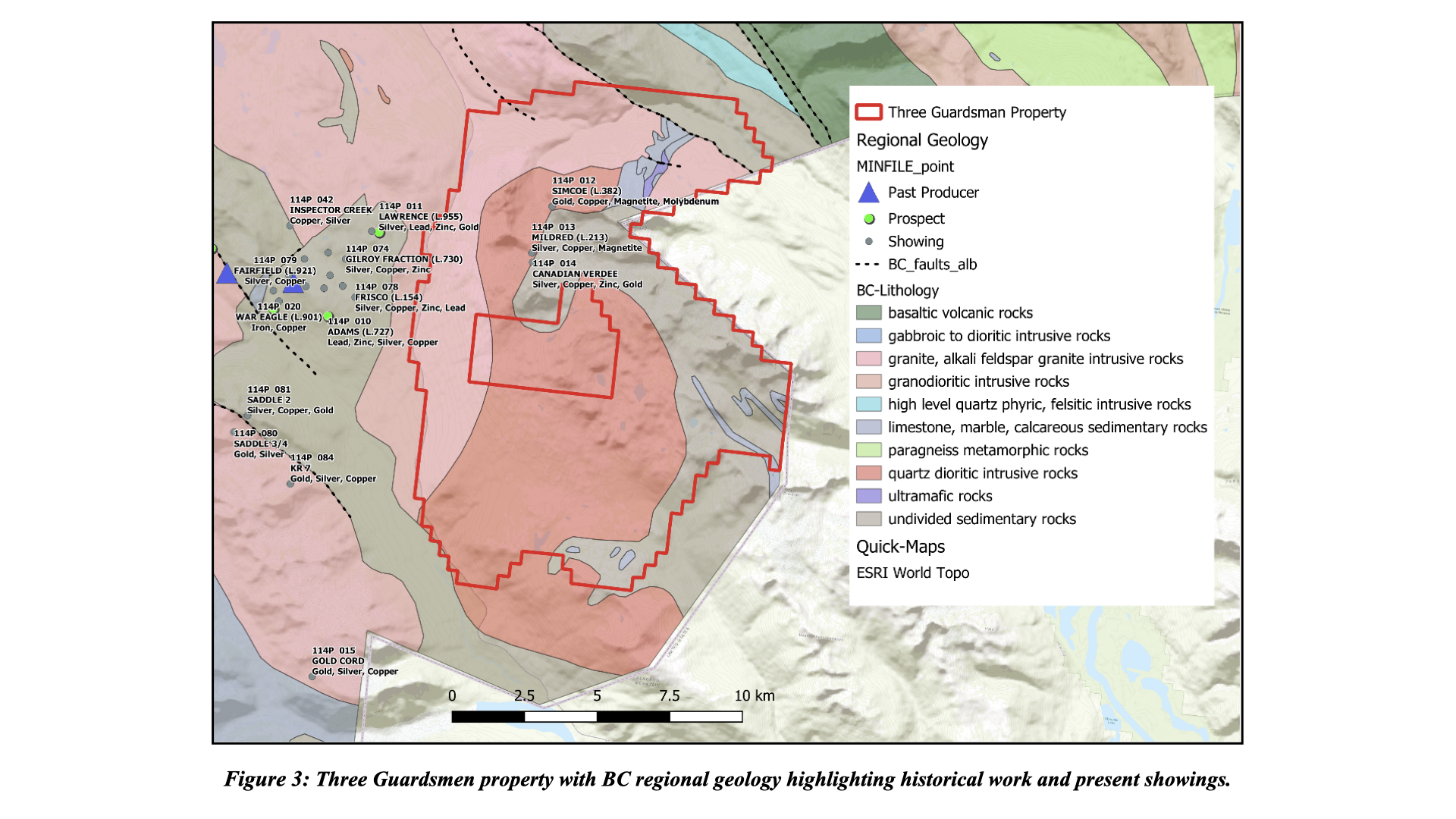

About GoldHaven’s 100% owned Three Guardsmen Property:

Located in the northwest corner of BC near Haines Junction, the Three Guardsmen Property contains 12 mineral tenures with historical findings of Gold, Copper, Molybdenum, Silver, Zinc, and Magnetite. Two past producers sit within 4km to the West of the Three Guardsmen with multiple other showings in the area.

Both the Magno and Three Guardsmen projects focus on the late Cretaceous terranes, known to host significant porphyry deposits like those at Casino and Red Mountain. The exploration team will target granitic bodies beneath promising skarn deposits, aiming to identify the source of mineralized fluids linked to these skarns. The focus will be on extensive geochemical and geophysical exploration to identify potential porphyry sources.

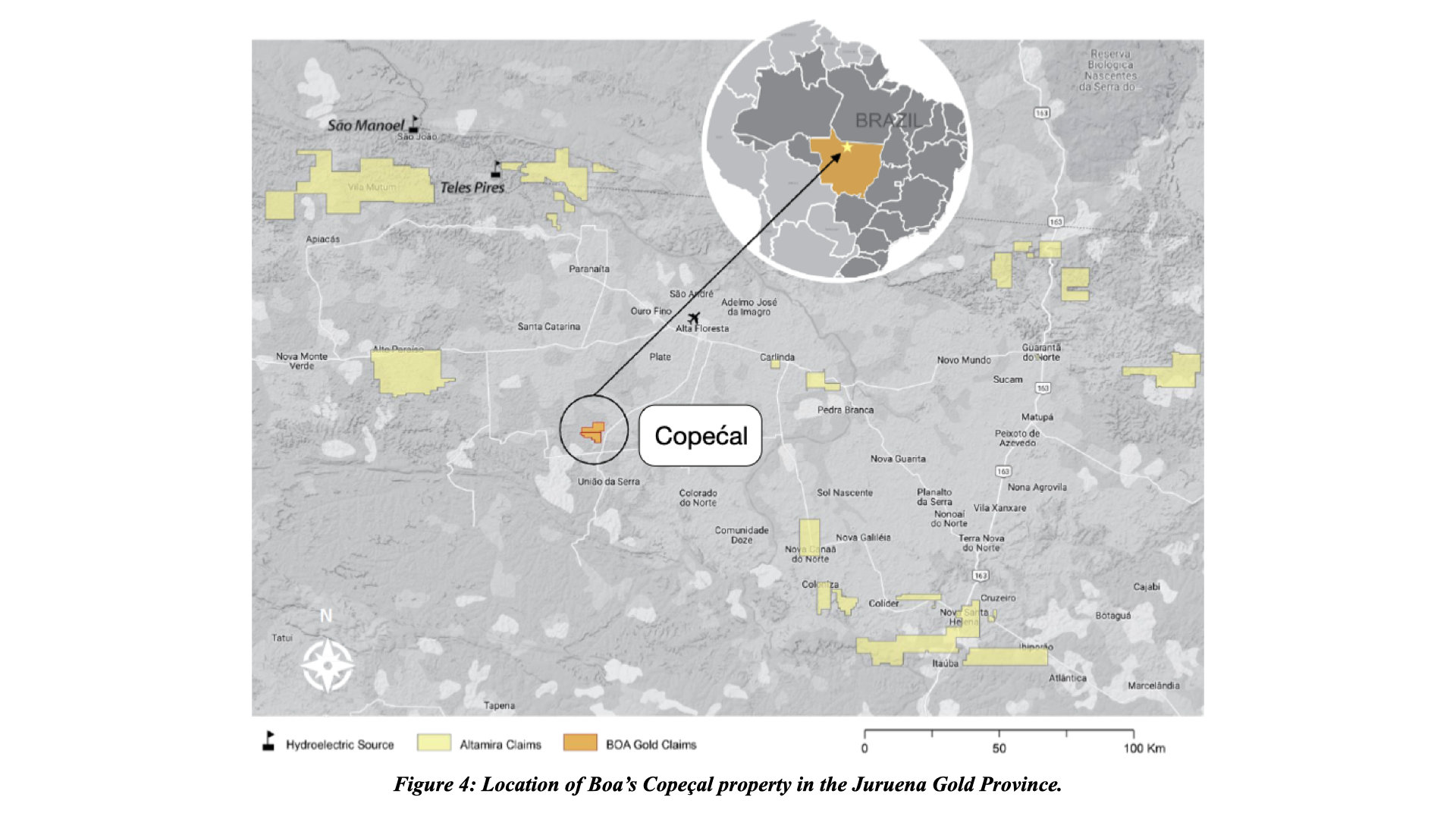

About GoldHaven’s 100% owned Brazil Projects:

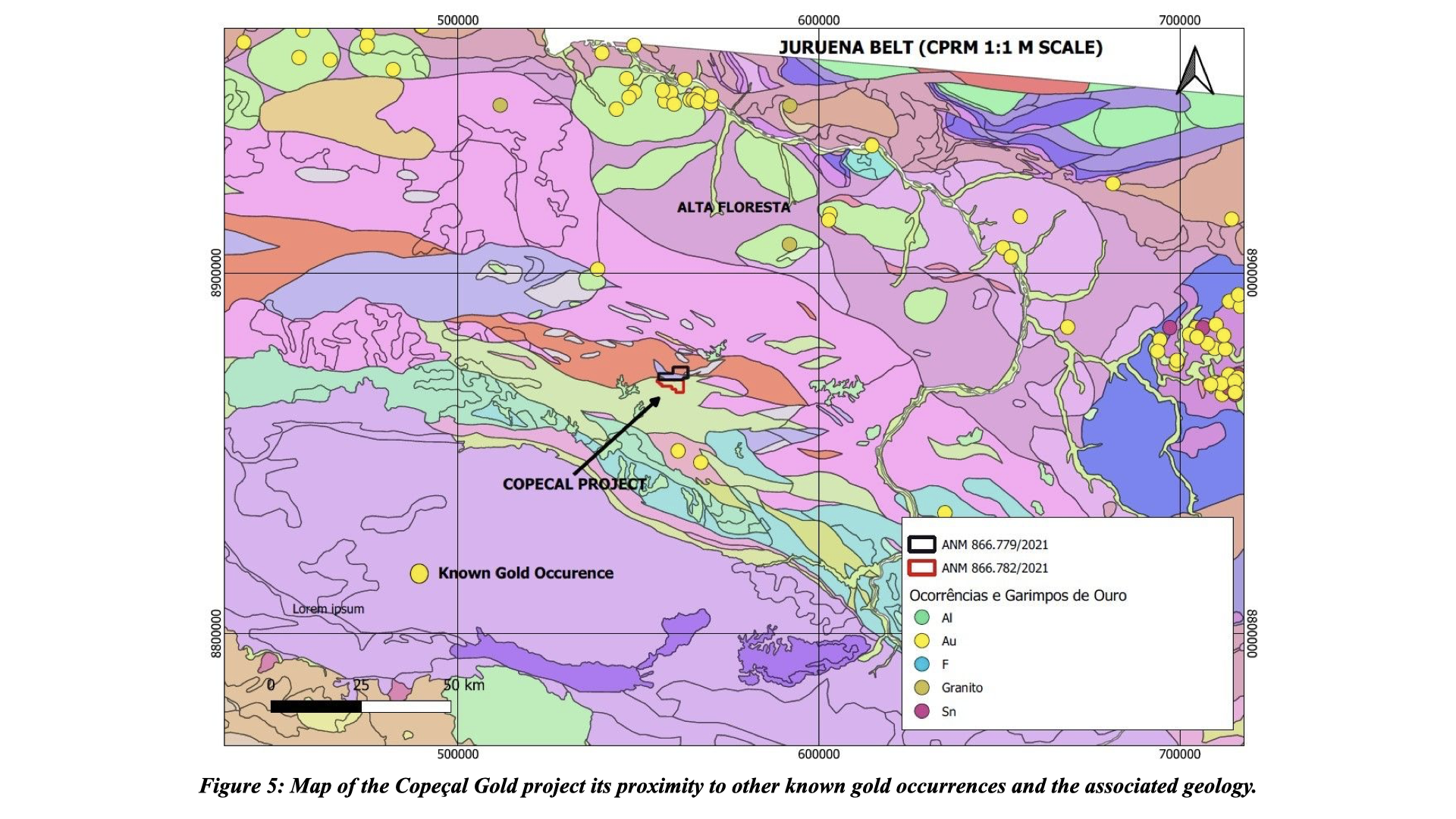

GoldHaven has acquired 100% ownership of four key projects in Brazil – Copeçal, Bahia North, Bahia South, and Iguatu. The Copeçal Gold Project is a 100% owned drill-ready property in the Juruena Gold Province in Brazil. This project is the primary acquired asset and will be the subject of immediate follow up in the field with surface and drill programs expected in Q2 and Q3 of 2025.

Copeçal Gold Project: Highlights

- Strategic ground positioning covering 3,681 hectares.

- Located within the Juruena Gold Province, a top ranked belt in Brazil.

- The claims are in a similar region and geology as Altamira Gold’s significant discoveries.

- 60km from Alta Floresta, a 50,000-population centre with daily commercial flights from Mato Grosso state capital, Cuiabá.

- Excellent Infrastructure (water, road access and energy).

- 100% owned drill-ready project.

- Local, experienced and successful operations team in Brazil.

Copeçal Gold Project: Geology

- Located in the Juruena Belt, an extensive emerging magmatic arc domain comprising fertile high-K calc alkaline plutonic and felsic volcanic rocks.

- Gold first discovered in the belt in the 1980’s.

- Historical gold production is largely informal and artisanal from surficial deposits.

- Potential for IRG Style Gold (Intrusive Related Gold), Porphyry style Copper – Gold, Epithermal Gold, Orogenic Gold.

- Estimated $1 million USD exploration spent by previous operator.

Previous work included:

- Geological and structural mapping.

- Stream sediment sampling generated anomalous basin.

- Follow up Soil Sampling generated extensive (6km strike) gold (+ arsenic) anomaly.

- IP and Magnetic Orientation Surveys.

- Shallow Auger (49 holes) and Air core (6 holes) drilling confirmed in-situ bedrock source for gold in soil anomaly.

Drill-ready:

Drill-ready:

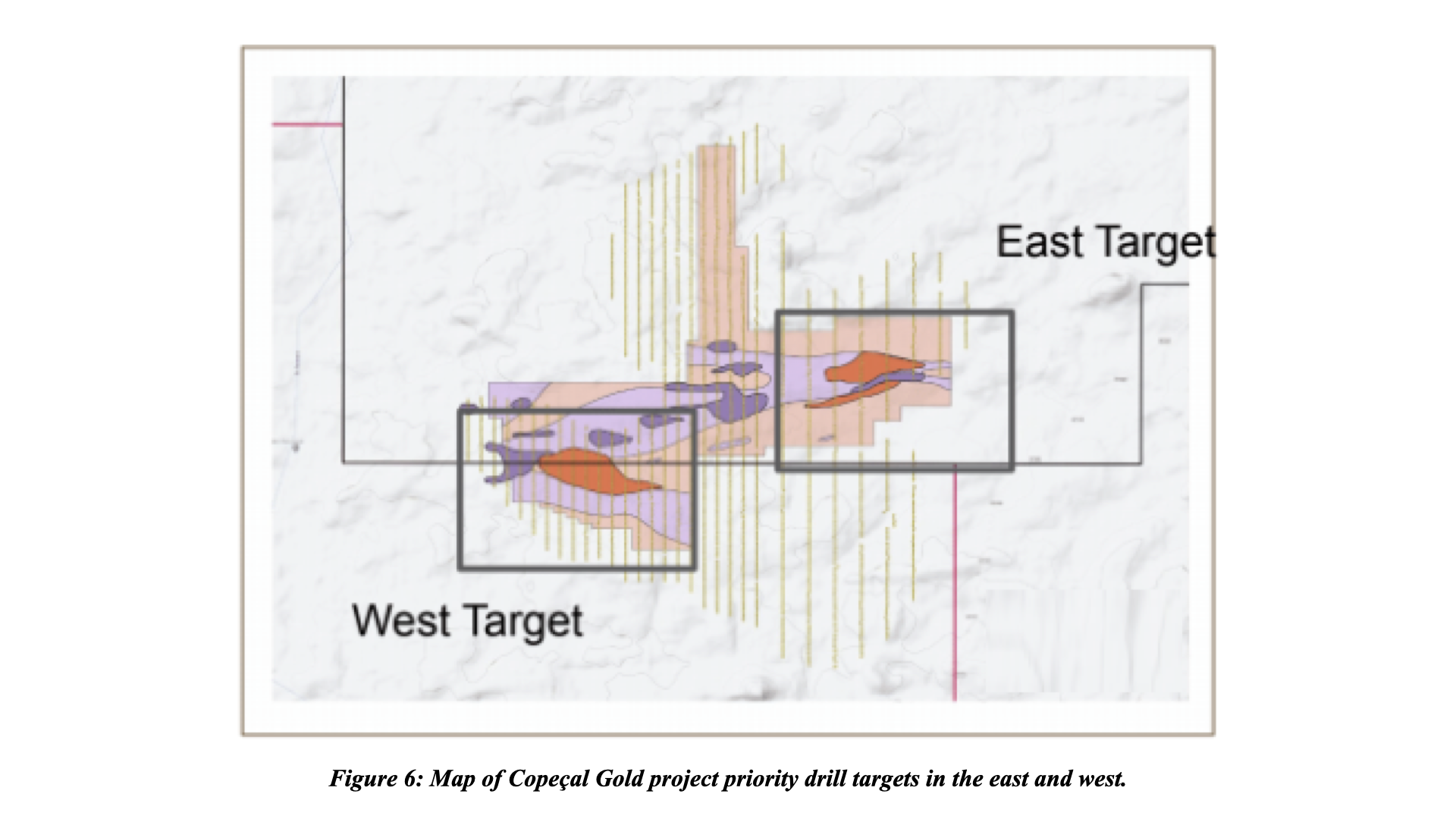

- Peak Au and As in soil anomalies coincide with fold hinges in mapped schist unit.

- 2 Priority Targets (East and West) defined and ready for deeper drilling.

- Below image gold anomaly illustrated in orange, Arsenic anomaly in purple.

Boa Gold’s Additional Three Critical Mineral Projects:

Boa Gold’s Additional Three Critical Mineral Projects:

- Extensive tenement package across 3 projects spanning 123,900 hectares: Bahia South, Bahia North and Iguatu.

- Regional Neighbours Include: Rio Tinto, Foxfire Metals, Mars Mines, Altamira Gold and Oceana Lithium.

- Geological suite favourable for hosting multi-element critical minerals.

Brazil is a Premier Mining Jurisdiction:

- Accounts for >30% of global iron ore production.

- Major Exporter: Leading exporter of lithium, tin, and manganese with substantial reserves of gold, nickel, bauxite, and niobium.

- Pro-Mining Culture: Attracts significant foreign investment in the mining industry.

- No Governmental Ownership Mandate: Mining projects not mandated to be government-owned.

- Honouring Agreements: Strong track record of honouring mining agreements.

- Economic Impact: Mining sector is a top three contributor to the 10th largest economy in the World.

About GoldHaven Resources Corp.

GoldHaven Resources Corp. is a Canadian junior exploration Company focused on acquiring and exploring highly prospective land packages in North and South America. The Company’s projects include the flagship Magno Project, a district-scale polymetallic property adjacent to the historic Cassiar mining district in British Columbia. The Three Guardsman Project, which exhibits significant potential for copper and gold-skarn mineralization. The Copeçal Gold Project, a drill-ready gold project located in Mato Grosso, Brazil with a 6km strike of anomalous gold in soil samples. Three Critical Mineral projects with extensive tenement packages totalling 123,900 hectares: Bahia South, Bahia North and Iguatu projects located in Brazil.

On Behalf of the Board of Directors

Bonn Smith, Chief Executive Officer

For further information, please contact:

Bonn Smith, CEO

www.GoldHavenresources.com

bsmith@goldhavenresources.com

Office Direct: (604) 629-8254

The scientific and technical information regarding the Company’s Brazil assets disclosed in this document have been reviewed and approved by Jonathan Victor Hill BSc Hons, FAUSIMM, a Qualified Person consistent with National Instrument 43-101 Standards of Disclosure for Mineral Projects.

The scientific and technical information regarding the Company’s Magno and Three Guardsmen properties disclosed in this document have been reviewed and approved by R.J. (Bob) Johnston, P.Geo from Engineers & Geoscientists British Columbia, a qualified person consistent with NI 43-101 Standards of Disclosure for Mineral Projects.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE- Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains forward-looking statements and forward-looking information (collectively, “forward looking statements”) within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, the possible acquisition of the future projects, the Company’s expectation that it will be successful in enacting its business plans, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: “believes”, “will”, “expects”, “anticipates”, “intends”, “estimates”, “plans”, “may”, “should”, “potential”, “scheduled”, or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of any future projects in a timely manner, the availability of financing on suitable terms for exploration and development of future projects and the Company’s ability to comply with environmental, health and safety laws.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, operating and technical difficulties in connection with mineral exploration and development activities, actual results of exploration activities, the estimation or realization of mineral reserves and mineral resources, the inability of the Company to obtain the necessary financing required to conduct its business and affairs, as currently contemplated, , the inability of the Company to enter into definitive agreements in respect of possible Letters of Intent, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of precious metals, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in future financings, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, changes in laws, regulations and policies affecting mining operations, title disputes, the inability of the Company to obtain any necessary permits, consents, approvals or authorizations, including by the Exchange, the timing and possible outcome of any pending litigation, environmental issues and liabilities, and risks related to joint venture operations, and other risks and uncertainties disclosed in the Company’s latest interim Management’s Discussion and Analysis and filed with certain securities commissions in Canada. All of the Company’s Canadian public disclosure filings may be accessed via www.sedarplus.ca and readers are urged to review these materials.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/510558b6-b99e-4565-a0bf-41e990536ed0

https://www.globenewswire.com/NewsRoom/AttachmentNg/6530719c-b40d-48cf-b090-b650cd3b4847

https://www.globenewswire.com/NewsRoom/AttachmentNg/7231e4bd-2bce-4523-b2a1-cf081ba3099f

https://www.globenewswire.com/NewsRoom/AttachmentNg/5dd9670d-2993-452d-a493-949bb006d46d

https://www.globenewswire.com/NewsRoom/AttachmentNg/fc6d4fd8-2b80-44d5-8388-60fc8a6a3f28

https://www.globenewswire.com/NewsRoom/AttachmentNg/8a16e2e3-d838-489a-9990-6a99ac6346a1

![]()