Initiative Equity Partners acquired 16% equity in ArtIn Energy ramping up expansion in North America

NEW YORK, April 25, 2024 (GLOBE NEWSWIRE) — Initiative Equity Partners, a value and impact driven investment company based in New York, is pleased to announce the acquisition of 16% equity in ArtIn Energy, a technology leader of renewable energy in the fields of photovoltaics, energy storage, electrical mobility, and green hydrogen. This strategic effort registers a meaningful milestone in the company’s commitment to fostering sustainable development and progressing the global transition to clean energy and a carbon-free world. With recently awarded contracts of $2.7 Billion in value, ArtIn Energy is positioned to continue propelling growth and innovation in the energy sector. Commenting on the acquisition, Jhon Cohen, Chief Executive Officer at ArtIn Energy, stated: “We are deeply honoured and excited to welcome Initiative Equity Partners into the ArtIn Energy family. Our partnership aligns seamlessly with our mission to invest in sustainable projects and initiatives that not only generate strong financial returns but also create a meaningful positive impact for our environment.”

ArtIn Energy 10 MWp Solar Energy Farm:

Image source: https://www.dropbox.com/scl/fi/oboarsawky73wingngne4/ArtIn-Energy-GeoPark-10-MW.jpeg?rlkey=fid118a2fdlp2r92vc7y78co7&e=1&dl=0

With this acquisition, Initiative Equity Partners emphasizes its commitment to investing in innovative solutions that address the need for cleaner and sustainable energy. By integrating ArtIn Energy into its portfolio, the firm aims to accelerate the deployment of renewable energy technologies and expand access to clean energy solutions worldwide targeting corporate clients in the Industrial and Commercial segment.

ArtIn Energy has established itself as a leader in the renewable energy industry, renowned for its innovative technologies and commitment to environmental sustainability.

Through its comprehensive portfolio of solar energy and green hydrogen, the company has been instrumental in driving the adoption of renewable energy deploying 56 operational solar energy plants for Industrial and Commercial clients across several industries including Oil & Gas, Education, Organic Food, EV Transportation, among others. The ArtIn Energy optimized solar panel placement applies Artificial Intelligence algorithms analysing geographic and environmental data to determine the most efficient placement of solar panels. By considering factors like sunlight intensity, shading, and weather patterns, Artificial Intelligence optimizes the positioning of panels to maximize energy generation to continuously adjust parameters such as tilt angle and orientation of solar panels based on weather conditions and sun positioning, maximizing energy yield throughout the day and across seasons.

ArtIn Energy will continue to operate under its existing brand and management team, ensuring continuity and stability for its employees, partners, and stakeholders. The acquisition will provide ArtIn Energy with enhanced access to capital, resources, and strategic expertise, empowering the company to pursue ambitious growth initiatives and expand its reach in key global markets.

Initiative Equity Partners’ mission is to deliver value to companies who will bring to market solutions and products that society can benefit from. Initiative seeks to deliver this value by identifying and investing in the leaders, enablers and beneficiaries of companies who share similar attributes to those Cristhian Andrews (Chairman) and Oscar Felipe (Vice-Chairman) share.

As the world faces escalating environmental challenges, Initiative Equity Partners remains steadfast in its commitment to driving positive change through strategic investments in sustainable businesses.

The acquisition of ArtIn Energy represents a significant step forward in completing this vision and accentuates the firm’s unwavering dedication to building a more resilient and sustainable future. Driven by a mission to revolutionize the way the world harnesses solar power, energy storage and green hydrogen, ArtIn Energy has established itself as a pioneer in the solar energy industry. With a focus on technological innovation, reliability, and environmental sustainability, the company has developed a diverse portfolio of cutting-edge solar products and services tailored to meet the evolving needs of consumers, businesses, and industrial clients.

“Investing in ArtIn Energy aligns seamlessly with Initiative Equity Partners’ value-driven initiative to facilitate widespread access to clean energy sources and transformative solutions. ArtIn Energy stands as a beacon in the energy sector, leveraging cutting-edge technology to propel businesses toward sustainability. By supporting ArtIn Energy, we contribute to a global shift toward cleaner, more efficient energy practices. This investment not only fosters environmental responsibility but also embraces a vision where clean energy solutions play a pivotal role in shaping a better future. Together, we are pioneering a path toward a greener, more sustainable tomorrow,” said Cristhian Andrews, Chairman & Chief Executive Officer of Initiative Equity Partners.

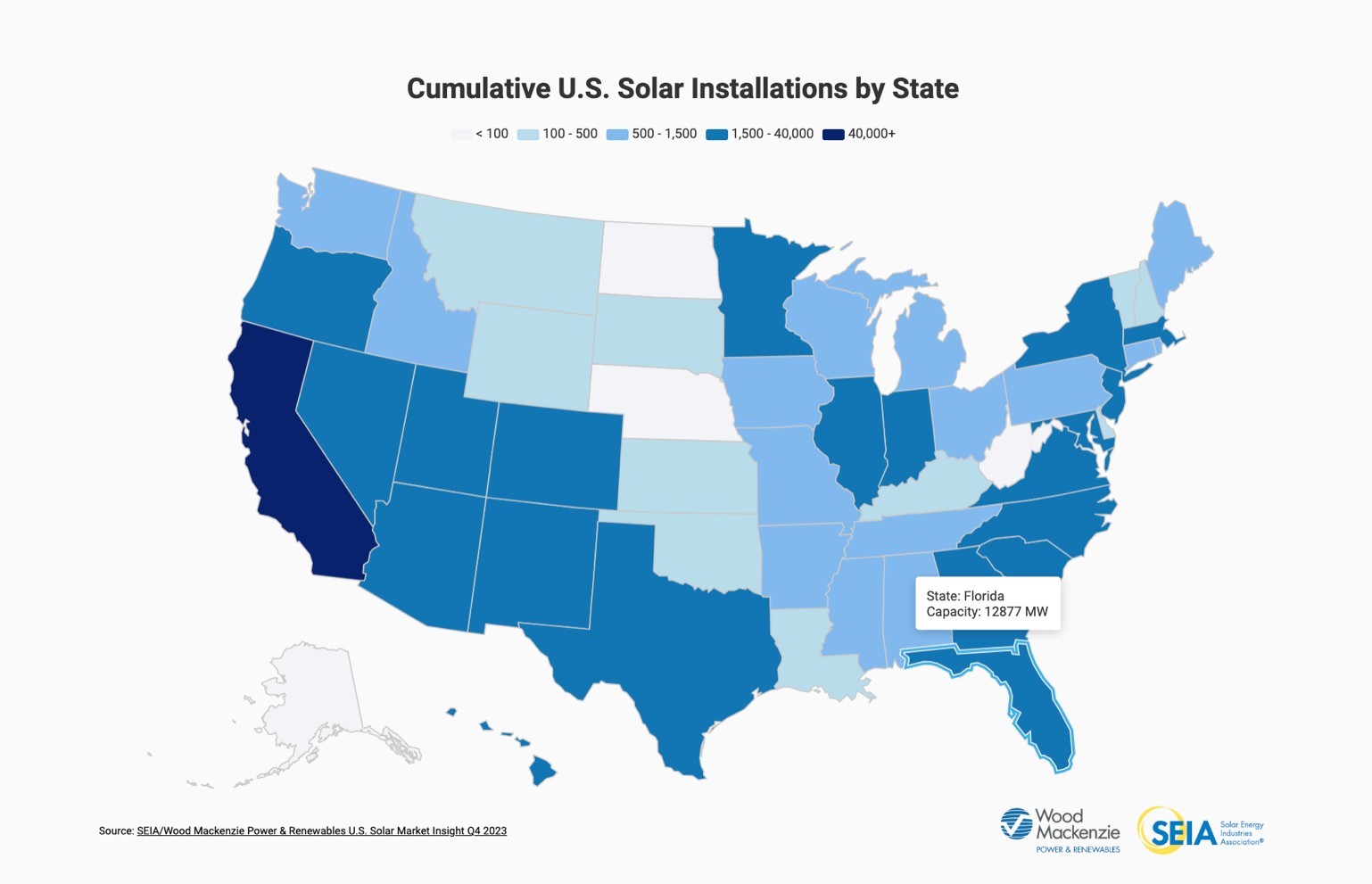

Large scale investments in sustainable energy continue to increase and the appetite of institutional investors is increasingly focused on solar energy ventures as a key solution to address environmental challenges while driving economic growth. Investing in solar energy offers a multitude of benefits, ranging from environmental sustainability to financial returns and tax incentives. According to The Solar Energy Industries Association (SEIA), The U.S Solar Industry is a 50 – State Market, while California has traditionally dominated the U.S. solar market, other markets are continuing to expand rapidly. States like Texas, Florida, and New York all saw major growth in 2022. In addition, half of U.S. states have now installed 1 GW or more of solar, compared to only three a decade ago. As demand for solar continues to grow, new state entrants will grab an increasing share of the national market.

Cumulative U.S. Solar Installations by State:

Image File Source: www.seia.org/solar-industry-research-data

Source: SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight Q4 2023.

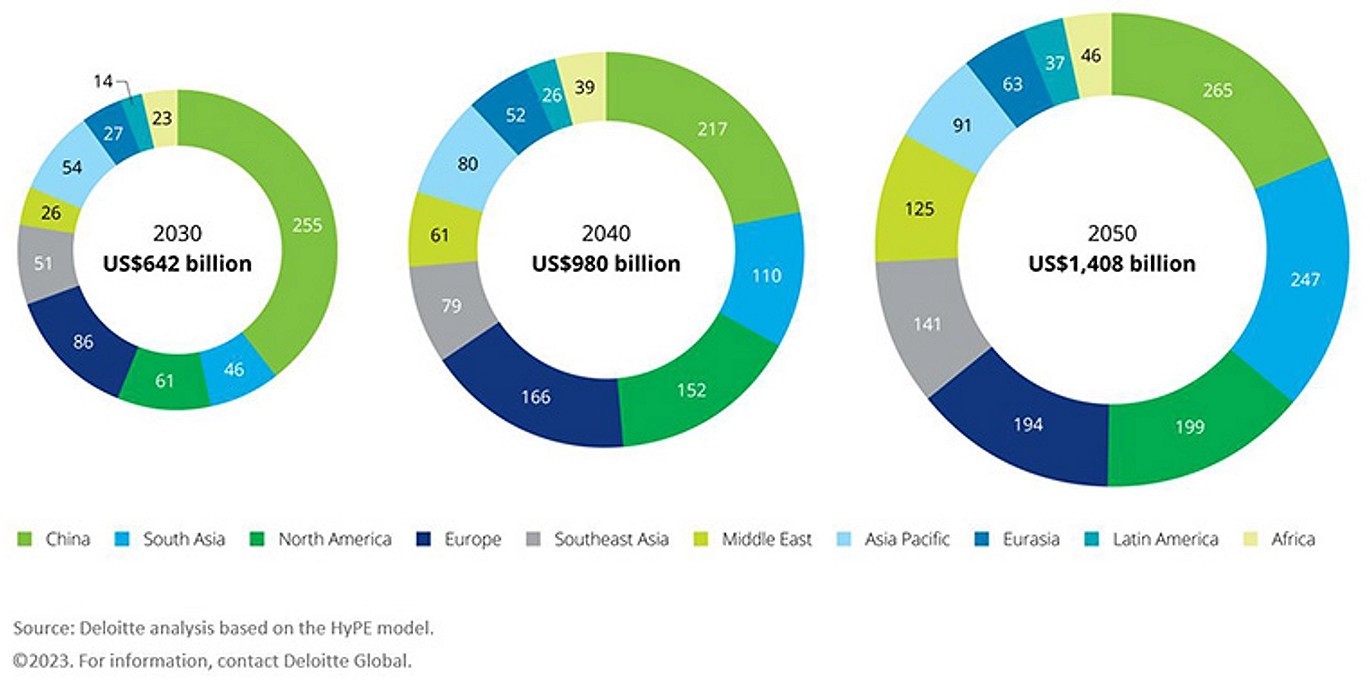

Leveraging their corporate experience and assets in Photovoltaics, ArtIn Energy deploys cutting edge Green Hydrogen technology for C&I clients, reducing their current expenditure in natural gas for industrial production. According to Deloitte, the green hydrogen market is set to help reshape the global energy map by the end of the decade, creating a $1.4 trillion market by 2050 and supporting up to 2 million jobs globally per year between 2030 and 2050.

Investments in Green Hydrogen by Region:

Image file: hydrogen-report-press-figure-img-new (1440×684) (deloitte.com)

For media inquiries, please contact:

Initiative Equity Partners

230 Park Ave, 4th FL

New York, NY 10169

https://www.initiativeequitypartners.com/

ArtIn Energy

+1 (727) 324-9295

media@artinenergy.com

https://artinenergy.com/

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1ca8fbb2-6cbf-44b1-abd9-9258a76924b6

https://www.globenewswire.com/NewsRoom/AttachmentNg/38ff769e-5350-4468-ae8a-6601b0bf30bd

https://www.globenewswire.com/NewsRoom/AttachmentNg/3d719009-aa53-4ffc-b40b-591ab0c2e3e6

![]()