Amseco Exploration Announces Letter of Intent for Proposed Reverse Takeover Transaction With Canadian Gold Resources Ltd.

Canadian gold Amseco

Not for distribution to United States newswire services or for release publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States.

MONTREAL, Dec. 19, 2023 (GLOBE NEWSWIRE) — AMSECO EXPLORATION LTD. (TSX-V: AEL.H) (“Amseco”), a mineral exploration company listed on the NEX board of the TSX Venture Exchange (the “Exchange”), is pleased to announce that it has entered into a binding letter of intent (the “Letter of Intent”) dated December 18, 2023 with Canadian Gold Resources Ltd. (“Canadian Gold”) in respect of a proposed business combination (the “Proposed Transaction”). It is anticipated that the Proposed Transaction will constitute a “Reverse Takeover” of Amseco in accordance with Policy 5.2 – Changes of Business and Reverse Takeovers of the Exchange. All currency references herein are in Canadian currency unless otherwise specified.

About Canadian Gold

Canadian Gold is a private company existing under the laws of Canada with gold projects in the Gaspé gold belt in the Province of Québec. Immediately prior to closing of the Proposed Transaction, Canadian Gold shall have 20,000,000 common shares (the “Canadian Gold Shares”) outstanding, excluding any securities issued pursuant to the Concurrent Financing (as defined herein).

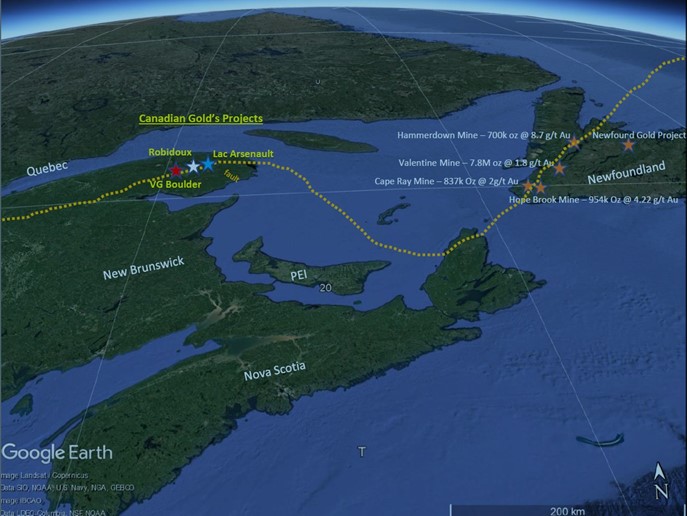

Canadian Gold’s material asset consists of its 100% interest in three gold exploration projects (the “Properties”) along the Grand Pabos Fault on the Gaspe Peninsula of Quebec. Gold mineralization in the region is known to be hosted by structures related to the Grand Pabos Fault, a major regional structure that can be traced across the entire Gaspe Peninsula and into Newfoundland where major gold discoveries have been made recently. Canadian Gold holds the Robidoux property (1,940 hectares), the VG Boulder property (5,787 hectares), and the Lac Arsenault property (4,118 hectares, with NI43-101 Technical report (2023)). These properties combined cover 34km along the Grand Pabos Fault system, gold is associated with major structural systems such as strike-slip faults, breccia zones, and swarm structures.

The properties are located in the province of Québec, Gaspé Peninsula, southwest of Gaspé Municipality accessible by logging road approximately twenty-five kilometers north of the village of Paspebiac. They are situated in a sequence of Palaeozoic (Era) metasedimentary rocks, located near the eastern end of the Aroostook-Matapedia Anticlinorium a major structural unit of the Appalachians that extends from Matapedia to Percé in Quebec. Mineralization occurs within the Honorat Group rocks, is vein type, characterized by brittle deformation and occurs in competent Ordovician (Period) Honorat Group sandstones and greywackes.

The Robidoux property has yielded historical bulk samples as high grade 400 tonnes at 31.54 g/t Au & 8.9 g/t Ag, and 657 tonnes at 12.02 g/t Au. Historic drilling results have been 4.1 g/t Au over 4.46m, and, 2.4 g/t Au over 2.50m. Historic trench sampling results have been 92.0 g/t Au over 1.70m, 45.9 g/t Au over 3.10m, and, 19.9 g/t Au over 3.10m.

The VG Boulder property has yielded samples up to 75.7 and 22.4 g/t Au in boulders and outcrop collected by previous workers, and multiple visible gold samples in boulders reported by previous workers.

The Lac Arsenault property contains a new NI43-101 Technical report (2023). In 1946 Walter Baker, a prospector, discovered boulders containing gold, silver and the sulphides sphalerite, galena, arsenopyrite and pyrite. This property was explored by Imperial & Esso Minerals in the mid 1970’s who identified 40,000 tonnes at 15.43 g/t Au, 197.00 g/t Ag, 6.6% Pb, and 3.5% Zn in three veins exposed on surface (Baker vein, Mersereau vein, and L4W vein) (this estimate is historical and has not been verified – it is not NI 43-101 compliant –additional work is required to confirm this estimate). Historic assays of up to 1.4 oz Au/ton and 25 oz Ag/ton have been recorded. Base metal ranges from traces up to 15 percent combined Pb-Zn. Best results include 32.83 g/t Au over 0.27 m at the Baker vein. Best results from the southern part of the L4W vein include 13.5 g/t Au over 0.75m. Best results at the Mersereau vein include 39.7 g/t Au on surface. In 1986 an exploration program discovered a new Au bearing zone, Marleau vein, with an assay of 0.36 oz Au/t over 5.2 feet. The Lac Arsenault property has 93 historic drill holes totaling 7269.41m.

A press release with further information in respect of Canadian Gold, including significant financial information, will follow in accordance with the policies of the Exchange.

For further information regarding Canadian Gold and the Proposed Transaction, please contact Ron Goguen, President and CEO, at 506-866-4545 or rongoguen@cdngold.com.

Summary of the Proposed Transaction

The Letter of Intent contemplates that Amseco and Canadian Gold will negotiate and enter into a definitive agreement in respect of the Proposed Transaction (the “Definitive Agreement”), pursuant to which it is anticipated that Amseco will acquire all of the issued and outstanding Canadian Gold Shares, and shareholders of Canadian Gold will receive post-Consolidation (as defined below) Amseco common shares (the “Amseco Shares”) in exchange for their Canadian Gold Shares, resulting in a reverse takeover of Amseco by Canadian Gold. The Proposed Transaction will be structured as a share exchange, three-cornered amalgamation, plan of arrangement or other structure based on the advice of the parties’ respective advisors and taking into account various securities, tax, operating and other considerations.

Prior to the closing of the Proposed Transaction, Amseco will consolidate its outstanding Amseco Shares on the basis of one (1) new Amseco Share for each 5 old Amseco Shares (the “Consolidation”), such that, prior to closing of the Proposed Transaction, Amseco will have approximately 2,922,854 Amseco Shares issued and outstanding on a non-diluted basis.

It is intended that Amseco Shares will be issued to holders of Canadian Gold Shares on the basis of one (1) post-Consolidation Amseco Share for every one (1) Canadian Gold Share, resulting in the issuance of an aggregate 20,000,000 post-Consolidation Amseco Shares to the shareholders of Canadian Gold. It is expected that outstanding Canadian Gold warrants will become exercisable for post-Consolidation Amseco Shares, in accordance with the terms of such warrants, as applicable.

It is anticipated that the resulting entity (the “Resulting Issuer”) will continue the business of Canadian Gold under a name to be determined by Canadian Gold (the “Name Change”). The business of the Resulting Issuer will be primarily focussed on the exploration of the Property.

The post-Consolidation Amseco Shares to be issued pursuant to the Proposed Transaction will be issued pursuant to exemptions from the prospectus requirements of applicable securities legislation. Certain common shares of the Resulting Issuer to be issued pursuant to the Proposed Transaction are expected to be subject to restrictions on resale or escrow under the policies of the Exchange, including the securities to be issued to “Principals” (as defined under Exchange policies), which will subject to the escrow requirements of the Exchange.

The completion of the Proposed Transaction remains subject to a number of terms and conditions, among other standard conditions for a transaction of this nature, including, among other things: (i) the negotiation and execution of the Definitive Agreement; (ii) Canadian Gold delivering a NI 43-101 compliant technical report for the Property that is acceptable to the Exchange and Amseco; (iii) the delivery of audited, unaudited and pro forma financial statements of each party that are compliant with Exchange policies; (iv) if required by the Exchange, Canadian Gold delivering a title opinion for each of its material international properties in form and content satisfactory to the Exchange and Amseco; (v) no material adverse changes occurring in respect of either Amseco or Canadian Gold; (vi) the parties obtaining all necessary consents, orders and regulatory and shareholder approvals, including the conditional approval of the Exchange subject only to customary conditions of closing; (vii) if required by the Exchange, delivery of a sponsor report and an independent valuation satisfactory to the Exchange; (viii) the Consolidation, Name Change and any other corporate changes requested by Canadian Gold, acting reasonably, shall have been implemented; (ix) completion of the Concurrent Financing described below; (x) completion of satisfactory due diligence by each Party of the other Party; (xi) if the Exchange deems any property of Canadian Gold, other than the Property, to be a material property of Canadian Gold, Canadian Gold shall either deliver a technical report prepared in accordance with NI 43-101 for such property, or divest any interest or ownership it holds in such property; and (xii) Exchange acceptance. There can be no assurance that all of the necessary regulatory and shareholder approvals will be obtained or that all conditions of closing will be met.

Upon completion of the Proposed Transaction, it is anticipated that the Resulting Issuer will be listed as a Tier 2 Mining Issuer on the Exchange, with Canadian Gold as its primary operating subsidiary.

Concurrent Financing

In connection with the Proposed Transaction, Canadian Gold will arrange a concurrent non-brokered private placement for sufficient gross proceeds for the Resulting Issuer to meet the Exchange’s listing requirement at a minimum price of $0.25 per post-Consolidation Amseco Share (the “Concurrent Financing”).

Finder’s fees may be paid in connection with the Concurrent Financing within the maximum amount permitted by the policies of the Exchange.

The proceeds of the Concurrent Financing will be used to fund (i) expenses of the Proposed Transaction and the Concurrent Financing, (ii) the exploration and other expenses relating to the Property, and (iii) the working capital requirements of the Resulting Issuer.

Summary of Proposed Directors and Officers of the Resulting Issuer

In conjunction with and upon closing of the Proposed Transaction, the board of directors of the Resulting Issuer are expected to consist of four directors, each of whom will be nominated by Canadian Gold. If applicable, the existing directors and officers of Amseco shall resign at or prior to the closing of the Proposed Transaction.

The first directors of the Resulting Issuer are expected to be Ron Goguen, Ken Booth, Mark Smethurst and Ian Mcgavney, and such other directors as determined by Canadian Gold. These directors shall hold office until the first annual meeting of the shareholders of the Resulting Issuer following closing, or until their successors are duly appointed or elected. The first officers of the Resulting Issuer are expected to be Ron Goguen (Executive Chairman and President), Camilla Cormier (Chief Financial Officer and Corporate Secretary), and such other officers as determined by Canadian Gold.

Summary of Insiders of the Resulting Issuer other than Directors and Officers

No insiders of the Resulting Issuer are expected other than the board and management.

Sponsorship of Proposed Transaction

Sponsorship of the Proposed Transaction may be required by the Exchange unless an exemption or waiver from this requirement is obtained in accordance with the policies of the Exchange. Canadian Gold has not yet engaged a sponsor in connection with the Proposed Transaction. Canadian Gold intends to apply for an exemption from the Exchange’s sponsorship requirement. Additional information on sponsorship arrangements will be provided once available.

Other Information relating to the Proposed Transaction

The Proposed Transaction is not a “related party transaction” as such term is defined by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions and is not subject to Policy 5.9 of the Exchange.

No finder’s fees are expected to be payable in connection with the Proposed Transaction.

In accordance with Exchange Policy 5.2, Amseco intends apply for an exemption from obtaining shareholder approval, as the Proposed Transaction exhibits the following characteristics: (i) the Proposed Transaction is not a related party transaction (and no other circumstances exist which may compromise the independence of Amseco or other interested parties); (ii) Amseco does not have active operations; (iii) Amseco is not subject to a cease trade order and management believes it will not be suspended from trading on completion of the Proposed Transaction; and (iv) there is no requirement to obtain shareholder approval of the Proposed Transaction (or any element thereof) under any applicable corporate or securities laws.

The Proposed Transaction will require the approval of the shareholders of Canadian Gold. Canadian Gold intends to hold a shareholder meeting to seek all necessary approvals, the details of which will be disclosed once available.

In accordance with the policies of the Exchange, Trading in the Amseco Shares has been halted as a result of this announcement. and will not resume trading until such time as the Exchange determines, which, depending on the policies of the Exchange, may not occur until completion of the Proposed Transaction.

Additional information concerning the Proposed Transaction, Amseco, Canadian Gold and the Resulting Issuer will be provided once determined in a subsequent news release and in the Filing Statement to be filed by Amseco in connection with the Proposed Transaction and which will be available in due course under Amseco’s SEDAR profile at www.sedar.com.

About Amseco Exploration Ltd.

Amseco is a mineral exploration company focused on the acquisition, exploration and development of mineral resource properties.

For further information regarding Amseco and the Proposed Transaction, please contact Jean Desmarais, Chief Executive Officer of Amseco, at jeandesmarais@mac.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF AMSECO EXPLORATION LTD.

Jean Desmarais, Director and CEO

jeandesmarais@mac.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Person

Mark T. Smethurst, P.Geo., a director of Canadian Gold. is a qualified person as defined by NI 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Neither Mr. Desmarais nor the Company has verified the technical information in this press release.

Completion of the Proposed Transaction is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable pursuant to Exchange Requirements, disinterested approval. Where applicable, the Proposed Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Proposed Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Proposed Transaction, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Amseco should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the Proposed Transaction and has neither approved nor disapproved the contents of this press release.

All information contained in this news release with respect to Amseco and Canadian Gold was supplied by the parties, respectively, for inclusion herein, and Amseco and its respective directors and officers have relied on Canadian Gold for any information concerning such party.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Forward Looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations (including negative and grammatical variations) of such words and phrases or state that certain acts, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

Forward-looking information in this press release may include, without limitation, statements relating to: the completion of the Proposed Transaction and the timing thereof, the execution of the Definitive Agreement, the proposed business of the Resulting Issuer, degree to which historical results are reflective of actual mineral resources, the completion of the proposed Concurrent Financing and the use of proceeds therefrom, the completion a NI 43-101 technical report for the Property, the proposed directors and officers of the Resulting Issuer, obtaining regulatory approval for the Property, Canadian Gold or the Resulting Issuer satisfying terms of the Option Agreement and acquiring 100% interest in the Property, the completion of the Consolidation, the completion of the Name Change, completion of satisfactory due diligence, Exchange sponsorship requirements and intended application for exemption therefrom, shareholder and regulatory approvals, and future press releases and disclosure.

These statements are based upon assumptions that are subject to significant risks and uncertainties, including risks regarding the mining industry, commodity prices, market conditions, general economic factors, management’s ability to manage and to operate the business, and explore and develop the projects, of the Resulting Issuer, and the equity markets generally. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance of each of Amseco and Canadian Gold may differ materially from those anticipated and indicated by these forward-looking statements. Any number of factors could cause actual results to differ materially from these forward-looking statements as well as future results. Although each of Amseco and Canadian Gold believes that the expectations reflected in forward looking statements are reasonable, they can give no assurances that the expectations of any forward-looking statements will prove to be correct. Except as required by law, each of Amseco and Canadian Gold disclaims any intention and assume no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/cfc7347b-6639-4b07-a358-b14a80e3d02c

![]()