Westhaven Provides an Update From its 2023 Exploration Programs Across the Spences Bridge Gold Belt

Image 1

Image 2

Image 3

Image 4

Image 5

Image 6

VANCOUVER, British Columbia, Jan. 11, 2024 (GLOBE NEWSWIRE) — Westhaven Gold Corp. (TSX-V:WHN) provides an update from its 2023 exploration programs across the Spences Bridge Gold Belt in Southwestern British Columbia.

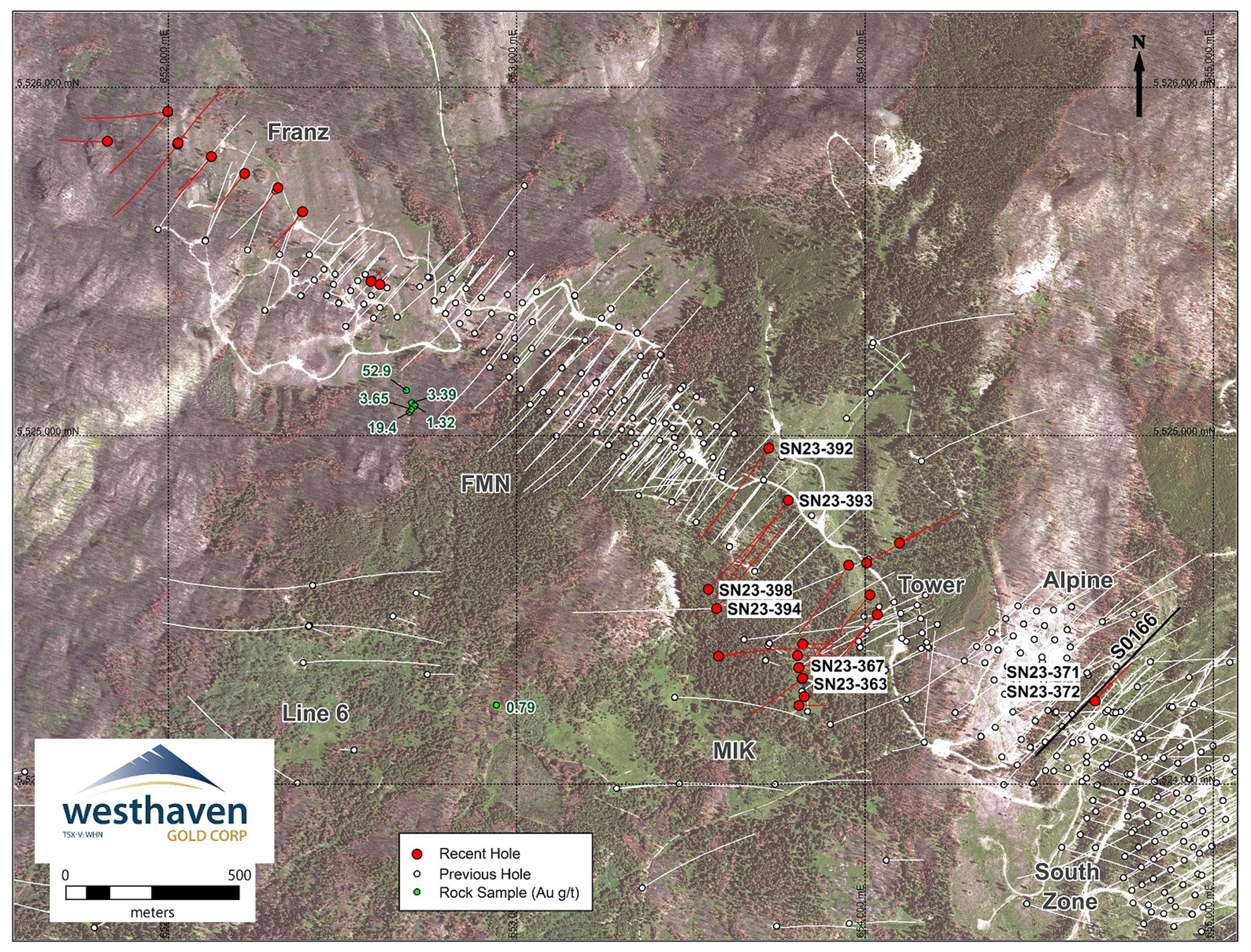

Gareth Thomas, President & CEO, states: “In 2023, Westhaven completed multiple exploration programs across its properties on the Spences Bridge Gold Belt, which resulted in the identification of several new gold mineralized areas of interest. At the Shovelnose, drilling has outlined a gold mineralized corridor between Line 6, Southeast FMN, and the MIK zones (SN23-360: 3.68m of 17.61 g/t gold) where multiple vein and structures appear to coalesce. As previously seen at the South Zone (SN19-01: 12.66m of 39.31 g/t Au), FMN Zone (SN22-212: 23.03m of 37.24 g/t Au) and Franz Zone (SN22-33: 6.20m of 73.51 g/t Au), areas in which significant zones of veining are near faulting, are prospective for bonanza grades.”

Shovelnose Highlights:

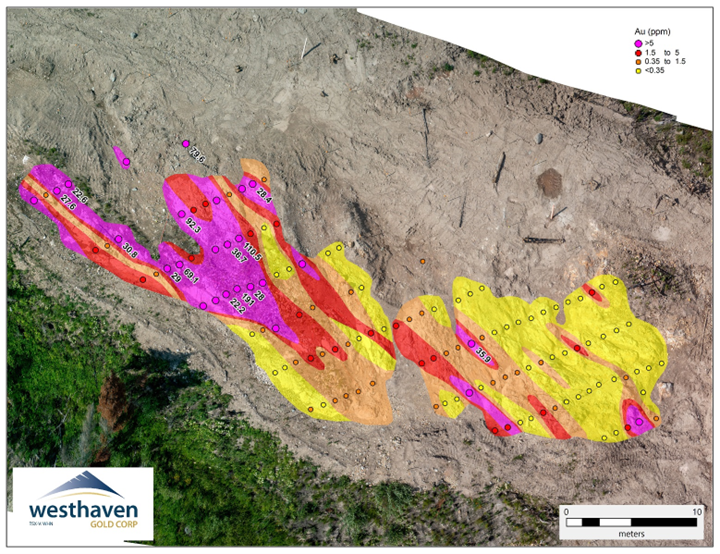

- Percussion drilling of outcrop at the Franz Zone (see below) has returned numerous high-grade assays, including 191 g/t Au and 226g/t Ag.

- New high-grade gold discovery in float (52.9 g/t Au) located 300 metres from Franz.

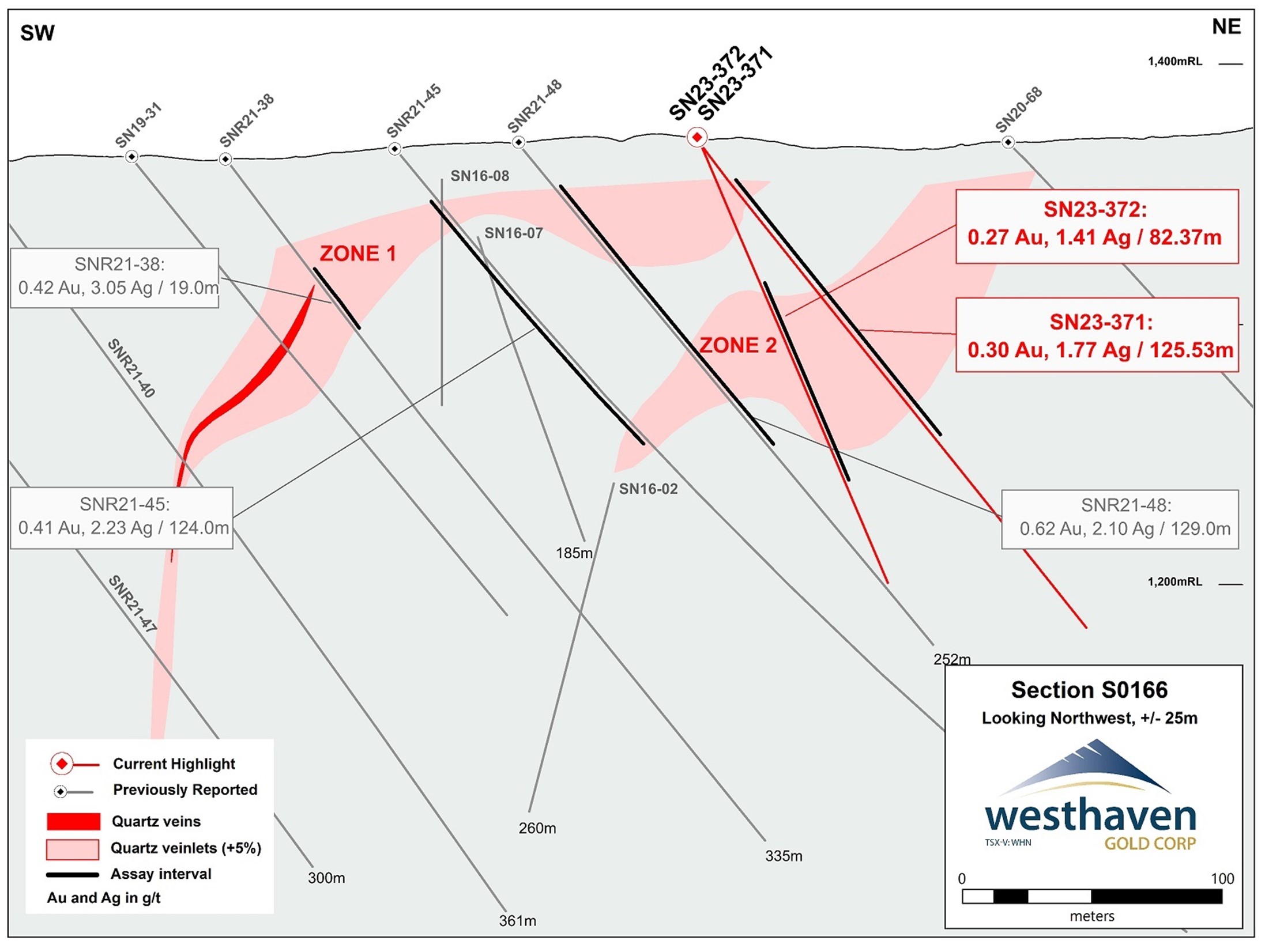

- Drilling at the Alpine Zone has expanded the broad, low-grade mineralization, intersecting 125m of 0.30 g/t Au and 1.77 g/t Ag.

- Drill Holes SN23-392, SN23-393, SN23-394 and SN23-398 all successfully intersected (though no gold assays of value, multiple metre-wide quartz veins were encountered) a new parallel zone located southwest of Vein Zone 1 between the FMN and MIK zones, that has been traced over a strike length of 300m.

- Expanded vein zone at MIK Zone; remains open in both directions:

- SN23-367: 1.80m of 3.98 g/t Au and 43.74 g/t Ag including, 0.8m of 8.54 g/t Au and 92.50 g/t Ag.

- SN23-363: 2.14m of 2.61 g/t Au and 5.34 g/t Ag.

Shovelnose Drilling:

Westhaven is reporting assays for the final 37 holes from its 2023 drill campaign at Shovelnose. Please see the map below. For a table of 2023 drill results please click here:

https://www.westhavengold.com/_resources/shovelnose/Shovelnose-Drilling-Assay-Summary-2023.pdf

FMN Southeast

Drilling during Fall 2023 at the FMN target was designed to better define Vein Zone 1 in an area of sparser drilling in the southeastern part of FMN (“FMN Southeast”) and to test for localized ore shoots that may have been missed, similar to the bonanza shoots intersected further to the northwest at FMN (e.g., holes SN22-211 and 212). A reinterpretation of 2023 drilling (holes SN23-392 to 394 and 398), together with results from 2022 drilling at FMN now suggests the presence of a subparallel northwest trending splay or parallel structure to Vein Zone 1 situated 50 to 80m to the southwest that had been overshot by the original drilling. This newly recognized vein zone has now been defined over a strike length of 300m and remains open to the southeast. Recent drilling suggests parts of this vein zone may be stronger mineralized than the original Vein Zone 1 at FMN Southeast.

MIK Zone

Drilling in 2023 at MIK, 200m southwest of the Vein Zone 1 trend, was initially following up a 2011 drill hole. Additional step out drilling in the same area (eleven holes) has outlined a north trending moderately west dipping near-surface veinlet zone up to 30m wide that returned up to 17.81 g/t Au over 3.68m (hole SN23-360). The zone has been traced over a strike length of 180m and remains open to the north and south. Follow-up drilling this winter will initially focus on step-outs to the south where the mineralization is strengthening in terms of width.

Franz

The Franz outcrop was discovered in 2020, with initial surface sampling returning gold grades up to 51.1 g/t from the outcrop (see Press Release Aug 26, 2020). Subsequent drilling has returned Bonanza grade intervals such as 12.0m of 39.42 g/t gold (473 gram-metres intercept) in hole SN22-333 (see Press Release Jan 17, 2023). As part of Westhaven’s work to establish a resource within this 165m long vein system, the outcrop was washed and gridded in 2022, geologically mapped and surveyed (differential GPS and aerial photography) in early 2023 and systematically sampled in mid-2023. Westhaven used handheld percussion drilling equipment to complete a series of short (~30cm deep) drill holes along predefined survey controlled traverse lines defining a 1m x 3.5m sampling grid. The average gold grade from all 127 sites is 7.96 g/t and the average silver grade is 23.7 g/t. Seventeen samples returned over 10 g/t gold up to 191 g/t gold (silver values for the same 17 samples ranged from 43 to 226 g/t). A colour coded image outlining the distribution of gold results within the two exposed lobes of the outcrop is shown below. Distribution of gold values on the edges of both outcrops, and two samples from probable outcrop to the northwest (16.4 and 79.6 g/t gold), suggest mineralization continues beneath the current overburden cover. Next steps in the evaluation of the Franz mineralization may include additional surface sampling, continued collection of environmental baseline data, and preliminary resource modelling. Both percussion and core drilling completed at the Franz outcrop in 2023 (e.g. SN23-337 with 24.95m of 14.66 g/t gold and 35.5 g/t silver) as reported herein, will also support this work, and potentially facilitate the collection of a larger surface sample.

Franz Northwest

A series of eleven holes (holes SN23-379 to SN23-389) were drilled this Summer and Fall 300 to 900m northwest of the Franz outcrop, stepping-out along the Vein Zone 1 trend. These holes have now defined a subparallel zone of elevated arsenic hosted in bleached, and clay altered rhyolite that extends west-northwest for 470m metres and is located 70 to 200m southwest of Vein Zone 1. This zone remains open to the northwest, projects 350m beyond the known extent of Vein Zone 1 and may represent the shallower parts of a splay or satellite vein system running parallel to Vein Zone 1. Additional work is planned for 2024 that may initially involve additional surface prospecting, sampling and follow-up drilling.

Alpine Zone

Recent drilling at the Alpine Zone continues to demonstrate the presence of near surface, very shallowly dipping, gold mineralization. Two holes were drilled during fall 2023 (SN23-371 and 372) to help fill a gap in previous drilling. Both holes have returned elevated gold grades over significant widths in rhyolite tuff cut by Vein Zones 1 and 2. Gold mineralization occurs in both vein zones and in the intervening tuff wallrock, as shown by hole SN23-371 which intersected 0.30 g/t Au over 125.53m, starting from the top of the hole. These two holes confirm the bulk tonnage potential of gold mineralization drilled at the Alpine target.

These Alpine intersections are outside of the mineral resources reported during the recent underground Preliminary Economic Assessment of the South Zone (see Press Release July 18, 2023). Shallow mineralization at the Alpine, Tower, FMN and Franz Zones could potentially provide easily accessible mill feed in a future mining scenario.

Metallurgy:

Six representative samples from the FMN Zone have been submitted for initial metallurgical test work. On July 18th, 2023, Westhaven published the highlights from the Preliminary Economic Assessment (PEA) of the South Zone. Westhaven has made multiple discoveries outside of the South Zone assessment area including the FMN, Franz and Alpines Zones. Management believes these zones have the potential to contribute significantly to the property wide mineral resource inventory. The purpose of this metallurgical work at the FMN Zone is to advance Westhaven’s understanding of mineralization and support its inclusion into future property wide mineral resource estimates.

Preliminary Economic Assessment Highlights:

*Base case parameters of US$1,800 per ounce gold, US$22 per ounce silver and CDN$/US$ exchange rate of $0.76.

*All costs are in Canadian dollars unless otherwise specified.

- Pre-tax Internal Rate of Return (“IRR”) of 41.4%; After-tax IRR of 32.3%.

- Low All-In Sustaining Cost (“AISC”) of $989/ounce (“oz”) (US$752/oz) gold equivalent (“AuEq”).

- Low Cash Cost of $804 oz/AuEq (US$ 611/oz AuEq).

- Pre-tax Net Present Value (“NPV”6%) of $359 million (M) and After-tax NPV of $222M.

- Payback period from start of production year 1 of 2.4 years pre-tax and 2.6 years after-tax.

- After-tax (NPV 6%) increases to $268.4M and After-tax IRR increases to 37.2% using spot prices of US$1,950 gold and US$24 silver.

Please click link below for the July 18th, 2023, news release:

https://www.westhavengold.com/news-and-media/news/news-display/index.php?content_id=339

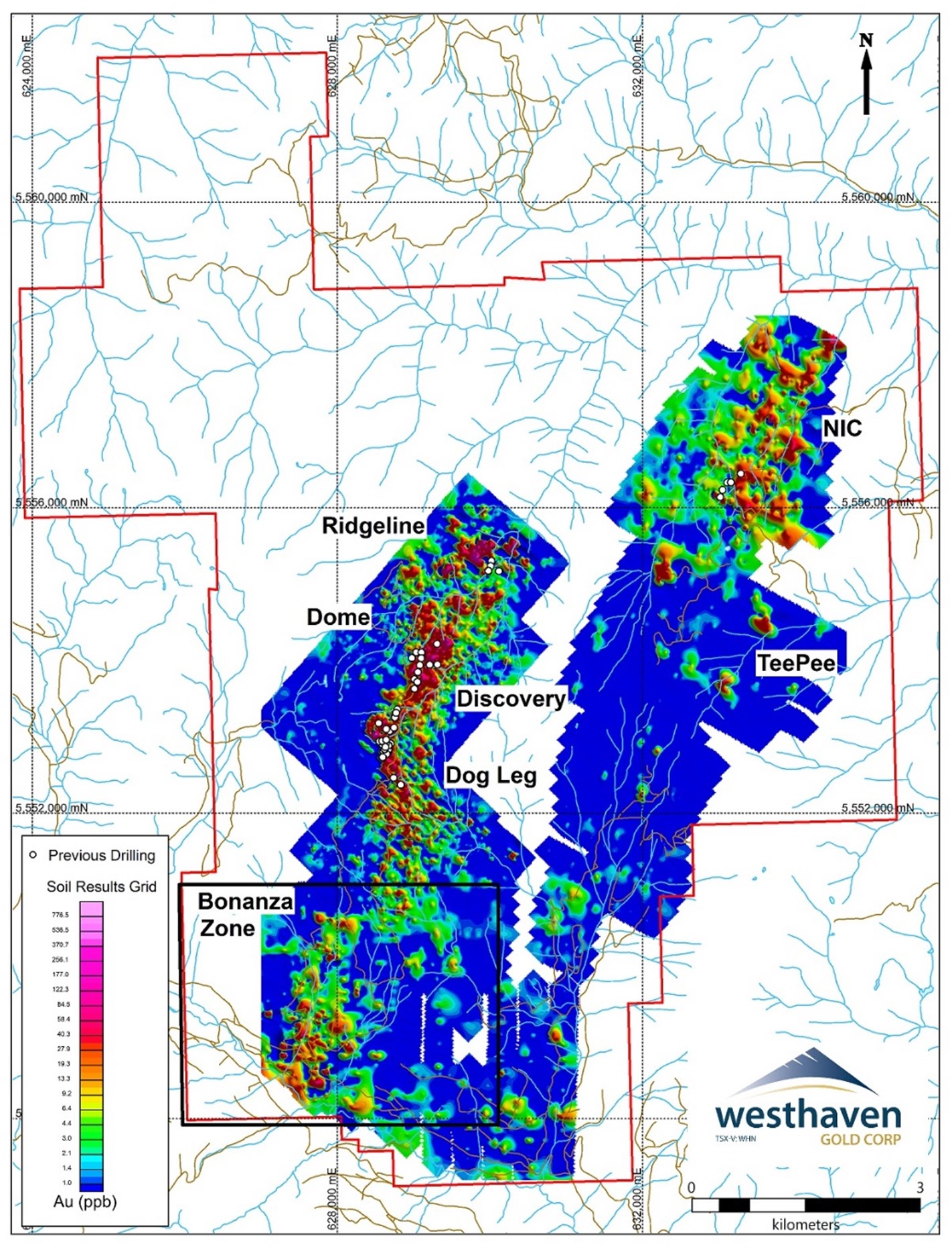

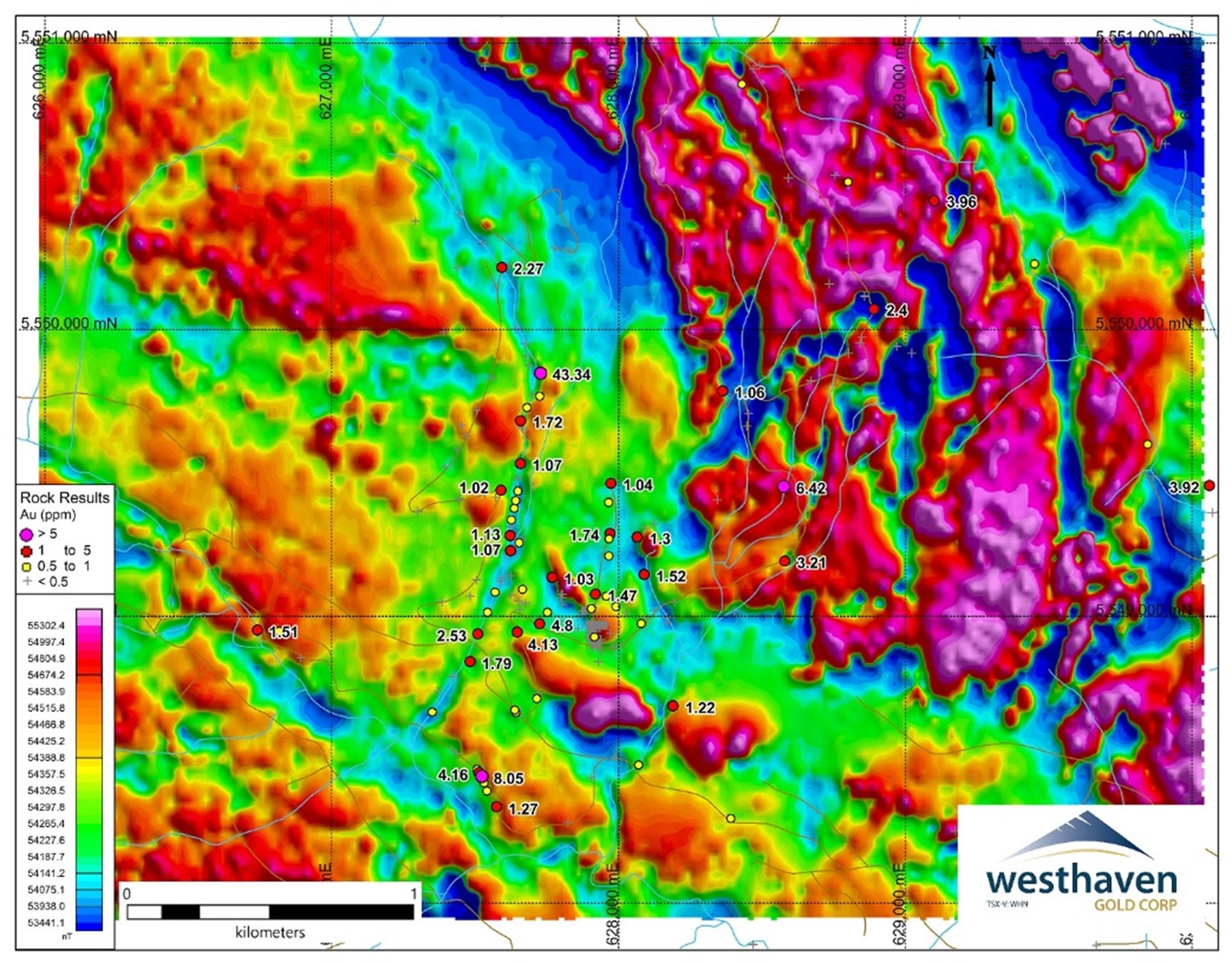

Prospect Valley (PV):

Westhaven previously collected ground magnetic data over the 3x4km Bonanza Zone and, in 2023, undertook a LiDAR survey and a surface rock sampling program. Sampling targeted specific stream channels within the Bonanza Area looking for new exposures created by flooding associated with the November 2021 excess rainfall event. Results of this work confirmed historical reports of high-grade quartz vein and quartz breccia float samples with assays of up to 3.21 g/t gold. Gold-in-soil anomalies associated with other mineralized zones on the property extend into the Bonanza Area (see images below).

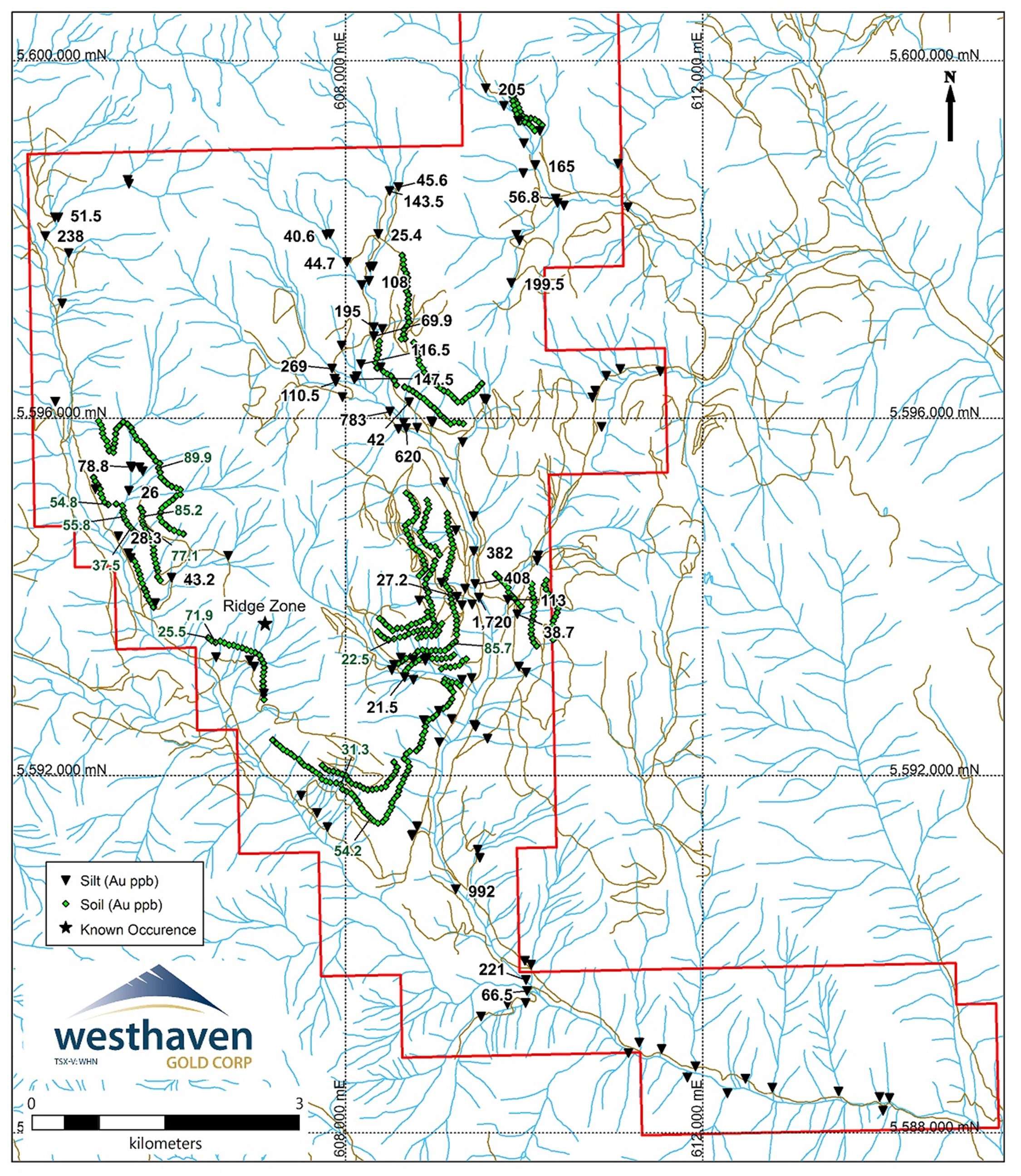

Skoonka North:

In the Fall of 2023, Westhaven initiated a follow-up sampling program (see image below), collecting an additional 313 soils, 19 stream silts and 83 rock for geochemical analysis. This program helped identify new areas of interest. In 2024, Westhaven intends to initiate additional mapping, prospecting, sampling and geophysical programs to develop and prioritize potential drill targets.

On behalf of the Board of Directors

WESTHAVEN GOLD CORP.

“Gareth Thomas”

Gareth Thomas, President, CEO & Director

Qualified Person Statement

Peter Fischl, P.Geo., who is a Qualified Person within the context of National Instrument 43-101 has read and takes responsibility for this release.

QA/QC

Core samples were prepared using the PREP-31 package in ALS’s Kamloops facility. Each core sample is crushed to better than 70 % passing a 2 mm (Tyler 9 mesh, US Std. No.10) screen. A split of 250 g is taken and pulverized to better than 85 % passing a 75-micron (Tyler 200 mesh, US Std. No. 200) screen. 0.75g of this pulverized split is digested by Four Acid and analyzed via ICP-MS (method code ME-MS61m (+Hg)), which reports a 49-element suite of elements. All samples are analyzed by Fire Assay with an AES finish, method code Au-ICP21 (30g sample size). Additional Au screening is performed using ALS’s Au-SCR24 method, select samples are dry screened to 100 microns. A duplicate 50g fire assay is conducted on the undersized fraction as well as an assay on the entire oversize fraction. Total Au content, individual assays and weight fractions are reported. All analytical and assay procedures are conducted in ALS’s North Vancouver facility. A QA/QC program included laboratory and field standards inserted every 25 samples. At least one field blank is inserted in every batch of 25 samples, with additional blanks inserted following samples with visible gold. Westhaven’s ongoing Quality Assurance and Quality Control programs include auditing of all exploration data. Any significant changes will be reported when available. Samples collected by percussion drilling at the Franz outcrop were split into two approximately equal parts to provide duplicate analyses for all sample sites. All materials, including blanks, standards, and certified reference materials, were submitted for gold and silver ore grade analyses by fire assay and gravimetric finish using a 50g sample aliquot (ME-GRA22). The detection limit for gold was 0.05-10,000 grams/tonne (g/t) and for silver 5-10,000 g/t.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Westhaven has engaged the services of GRA Enterprises LLC. (GRA) to provide digital media and marketing services. GRA, a US-based company, will provide content development, media distribution, and marketing services through social media channels to the company. The company and GRA act at arm’s length and GRA has no present interest, directly or indirectly, in the company or its securities. Under the terms of the agreement, GRA will be paid in aggregate US$50,000 for a period of 6 months.

About Westhaven Gold Corp.

Westhaven is a gold-focused exploration company advancing the high-grade discovery on the Shovelnose project in Canada’s newest gold district, the Spences Bridge Gold Belt. Westhaven controls 37,000 hectares (370 square kilometres) with four gold properties spread along this underexplored belt. The Shovelnose property is situated off a major highway, near power, rail, large producing mines, and within commuting distance from the city of Merritt, which translates into low-cost exploration. Westhaven trades on the TSX Venture Exchange under the ticker symbol WHN. For further information, please call 604-681-5558 or visit Westhaven’s website at www.westhavengold.com

Plan Map of Recent Drilling

Franz Outcrop Sampling ( >20 g/t Au )

Alpine Cross-Section

Prospect Valley

Skoonka North

Maps accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc3883d6-1536-4b88-b2f1-6e1d796f447c

https://www.globenewswire.com/NewsRoom/AttachmentNg/9dabd08c-d213-4841-a5aa-bdb6f5901db0

https://www.globenewswire.com/NewsRoom/AttachmentNg/17314496-0c19-484e-9ad7-7229bd74ad87

https://www.globenewswire.com/NewsRoom/AttachmentNg/839652e6-887c-4932-afda-92aff5cf048d

https://www.globenewswire.com/NewsRoom/AttachmentNg/6ca8c766-4424-40f0-8af8-13ec66174dd4

https://www.globenewswire.com/NewsRoom/AttachmentNg/effa64a8-fc7b-4025-b4ca-8d4148c0197d

![]()